(BJ Land has plenty of assets, but produces very little profit)

1. Introduction

Same as BJ Toto, I am not really interested in BJ Land. The reason I study it is because I am interested in BJ Corp, which recently launched its Toto betting business in Vietnam.

My objective for analysing BJ Land is very clear - BJ Corp holds 3.74 billion shares in BJ Land (75% equity interest). Based on latest price of RM0.70, that stake is worth RM2.62 billion. That is a huge amount, bearing in mind that BJ Corp's market cap is only RM1.86 billion.

I want to establish to what extent that value is backed by fundamentals.

2. Group Structure

BJ Land is principally involved in gaming (through 40% owned subsidiary BJ Toto), property development, property investment and leisure business (hotels, clubs, resorts, etc).

3. Historical Profitability

Key observations :-

(a) In FY2016, the BJ Land group generated RM6.3 billions revenue. However, RM5.6 billion was attribuatble to BJ Toto (its gaming and luxury car dealer operation generated revenue of RM3.3 billion and RM2.2 billion respectively).

BJ Land's own operation, namely property investment and development, hotels, club, etc generated revenue of RM744 mil only.

(b) Due to high gearing, the group needs to service high interest expenses every year. In FY2016, total interest expenses was RM207 mil, out of which RM48 mil belonged to BJ Toto. This means that every year, the group's non Toto operation is repsonsible for servicing interest expenses amounting to approximately RM150 mil.

This is met mostly by dividend income from BJ Toto. In my previous article, I mentioned that BJ Toto paid out dividend of approximately RM250 mil per annum to shareholders. By virtue of its 40% equity interest, BJ Land will receive RM100 mil.

(c) The group's non Toto operations, comprises property investment, property development and leisure businesses, are not impressive. In FY2016, those divisions generated EBIT of RM43 mil only. This is rather small if compared to overall Group revenue of RM6.3 billion and total interest expenses of RM207 mil.

4. Gearing

As at April 2016, the BJ Land Group has loans of RM3.69 billion, out of which RM0.83 billion is at BJ Toto level. As such, its actual loans are RM2.86 billion.

BJ Land (excludes BJ Toto) has cash of RM1.11 billion. As such, net loans are approximately RM1.74 billion.

BJ Land is in the process of disposing its Mall in Hebei, China for cash consideration of RM1.24 billion (arrived at based on Renminbi 2.08 billion and exchange rate of 1.68).

It is envisaged that RM301 mil * will be used to pare down Mall related project loans and RM360 mil to pay creditors, contractors, etc (Source : BJ Land announcement).

* According to April 2016 quarterly report, approximately RM301 mil of the group's borrowings are denominated in Yuan. As Hebei Mall is the Group's only major operation in China, it is likely that the entire RM301 mil is related to that project.

The remaining RM579 mil will be distributed back to shareholders. As BJ Land owns 51% of the Mall, it will be entitled to RM295 mil.

The cash proceed from Mall disposal will increase cash holding (non Toto) from RM1.117 billion to RM1.41 billion while reducing loans from RM2.86 billion to RM2.56 billion. Net loans will decline from RM1.74 billion to RM1.15 billion.

Of course, the above calculation is for illustration purpose only. It is unlikely that the entire RM1.41 billion cash will be used to pare down borrowings. As usual, part of it will be used as working capital or buy new assets. The high gearing problem is likely to remain. However, the above exercise does show that liquidity is not a big issue at least in the next two to three years.

Summary Conclusion : At first look, BJ Land Group's total borrowings of RM3.69 billion is very alarming. However, after making a series of adjustments and factoring in the cash in hand, net borrowings will decline to RM1.15 billion only. This is not to say that the Group's gearing problem is not real. However, it seemed that if they manage it carefully, keeping the group solvent in the next two to three years shouldn't be a problem (Note : two to three years is my investment horizon).

5. Cash Flow

Key observations :-

(a) BJ Land group generated net operating cash flow of few hundred millions Ringgit per annum. However, if you remove BJ Toto from the picture, net operating cash flow will become negative (average of RM50 mil to RM100 mil per annum).

That is consistent with my earlier observation in Section 3 that non Toto operations only generated EBIT of RM43 mil (in FY2016).

However, things took a turn for the better in FY2016. The Group undertook a series of assets disposals, resulted in drastic improvement in net operating cash flow to RM573 mil (even without BJ Toto contribution).

(b) The same happened for investing cash flow. In FY2014 and 15, BJ Land spent closed to RM300 mil per annum to acquire new assets (a casual check reveals that most are overseas land banks). However, in FY2016, the group disposed various assets, resulted in positive net investing cash flow of RM413 mil.

(c) In a typical year, due to negative operating and investing cashflow, the group has to rely on new loans to plug the funding gap. For example, in FY2014 and 15, the group made net draw down of more than RM500 mil per annum.

However, in FY2016, due to positive net cash flow of RM986 mil from operating and investing activities, the group pared down RM485 mil borrowings.

(d) For the first time in many years, the group ended FY2016 with net increase in cash by RM501 mil without relying on new loans. It is difficult to tell whether it was a one off phenomenon or the beginning of a new era. We will just have to wait to find out.

6. Property Assets

The BJ Land group (excludes BJ Toto, which doesn't own much property assets anyway) has many property assets. The list is so long that it will make your head spins.

According to FY2015 Annual Report, the Net Book Value of those assets was RM4.53 billion. How closed is this value to Open Market Value ? Let's take a look.

Key obersvations :-

(a) Overseas Land Bank

The group has 308 acres land bank overseas with Net Book Value of RM2.26 billion. I am quite comfortable with that figure (namely, no need for impairment) as the land banks are located in prime area and has good development potential.

(b) Investment Properties

The group has investment properties with Net Book Value of RM728 mil. According to FY2015 Annual Report, this division reported PBT of RM18 mil. Based on assumed tax rate of 25%, net profit would be RM13.5 mil.

Even by applying a generous Earnings Yield of 5% (the lower the more generous), Open Market Value works out to be RM270 mil only (RM458 mil lower than Net Book Value).

(c) Hotels & Resorts

The Group's hotels and resorts have Net Book Value of RM698 mil.

According to FY2015 Annual Report, this division generated PBT of RM27 mil. Based on assumed tax rate of 25%, net profit would be approximately RM20 mil.

Even by applying a generous Earnings Yield of 5% (the lower the more generous), Open Market Value works out to be RM400 mil only (RM298 mil lower than Net Book Value).

(d) Clubs

This division incurred loss of RM33 mil in FY2016. However, its Net Book Value per acre is very low at RM456,000 per acre (being RM250 mil / 546 acres). In addition, the Clubs are mostly located at prime area (PJ, Mont Kiara, Gombak, etc).

Even though I am not an expert in properties, I believe the Net Book Value of RM250 mil is realisable (redevelopment in the future ?).

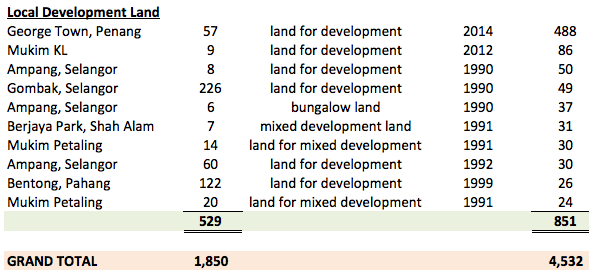

(e) Local Development Land

The group has 530 acres developemnt land with Net Book Value of RM851 mil.

Of the RM851 mil, RM488 mil and RM86 mil are attributable to land in George Town and KL respectively. These two pieces of land were acquired quite recently (in 2014 and 2012 respectively). As such, I assume that their Open Market Value is closed to Net Book Value (no impairment or surplus).

The remaining RM278 mil is attributable to 466 acres of land located at various good locations in Selangor. These lands were last revalued in 1990.

Based on assumed annual rate of appreciation of 3.5% (better put money in Fixed Deposit if you can't get return of at least 3.5% per annum from your land investment), the land should have appreciated to at least RM657 mil over a period of 25 years (from 1990 to 2016). That represents a gain of at least RM379 mil.

7. Sum of Parts Valuation

Now we have come to the gist of this article. In Section 1 above, I explained that the main objective of my analysis is to establish whether BJ Land's market cap of RM3.5 billion (being 5 billion shares x RM0.70) is backed by fundamentals.

As BJ Land's earnings are erratic, I can't use PE Multiple to value it. In this case, Sum of Parts Valuation is more appropriate.

Assets

First of all, let's work on the assets.

As shown in table above, the Group has total assets of RM14.3 billion. However, after excluding BJ Toto's assets, total assets would be RM11.7 billion.

Of the RM11.7 billion, RM3.93 billion is intangibles (the bulk of which is BJ Toto related goodwill). After eliminating that amount and add back RM1.77 billion BJ Toto shares (being 540 mil shares x RM3.28), total assets will be RM9.54 billion.

After factoring in the following revaluations :-

(a) deficit of RM458 mil for investment properties;

(b) deficit of RM298 mil for hotels and resorts; and

(c) surplus of RM379 mil for development landbanks,

total assets will become RM9.163 billion.

Liabilities

The group has RM6.353 billion liabilities. However, after excluding BJ Toto, the amount dropped to RM4.56 billion.

Sum of Parts

Sum of Parts = Adjusted Assets - Adjusted Liabilities

= RM9.163 billion - RM4.564 billion

= RM4.599 billion.

Divided by 5 billion BJ Land shares, Intrinsic Value = RM0.92 per share.

8, Property Development

The

group tries to create value through its property development

activities. It is clear that they like to venture overseas. So far, the

results are mixed.

(a) Jeju Island Project, South Korea

Their

Jeju Island project in South Korea started out promising.

Unfortunately, due to things beyond their control (unforeseen legal

tussels), the project has now been derailed.

On

a positive note, I believe they have a good chance of winning the court

case against their JV partner (Jeju Government linked entity) as it is

quite clear that it is the Jeju side's negligence that got the project

into trouble. Due to the huge amount involved, a favorable rulling will

be very positive for the BJ Land Group.

(b) Hebei Mall, China

BJ Land has invested huge amount of time and resources in this project. Unfortunately, it has

not generated much return. The group recently entered into agreement to

dispose of the Mall to a China buyer. The disposal will not generate

much profit (small losses instead). However, I am happy that they are

getting back substantial amount of cash. That will go a long way towards

addressing their gearing issue.

(c) Kyoto Project, Japan

The

Four Season hotel project is targeted to be completed by end of 2016.

It is not clear whether BJ Land will dispose it of (my preferred

outcome) or keep it for investment purpose. Lets just wait and see.

(d) Vietnam Projects

Several

years ago, the group has been quite high profile about their various

intended projects for Vietnam. However, it seemed that they are

currently holding back. I Googled for related news and found some

Vietnamese articles criticising BJ Land for sitting on the landbanks

doing nothing.

9. Concluding Remarks

(a) BJ Land is a giant group. However, after stripping off BJ Toto's contribution, what was left was plenty of debts, some landbanks and low yield assets in the form of hotels, resorts and clubs.

(b) What I mentioned above was nothing new. The market has known about it all this while. However, my article went one step further to study the Group in details to try to determine its break up value (Sum of Parts Valuation). The purpose is to ensure that even if BJ Land's market cap suddenly collapses one day (something I constantly worry about for companies not generating profit), there are tangible assets left to back up BJ Corp's own market cap.

(c) I am quite satisfied with the outcome of the anaysis - BJ Land is not a house of cards, its current market cap is properly backed by assets that are realisable in the event of liquidation. I heave a big sigh of relief.

(d) Profit wise, pleased don't have high expectations. Due to high gearing, whatever profit generated by 40% stake in BJ Toto will be wiped off by high interest expenses of more than RM200 mil per annum. Unless the group gets serious about paring down its borrowings, it is unlikely to churn out profit in a meaningful way.

(e) As mentioned in Section 1 above, I am not interested in BJ Land at all. The reason I studied it is because of BJ Corp, which recently launched its Toto operation in Vietnam. Now that I have established that BJ Land does have some substance (proper assets backing), my next step would be to study BJ Corp to try to understand it better.

Look out for my next article. Have a nice day.

BJCORP (3395) - (Icon) Berjaya Corp (4) - BJ Land : Plenty of Muscles, No Brain

http://klse.i3investor.com/blogs/icon8888/99941.jsp