Classic Scenic, A Gem Unearthed - Salvador Dali

This is what a good research report should look like:

a) unearthing deep value in a stock

b) discovering a largely un-followed stock, below the radar of most investors

CIMB

came out with this report a couple of days back and as you can see the

price has only started to budge. Classic Scenic (CSB) has proven that it

can weather the storm during the subprime mess, even though the bulk of

their clients are from the US.

As

per the report, CSB is almost a replica of Larson Juls, even though the

latter is a client of CSB, and as such conforms to all the metrics

deemed as an excellent buy by Warren Buffett.

-------------------------------------------------------------

CSB exports almost all of its products. Its largest market is North America,

where USA makes up 77% and Canada 3%. This is followed by Australia (9%),

Europe (6%) and Asia (5%).

Its major customers are in the US - Michaels Stores, Hobby Lobby and Larson

Juhl - which collectively account for 50-60% of annual revenue.

a) Michaels Stores, Inc. (Michaels) is the largest retailer of arts and crafts

materials in USA, with 1,260 stores in USA and Canada. With annual

sales of US$4.5bn, Michaels Stores generates sales of about US$760m

from its picture framing division. CSB is its largest foreign vendor and

one of Michaels’s six approved foreign suppliers. Over 20% of

Michaels’s wooden picture frames are sourced from CSB. Michaels was

taken private by Blackstone Group and Bain Capital in 2006 and was

re-listed on the NASDAQ in Jul 14;

b) Hobby Lobby, Inc., one of the largest private companies in America, is

another chain of retail arts and crafts stores. It is based in Oklahoma

City and operates 600 stores across 47 states in USA. It sources

70-80% of its picture frame mouldings from CSB; and

c) Larson Juhl is a Warren Buffet company, having been taken private by

Berkshire Hathaway in Dec 01. It is a 100-year-old company that

designs, makes and distributes high-quality picture framing products,

with 24 manufacturing facilities across the US, and is present in 15

countries around the world.

-------------------------------------------------------------

CSB exports almost all of its products. Its largest market is North America,

where USA makes up 77% and Canada 3%. This is followed by Australia (9%),

Europe (6%) and Asia (5%).

Its major customers are in the US - Michaels Stores, Hobby Lobby and Larson

Juhl - which collectively account for 50-60% of annual revenue.

a) Michaels Stores, Inc. (Michaels) is the largest retailer of arts and crafts

materials in USA, with 1,260 stores in USA and Canada. With annual

sales of US$4.5bn, Michaels Stores generates sales of about US$760m

from its picture framing division. CSB is its largest foreign vendor and

one of Michaels’s six approved foreign suppliers. Over 20% of

Michaels’s wooden picture frames are sourced from CSB. Michaels was

taken private by Blackstone Group and Bain Capital in 2006 and was

re-listed on the NASDAQ in Jul 14;

b) Hobby Lobby, Inc., one of the largest private companies in America, is

another chain of retail arts and crafts stores. It is based in Oklahoma

City and operates 600 stores across 47 states in USA. It sources

70-80% of its picture frame mouldings from CSB; and

c) Larson Juhl is a Warren Buffet company, having been taken private by

Berkshire Hathaway in Dec 01. It is a 100-year-old company that

designs, makes and distributes high-quality picture framing products,

with 24 manufacturing facilities across the US, and is present in 15

countries around the world.

The wooden picture frame moulding industry is a very small, fragmented and

niche industry. At revenues of RM50m-60m, CSB is already considered the

largest wooden picture frame manufacturer in the world. Global market

demand is driven primarily by North America given the popularity of wooden

picture frames in American culture, which is not seen in many parts of the

world. As the US market is considered a mature market, the industry does not

attract too many new entrants as it is deemed too small and occupying a

low-growth environment.

niche industry. At revenues of RM50m-60m, CSB is already considered the

largest wooden picture frame manufacturer in the world. Global market

demand is driven primarily by North America given the popularity of wooden

picture frames in American culture, which is not seen in many parts of the

world. As the US market is considered a mature market, the industry does not

attract too many new entrants as it is deemed too small and occupying a

low-growth environment.

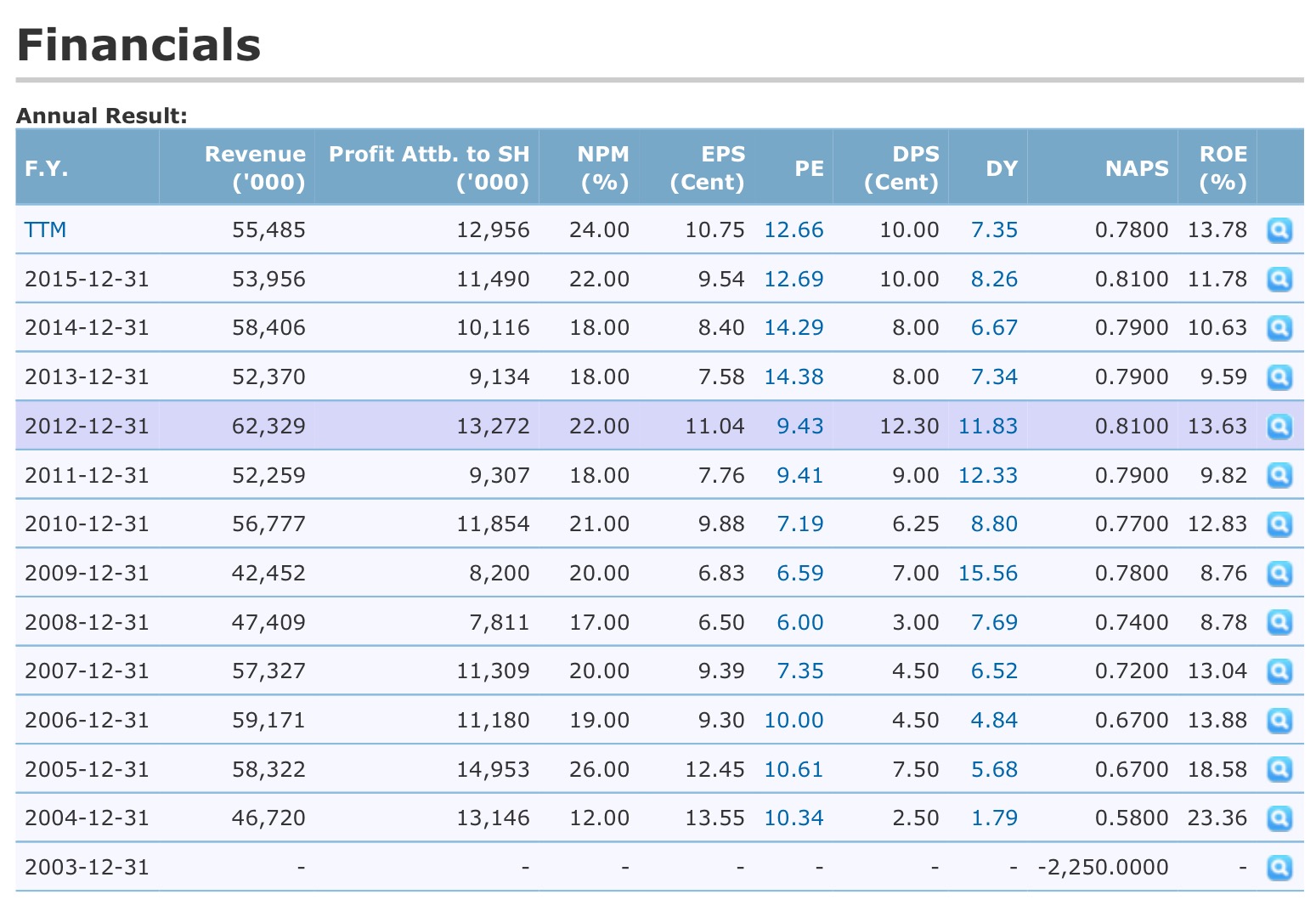

Superior profit margins and dividends

CSB’s margins are far superior to many other downstream wood-related

consumer products. Compared to domestic furniture manufacturers, such as Lii

Hen Industries and Latitude Tree, which only earn a pretax margin of 9-11%,

CSB’s pretax margins are 23-24%. CSB’s pretax margins have never dipped

below 20% in the past five years. During the 2008 global financial crisis, pretax

margins still hovered between 14% and 19%.

According to CSB, there are only 4-5 large-scale global players in the wooden

picture moulding industry. There are two in Malaysia (CSB and E-Wood

Moulding), two in Indonesia and one in China. During the global financial crisis,

many of its North American competitors went bankrupt on account of their

high cost bases. In recent years, China has also lost its competitive edge given

its high labour costs and higher overall cost structure.

Even at the height of the global financial crisis, when the US consumer was

hardest hit, CSB reported an FY08 net profit of RM7.8m (FY08 EPS = 6.5 sen).

consumer products. Compared to domestic furniture manufacturers, such as Lii

Hen Industries and Latitude Tree, which only earn a pretax margin of 9-11%,

CSB’s pretax margins are 23-24%. CSB’s pretax margins have never dipped

below 20% in the past five years. During the 2008 global financial crisis, pretax

margins still hovered between 14% and 19%.

According to CSB, there are only 4-5 large-scale global players in the wooden

picture moulding industry. There are two in Malaysia (CSB and E-Wood

Moulding), two in Indonesia and one in China. During the global financial crisis,

many of its North American competitors went bankrupt on account of their

high cost bases. In recent years, China has also lost its competitive edge given

its high labour costs and higher overall cost structure.

Even at the height of the global financial crisis, when the US consumer was

hardest hit, CSB reported an FY08 net profit of RM7.8m (FY08 EPS = 6.5 sen).

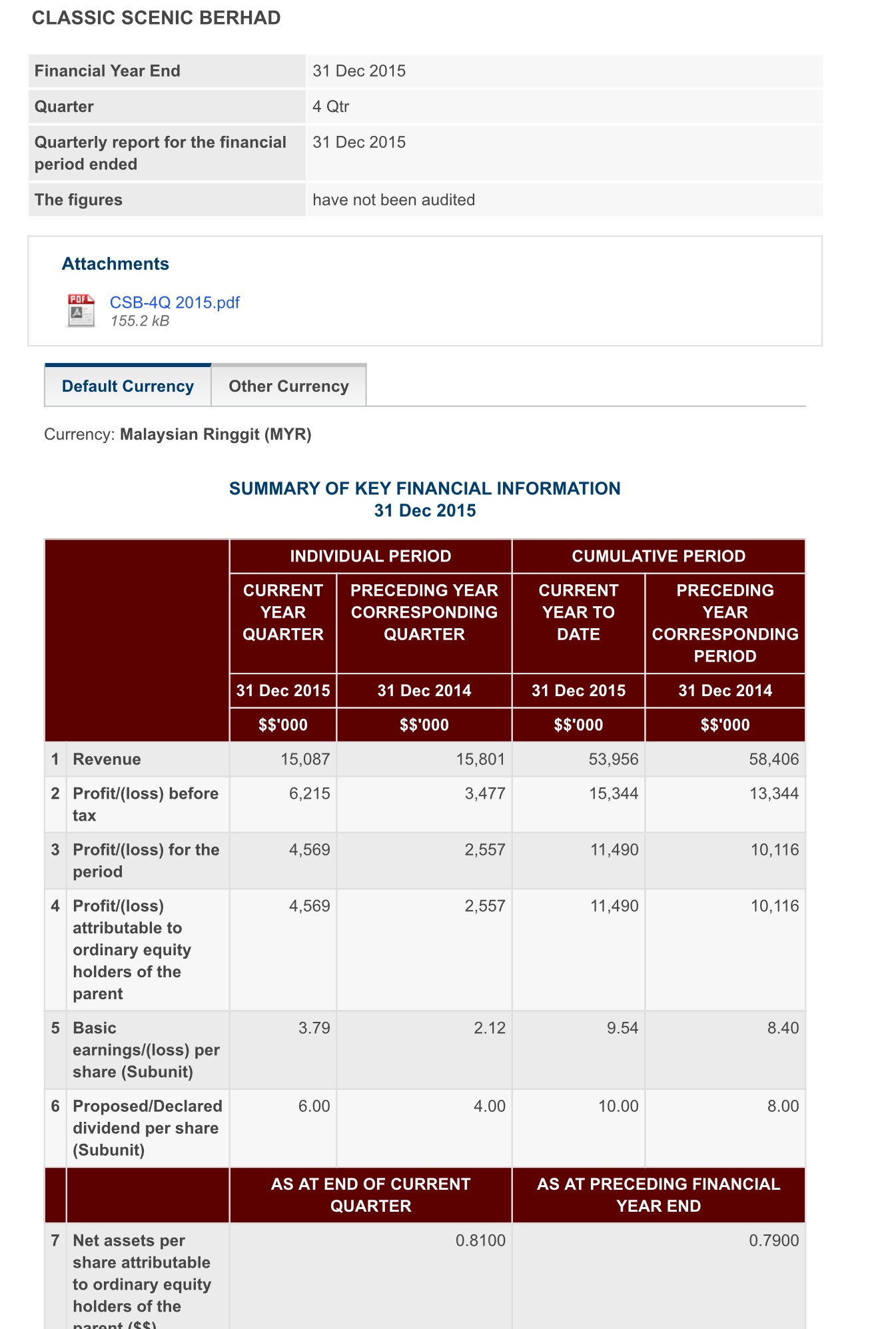

After 2008, CSB started paying out dividends at a payout ratio of at least 90%

in FY09 and we expect this to continue as maintenance and expansion capex is

minimal. The company generates very strong free cashflow of 8-12 sen a share

annually. Since FY09, CSB has been declaring annual DPS of between 7 sen and

10.5 sen, comprising an interim and final dividend. We do not rule out CSB

commencing quarterly dividends, which will further add to its dividend appeal

and boost its trading liquidity.

For 1H14, CSB has declared an interim dividend of 4 sen per share (going ex on

30 Oct 14), translating into a payout ratio of 88%. We anticipate a stronger 2H

as it is seasonally the stronger half due to accelerated order flow by its

customers ahead of the Christmas shopping season.

in FY09 and we expect this to continue as maintenance and expansion capex is

minimal. The company generates very strong free cashflow of 8-12 sen a share

annually. Since FY09, CSB has been declaring annual DPS of between 7 sen and

10.5 sen, comprising an interim and final dividend. We do not rule out CSB

commencing quarterly dividends, which will further add to its dividend appeal

and boost its trading liquidity.

For 1H14, CSB has declared an interim dividend of 4 sen per share (going ex on

30 Oct 14), translating into a payout ratio of 88%. We anticipate a stronger 2H

as it is seasonally the stronger half due to accelerated order flow by its

customers ahead of the Christmas shopping season.

We believe that a final dividend of 5-6 sen per share is possible, which will translate into a full-year dividend of 10-11 sen (8.8-9.6% annual dividend yield).

NOTE: The above opinion is not an invitation to buy or sell. It serves as a blogging activity of my investing thoughts and ideas, this does not represent an investment advisory service as I charge no subscription or management fees (donations are welcomed though). I may already have positions in the stock mentioned above. The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

---------------------------------------------------------------------------

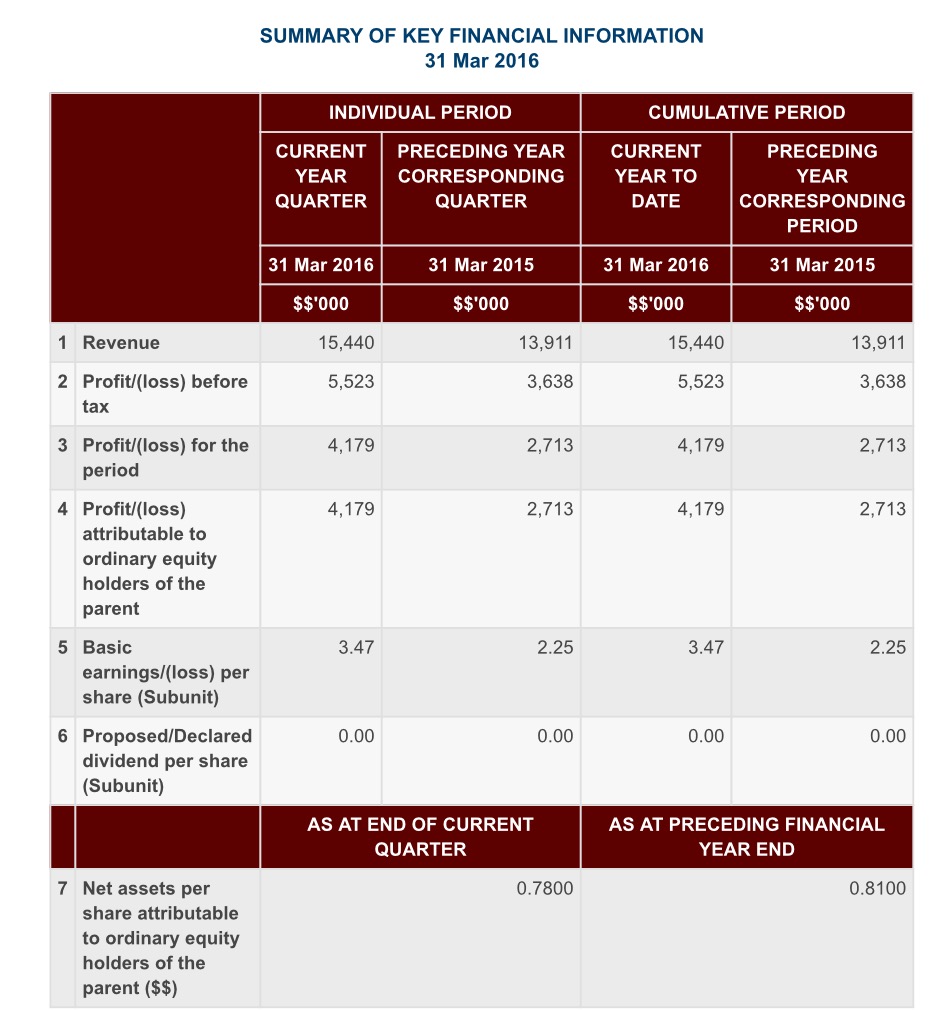

This

article was published in October 2014. CIMB Research was too early to

make a Buy call on Classic Scenic but the fundamentals were excellent -conforms to all metrics deemed as an excellent buy by Warren Buffett.

If

CIMB Research was right on timing back then, the stock price would have

risen above it's initial target price of RM2.06. Mind you, the research

report was written by the Head of Research!

Now that the actual full-year dividend is 10 sen, shouldn't Classic Scenic be worth RM2.06?

Invest at your own risk. Please consult your investment adviser before making any decision.

CSCENIC (7202) - Classic Scenic, A Gem Unearthed - Then and Now

http://klse.i3investor.com/blogs/Goodstockstoshare/97173.jsp