PPHB (8273) - 3 crowns of PPHB in Georgetown World Heritage Site

Capital

allocation is a CEO’s most important job. The objective of capital allocation

is to increase per share value, not

overall growth or size in the long run.

In

previous post (read here), we shared with you a

capital allocation framework that used by Buffett and Munger in Berkshire

Hathaway. Using that framework, we verified that PPHB’s management has made a

commendable call to reinvest all its retained earnings.

In

PPHB, every RM1 reinvestment has generated RM2.07 value. That added value is

realized in the form of free cash flow.

In

this letter, we dig the vein further to identify hidden value in properties that

owned by PPHB.

The most significant property

Based

on its Annual Reports, the most significant property in term of carrying amount

is 2 buildings and 1 land that owned by PPH Plaza – a subsidiary engaged in

property development business.

The

2 buildings are two-storey pre-war heritage buildings bearing postal addresses

Nos. 29 & 31, Lebuh Pantai, 10300 Georgetown, Penang.

The

land is located at No. 7, Pengkalan Weld, 10300 Georgetown, Penang.

These properties

are located approximately 1 kilometre north-west of The Butterworth Ferry

Terminal (Pengkalan Tun Raja Uda) and is about 2 kilometres north-east of

KOMTAR, the urban renewal centre of Penang.

The Land

is approachable directly from Lebuh Pantai and Weld Quay.

These

significant properties sit in the central of UNESCO’s George Town World

Heritage City with

close proximity to well-known heritage buildings such as the OCBC Bank, The

Whiteways Arcade and the Logan Heritage.

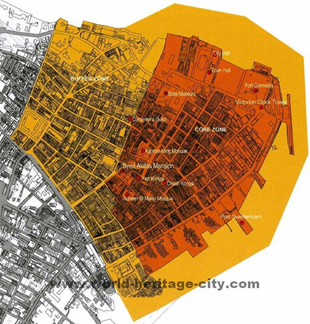

Note:

Dark orange refers to UNESCO’s World Heritage City; Light orange denotes to

buffer zone

Right next to these properties of PPHB at Lebuh Pantai and Pengkalan Weld, Asian Global Business Sdn Bhd is building a boutique hotel, private residences, retail units, office buildings, and F&B outlets for The Rice Miller (see their projects here). The private residences are selling for at least RM1,300/sf.

The

immediate surrounding properties comprise mainly of commercial colonial

buildings, pre-war double-storey shophouses in nature.

Collectively,

they are one of the most popular tourism areas in Penang.

Here

are some surrounding attractions:

Street

art

Book value of the properties

PPH

Plaza was incorporate on 12 January 1995.

As

noted in Annual Report 2011, the properties were acquired on 11 Nov 1995 for

RM14.9m.

The

latest revaluation for these properties was done on 23 Dec 2002 and reached

RM21.1m.

To

date, that RM21.1m is still recorded as the book value in the Balance Sheet of

PPHB.

Present value of the properties

To

hypothesize its present value, recent transacted prices of surrounding

properties are used as the reference.

In

2014, the market was asking RM1,005/sf.

Today,

the market is demanding RM1,100/sf.

Although

some surrounding properties presently sell for RM1,300/sf, it is better to be

conservative.

Given

that the PPHB’s properties occupy a total land area of 56,244 sf, their

revaluation may reach approximately between RM56.53m (56,244 sf x RM1,005/sf)

and RMRM61.87m (56,244 sf x RM1,100/sf).

Higher

valuation is possible given that restoration job was constantly done to

maintain the 2 buildings at Lebuh Pantai. The said buildings are also tenanted.

For

example, Phillip Capital Penang is one of its tenants.

What does it mean to shareholders?

In

retrospect, the objective of capital allocation is to increase per share value, not overall growth or

size in the long run.

However,

not all values are visible to shareholders.

In

this case of the 3 properties that owned by PPHB, we have demonstrated that:

Book value: RM21,137,092

(as revalued in 2002)

Value range:

RM56,525,220 to RM61,868,400 (based on present market prices)

Consequently,

as much as RM35.39m–RM40.73m value is hidden in these properties. These

estimates represent 29.25%–33.66% of its RM121m market capitalization.

A

revaluation exercise will increase shareholders’ book value (presently RM1.714)

per share by 18.79%–21.62%.

As

a result, present PPHB stock price is trading just about half of its actual

book value.

Conclusion

Shareholders

are business partners. It is their responsibility to be aware of assets that

they owned.

Graham

and Dodd regard asset value as the most reliable source of valuation.

The

asset value above counters the scepticism with which investors regard present

value calculations of PPHB’s future free cash flows amid the imminence of e-commerce

boom.

As

demonstrated above, PPHB shareholders are protected by a good margin of safety

that derived solely from that 3 properties.

Deeper

margin of safety is offered given that PPHB is (1) the cheapest yet highest

quality stock among its peers, and (2) its growth-driven intrinsic value is

anticipated to worth at least RM1.78 per share.

PPHB (8273) - 3 crowns of PPHB in Georgetown World Heritage Site

http://valueveins.blogspot.my/2017/04/3-crowns-of-pphb-in-georgetown-world.html