Malayan Flour Mills Berhad (“MFLOUR”)

Brief Background

MFLOUR is the pioneer wheat flour milling company in Malaysia, with operations located at Lumut and Pasir Gudang with a total milling capacity of 1,250 ton of wheat per day. Besides Malaysia, MFLOUR also have similar operations in both the Northern and Southern Vietnam.

Its business segments can be divided into two:

- Flour and trading in grains and other allied products

- Poultry integration

Products & Brands

Indonesia Venture

Back to year 2011, PT FKS Capital (Indonesia), Malayan Flour Mills (Malaysia) and Toyota Tsusho (Japan) had formed a partnership to create Indonesia’s newest flour milling company, PT Bungasari Flour Mills Indonesia, with 40%, 30% and 30% equity stake respectively.

Bungasari Flour Mills involved in the business of flour milling and distribution of flour products and by-products.

Bungasari Flour Mills began commercial production in the second half of year 2014 and is now producing 1,500 tonnes of flour per day. It is growing in Indonesia by catering to growing middle-income group with its large population base of 240 million.

However, Bungsari Flour Mills was not doing well in FY14 and FY15 in term of financial result. Even though its revenue increased from MYR66m in FY14 to MYR392m in FY15, Bungsari Flour Mills still remained in the red due to lack of economies of scale in its operations and intense price war in FY15.

MFLOUR’s share of loss amounting to MYR21.8m was recorded in FY15, which was also the main factor for its underperforming result in FY15.

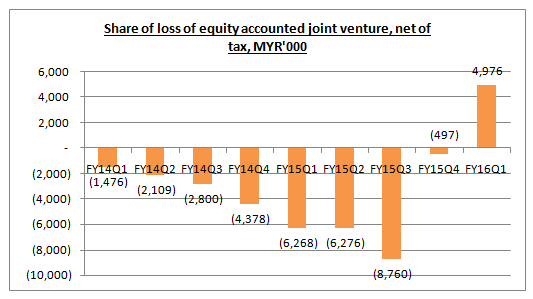

As extracted from its quarter report, MFLOUR had been hit by share of loss of Bungsari Flour Mills since FY14 and its losses were getting serious from quarter to quarter.

Having said so, Bungsari Flour Mills had finally turned over its result in FY16, by making profit for the first time. It was definitely a good sign for MFLOUR as Bungsari Flour Mills had started to contribute in FY16, as compared to a burden in FY14 and FY15.

MFLOUR expects to see sustainable profit growth for the remaining quarters in FY16 from its joint-venture business in Indonesia.

Indonesia Flour Industry

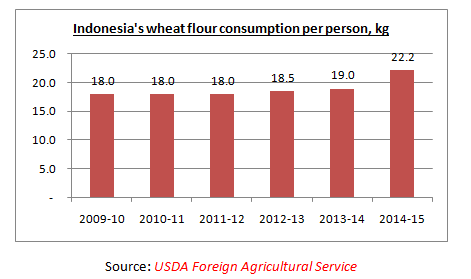

Indonesia’s wheat flour consumption per person had increased significantly in 2014-15, from 19kg to 22.2kg. Nowadays, relatively stable macro-economic conditions in Indonesia have allowed middle and upper-middle income consumers to diversify their diets to include more western-style foods like bread and pasta. Rather than eating rice three daily meals, many Indonesians have switched to eating bread or noodles for breakfast.

Instant noodle prices are currently cheaper than rice, and many more lower and middle income consumers substitute instant noodles for breakfast or dinner. As a result, the noodle industry continues to grow rapidly, consuming 70% of Indonesia’s wheat flour. Bakery industry consumption follows with 20% of flour, while household and commercial biscuit producers each consume 10%, respectively.

The single main driver of rising wheat consumption in Indonesia is the growing popularity of instant noodles. FYI, Indonesia is the second-biggest market for instant noodles and home to the world’s largest instant noodle producer, Indofood Sukses Makmur.

Due to the fact that sales of wheat-based foods rely to a large extent on middle class consumers, the growth of the wheat flour market in Indonesia is a force to be reckoned with for years to come.

Bungsari Flour Mill is expected to benefit from the current trend in Indonesia and indirectly contribute to MFLOUR’s financial result.

Source: http://www.world-grain.com/

In FY15, flours & trading segment and poultry segment contributed 68% and 32% to the Group’s revenue respectively.

In term of segmental profit, flours & trading segment was still the largest contributor 60%, while poultry segment contributed the remaining 40%.

Flour & Trading Segment

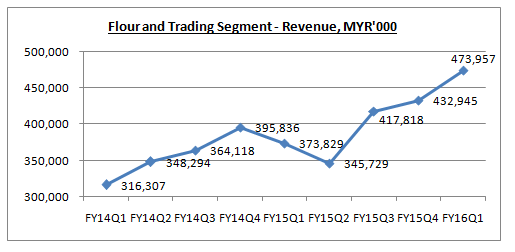

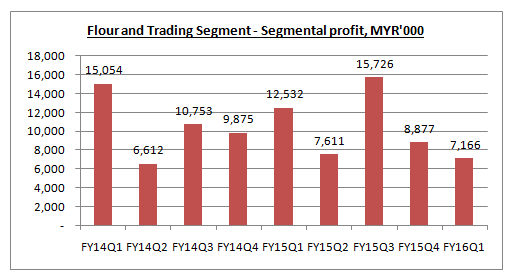

Back to its own business in Malaysia, MFLOUR’s flour & trading segment was growing in FY14 and FY15.

Its revenue from this segment had increased significantly in FY15, which contributed from higher sales volume of flour and grains. Currently, it is still on a very strong growth momentum.

However, despite excellent result in revenue, its profit from this segment had seems to be flat and reducing. According to its explanation in quarter report, MFLOUR was heavily hit by unrealized loss on foreign currency in recent quarters.

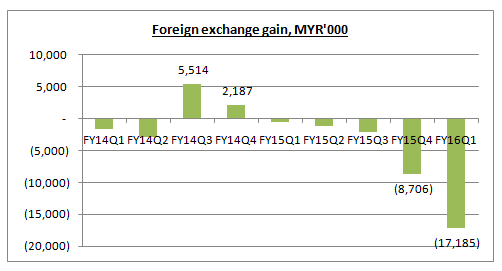

As extracted from its quarter report, MFLOUR had accounted foreign exchange loss of MYR8.7m and MYR17.2m in FY15Q4 and FY16Q1 respectively! It was a very heavy impact for MFLOUR. If these two foreign exchange losses can be excluded from its result, initially MFLOUR’s segmental profit in FY15Q4 and FY16Q1 will be MYR17.6m and MYR24.3m respectively, a new high over the past two years.

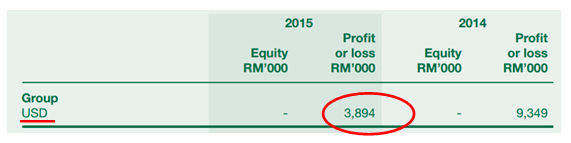

MFLOUR are exposed to foreign currency risk on sales, purchases and borrowings that are denominated in foreign currency, primarily USD. Regarding on its revenue geographical segment, it was not disclosed in MFLOUR’s annual report.

Based on its currency sensitivity analysis, for every strengthening of MYR against USD by 5%, MFLOUR will have a gain of MYR3.89m. It was because MFLOUR has a borrowing denominated in USD which worth up to MYR423m. So, theoretically MFLOUR is a beneficiary of strengthening of MYR.

However, during FY16Q1 USD/MYR had dropped from 4.20 to lowest 3.80, what is the factor behind the huge amount of foreign exchange loss? It is a big question mark.

I believe this foreign currency loss can be reduced or wiped off in the next quarter, as long as USD/MYR stabilizes and no longer that volatile.

Poultry Segment

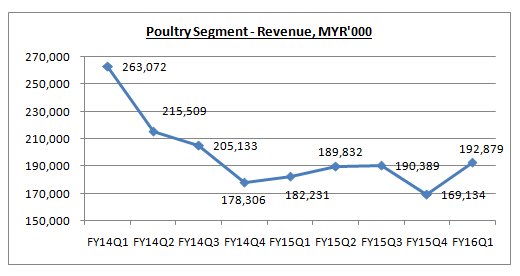

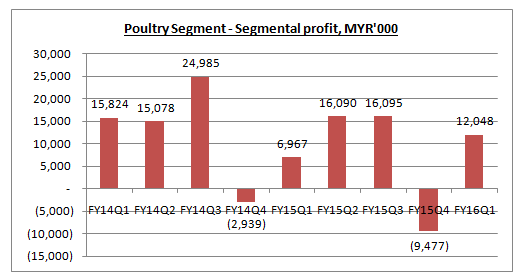

MFLOUR’s revenue from poultry segment had dropped by 15% in FY15, which mainly due to lower sales volume.

In term of margin, MFLOUR was highly depended on the live bird selling price. As in FY15Q4, the loss making of MYR9.5m from this segment was due to lower live bird selling price coupled with higher costs giving. As in FY16Q1, MFLOUR was contributed from higher live bird selling price giving rise to higher margin.

Currently, there is no excitement in MFLOUR’s poultry segment. However, in the long run, MFLOUR is in a well-positioned to benefit from the synergies derived from an integrated poultry business and the Group is working on further expansion in this segment.

As part of the expansion, in FY15 MFLOUR had increased stake in its subsidiaries, Dindings Poultry Processing and Dindings Soya & Multifeeds.

Leasing and Acquisition

In Oct 2015, MFLOUR had proposed to lease 3 pieces of land, measuring 200 acres in Lumut, Perak for MYR2.53m. The payment will be satisfied by the issuance of 1.96 million new shares, at an issue price of MYR1.29 per share.

Besides, MFLOUR also proposed to lease another 3 pieces of land, measuring 464.96 acres in Pengkalan Baru, Perak for MYR4.65mn, to be satisfied by the issuance of 3.6 million new shares at an issue price of MYR1.29 per share.

FYI, MFLOUR had been operating on the above mentioned lands for the past 25 years and 22 years respectively. The lease period of the 6 lands are for 30 years, with automatic renewal of another 30 years.

MFLOUR also plans to acquire 2.96% and 17.55% of the equity interest in Dindings Poultry Processing and Dindings Soya & Multifeeds respectively, for a combined MYR8.32m or MYR1.29 per share.

The acquisition of Dindings Poultry Processing will see MFLOUR’s stake increasing from 94.74% to 97.7%; while its stake in Dindings Soya & Multifeeds will increase from 70.21% to 87.76%.

The land leasing and acquisition above involved a total consideration of MYR15.49m which was satisfied by issuance of 12.01m new shares at an issue price of MYR1.29 per ordinary share. The new shares were listed and quoted on the Main Market of Bursa Malaysia on 5 Jan 2016.

According to MFLOUR, the proposed leasing of lands are mainly for the poultry integration business of the group, while the proposed acquisitions will facilitate the group’s aspiration to further expand its poultry integration business.

Overall, the additional profit from the stake of 2.96% in Dindings Poultry Processing and 17.55% in Dindings Soya & Multifeeds will be accounted into MFLOUR financial result from FY16 onwards.

Valuation

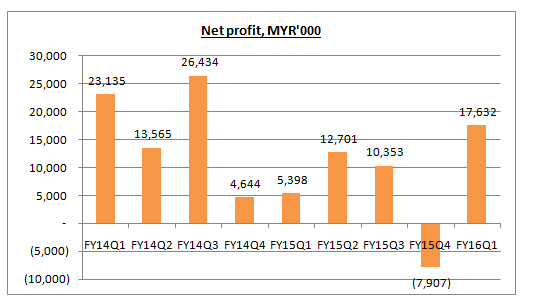

MFLOUR’s net profit over the past 13 quarters was as below:

FY16Q1 marked the first time where Bungsari Flour Mill started to contribute positively to the Group, however MFLOUR was hit by MYR17m foreign currency loss in that quarter too. In other words, if the foreign currency loss can be neglected, MFLOUR supposingly can deliver MYR34m net profit in FY16Q1.

The Bungsari Flour Mill had just started to bear fruit and it definitely will not be one-time off positive contribution only. Currently, USD/MYR had stabilized around 3.95 to 4.05, so foreign currency loss is expected to reduce and minimize in the remaining FY16.

So, let’s assume MFLOUR’s net profit is able to hit MYR100m in FY16 (MYR25m each quarter averagely). Based on its outstanding shares of 550.24m, MFLOUR’s earnings per share will be 18.17 cent.

With an estimated PE of 10-12x, MFLOUR will have an intrinsic value between MYR1.82 and MYR2.18. Based on its current share price MYR1.41, MFLOUR will have more than 25% potential upside.

Technical Chart

Technically, MFLOUR had passed through a huge downtrend from Aug 2014 to Aug 2015, whereby its price dropped from MYR2.16 to MYR1.20, which equivalent to a drop of 44%.

After a change of trend, MFLOUR had entered into a consolidation period until now. Recently, there is a huge price movement in MFLOUR, supported by huge volume.

Based on the chart above, MFLOUR seems likely to test its resistance 1.42 and look forward for a breakout from this level.

Conclusion

In Mar 2016, the wheat flour subsidy for 25kg bag flour had been removed by the Government. This is a positive move towards a free market environment where the selling price of wheat flour will be based on market supply and demand.

Other than that, MFLOUR wishes that the government would remove the subsidy for 1kg bags of wheat flour too, so as to promote a free market in flour trading.

MFLOUR will be benefited from this removal of subsidy as it is able to price its products at a premium price.

Overall, MFLOUR’s flour sales volume was doing good and showing improvement from quarter to quarter. The only concern for MFLOUR is the foreign exchange risk. As long as USD/MYR can be stabilized, the huge amount of foreign exchange losses can be reduced.

Besides, its 30% equity stake in Bungasari Flour Mills had finally made profit for the first time. In addition with the strong consumption rate in Indonesia, Bungasari Flour Mills is expected to contribute positively and continuously to MFLOUR.

As for its poultry segment, there is no excitement. MFLOUR’s profit from this segment is highly depends on living bird price. Do take note that, the additional profit from the stake of 2.96% in Dindings Poultry Processing and 17.55% in Dindings Soya & Multifeeds will be accounted into MFLOUR financial result from FY16 onwards. It is considered a small positive note for MFLOUR.

Just for sharing

*I do not own any shares in MFLOUR.

Hey guys, I am writing stock analysis report to earn some pocket money. For more information, you may email me at richeho_92@hotmail.com

If you guys like my writing, kindly give me a like on my FB page :)

https://www.facebook.com/rhresearch/

For any enquiry, you may contact me as well. Sharing is caring.

Happy investing!

Cheers!

MFLOUR 3662 - (RICHE HO) Malayan Flour Mills Berhad - Good Day Ahead?