POHUAT (7088) - (Icon) Poh Huat (6) - Time To Huat ?

1. Introduction

Poh Huat was the first stock I wrote for export theme (December 2014). Altogether, I have written 5 articles about it. I stopped covering the stock after cashing out from it.

Poh Huat was trading at around RM1.40 in December 2014 when I first wrote about it. It went up to as high as RM4.24 on 28 December 2015 (after factoring in 1 for 1 split). At current price of RM1.66, it is equivalent to RM3.32 before split.

Now that we are on the verge of another round of export play, I would like to once again kick start the new cycle by introducing Poh Huat.

As I have written about Poh Huat before, I will not go into details regarding its operations and basic financials. For those readers who are not familiar with this group, kindly refer to the abovementioned old articles.

Poh Huat's financial year end is October. Its next quarter result will be announced by end December 2016. In this article, I will focus on its earnings and discuss what to expect for the coming quarter result.

2. Earnings Discussion

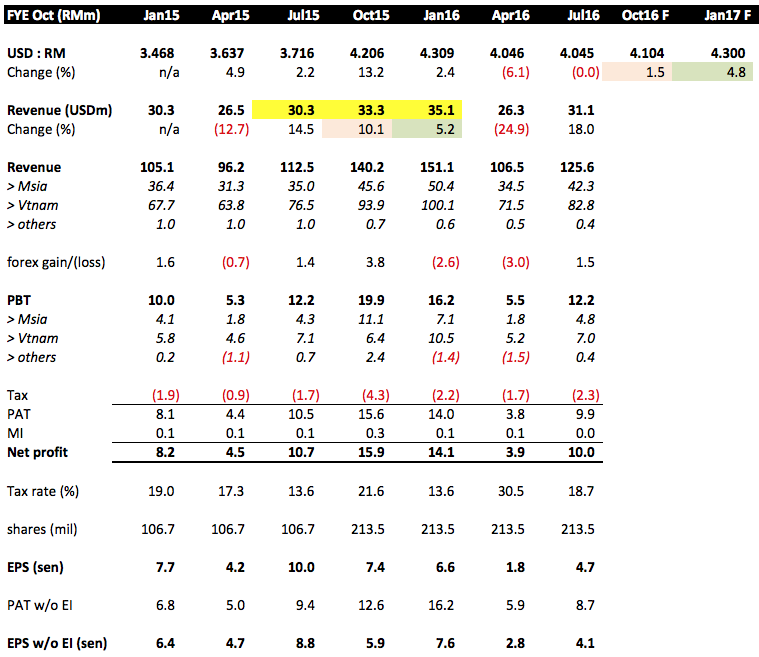

The following is Poh Huat's historical P&L for the past few quarters :-

Key points :-

(a) Poh Huat's operation is slightly seasonal. The April quarter is traditionally the weakest. July quarter is higher, but the strongest quarters are October (the coming quarter) and January. These two quarters are strong due to demand by customers to meet holiday season demand.

(b) In the latest July quarter, the group reported EPS (without exceptional items) of 4.1 sen. That was based on average exchange rate of 4.045.

The coming quarter result has the potential to be better due to the following factors :-

> Higher revenue In FY2015, October quarter's revenue in USD terms, was 10.1% higher than that of July quarter; and

> Higher USD exchange rate October quarter average USD was 1.5% higher than that of July quarter.

The net effect is that revenue in Ringgit terms could be approximately 11% higher (being 1.101 x 1.015) than that of July.

Based on assumption that net profit increases proportionately, we could be looking at core EPS of 4.6 sen for the coming October quarter.

(c) By applying the same method, let us try to work out something for the January 2017 quarter.

In FY2015, January quarter's revenue in USD terms, was 5.2% higher than that of October quarter.

The average exchange rate for January 2017 quarter (comprises November 2016, December 2016 and January 2017) is still not available. As at to-date, USD : RM is 4.40 while the average exchange rate for the first 18 days of November 2016 was 4.269. For discussion sake, let's just assume that average exchange rate for January 2017 quarter is 4.30 (I believe this is not an aggressive assumption). That will be approximately 4.8% higher than that of October 2016 quarter.

Based on the above, revenue in Ringgit terms shall be 10.2% higher (being 1.052 x 1.048).

Based on assumption that net profit increases proportionately, we could be looking at core EPS of 5.1 sen for the coming January 2017 quarter.

(d) Poh Huat traditionally has more USD assets than USD liabilities. As such, it will usually register forex gain whenever USD strengthens. If you refer to the table above, you can see a consistent pattern. The only exception was January 2016 quarter whereby it registered a forex loss of RM2.6 mil despite USD strengthened from 4.206 to 4.309. I don't have an explanation for that. If you have answer, kindly let me know.

As mentioned above, October 2016 USD was stronger than that of July. The same is likely to happen for the January 2017 quarter. If there are indeed forex gains, the coming two quarters' EPS will be further boosted. Even though investors nowadays are quite discerning, based on my 2015 experience, it will still lead to feel good effect that have positive impact on share price.

3. Capacity Expansion and Improvement In Efficiency

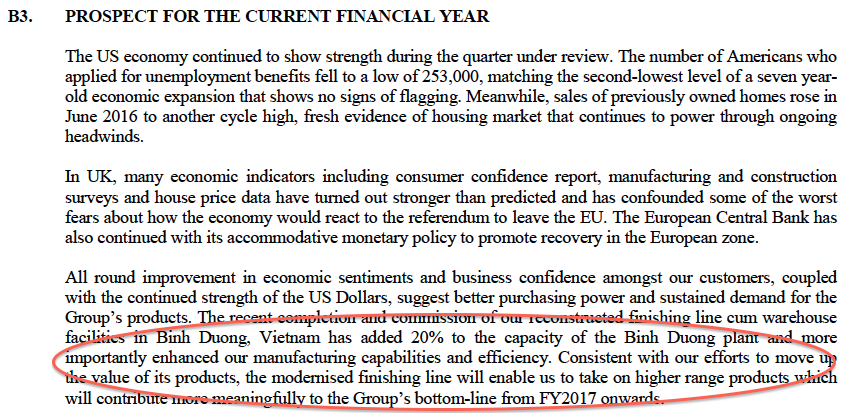

I picked up the following from the company's July 2016 quarterly report :-

4. Concluding Remarks

My analysis shows that Poh Huat is entering seasonally strong quarters soon. Based on previous experience, Poh Huat's management are quite competent and they usually will be able to avoid negative surprises such as bad debts, inventories write off, etc (a fire happened in 2015, but I think that is a different story altogether). The only exceptional item is usually forex related, which in this case should be favorable due to stregthening of USD.

Having said so, I would like to point out that since I don't have insider information, there is no assurance that the coming quarters' results will be as good as predicted. If things do not work out as expected, please don't blame me. Your money, your risk, your reward.

POHUAT (7088) - (Icon) Poh Huat (6) - Time To Huat ?

http://klse.i3investor.com/blogs/icon8888/109246.jsp