FLBHD (5197) - [Shaun Loong] - Value Emerge For FLBHD After 42% Rout YTD

FLBHD (5197) - [Shaun Loong] - Value Emerge For FLBHD After 42% Rout YTD

http://klse.i3investor.com/jsp/blog/blpost.jsp?blid=1524

Please do not construe this as an investment advice. Article presentation looks better in PDF. To view PDF, click FLBHD.

It’s

only been 3 months since Datuk Muhammad Ibrahim was appointed as the

new BNM governor, and he has surprised the markets with a 25 bps cut on

key interest rates. His unprecedented move on 15th July sent the stock market rallying as investors seek opportunities in favour of high yield stocks.

One of the more attractive dividend stocks I came across is Focus Lumber (FLBHD); trailing 8.9% yield at its current valuations! FLBHD was a top performer in 2015 with a ROI of 182%, hitting an all-time high on 11th Jan 2016 at RM 3.09. However, since then the stock has consolidated 46% to close at RM 1.68 today. YTD, the stock is down 42% and is at its 10-month low. Yesterday, I have added FLBHD into my portfolio. In my opinion, I think that the market has significantly undervalued FLBHD, which should be fair valued around RM 2.11 – RM 2.24 for the following reasons:

COMPANY BACKGROUND

FLBHD is a timber company which focuses on the manufacturing and sale of plywood and veneer, using the waste from its manufacturing activities to generate and sell electricity. FLBHD has been around for more than 25 years. In FY2015, 99.9% of the company’s revenue the company’s revenue was derived from the manufacturing segment, with its main markets in United States (71.3%), Korea (12.4%) and Taiwan (11.5%).

Over the last 5 years, the company has registered a 10.2% CAGR on its revenue and 23.3% CAGR on its earnings from continuing operations. Earnings growth outperformed revenue growth as the company continues to improve its operational efficiencies. As a result, net profit margin has also expanded from 11.2% in FY2011 to 17.6% in FY2015.

CATALYSTS

In the next 6 months, several catalysts that can help FLBHD realise its fair value include:

As a note, USD/MYR has strengthened 3.5% in the 2nd

half of 2016. Given that FLBHD is extremely susceptible to lumpy forex

gain/loss, the favourable forex fluctuations should help to provide

forex gains for coming QR release. Additionally, FLBHD is stepping up

production volume to improve cost efficiency. For these reasons, I

reckon that FLBHD will report encouraging results for Q2FY2015.

Historically, FLBHD reports Q2FY2015 around 21 – 22 August.

As a note, USD/MYR has strengthened 3.5% in the 2nd

half of 2016. Given that FLBHD is extremely susceptible to lumpy forex

gain/loss, the favourable forex fluctuations should help to provide

forex gains for coming QR release. Additionally, FLBHD is stepping up

production volume to improve cost efficiency. For these reasons, I

reckon that FLBHD will report encouraging results for Q2FY2015.

Historically, FLBHD reports Q2FY2015 around 21 – 22 August.

Over the past 5 years, FLBHD has tried to maintain a 50% dividend payout ratio. As a result, FLBHD experienced a 25.7% dividend growth within this period. With RM 88.9 million in cash and equivalents and zero debts, FLBHD is able to sustain repeat 15 cents payout for the next 6 years! Even if the 15 cents payout is a one-off reward, an 8 cents dividend still yields a decent 4.8% yield.

Finally, FLBHD should consider a bonus issue/share split to promote liquidity for its stock. Doing so could attract institutional investors in the market. As a note to FLBHD management, this might be the reason none of the top 30 shareholders are institutional investors! FactSet estimates that free float comprise 35.1% of total shares of 103.2 million. Hence, this implies 36,223,200 free float available for public trading; or RM 60.8 million worth of free float. FLBHD has a free float market capitalisation equivalent to a microcap stock, which does not appeal to institutional investors.

RISKS

Investing in FLBHD is not without its risks. They include:

As of 3rd

August yesterday, Lu Kuan-Cheng has announced his resignation from his

position as an Executive Director. In his latest filings, he continues

to hold 5,920,415 shares or 5.7% stake in the company. The risk of

further downside in FLBHD lies in his hands depending on how quickly he

continues to dispose of his stake via the open markets.

So far, the management has succeeded in their risk taking activities as they didn’t hedge their currency exposure during the periods of heightened volatility. As a reward, the company rejoices as USD/MYR rates remain favourable. Given the poor forex rates now, currency fluctuations could be less favourable and negatively impact its P&L. Investors of FLBHD should keep a close eye on the USD/MYR pair.

VALUATION

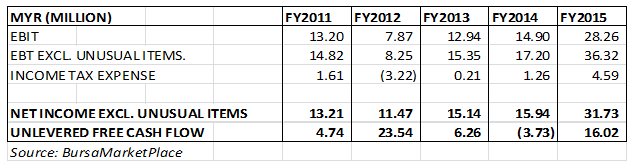

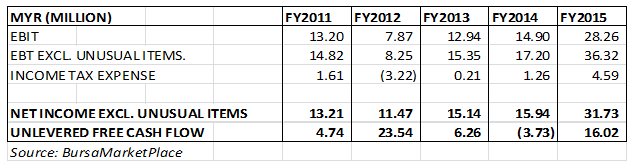

At present, FLBHD costs RM 1.68 per share and 103.2 million shares outstanding; hence a market cap of RM 173.4 million. Referring to BursaMarketPlace, in the last twelve months, the company reported RM 31.0 million EBIT and RM 31.7 million net profits. With RM 89.1 million net cash position, the company trades at a 5.5x trailing P/E and 2.7x EV/EBIT.

For valuation purposes, let’s ignore results in FY2015 and consider it as an outlier.

Over the past 5 years, FLBHD has received a total of RM 46.83 million in FCF; average RM 9.4 million p.a. Assuming 4% terminal growth at 10% discount, I obtain RM 156.7 million in NPV of FCF. Adding RM 89.1 million of net cash, fair value of FLBHD is RM 2.38.

On average, FLBHD is fairly valued at RM 2.13. At current price of RM 1.68, potential upside is 26.8%.

With steady FCF and consistent annual dividends over the past 5 years, FLBHD is an attractive investment; undervalued with a vast growth potential.

Disclosure: I own stocks of FLBHD.

One of the more attractive dividend stocks I came across is Focus Lumber (FLBHD); trailing 8.9% yield at its current valuations! FLBHD was a top performer in 2015 with a ROI of 182%, hitting an all-time high on 11th Jan 2016 at RM 3.09. However, since then the stock has consolidated 46% to close at RM 1.68 today. YTD, the stock is down 42% and is at its 10-month low. Yesterday, I have added FLBHD into my portfolio. In my opinion, I think that the market has significantly undervalued FLBHD, which should be fair valued around RM 2.11 – RM 2.24 for the following reasons:

- Forex gain/loss distorts investment judgements by retailers, coupled with lack of professional guidance from investment banks.

- Low public float amplifies price deviation from fair value. It is easy for retailers to move market for FLBHD in the wrong direction.

- Top line growth remains solid. A strong USD/MYR rate should continue into the next few years as US aims to increase its interest rates while Malaysia reduces its interest rates.

COMPANY BACKGROUND

FLBHD is a timber company which focuses on the manufacturing and sale of plywood and veneer, using the waste from its manufacturing activities to generate and sell electricity. FLBHD has been around for more than 25 years. In FY2015, 99.9% of the company’s revenue the company’s revenue was derived from the manufacturing segment, with its main markets in United States (71.3%), Korea (12.4%) and Taiwan (11.5%).

Over the last 5 years, the company has registered a 10.2% CAGR on its revenue and 23.3% CAGR on its earnings from continuing operations. Earnings growth outperformed revenue growth as the company continues to improve its operational efficiencies. As a result, net profit margin has also expanded from 11.2% in FY2011 to 17.6% in FY2015.

CATALYSTS

In the next 6 months, several catalysts that can help FLBHD realise its fair value include:

- QR with strong bottom line growths should help retailers discover and realise its fundamental values.

- Positive surprises in dividend payout.

- Increase in public float should help promote liquidity to encourage institutional investors.

As a note, USD/MYR has strengthened 3.5% in the 2nd

half of 2016. Given that FLBHD is extremely susceptible to lumpy forex

gain/loss, the favourable forex fluctuations should help to provide

forex gains for coming QR release. Additionally, FLBHD is stepping up

production volume to improve cost efficiency. For these reasons, I

reckon that FLBHD will report encouraging results for Q2FY2015.

Historically, FLBHD reports Q2FY2015 around 21 – 22 August.

As a note, USD/MYR has strengthened 3.5% in the 2nd

half of 2016. Given that FLBHD is extremely susceptible to lumpy forex

gain/loss, the favourable forex fluctuations should help to provide

forex gains for coming QR release. Additionally, FLBHD is stepping up

production volume to improve cost efficiency. For these reasons, I

reckon that FLBHD will report encouraging results for Q2FY2015.

Historically, FLBHD reports Q2FY2015 around 21 – 22 August.Over the past 5 years, FLBHD has tried to maintain a 50% dividend payout ratio. As a result, FLBHD experienced a 25.7% dividend growth within this period. With RM 88.9 million in cash and equivalents and zero debts, FLBHD is able to sustain repeat 15 cents payout for the next 6 years! Even if the 15 cents payout is a one-off reward, an 8 cents dividend still yields a decent 4.8% yield.

Finally, FLBHD should consider a bonus issue/share split to promote liquidity for its stock. Doing so could attract institutional investors in the market. As a note to FLBHD management, this might be the reason none of the top 30 shareholders are institutional investors! FactSet estimates that free float comprise 35.1% of total shares of 103.2 million. Hence, this implies 36,223,200 free float available for public trading; or RM 60.8 million worth of free float. FLBHD has a free float market capitalisation equivalent to a microcap stock, which does not appeal to institutional investors.

RISKS

Investing in FLBHD is not without its risks. They include:

- Margin erosion from minimum wage policy and intense price war with competitors.

- Resignation and disposal of Lu Kuan-Cheng’s 7.3% stake as at 31 Mar 2016.

- High risk taking appetite of management; no/minimal hedging against wild currency fluctuations.

| Employees below new minimum wage | 10% | 20% | 30% | 40% | 50% |

| Impact on earnings (mil) | -2.20126 | -4.40253 | -6.60379 | -8.80505 | -11.0063 |

So far, the management has succeeded in their risk taking activities as they didn’t hedge their currency exposure during the periods of heightened volatility. As a reward, the company rejoices as USD/MYR rates remain favourable. Given the poor forex rates now, currency fluctuations could be less favourable and negatively impact its P&L. Investors of FLBHD should keep a close eye on the USD/MYR pair.

VALUATION

At present, FLBHD costs RM 1.68 per share and 103.2 million shares outstanding; hence a market cap of RM 173.4 million. Referring to BursaMarketPlace, in the last twelve months, the company reported RM 31.0 million EBIT and RM 31.7 million net profits. With RM 89.1 million net cash position, the company trades at a 5.5x trailing P/E and 2.7x EV/EBIT.

For valuation purposes, let’s ignore results in FY2015 and consider it as an outlier.

- From FY2011 – FY2014, EBIT averaged RM 12.2 million. Ascribing a 10x EV/EBIT, enterprise value for FLBHD is RM 122 million. Since FLBHD holds a net cash of RM 89.1 million, therefore the value of market cap is RM 211.1 million; implying a RM 2.05 fair value per share.

- From FY2011 – FY2014, net income averaged RM 13.9 million. Ascribing a 15x P/E, fair value obtained in RM 2.02.

Over the past 5 years, FLBHD has received a total of RM 46.83 million in FCF; average RM 9.4 million p.a. Assuming 4% terminal growth at 10% discount, I obtain RM 156.7 million in NPV of FCF. Adding RM 89.1 million of net cash, fair value of FLBHD is RM 2.38.

On average, FLBHD is fairly valued at RM 2.13. At current price of RM 1.68, potential upside is 26.8%.

With steady FCF and consistent annual dividends over the past 5 years, FLBHD is an attractive investment; undervalued with a vast growth potential.

Disclosure: I own stocks of FLBHD.

FLBHD (5197) - [Shaun Loong] - Value Emerge For FLBHD After 42% Rout YTD

http://klse.i3investor.com/jsp/blog/blpost.jsp?blid=1524