KSL (5038) - This Company can Load Up your Duit Raya Packet now!

In the stock market, we must admit that irrational things will happen. As a normal human being, we are always taught to be rational in everything we do. Rational in our thinking, rational in our action and there goes the list. However in stock market, many a times, we start to have self doubt when we are accessing stock rationally, yet the stock acted otherwise.

The irrationality of the market that frustrate most of the investor is when bad stock are in good times, and good stock are in bad times. This happened so often that investor are conquer by frustration, which lead to emotional judgment, and hence a potentially wrong decision. And often due to this, we will be shy to recognize and confront the wrong move made, hence, we will always repeat the same old movement again and again.

Many a time in investment, we have to really cling to our own precious study, and endure the market irrationality towards the pricing of the stock. Of course, here I am pointing out on stocks that are fundamentally good, yet traded at a misunderstood pricing.

Before I would hand to you this stock that had been misunderstood by the market, and trading at a irrational low price, I had to tell you a real scenario where I had encountered the same situation in 2016.

Back then in the spring of 2016, the Malaysian equity market is severely punished, with problem such as low crude oil price, volatile and weak exchange rate and a series of scams as well. Banks are doing huge restructuring and taking in big impairment that had drag down the financial reports. During those tough moment, it is where undervalue share with great fundamental become gems. So it is this one stock named KESM that I had noticed then which is very undervalued despite it's solid earning and cash position in the company.

As you can see, during bad times like 2016, a good stock can be misunderstood, and being priced at a valuation of PER x 5, despite the fact that the company had been growing in revenue, sector is beefing up for a much greater expansion, and the company had been sitting in huge cash position.

However, when the market turn on to a bullish note, albeit the company did improve it's bottom line EPS by 33%, the valuation shot up from trading at PER x 5 to PER x 15. And I had to tell you that this big leap in valuation brought KESM into almost four fold in price appreciation, from RM 4 all the way to RM 15.

So, did you get your lesson now ?

As the Hari Raya is coming, I would like to try to point to you this 1 valuable share that could increase your Duit Raya. This share I believe is bearing the same traits of being misunderstood for it's fundamental, and to see it trading at irrational prices, you either take action, or see people take action.

So this share is called KSL Holdings Berhad (KSL - 5038).

You might think that what is so special in this property developer now that can give you a fatter and juicier Duit Raya to spend.

For this, I have to show you few things that is happening in this company that is comparable to KESM.

Firstly, we must talk about earning. Base on FYE 2016, KSL had a final EPS of 31 cents. If we talk about valuation of PER x 5, that is also RM 1.50 already, right? Now let's forget about 2016, we will talk about 2017.

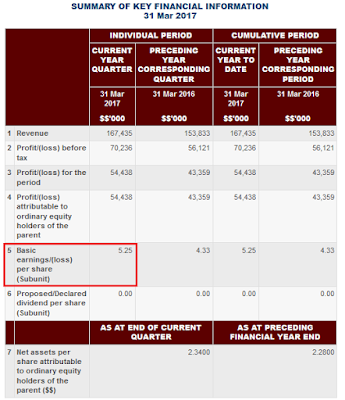

Based on Q1 FYE 2017, the earning is 5.25 cents. Most of the contribution are from property development in Johor and Klang. Others contributing segment is property management and car park.

Since KSL have a good track record and as property billing are progressive in nature, let's take annualized the earning and take 80% of it, that will come out to a projection of 16.8 cents for FYE 2017. I had to tell you this calculation is very "kiamsap" to the max, because as you can see property sentiment had started to pick up, I am taking a very bad case scenario by further discounting 20%. What if KSL 2nd Quarter is better, 3rd Quarter is even better, and 4th Quarter also around the same? Alright, we will stop building big mansion in the sky first.

Let's talk about putting a PER x 10 valuation on projected earning of 16.8 cents. That alone will see KSL worth RM 1.68 per share. I have to tell you that KSL is now trading at RM 1.25 and you have to be fast, because these 2 parties are not going to wait for you at all.

As you can see, the first party is Lembaga Tabung Haji. As a matter of fact, they had been mopping up KSL share since earlier this year, and it had gone even intense lately, with the latest being 870,900 units mopped up on 1st June 2017.

The second person mopping up is none other than director himself. As you can see, for the past 3 days, he had been committed in mopping 100,000 units from the open market.

Both their action signal 1 thing in accord - The share of KSL is very undervalued, misunderstood, and trading at irrationally cheap price !

I do not need to convince you further, but you have to look at the cash position as of lately.

As you can see, one of the major reason on the massive drop in share price is due to no dividend payment in 2016. With this RM 230 million cash pile in the bank, KSL will probably restart their dividend again in 2017.

To make sure the cash are not loaded out from extra loan incurred, this financial statement is a strong proof, showing great decrease in liabilities and bank borrowings as well.

In a nut shell, with RM 230 million in cash and only RM 80 million in bank borrowing, this is a net cash property developer company.

So, I had presented to you a company

1. Trading at low single digit PE

2. Trading 50% from NTA

3. Net cash company

4. Consistent development plan in Johor and Klang

5. Share mopped up in open market by director and institution fund

Now the ball is yours. Take the shot wisely. Good luck!

KSL (5038) - This Company can Load Up your Duit Raya Packet now!

http://bonescythe.blogspot.my/2017/06/this-company-can-load-up-your-duit-raya.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+BonescytheStockWatch+%28Bonescythe+Stock+Watch%29