Visit https://www.facebook.com/donkeystock/ or http://www.donkeystock.biz/ for more infographic.

Subscribe us to get a free copy of e-book on Investment Guides all in infographics.

You may be interested in:

Red Flag Spotting: Signals to beware when analysing financial statement.

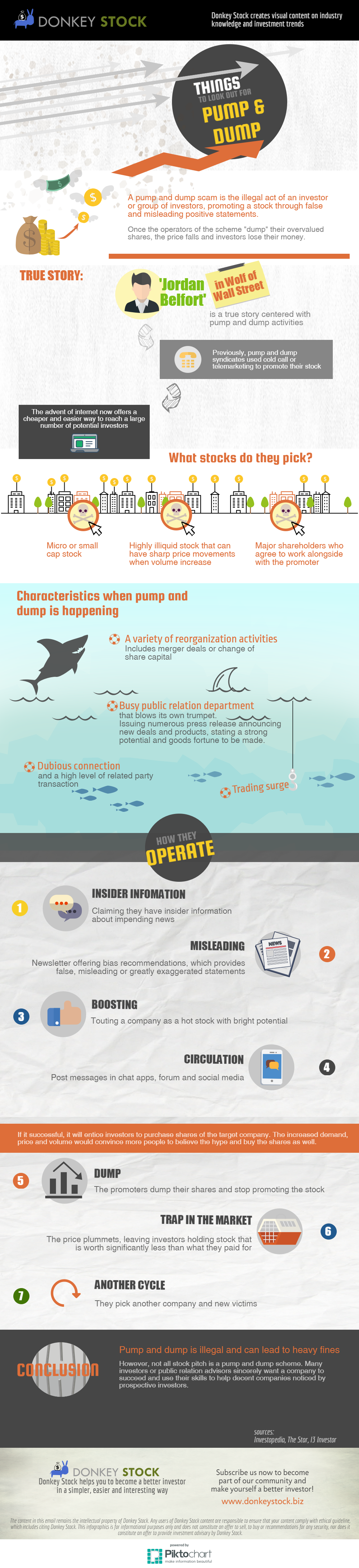

Pump and Dump

Not all stock pitch is a pump and dump scheme. Many investors or public relation advisors sincerely want a company to succeed and use their skills to help decent companies noticed by prospective investors.

There are also promoters who dupe investors putting their money into companies that are not viable investments. Usually a bad company will attract bad stock promoters.

Previously, pump and dump syndicates used cold call or telemarketing to promote their stock, Jordan Belfort in the movie Wolf of Wall Street is a movie centred with pump and dump activities. The advent of internet now offers a cheaper and easier way to reach a large number of potential investors.

Companies with the characteristics of operating pump and dump

· A variety of reorganization activities, which include merger deals or change of share capital

· A very busy public relation department that blows its own trumpet. Issuing numerous press release announcing new deals and products, stating a strong potential and goods fortune to be made.

· Dubious connection and a high level of related party transaction

· Trading surge

How they operate?

1. Claiming they have insider information about impending news

2. Newsletter offering bias recommendations, which provides false, misleading or greatly exaggerated statements

3. Touting a company as a hot stock with bright potential

4. Post messages in chat apps, forum and social media

If it successful, it will entice investors to purchase shares of the

target company. The increase demand, price and volume would convince

more people to believe the hype and buy the shares as well.

5. The promoters dump their shares and stop promoting the stock

6. The price plummets, leaving investors holding stock that is worth significantly less than what they paid for

7. They pick another company and start the cycle again

What company they pick?

· Micro or small cap stock

· Highly illiquid stock that can have sharp price movements when volume increase

· Major shareholders who agree to work alongside with the promoter

Is it legal?

No, it is illegal and can lead to heavy fines

http://klse.i3investor.com/blogs/donkeystocks/121187.jsp