FPGROUP (5277) - 5 things you should know about FoundPac’s IPO

One new company that will be appearing in Malaysia’s stock market soon is FoundPac Group Berhad.

Here are four things investors may want to know about the company’s initial public offering (IPO).

- Business Background

Taken from its website and IPO Prospectus (in my own words):

“FoundPac

was founded as an import-export company and moved into the

semiconductor sector in year 2004. offering precision parts, module

assembly and turn-key projects.

FoundPac is accredited with ISO 9001 as proof of its quality and commitment to excellence. Hence it is able to be the supplier for many MNCs by complying with their quality control requirements.”

FoundPac is accredited with ISO 9001 as proof of its quality and commitment to excellence. Hence it is able to be the supplier for many MNCs by complying with their quality control requirements.”

- IPO Offer details

FoundPac, an precision engineering parts fabricator and supplier, will

be listing on Dec 29 in the Main Market of Bursa Malaysia. FoundPac’s

IPO involves an offering of 40 million new shares and offer for sale of

92 million shares at an IPO price of 54 sen per share, of which 18.5

million shares would be offered to be public. And according to the news,

the public portion of was oversubscribed by 14.21 times!

As for the IPO proceeds, the company aims to raise up to RM21.6 million. The breakdown is as follows:

- RM8 million for purchase of new machinery,

- RM4 million for overseas expansion; setting-up of sales offices in Milan, Italy and California, US in the next two years

- 6 million for working capital

- RM3 million for D&D (design and development) expenditure

- The remaining RM3 million for listing expenses.

- Financials

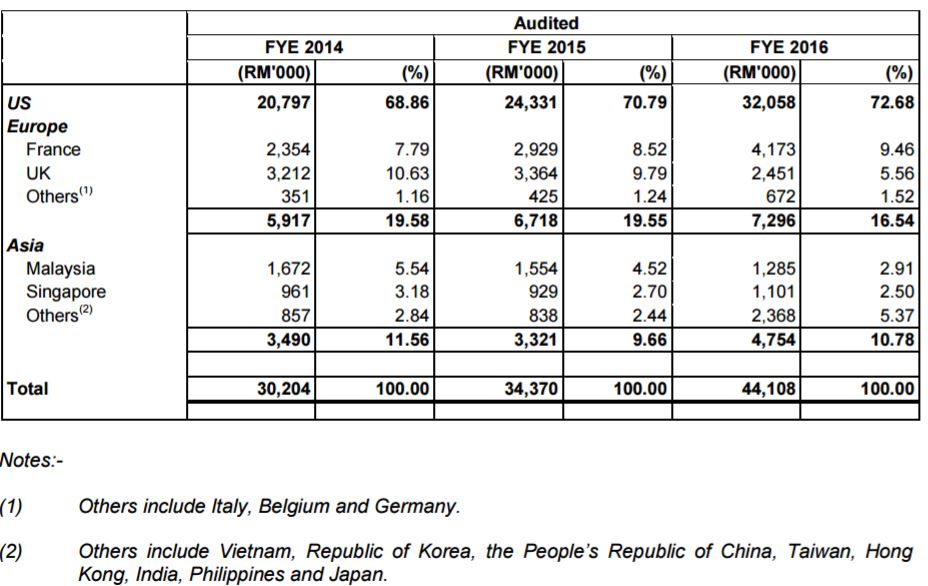

With that, let us take a look at its financials. First off, we zoom into its revenue for past 3 years.

Revenue has increased steadily over the 3 years from RM30 million to

RM44 million. Investors should take notice that a huge chunk of its

sales (72%) comes from the United States and 16% comes from Europe

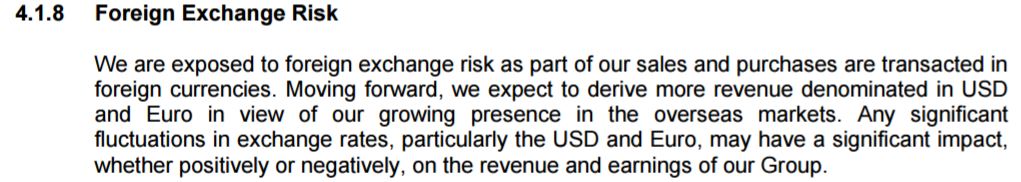

nations. Thus, any change in FX will affect Foundpac in a big way, as

shown below.

That said, we feel that it is going to benefit FoundPac in the near

term since the U.S. dollar has been strengthening due to the interest

rate policy.

On top of that, its net profits have also been on the uptrend, surging

from RM9.2 million in FY14 to RM16.4 in FY16. This represents a 78%

increase in just 2 years!

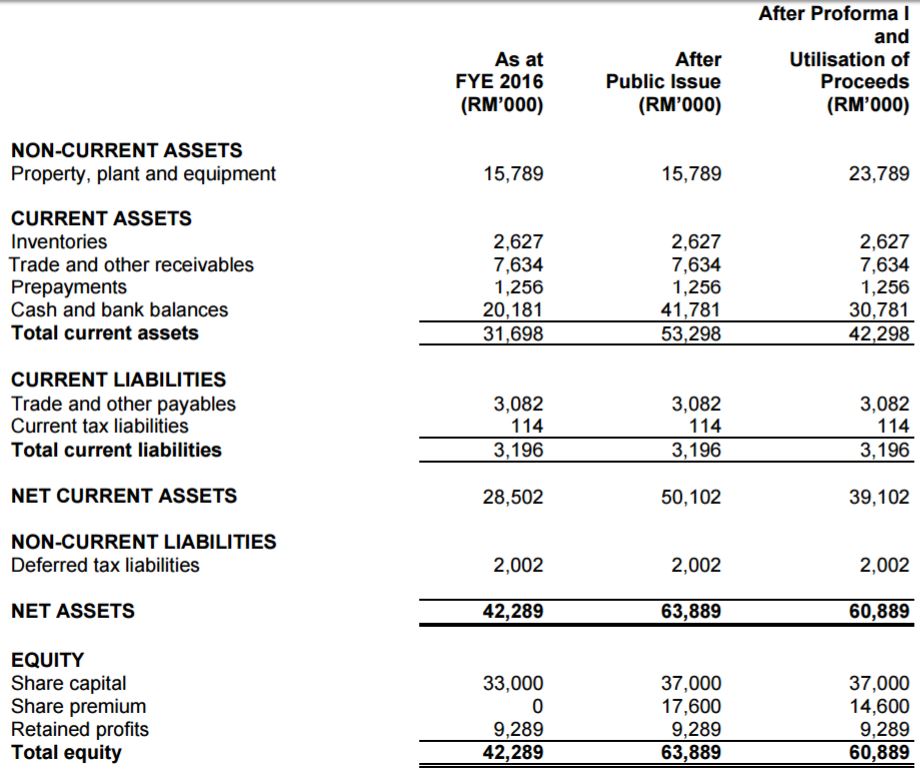

4. Strong Financial Position

Moving on, Foundpac’s has a pristine financial position too with RM20 million in FY16 and no debt at all.

Meanwhile, it is able to churn out steady streams of free cash flow. As

of the latest Financial year 2016, it generated RM16 million in cash

flows from operating activities and only used up RM1.2 million for

investing purposes.

- Dividend policy and valuation

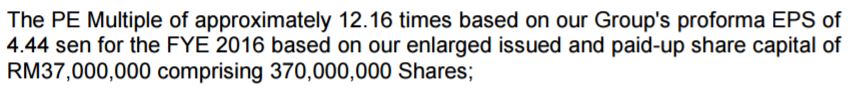

At Foundpac’s listing price of 0.54 sen per share, the firm’s valued at

12.16 times its earnings after taking into account the new shares to be

issued for the IPO. To give this figure some context, the KLCI (Kuala Lumpur Composite Index) has a price-to-earnings ratio of 16.2 at the moment.

Foundpac currently does not have a fixed dividend policy. But, it

intends to distribute at least 30% of its net profits as dividends.

Conclusion

As you can see, the company’s revenue, profit, and cash flow from

operations have all grown from 2014 to 2016. Incredibly, the firm has

not used any borrowings to fuel the growth as well. In addition, it is

listing at a cheaper price-multiple compared to the Index.

That said, being a supplier to the semi-conductor sector, Foundpac

faces stiff competition from other fragmented players which may undercut

their pricing at anytime.

Uchi Tech last closed at a price of MYR 1.79 and has a P/E ratio of 14.3.

We’ve released our 3 HOT growth stock picks which could skyrocket

>100% by the end of 2017. History has shown that getting in early on a

good idea can often pay big bucks – so don’t miss out on this moment.

Simply click here to receive your copy of our brand-new FREE report, “3 stocks poised for explosive growth”.

Do Like us on Facebook too as we share the latest investing articles and stock ideas for you!

FPGROUP (5277) - 5 things you should know about FoundPac’s IPO

http://klse.i3investor.com/blogs/small_cap_asia/118487.jsp