MAGNI (7087)

Review of Performance

- Revenue for the current quarter increased by 9.8% as compared to the preceding year corresponding quarter

- Revenue of garment business for the current quarter increased by 9.4%

mainly due to the favourable effect of USD against Ringgit, partially

offset by lower sales orders received. Revenue of packaging business

increased by 11.9% due to higher orders received.

- Profit before tax (PBT) for the current quarter increased by 8.7%

mainly due to higher garment revenue, partially offset by lower other

operating income arising from higher currency exchange loss.

Future Prospects

- The manufacturing and sales of garment will still be the Group’s major revenue contributor.

- The Group maintains a cautiously positive outlook for the next

financial year ending 30 April 2017 amid the global economic

uncertainty.

- Both the garment and packaging businesses are expected to remain profitable for the next financial year.

Note

- In FY16, free cash flow has decreased from RM47m~ to RM12m~ (-75%).

- This might be due to the huge amount spent on inventories, up from RM64m~ to RM116m~ (+81%).

OKA (7140)

Review of Performance

- The Group recorded revenue of RM40.7 million for the quarter under

review as compared to RM43.5 million in the corresponding quarter of the

preceding year.

- The Group’s profit before tax for the current quarter was RM6.6

million, representing an increase of RM4.4 million as compared to profit

before tax of RM2.2 million in the corresponding quarter of the

preceding year.

- The increase of the Group’s profit before tax was mainly due higher margin products sold and lower operating expenses during the current quarter as compared to the corresponding quarter of the preceding year.

Future Prospects

- Based on the current economic outlook in Malaysia, the construction industry is expected to remain progressive.

- However, uncertainty of uncontrollable factors such as raw materials

costs, fuel and energy costs including shortage of manpower in the

manufacturing sector are expected to affect the Group’s turnover and

profit.

- The Group’s continuous effort to diversify its products,

introduce products differentiation and to improve on the existing

products together with the implementation of cost savings measures will help to enhance its overall competitiveness in the industry.

- In addition, the Group is practicing more aggressive pricing to capture bigger market share.

- Hence, barring any unforeseen circumstances, the Group is optimistic

that it will remain profitable for the financial year ending 31 March

2017.

Note

- Free cash flow increased from RM14m~ to RM27m~ in FY16. (+84%)

- Cash and bank balance increased from RM6.5m~ to RM28m~ in FY16. (+332%)

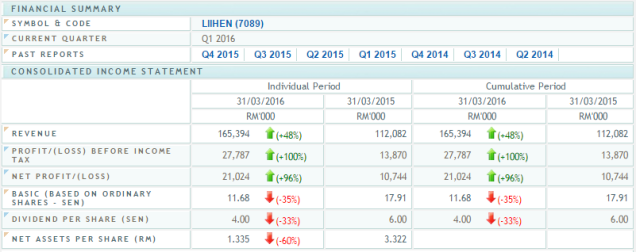

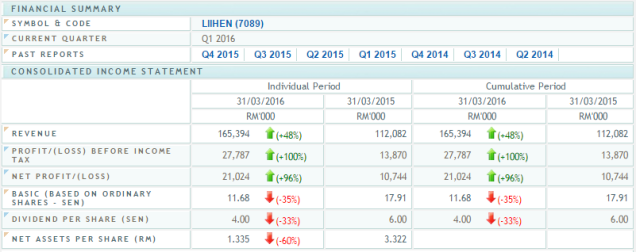

LIIHEN (7089)

Review of Performance

- The first quarter of Group’s revenue for 2016 registered at RM165

million, rose 48% as compared to the corresponding quarter of last year.

- The increases were mainly contributed from the increased in orders of the Group’s products by 27% and the strengthening of the US Dollar against RM.

- The average USD in the current quarter was at 4.20 as compared to 2015 of 3.55, appreciated by 18%.

- Due to higher revenue and better USD conversion rate, the Group’s

profit before tax for the current quarter recorded at RM27.8 million,

increased 100% as compared to the profit before tax of RM13.9 million in

the previous corresponding quarter.

Future Prospects

- US economic growth braked sharply in the first quarter to its slowest pace in two years as consumer spending softened and a strong dollar continued to undercut exports, but a pick up activity is anticipated given a buoyant labour market.

- The main challenges that the Group faced is at the local front where the acceleration of production costs and shortages of workforce will continue to affect the Group’s financial performance.

- In view of that, the management will continue to focus on the Group’s core products by diversifying its product range to strengthen the market position and expand the customer base and simultaneously continue to adopt an effective cost management.

- With better controllable cost structure and wider sales market base,

the Group is committed to deliver a favourable result for year 2016.

Note

- Nothing much to comment since it is only their first quarter.

FAVCO (7229)

Review of Performance

- For the current quarter ended 31 March 2016, the Group recorded

revenue of RM152.9 million with profit before tax of RM18.5 million as

compared to revenue of RM200.8 million with profit before tax of RM29.7

million in the previous quarter ended 31 March 2015.

- The decrease in profit before tax for the Group was mainly due to

decrease in sales which is in line with industry climate and order book.

Future Prospects

- Despite the challenging outlook in the current market, the Group has outstanding order book of RM 604 million as at 23 May 2016 from the global oil and gas, shipyard, construction and wind turbine industries.

- The Group will be taking appropriate measures and actions to cater for its business undertaking moving forward.

Note

https://stockhuat.wordpress.com/2016/06/24/first-quarter-review-2016-2/