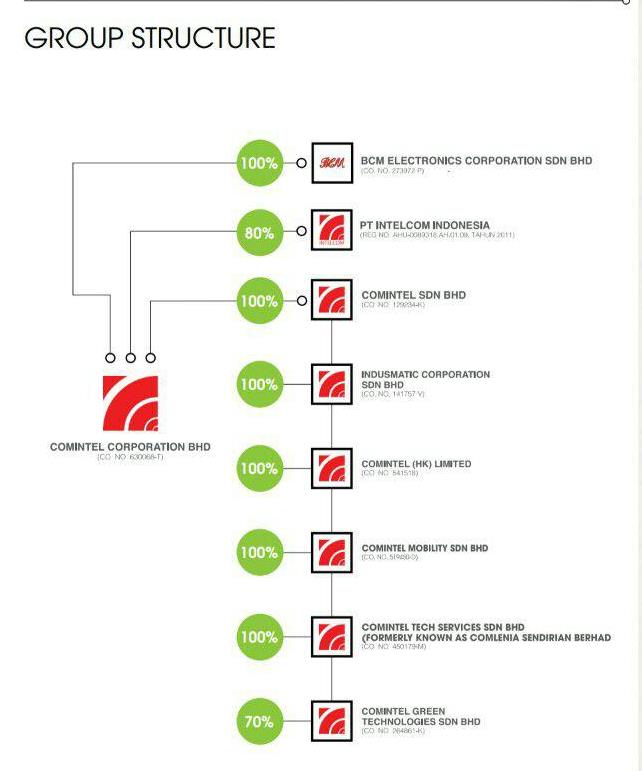

The Company is engaged in three business segments:

1) Communication and system integration, which is engaged in the provision of turnkey engineering design and integration,

program management, installation and commissioning;

2) Defense maintenance, which is engaged in the provision of electronic systems testing, repair and provision of integrated

logistics support,

3) Manufacturing, which is engaged in the manufacturing and assembling of electronic components. Its subsidiaries include

a) Indusmatic Corporation Sdn Bhd, which is engaged in the provision of research and development services;

b) Comintel (HK) Limited, which is engaged in the trading of electronic, engineering and telecommunication

equipment and the provision of related services, and

c) Comlenia Sendirian Berhad, which is engaged in the electronic systems testing and repair.

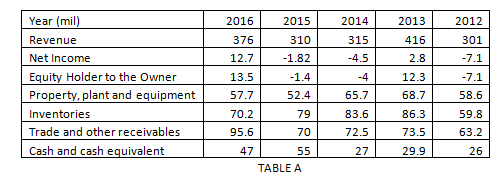

From the above Table A

1) Revenue increases 25% with CAGR 6%, anyway revenue increases 21% from 2015 to 2016

2) Net Income increases 279% with CAGR 16%, the net income increases tremendously, 80% from 2015 to 2016 even

though the revenue only increases 21%

3) Equity increases 26% with CAGR 6%

4) Cash or Cash equivalent increases 26% with CAGR 6%

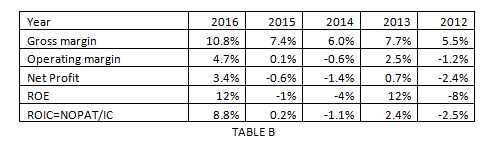

From the above Table B

1) The Gross Margin is 10.8% and 7.4% for year 2016 and 2015 respectively, this show that the gross margin improve

46% as compared to year 2015

2) The ROE is 12% and -1% for year 2016 and 2015 respectively, the ROE improves 1100% as compared to year 2015.

3) The ROIC is 8.8% and 0.2% for year 2016 and 2015 respectively, the data show the ROIC improves 4300%

The above data shows that the successful implementation of

“Lean Manufacturing processes for operational activities, efficiency and product quality improvement to capitalize on opportunity in manufacturing outsourcing activities from our existing and new customers”

Which stated in the 2016 Chairman’s Statement

The Big improvement in Manufacturing Segment is VERY IMPORTANT or CRITICATL since the Manufacturing segment contributes 97% and 75% in the Revenue and Net Profit respectively.

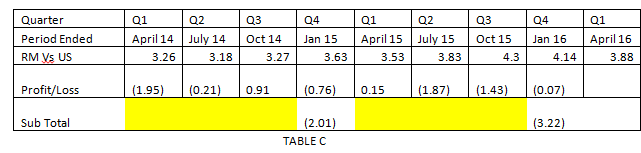

C)Foreign Currency Exchange

From the statement,

“Our Manufacturing Segment provides EMS services to multinational and international companies in the public safety, oil and gas, transportation, telecommunication and networking industrial. Our portfolio of products manufactured also have application in automobile, medical and consumer electronics market. All of the products manufactured by our manufactured segment are more export market. For financial year ended 31st Jan 2016, approximately 80% of EMS revenue was derived from North America, 15% from Asia-Pacific region and 5% from Europe.”

Let us look at their foreign currency status as stated in the table below

From the Table C, it seems like their losses in foreign exchange increased 60% even the RM depreciated around 18.4%.

This show that their profit is not generated from the depreciation of RM, however is their implementation of Lean Manufacturing.

Can we say that "It is a turn around company".

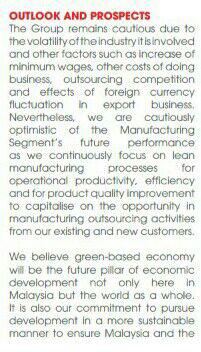

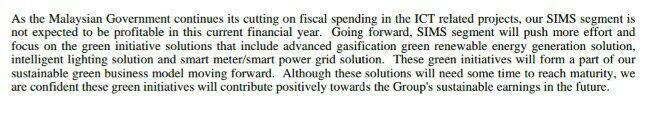

D)Year 2016 Prospect

TABLE D

From the TABLE D, we expect positive contribution from

1) Advanced gasification green renewable energy generation solution

Sin Chew Jit Poh

“康明電旗下第一座2兆瓦生物質發電廠,已預定5月杪啟用,這座號稱大馬第一項負碳值(Carbon Negative)的發電廠計劃,能夠利用材質和農產品殘渣來發電,同時不會產生二氧化碳和污染物。

假設每兆瓦電力年收入為100萬令吉(以其他再生能源收費作準),2兆瓦發電廠每年料為康明電帶來200萬令吉收入,雖不足以左右集團業績,勝在發展空間巨大,除自行經營發電廠,也能為其他機構提供綠色系統方案服務,如農業和木料相關領域。

2) Intelligent lighting solution (Innovation LED)

Sin Chew Jit Poh

有細讀上週公佈的2016年報的朋友或許會發現,康明電已成功研發出內建智能發光二極管(LED)照明燈產品,並已就此申請專利權,新的LED燈目前已準備好要推出市場,董事部有信心新產品將對未來業績作出正面貢獻,畢竟採用更耐更環保的LED燈已是當今趨勢

3) Smart meter/Smart power grid solution

Sin Chew Poh

康明電也已設計出含有通訊功能的智能測量器,目前正在認證階段,董事部說,這些新產品將由康明電自行製造和推銷,以期繼續壯大營業額和盈利,同時讓公司多元化至原件設計製造(ODM)市場和擴大產品組合。

As stated, the management are confident these green initiatives will contribute positively towards the Group’s sustainable earning in the future.

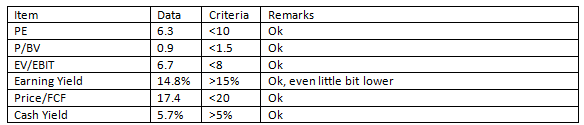

Now the BIG Question, Is the Share Price fair/Under or OVER VALUE?

E)Share Price & Debt Management

Let us look at the Debt Ratio,

Is it manageable, Yes even though not SUPER.

Now, let us look at current share price at 0.77

Note : Trailing 12 months

For VALUE INVESTOR, Is it fair to buy at this price? Wow! Again, not super, but it is fair value.

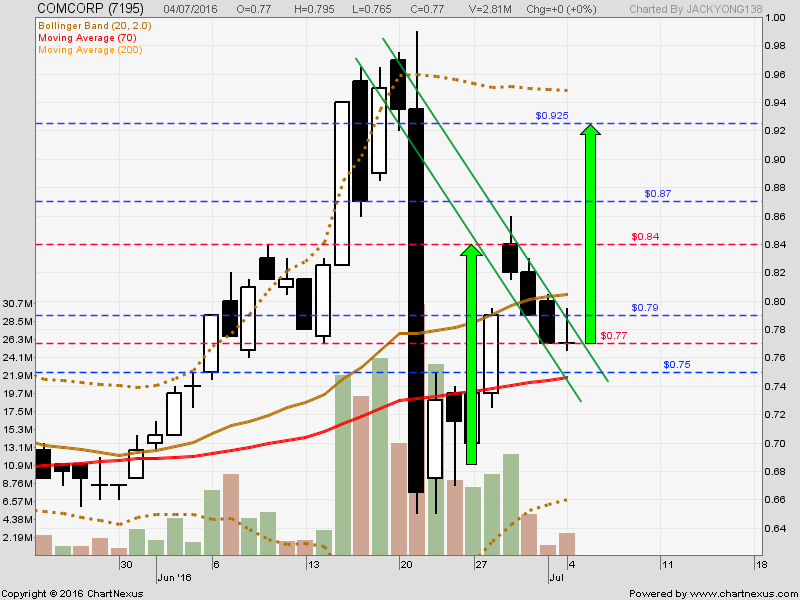

F)Technical Chart

It is a flag pattern, but not going to have high volume since KLCI to be closed from 5/7 (Tuesday, half a day) till 7/7(Thursday),

only re-open on 8/7 (Friday)

Last but not least, Wish Our Muslim Friends Selamat Balik Kampung & Selamat Hari Raya Adilfitri'

Wonder88

Disclaimer

This is an information sharing, it is not a buy or sell call. Please make your own research in order to have decision in investment.

COMCORP (7195) - Comcorp - Is It A Future Gold Mine?

http://klse.i3investor.com/blogs/Comcorp/99579.jsp