Insas undervalued?

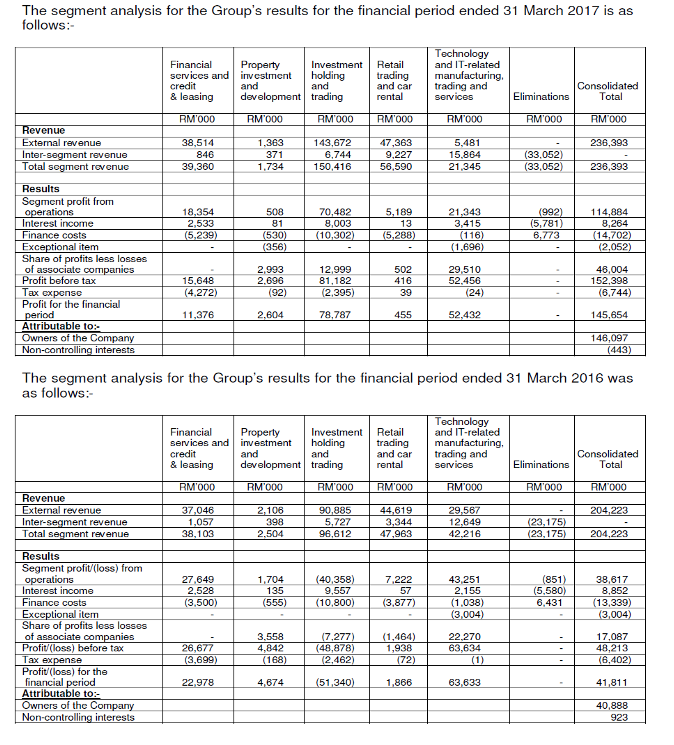

1)financial services and credit and leasing include stock broking and dealing in securities, credit and leasing and granting of loans and other related financing activities.

2)property investment and development include property development and property holding.

3)investment holding and trading include investment holding and trading of securities

4)retail trading and car rental include cars and limousines for hire/rental.

5)information technology related services include wireless microwave telecommunication products, and wireless broadcast card and electronic manufacturing services.

Look at business segments above, I am a bit dizzy. Can't find a suitable word to describe it, maybe can considered 'rojak' conglomerate of Malaysia.

Let's go to their lastest Q317 of the company.

Financial services and credit & leasing division

The unit reported lower pre-tax profit of RM15.6 million for the nine months period ended 31

March 2017 (nine months period ended 31 March 2016: RM26.7 million) due to lower gain on

fair value changes of financial assets at fair value through profit and loss of RM0.4 million in the

current period (nine months period ended 31 March 2016: gain on fair value changes RM9.8

million).

With

my limited knowledge on accounting, I guess this division involved in

financial services that holding some financial assets that value quite

volatile(securities?). Company will determine the value of the financial

assets in the end of some period. M&A Securities S/B-Stock broking

firm in this segmen? If compare to last financial year this segment not

that impressive.

Property Investment and development

No

explanation for this segment on Q317 report. Maybe the contribution

from this segment is too small to bring any significant impact. (Hop Hup

Construction Berhad in this segment?)

Investment holding and trading division

The investment unit reported higher revenue of RM143.7 million for the nine months period

ended 31 March 2017 as compared to revenue of RM90.9 million reported in the preceding

year’s corresponding period as a results of higher trading activities in the current financial

period.

The investment unit reported pre-tax profit of RM81.2 million for the nine months period ended

31 March 2017 (nine months period ended 31 March 2016: pre-tax loss of –RM48.9 million)

primarily due to gain on fair value changes of financial assets at fair value through profit and

loss of RM30.4 million and gain on foreign exchange of RM14.5 million (nine months period

ended 31 March 2016: loss on fair value changes of –RM42.0 million and loss on foreign

exchange of –RM16.8 million).

To

me this is also another hard to understand segment. From the result,

for the past 9 months this segment made the most profit compare to other

segments. I suspect this segment involved in trading the securities

including the subsidiaries and associate companies. This segment profit

comes form the gain of fair value of financial assets and foreign

exchange.

Retail trading and car rental

No

explanation for this segment also. Maybe the contribution from this

segment is too small to bring any significant impact on the profit for

this financial period.

Technology and IT-related manufacturing, trading and services division

The Technology unit reported lower revenue of RM5.5 million for the nine months period ended

31 March 2017 as compared to revenue of RM29.6 million reported in the preceding year’s

corresponding period as a results of lower trading activities in the current financial period.

The Technology unit reported a lower pre-tax profit of RM52.5 million for the nine months period

ended 31 March 2017 as compared to RM63.6 million in the preceding year corresponding

period due to lower gain on disposal of shares in an associate company of RM31.1 million (nine

months period ended 31 March 2016: gain on disposal of quoted securities of RM9.3 million and

gain on disposal of shares in an associate company of RM38.0 million) and loss on foreign

exchange of -RM2.9 million (nine months period ended 31 March 2016: gain on foreign

exchange of RM1.0).

The Group’s equity accounting for Inari Amertron Group’s after-tax profit for the nine months

period ended 31 March 2017 was RM31.4 million (nine months period ended 31 March 2016:

RM22.7 million).

Another

hard to understand segment. Lower revenue due to lower trading

activities? Can it be lower trading activities from associate companies

like Numoni, J&C...

This segment also involved disposal of shares in an associate company (company name not stated).

The

only thing I can confirm is Inari Amertron Group’s after-tax profit for

the nine months period ended 31 March 2017 was RM31.4 million

In

my opinion, Insas is an asset management company that operate in such a

way like our mini EPF manage a pool of funds, do quite a lot of

securities trading. On the same time the company also owned some money

making subsidiaries and associate companies like M&A Securities,

Inari Amertron, Ho Hup, Melium Group (fashion), DOME cafe

(F&B)...etc

SO WHAT IS THE CATCH HERE?

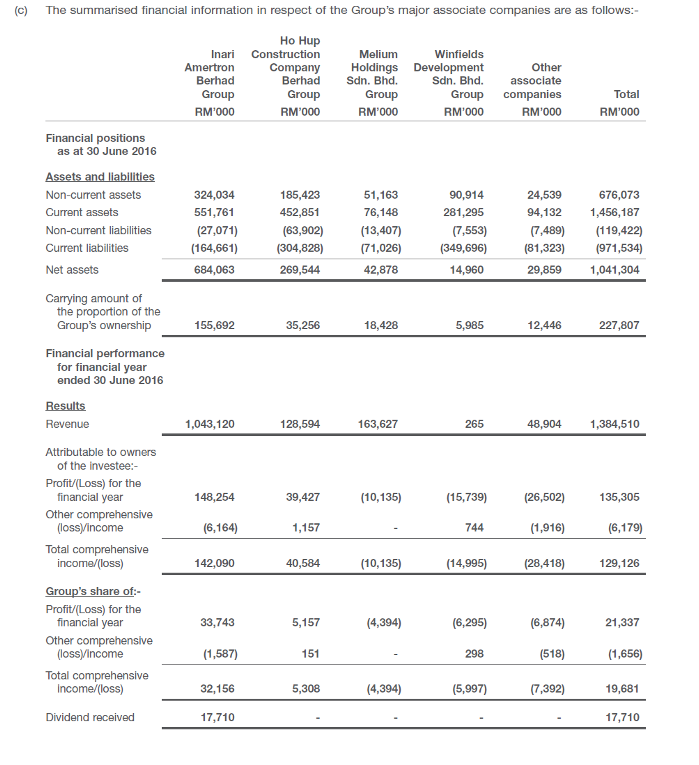

From 2016 AR below, we can see no adjustment on associate companies valuation.

In 2016 AR, 22.7% of Inari with carrying amount RM156m only, but today market value is RM964m

Let's say the management want to sell off some of the associate companies tomorrow, I assume:

-

If the company still holding 17% (instead 22%) of Inari Amertron, the market value is RM722m

-

if the company still holding 13% of Ho Hup, the market value is RM39m

Now what will happen to the company cash per share

Personally, my estimation of the company net cash at least RM500m.

cash per share = RM500m + RM761m = RM1261m/663m = RM1.91 per share

How about the NTA, if the company reevaluate value of some associate companies?

With some minor adjustment I will add in RM621m (from Inari and Ho Hup)

NTA = RM2.30 + RM0.93 = RM3.23 per share

To

me, Insas is kind of asset play company (deep in value) with grow

potential, but hard to understand asset management business due to lack

of information provided.

***caution,

above writing is my own imagination and all the assumption and

estimation without any concrete evidence, strictly for sharing purpose,

not a buy or sell call of the company.

http://klse.i3investor.com/blogs/InsasUndervalued/126788.jsp

http://klse.i3investor.com/blogs/InsasUndervalued/126788.jsp