Trive Property Group Bhd. (TRIVE – 0118) is an investment holding

company, which engages in the provision of management services. It

operates through the following segments: Manufacturing, Construction,

Investment Holding, and Others. The Manufacturing segment manufactures,

assembles, and markets battery management system. The Construction

segment involves in residential development. The Investment Holding

segment invests in ordinary and quoted shares. The company was founded

on September 30, 2004 and is headquartered in Kulim, Malaysia. Its

subsidiaries include ETI Tech (M) Sdn Bhd engaged in research and

development of BMS technology, as well as the design and marketing of

the resulting battery packs and potable power packs; ETI Tech

International Sdn. Bhd., and ETI Tech Homes Sdn. Bhd. As at 10 June

2016, the total market capitalisation is RM 121 million.

Venture into Solar Power Business

Trive Property Group Bhd (Trive) announced at 8 June 2016 the company has entered into a memorandum of understanding to establish a joint venture company with Fortunate Solar Technology Ltd (Fortunate Solar), one of the world’s leading integrated high-tech provider of solar products/services and silicon products/services such as ingot, wafer and solar cell.

A total investment of RM60 million will be raised between the parties for the establishment of a JV company in Malaysia, which will be equally owned by Fortunate Solar and Trive. Funds raised will be used to set up a production line in the new factory, which will provide full range of products or one stop solution in the solar business. The joint venture company will also collaborate in the area of research and development, production, assembly, distribution and marketing of the solar energy systems.

Outlook on Global Solar Industry

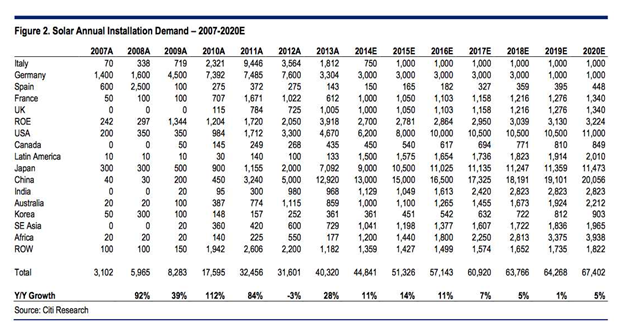

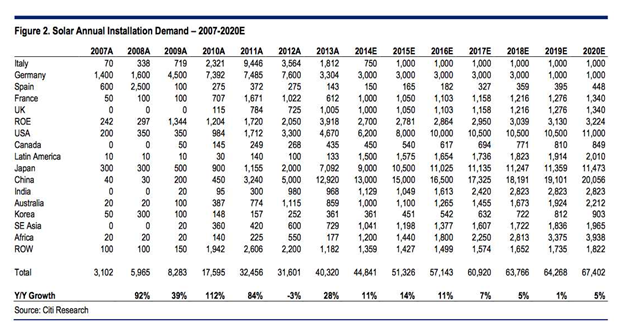

The solar annual installation demand is continued to seem strong for the upcoming years. From the data from Citi Research above, China is going to lead the global photovoltaic (PV) system installations around 30% market shares in the world in 2020 with Japan and US in second and third. Noteworthy the solar annual installation demand in South East Asia is picking up with a 4 years CAGR of 9.2% annually.

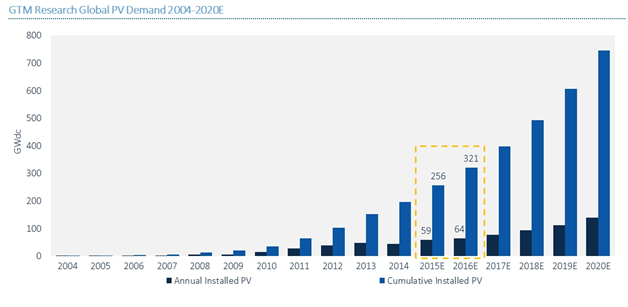

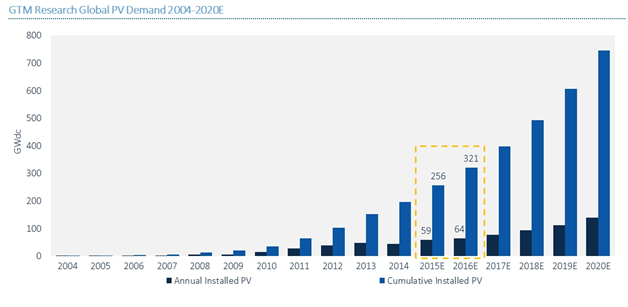

According to GTM Research, global solar demand is forecasted to hit 135GW by 2020, 4 years CAGR 20% from 2016. The reason is many of those countries have pledged substantial goals for deploying renewable and mitigating climate change and PV is seen as a quick, cost-effective, and scalable opportunity within that.

The idea to mark a footprint in China Market by Trive is seen as a brilliant move to generate huge potential revenue to turnaround the company from loss to profit in future.

Battery Storage

Lithium-ion

storage battery is accounted for the majority of the grid-connected PV

energy storage market. The increase number of newly installed energy

storage systems with solar power is aligned with the increase of

installation of PV.

Lithium-ion

storage battery is accounted for the majority of the grid-connected PV

energy storage market. The increase number of newly installed energy

storage systems with solar power is aligned with the increase of

installation of PV.

Trive is streamlining its business portfolios to focus on its core business in design, development and marketing of green and renewable energy products, such as medium and high powered battery products and solutions, particularly, the solar related products so as to remain competitive in the business environment.

Corporate Restructuring

Trive has taken a series of action to restate its financial position including completing the debts restructuring programme and increase of its share capital dated Jan 9, 2015, private placements dated Sept 15, 2015, capital reduction on Jan 14, 2016 and proposed employee share option scheme on March 17, 2016

With a series of debt restructuring programme, the debt to equity ratio has reduced significantly to 0.19. The company has a cash amount to RM4.06mil and term borrowing of RM4.0mil. Thus the management is keen to strengthen the financial position of the company.

For the quarter ended 31 January 2016, the Group recorded revenue of RM1.51 million as compared to RM0.67 million in the immediate corresponding quarter of the preceding period. The increase in the Group’s revenue by RM0.84 million was mainly due to the increased contribution from Construction and Property Development Division in the current quarter.

In my opinion, the company’s earning will be further boost by the two projects currently in hand which is awarded at 24 June 2015 and 04 February 2015 respectively:

The Group registered a loss before taxation for the quarter ended 31 January 2016 of approximately RM18.52 million. The loss in the reporting quarter was mainly due to the impairment on other receivables (mainly non-trade receivable related), depreciation of property, plant and equipment and operating costs incurred.

In my opinion, at the end of each reporting period an entity is required to assess whether there is any indication that an asset may be impaired. Thus the impairment loss is a one-off loss to the company on the quarter.

Conclusion:

At the current outlook, Trive is beneficial on below statements:

On last Thrusday the price already shoot past the 200ma line and proceeded further to close at 0.100 on Friday.

On last Thrusday the price already shoot past the 200ma line and proceeded further to close at 0.100 on Friday.

Tomorrow we will anticipate the price to hike further up.

The price will have to past 0.120 initially and also 0.155 to find our possible TP at 0.300

Happy trading and good luck. TAYOR

Regards,

Ms Kana

For Kim’s Stockwatch

Telegram : https://www.telegram.me/kimstock (Real live time trading)

Facebook : https://www.facebook.com/Kim-990381907717321

Venture into Solar Power Business

Trive Property Group Bhd (Trive) announced at 8 June 2016 the company has entered into a memorandum of understanding to establish a joint venture company with Fortunate Solar Technology Ltd (Fortunate Solar), one of the world’s leading integrated high-tech provider of solar products/services and silicon products/services such as ingot, wafer and solar cell.

A total investment of RM60 million will be raised between the parties for the establishment of a JV company in Malaysia, which will be equally owned by Fortunate Solar and Trive. Funds raised will be used to set up a production line in the new factory, which will provide full range of products or one stop solution in the solar business. The joint venture company will also collaborate in the area of research and development, production, assembly, distribution and marketing of the solar energy systems.

Outlook on Global Solar Industry

The solar annual installation demand is continued to seem strong for the upcoming years. From the data from Citi Research above, China is going to lead the global photovoltaic (PV) system installations around 30% market shares in the world in 2020 with Japan and US in second and third. Noteworthy the solar annual installation demand in South East Asia is picking up with a 4 years CAGR of 9.2% annually.

According to GTM Research, global solar demand is forecasted to hit 135GW by 2020, 4 years CAGR 20% from 2016. The reason is many of those countries have pledged substantial goals for deploying renewable and mitigating climate change and PV is seen as a quick, cost-effective, and scalable opportunity within that.

The idea to mark a footprint in China Market by Trive is seen as a brilliant move to generate huge potential revenue to turnaround the company from loss to profit in future.

Battery Storage

Lithium-ion

storage battery is accounted for the majority of the grid-connected PV

energy storage market. The increase number of newly installed energy

storage systems with solar power is aligned with the increase of

installation of PV.

Lithium-ion

storage battery is accounted for the majority of the grid-connected PV

energy storage market. The increase number of newly installed energy

storage systems with solar power is aligned with the increase of

installation of PV.Trive is streamlining its business portfolios to focus on its core business in design, development and marketing of green and renewable energy products, such as medium and high powered battery products and solutions, particularly, the solar related products so as to remain competitive in the business environment.

Corporate Restructuring

Trive has taken a series of action to restate its financial position including completing the debts restructuring programme and increase of its share capital dated Jan 9, 2015, private placements dated Sept 15, 2015, capital reduction on Jan 14, 2016 and proposed employee share option scheme on March 17, 2016

With a series of debt restructuring programme, the debt to equity ratio has reduced significantly to 0.19. The company has a cash amount to RM4.06mil and term borrowing of RM4.0mil. Thus the management is keen to strengthen the financial position of the company.

For the quarter ended 31 January 2016, the Group recorded revenue of RM1.51 million as compared to RM0.67 million in the immediate corresponding quarter of the preceding period. The increase in the Group’s revenue by RM0.84 million was mainly due to the increased contribution from Construction and Property Development Division in the current quarter.

In my opinion, the company’s earning will be further boost by the two projects currently in hand which is awarded at 24 June 2015 and 04 February 2015 respectively:

- The Board of Directors of TRIVE wishes to announce that Trive

Property Sdn Bhd (“TPSB”), a wholly owned subsidiary of the Company had,

on 24 June 2015 appointed as the Main Contractor by

Pakadiri Sdn Bhd (“the Developer”) to undertake the construction of

infrastructure works and 160 residential units including the sales and

marketing for the Bandar Baru Kertih Jaya Phase 1 project.

The contract sum for the Phase 1 project is RM24.296 million

and to commence within 3 months from 24 June 2015 (“Commencement

Date”). The Phase 1 project is to be completed within 24 months after

the Commencement Date and is expected to contribute positively to the

earnings of the Group for the financial year ending 31 July 2016

onwards. Subject to the satisfactory performance and construction of the

Phase 1 project, the Developer shall award the Phase 2 and Phase 3

contracts worth RM60.311 million to TPSB.

- Further to the earlier announcement dated 04 February 2015, the Company is pleased to inform that the contract RM65 million

awarded by Wira Syukur (M) Sdn. Bhd. to Proper Methods Sdn. Bhd., a

wholly-owned subsidiary of ETITECH as a sub-contractor to design,

construct and complete the 500 units of apartments in Tawau, Sabah under

the People’s Housing Programme will not have any material effect on the

net assets and gearing of ETITECH Group. Nevertheless, it is expected

to contribute positively to the earnings of ETITECH Group for the

financial year ending 31 July 2016 onwards.

**Note: Proper Methods Sdn. Bhd is the wholly subsidiary of Trive

Property Group Bhd thus all profits will be consolidated with the group.

The Group registered a loss before taxation for the quarter ended 31 January 2016 of approximately RM18.52 million. The loss in the reporting quarter was mainly due to the impairment on other receivables (mainly non-trade receivable related), depreciation of property, plant and equipment and operating costs incurred.

In my opinion, at the end of each reporting period an entity is required to assess whether there is any indication that an asset may be impaired. Thus the impairment loss is a one-off loss to the company on the quarter.

Conclusion:

At the current outlook, Trive is beneficial on below statements:

- Solar market is not expected to become saturated in 2020.

- PV will still be a relatively low percentage of the energy mix in

countries like China, the U.S. and India by this golden year.

- Battery storage demand grows with increase installation of PV in upcoming years.

- The company financial position is strengthened.

- The synergy between Trive and Fortunate Solar.

- Increased contribution from Construction and Property Development Division from the two awarded projects.

Tomorrow we will anticipate the price to hike further up.

The price will have to past 0.120 initially and also 0.155 to find our possible TP at 0.300

Happy trading and good luck. TAYOR

Regards,

Ms Kana

For Kim’s Stockwatch

Telegram : https://www.telegram.me/kimstock (Real live time trading)

Facebook : https://www.facebook.com/Kim-990381907717321

TRIVE (0118) - TRIVE WILL BE THRIVING

http://klse.i3investor.com/blogs/kimstockwatchfajar/98213.jsp