富佳木业 FLBHD:油价偏低利好出口 供应链不怕木材慌

Author: kakashit Publish date: Fri, 23 Jun 2017, 11:32 AM

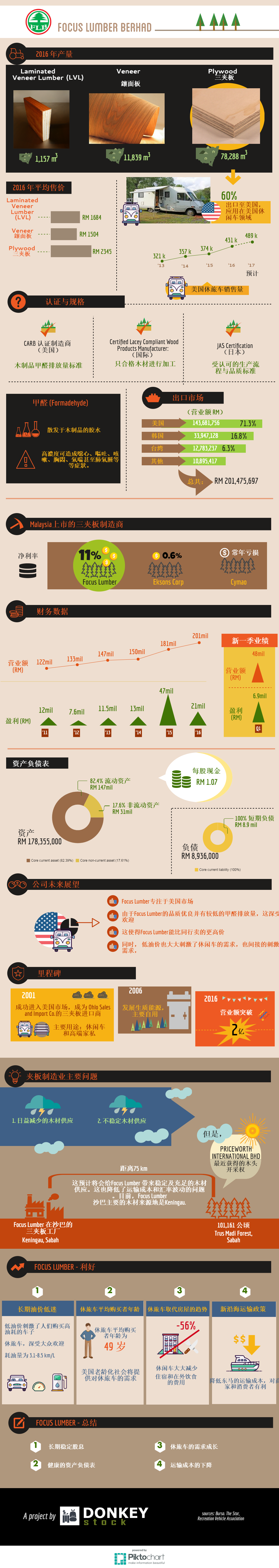

“北美房车工业协会从 1979 年开始记录旅行房车的销售数量,今年达到了史上最高。2017 年制造商们估计美国 RV(旅行房车总称)的数量将达到 446000 台,比去年的 430691 台高 3.6%。

过去,人们说到 RV 的第一反应就是退休老年人,不过现在这一观念得改一改了。调查发现如今买 RV

的大多是年轻人。年轻人追求便宜、多样化的旅行计划,而 RV 刚好可以满足这些需求。如今油价便宜,利息率低,加上美国人对户外运动的痴迷让 RV

成了一个绝佳选择。

“RV 刚好切中了美国人想要在户外拥抱自然,和家庭一起旅行的价值观,而 RV 也不会让他们破产,” 北美房车工业协会的发言人 Kevin Broom 说。

跟据 Business Wire 的数据,不仅是北美,全球的 RV 市场在未来的 5 年内年复合增长率会达到

7%。其中一个重要原因是全球的旅行消费增高,年轻人更重视旅行,他们愿意在 RV

上花钱。“美国、英国、印度、澳大利亚、德国和新西兰这几个国家,国际游客明显增多。假期里到这些国家旅游的人很多都会选择 RV,刺激了全球 RV

业的增长。” Technavio 的分析师 Gaurav Mohindru 说。”

补充:

"Availability of log, being the main raw material for the

manufacturing of plywood is important to us. We may be subject to risk

of shortage in supply of log as we do not own any timber concessions.

Substantially all of our logs are harvested from Sabah, in particular

Keningau. Forestry Department of the State of Sabah controls the volumes

that can be harvested every year. Determinations by Forestry Department

of Sabah to reduce the volume of timber that may be harvested may

reduce our ability to secure log supply and may increase our log

purchase costs." ---AR16

虽然美国的休旅车市场在低油价的支撑下一片向好,但富佳木业依然面对木材供应短缺的问题,毕竟该公司没有自己的森林开发权,每年能买入多少的原木全靠沙巴森林局的批量固打。

而刚好沙巴的一家伐木公司实值国际(Pworth)刚好获得沙巴FMU 5(占地10万1161公顷)截至2097年的森林管理经营权(伐木权),为FLB的供应烦恼打开了一道希望之门。

重点是FLB的厂房与Pworth的森林开发地仅距离75公里,运输时间大大缩短,可以在整个供应链上产生很好的协同作用。

The terrain of FMU5 ranges from 150 to 2,300 meters above sea level

3 reasons why you should load up on this cash rich stock!

Author: OngMali Publish date: Sun, 2 Jul 2017, 12:18 AM

Reason 1 - Great time is just around the corner

Average USD/MYR had gone up 8% from 4.0171 in Q2 2016 to 4.3305 in Q2 2017.

Q2 2016 net profit to shareholder was RM4.64 mil.

Assume constant sales of RM52.74 mil in Q2 2017, an additional RM4.11 mil flows direct to bottom line. Bear in mind sales grew 11% last year.

In other words, net profit to shareholder should grow 88.6% in Q2 2017! Almost the same with Q1 2017.

Reason 2 - Further expansion in US

In Annual Report 2016 dated April 2017, Focus Lumber disclosed it will continue to expand in US. it is in a position to procure more customers from the lucrative RV market.

The group is confident revenue and profit will improve.

Revenue improved every year for last 5 years from Rm132 mil to RM201 mil.

Reason 3 - Bumpy Dividend coming soon

I forecast net profit to shareholder at RM25 mil. Operating cash flow was RM24.88 mil in Q1 2017. Yes, Q1 only, not whole year.

Focus Lumber disclosed new information in Annual report 2016. "Our cash requirements, other than for operating purposes, are primarily for additions to property, plant and equipment, acquisitions and payment of dividends."

The group estimates capex of RM5 mil to improve manufacturing facilities. That leaves a balance of RM20 mil for payment of dividends.

Focus Lumber has 103.2 mil shares outstanding.

RM 20 mil divide 103.2 mil equal 19 sen. At 1.74, dividend yield is 11%!

Dont forget Focus Lumber had RM1.07 per share net cash. I won't rule out a special dividend of 30-50 sen. Do your own math.

This is not a buy recommendation. Consult your own investment adviser before you invest.

FLBHD: From COLD STOCK to HOT STOCK?? - Stockaholics

Author: Tan KW Publish date: Fri, 26 May 2017, 02:49 PM

ttm profit: RM22.1mil

ttm FCF: RM21.45mil

.

1) GROWTH: RV shipments are expected to continue their robust growth this year, driven by an improving US economy, consumer preference for the RV lifestyle and innovative RV designs. (pic2&3)

.

2) ROE: 13.32% (consistently >10% since listing)

.

3) CASH FLOW: average FCF of RM18.45mil a year for the past 5 years. Net cash RM110.75mil vs RM57.5mil in FY12 (pic4)

.

4) DIVIDEND: RM0.06 per share, at RM1.76, dividend yield = 3.4% (pic1)

.

5) PER: 8.21x (pic1)

.

Other valuation methods:

1) If FLBHD is able to generate 18mil FCF forever, with 10% discount rate and RM110.75mil net cash, the present value per share = RM2.82

2) Current market cap = RM181.63mil, minus net cash of RM110.75mil = buying the business at RM70.88mil

Assuming FLBHD is able to generate 18-20mil profit/FCF a year for the next few years, we will be able to own the business for free within 4 years

.

**main concerns**

1) Revenue decreased 10% due to lower sales volume as well as lower selling price in US dollar, profit increased due to improved production recovery rate and achieved a lower production cost per cubic metre

2) Reliance on a single customer as 54% of revenue was from Ihlo Sales & Import Co

3) Other factors like availability of log supply, fluctuation in log prices & currency and labour shortage might affect FLBHD’s profitability

.

Previous post on FLBHD: https://www.facebook.com/…/Stockaholics-1818634888…/photos/…

.

Disclaimer:

Please be informed that the information above is solely for the purpose of sharing and does not constitute a buy or sell call. YOU ARE RESPONSIBLE FOR YOUR OWN ACTION.

.

2) ROE: 13.32% (consistently >10% since listing)

.

3) CASH FLOW: average FCF of RM18.45mil a year for the past 5 years. Net cash RM110.75mil vs RM57.5mil in FY12 (pic4)

.

4) DIVIDEND: RM0.06 per share, at RM1.76, dividend yield = 3.4% (pic1)

.

5) PER: 8.21x (pic1)

.

Other valuation methods:

1) If FLBHD is able to generate 18mil FCF forever, with 10% discount rate and RM110.75mil net cash, the present value per share = RM2.82

2) Current market cap = RM181.63mil, minus net cash of RM110.75mil = buying the business at RM70.88mil

Assuming FLBHD is able to generate 18-20mil profit/FCF a year for the next few years, we will be able to own the business for free within 4 years

.

**main concerns**

1) Revenue decreased 10% due to lower sales volume as well as lower selling price in US dollar, profit increased due to improved production recovery rate and achieved a lower production cost per cubic metre

2) Reliance on a single customer as 54% of revenue was from Ihlo Sales & Import Co

3) Other factors like availability of log supply, fluctuation in log prices & currency and labour shortage might affect FLBHD’s profitability

.

Previous post on FLBHD: https://www.facebook.com/…/Stockaholics-1818634888…/photos/…

.

Disclaimer:

Please be informed that the information above is solely for the purpose of sharing and does not constitute a buy or sell call. YOU ARE RESPONSIBLE FOR YOUR OWN ACTION.