HeveaBoard was incorporated in year 1993 as a private limited company under the name of HeveaBoard Sdn Bhd. The Company was converted into a public limited company in year 2004 and assumed its present name, and was subsequently listed on the main board of Bursa Malaysia Securities Berhad in year 2005.

HeveaBoard Berhad (“HEVEA”) and its subsidiaries are involving in manufacturing, trading and distributing a wide range of particleboard, particleboard-based products and ready-to-assemble (“RTA”) products.

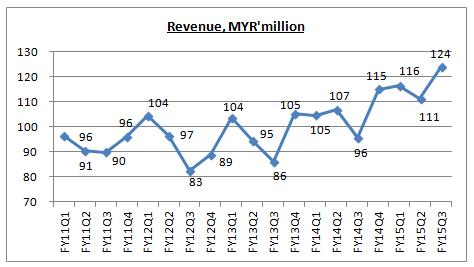

Financial Performance

The higher revenue in FY15Q3 is contributed by an increase sales in value added products and higher USD exchange rate to MYR.

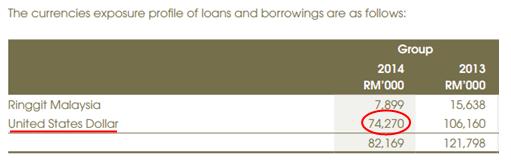

However, do note that even though higher USD/MYR had increased revenue amount, overall HEVEA is actually not benefited from strengthening of USD. In the latest quarter, it had an unrealized exchange loss of MYR10.23m from the translation of the USD denominated term loan!

Among its MYR82m loans and borrowings, HEVEA has MYR74m loan which denominated in USD!

As extracted from HEVEA annual report - currency sensitivity analysis, for every 10% strengthening of USD, HEVEA will actually have a loss of MYR1.4m!

So, even though 92% of its revenue is contributed from overseas, please stop saying HEVEA is a beneficiary of strengthening of USD.

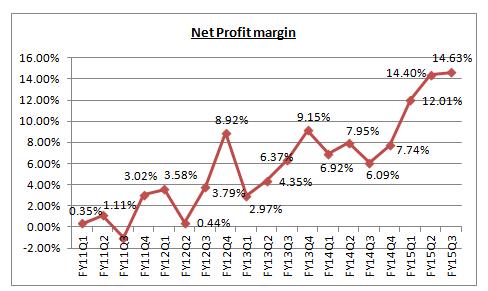

Having said so, HEVEA net profit margin is still showing an improvement despite of the foreign exchange translation loss! In other words, HEVEA is developing higher margin products.

FYI, HEVEA’s ready to assemble sector had been through two aggressive years, FY13 & FY14, of capital expenditure worth almost MYR20m in order to achieve higher automation and wider range of higher value product diversifications.

Finally, HEVEA had started to see result from this. It was able to mitigate the labor cost increase and contribute additional revenue stream to the Group. As a result, HEVEA net profit margin had shown significant improvement in FY15.

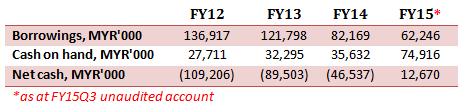

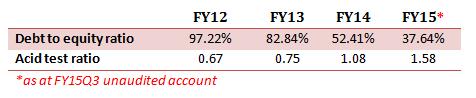

Financial Strength

To be easy to understand, I extracted out HEVEA’s borrowing and cash on hand over the past 3 years. As in its latest quarter, HEVEA had finally turned into a cash positive position. HEVEA had slowly improved its financial strength from year to year.

As we can seen above, its debt to equity had reduced from 97.22% in FY12 to 37.64% in FY15! Its acid test ratio of 1.58 indicated that HEVEA is liquid enough to meets it short term liabilities even though without its inventories.

In short, HEVEA financial strength is considered good and stable.

Conclusion

Despite being a victim of strengthening of USD, HEVEA is still able to improve continuously on its net profit margin.

Do note that, HEVEA had turned its business into higher automation and higher productivity. The mitigation of labor cost is definitely not a one-time contribution. So, I believe HEVEA net profit margin will be able to sustain above 14%.

Furthermore, HEVEA borrowing had been decreased from time to time as shown at above table. When its USD loan is able to cut down, it will reduce its unrealized exchange loss as well. It is definitely a good sign and good catalyst for HEVEA.

Currently, with a share price of MYR1.59, HEVEA had a PE of 12.16 and ROE of 17.78%. HEVEA is still growing in its financial performance. Compared to its peers EVERGREEN and MIECO, HEVEA performed better than them and it is also the cheapest.

Overall, as value investors, this is all we can do to study a company. The rest of it is beyond our control. Don’t easily influence by rumors and news which is still not confirmed.

KISS principle - Keep Investment as Simple as Possible

Happy investing!

Hey guys, I am writing stock analysis report to earn some pocket money.

For more information, you may email me at richeho_92@hotmail.com

I will send you one or two samples of my report, for your reference.

Happy 2016 new year! Huat ah!

Cheers!

HEVEA (5095) - (RICHE HO) HeveaBoard Berhad

HEVEA (5095) - (RICHE HO) HeveaBoard Berhad

http://klse.i3investor.com/blogs/rhinvest/89467.jsp