Back to Fed watching

Here we go again. Recent hawkish comments from various Fed officials seem to suggest that the central bank is preparing the market for a rate hike sooner rather than later.

This introduced renewed uncertainties to the recent rally, which was not that convincing to begin with. Foreign funds are pulling out of emerging markets as the greenback regained positive momentum. Our local bourse saw net selling by foreign investors for the fourth straight week to last Friday.

In addition to increased uncertainties in global markets, stocks on the local bourse also have to contend with the latest round of earnings results, which, by and large, remains stuck in a downtrend. It is looking like there will have to be further cuts to earnings forecasts.

Unsurprisingly, bad earnings led to stock selloffs while good results were generally rewarded by share price gains. However, investors should take note where volatile forex plays havoc with headline earnings.

For instance, unrealised translation gains/losses – gains from translation of US$-denominated borrowings (Telekom, Air Asia X) and losses for assets held in US$ (Latitude, Focus Lumber) – are causing big swings that have little to do with the underlying business.

Lii Hen was the top performer in my portfolio this week after reporting a set of robust earnings for 1Q2016. Sales were up 48% y-y to RM165 million, underpinned by strong volume growth of 27% y-y. The US market accounted for some 78% of total sales. Despite some forex losses, the company benefited from a stronger US$ compared with the previous corresponding quarter. Net profit nearly doubled to RM21 million.

Outlook for furniture exports to the US remains positive. The latest data on US housing starts, new and existing home sales have been quite strong and should continue to gain traction on the back of steady job gains and rising wages with historically low interest rates propping up demand.

Lii Hen’s valuations are still attractive given the upbeat earnings outlook and it is rewarding shareholders with better dividends. Its shares will trade ex-entitlement for 4 sen dividend on June 10 and another 4 sen July 8.

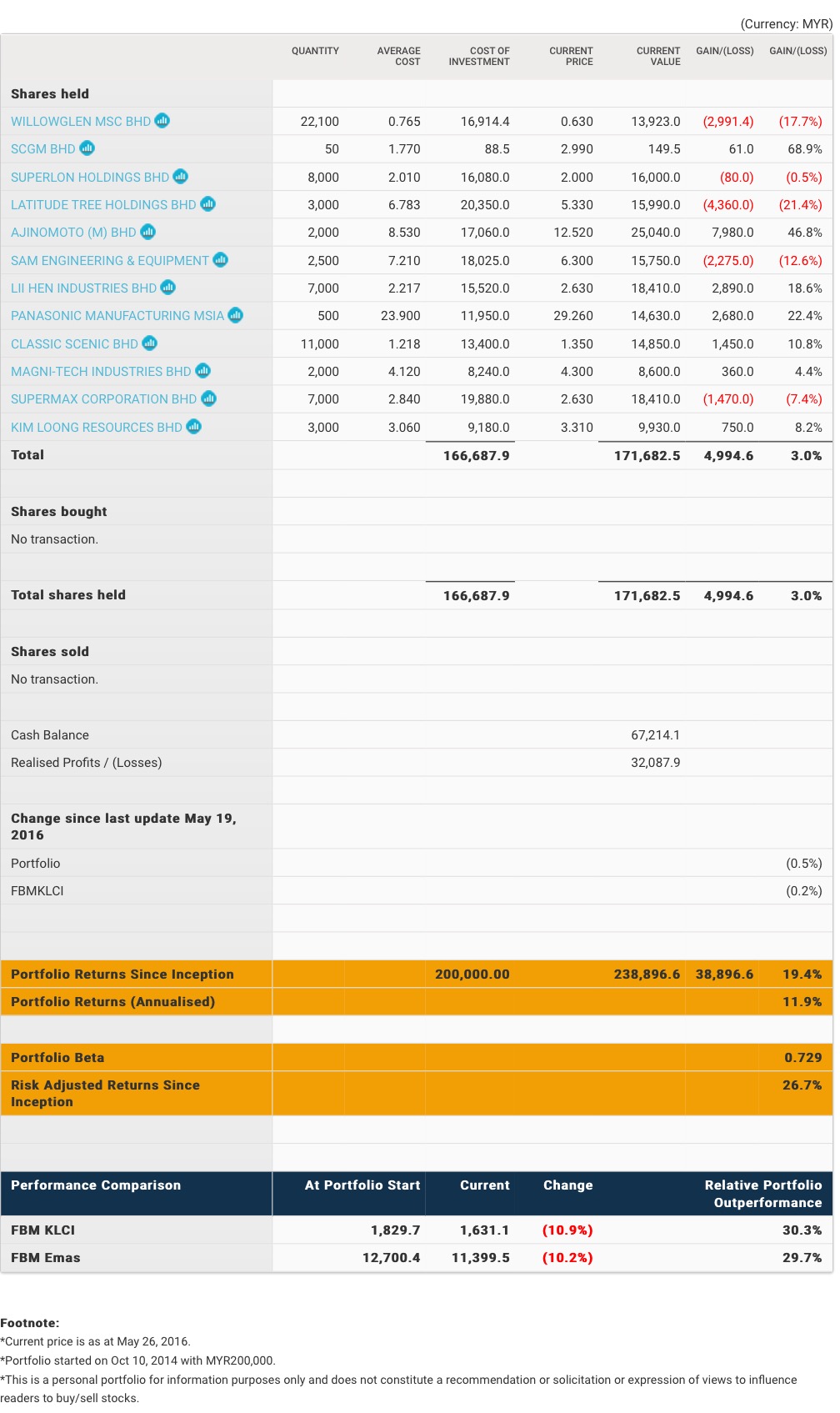

Year to date, my portfolio is up 2.8% while the FBM KLCI is down 3.6%. I kept my portfolio unchanged. I am still holding some RM67,214 in cash. My portfolio is currently 72% invested.

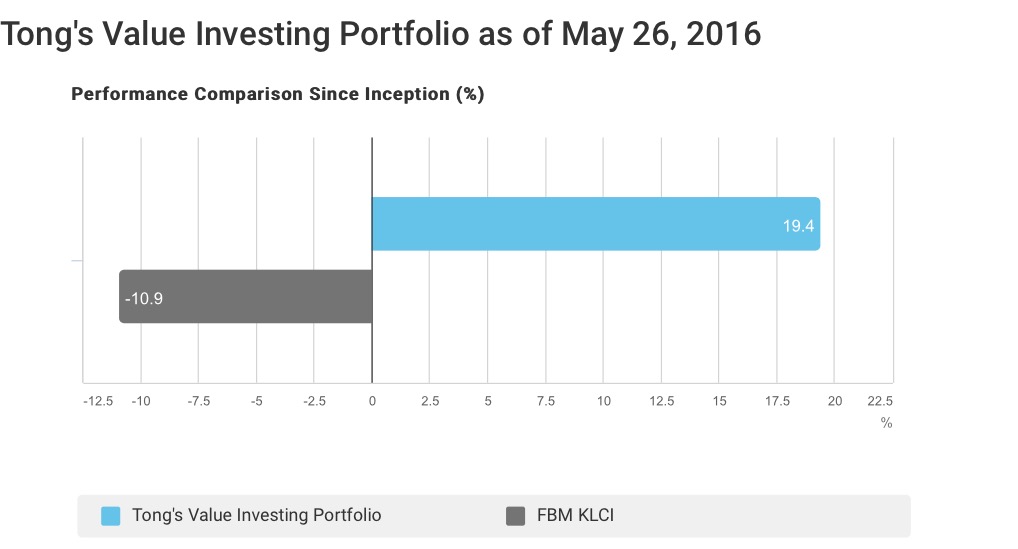

Over the longer term, my portfolio continues to outperform the market benchmark by a long, long way. Total portfolio returns now stand at 19.4% since inception. Over the same period, the benchmark index is down 10.9%.

Here we go again. Recent hawkish comments from various Fed officials seem to suggest that the central bank is preparing the market for a rate hike sooner rather than later.

This introduced renewed uncertainties to the recent rally, which was not that convincing to begin with. Foreign funds are pulling out of emerging markets as the greenback regained positive momentum. Our local bourse saw net selling by foreign investors for the fourth straight week to last Friday.

In addition to increased uncertainties in global markets, stocks on the local bourse also have to contend with the latest round of earnings results, which, by and large, remains stuck in a downtrend. It is looking like there will have to be further cuts to earnings forecasts.

Unsurprisingly, bad earnings led to stock selloffs while good results were generally rewarded by share price gains. However, investors should take note where volatile forex plays havoc with headline earnings.

For instance, unrealised translation gains/losses – gains from translation of US$-denominated borrowings (Telekom, Air Asia X) and losses for assets held in US$ (Latitude, Focus Lumber) – are causing big swings that have little to do with the underlying business.

Lii Hen was the top performer in my portfolio this week after reporting a set of robust earnings for 1Q2016. Sales were up 48% y-y to RM165 million, underpinned by strong volume growth of 27% y-y. The US market accounted for some 78% of total sales. Despite some forex losses, the company benefited from a stronger US$ compared with the previous corresponding quarter. Net profit nearly doubled to RM21 million.

Outlook for furniture exports to the US remains positive. The latest data on US housing starts, new and existing home sales have been quite strong and should continue to gain traction on the back of steady job gains and rising wages with historically low interest rates propping up demand.

Lii Hen’s valuations are still attractive given the upbeat earnings outlook and it is rewarding shareholders with better dividends. Its shares will trade ex-entitlement for 4 sen dividend on June 10 and another 4 sen July 8.

Year to date, my portfolio is up 2.8% while the FBM KLCI is down 3.6%. I kept my portfolio unchanged. I am still holding some RM67,214 in cash. My portfolio is currently 72% invested.

Over the longer term, my portfolio continues to outperform the market benchmark by a long, long way. Total portfolio returns now stand at 19.4% since inception. Over the same period, the benchmark index is down 10.9%.

http://www.theedgemarkets.com