[Shaun Loong] - A Worthwhile Revisit On HEVEA (5095) and POHUAT (7088) Counters

Please do not construe this as an investment advice. Article presentation looks better in PDF. To view PDF, click here.

In 2015, HEVEA and POHUAT were star performers with ROI of 303% and 217% respectively. Referring to the chart below, both are in the midst of consolidation with similar pattern since the beginning of year 2016.

At current price of RM 1.19, HEVEA’s return YTD is -33%. Referring to the chart above, the stock is currently trending sideways and is trading at a major support level.

Similarly, POHUAT is experiencing a similar trend. After a -20.6% consolidation YTD, the stock has been trading sideways, forming a major support around RM 1.42. Interestingly, POHUAT experienced 3 minor breakouts in the past 4 months.

At the current price levels, I think this presents 3 attractive opportunities, i.e. HEVEA (+45%), HEVEA-WB (+71%) and POHUAT-WB (+73%). I reckon that the mispricing of these assets is due to:

Profit taking after the strong rally in 2015.

Investors turning away from furniture stocks assuming that it is overvalued after the strong rally.

Quiet markets from relatively low volume and zero news release caused the stocks to be off-radar.

Company Background

Most investors should be familiar with HEVEA and POHUAT.

HeveaBoard Berhad is a manufacturer and distributor of particleboards and wood panel related items, commonly used in furnitures. Their products are exported to various countries worldwide, with the largest markets being Japan (33.9%), China (20.5%) and Malaysia (7.1%). For more information, please visit their website.

Poh Huat Group is a furniture manufacturer and distributor in Vietnam (66.5%), Malaysia (32.7%) and South Africa (0.8%). For more information, please visit their website.

Catalysts

In the next 6 months, several catalysts that can help HEVEA and POHUAT realise its fair value include:

Outperforming QR release with positive growth in revenue and net profit.

Any positive news relating to the company or furniture industry.

This article (hopefully

)

)Earnings report is the only “sure-happen” catalyst to stimulate the markets. Any other positive news should also help these counters realise their intrinsic value. These stocks are currently out of news coverage which makes them off the grid in investors’ stock selection.

Finally, I hope that this article can also help to create awareness of these opportunities.

Risks – HEVEA & POHUAT

Other than the usual poor QR results risk, no notable and predictable risks are found in HEVEA and POHUAT except for volatility in USD/MYR exchange rates. The industry outperformance is dependent on favourable forex rates, particularly USD/MYR since most of its products are billed in USD.

These stocks are also lacking fresh catalysts for price movements other than release of good QR.

Additional Risks – HEVEA-WB & POHUAT-WB

Higher-than-expected dividends are not favourable when investing in warrants. Both HEVEA and POHUAT possess the ability to raise dividends given their clean balance sheet with a net cash position and minimal debts.

For POHUAT-WB, director’s transactions pose an additional risk to retail investors. Managing director Mr Tay Kim Huat has been actively disposing POHUAT-WB whilst accumulating the mother share POHUAT. Mr Tay has disposed about half of his warrant holdings since his initial direct holdings of 12.8 million in October 2015. Based on his latest announcement on 16th Oct 2016, he still holds 6.4 million warrants directly. Meanwhile, in January 2016, Mr Tay holds 51.3 million shares. As of 12th Aug 2016, Mr Tay increased his position slightly to 51.5 million shares. Overall, his stake in POHUAT has reduced his direct ownership from 27.3% to 24.6%, assuming diluted share count of 234.9 million.

Valuation – HEVEA & HEVEA-WB

Based on data from the latest quarter, HEVEA has:

RM 92.5 million cash, RM 13.2 million debts; net cash RM 79.2 million

119.9 million warrants outstanding; exercise price RM 0.25

447.3 million basic shares outstanding; 567.2 million diluted shares outstanding

At RM 1.18 per share, HEVEA has a market cap of RM 527.8 million. Enterprise value is RM 448.6 million (market cap – net cash).

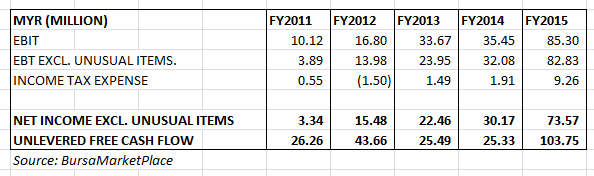

From observation, net income and unlevered FCF averaged RM 43.8 million, excluding FY2011 and FY2012 net income. This exclusion is my personal assumption that HEVEA is not likely to report such low earnings in future. Assuming 8% growth for 5 years, 4% terminal growth and 9% discount rate, present value of FCF is RM 878 million. Adding net cash of RM 79.2 million, HEVEA is worth RM 2.14 per share.

With such a low exercise price for HEVEA-WB, it is almost certain that it will expire in-the-money. This will inject additional RM 30 million while expanding share count to 567.2 million. Hence, HEVEA’s adjusted fair value is RM 1.74. As a side note, CIMB’s Marcus Chan has a target price of RM 2.08.

HEVEA-WB expires in 1st Mar 2020. At current price of RM 0.925, this represents a -1.3% premium against the mother share. Using Black-Scholes model to price the warrants, I assume 9% return, 3% dividends and 10% volatility to arrive at a minimum value of HEVEA-WB to be RM 0.90. It is important to remember that HEVEA-WB is an American option while Black-Scholes models for European options. Additionally, HEVEA’s fair value of RM 1.74 above implies an intrinsic value of RM 1.49 for HEVEA-WB. HEVEA-WB offers 56.5 cents upside against a 2.5 cents downside; reward-risk ratio is 22.6:1.

Valuation – POHUAT & POHUAT-WB

Based on data from the latest quarter, POHUAT has:

RM 66.9 million cash and equivalents, RM 44.9 million debts and minority interest; net cash RM 22 million

21.4 million warrants outstanding; exercise price RM 1

213.5 million basic shares outstanding; 234.9 million diluted shares outstanding

At RM 1.57 per share, POHUAT has a market cap of RM 335.2 million. Enterprise value is RM 313.2 million (market cap – net cash).

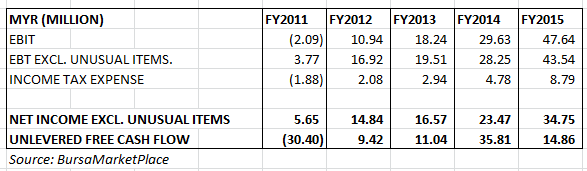

Excluding FY2011 as an outlier, average FCF is RM 17.8 million. Assuming 8% growth for 5 years, 4% terminal growth and 9% discount rate, present value of FCF is RM 356.9 million. Adding net cash of RM 22 million, fair value of POHUAT is RM 1.77.

Since it is very likely that POHUAT-WB will expire in-the-money, adjusted fair value for POHUAT is RM 1.70. At current price range of RM 1.57, POHUAT is fairly valued.

Meanwhile, assuming 9% return, 5% dividends and 10% volatility, Black-Scholes model values POHUAT-WB at 59 cents. However, this only applies if POHUAT-WB is a European option. Ascribing 68 cents premium (40% premium on fair value) for an American option, POHUAT-WB is worth RM 1.27.

Disclosure: I own warrants of HEVEA.

[Shaun Loong] - A Worthwhile Revisit On HEVEA (5095) and POHUAT (7088) Counters

http://klse.i3investor.com/servlets/cube/slmf1995.jsp