VisDynamics Holdings Berhad designs, researches and develops, and assembles back-end semiconductor equipment. The company offers equipment solutions to the semiconductor assembly and test industries. It provides tray based systems, including tray-tape and reel inspection systems, and universal gang pick products. The company also offers gravity based systems comprising rotary gravity-feed electrical test, vision inspection, and taping systems. In addition, it provides OEM vision inspection systems and 3 in 1 de-taping systems. The company sells its products in Malaysia, Southeast Asia, North Asia, and the United States. VisDynamics Holdings Berhad was founded in 2003 and is headquartered in Ayer Keroh, Malaysia.

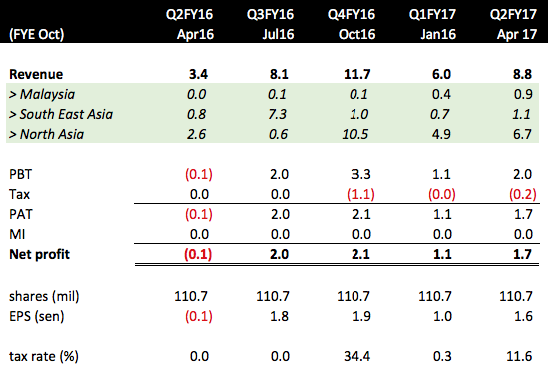

As shown in table above, the group turned around in July 2016 quarter (results announced in September 2016). In the subsequent three quarters, the group continued to report profit. As a result, share price went up from 25 sen to RM1.25, an increase of 400%.

Based on past 12 months aggregate profit of RM7 mil and market cap of RM138 mil, PER is 19.7 times.

Conclusion

Visdyamics is not a very strong industry player. All these years, the group has not been profitable. However, rising water lifts all boats. Its fortune was boosted by the strong performance of semiconductor industry in past 12 months. As a result of that, its share price has risen dramatically.

Whoever that paid attention to this stock would have benifited substantially.

I studied the stock two years ago. Due to its low profitability, I kicked it out of my stock monitoring list. Of course, now I regretted doing that.

One lesson I learned is that don't dimiss ACE counters. Keep track of them for signs of turning around. ACE counters tend to attract support of syndicates. Once they turn around, their stock price performance will usually be much much more sexy than non ACE companies.

Maybe we should pay more attention to ACE counters in the future.

http://klse.i3investor.com/blogs/light/127928.jsp