A)Introduction

The group primarily involved in the trading and distribution of Process Control Equipment (PCE) and Measurement

Instruments. Its focus area is mainly in the palm oil and oleochemicals, oil and gas and petrochemical and water

treatment and sewerage industries. With more than 20 years experience in the valves and automation industries,

Dancomech has successfully managed and meet the demands of some major Project Developers and manufactures

in the oil and gas industries.

The Corporate Structure as below:

B)Financial Performance

i)Yearly Performance

From the above table

1)The Revenue is dropped, -24% fr year 2014 to 2016, whereas the Profit from Operations and Profit after Tax

both increases 4%.

2)Cash and Cash Equivalent increases 139% from Year 2014 to 2016, with RM50 mil Cash in hand,

whereas the Debt/Equity reduces tremdendously, -10.4%

3)Net Assets Per Share increases 46% from year 2014 to 2016.

The above data shows that the management did a WONDERFUL job eventhough the Revenue decreased.

ii)Latest Quarterly (Q1 17) Financial Performance

Performance Review

The Group registered a slight decrease in pre-tax profit of RM0.2 million due to lower margin of goods sold during

the current quarter.

iii)Financial Performance Trailing 12 months

From the above table, the valuation done at Price RM0.565 (closed on 3/8/17)

a)PE =13.5 < 15 Ok

b)P/BV =1.6 < 2.0 Ok

c)EV/EBIT =7.1 <8 .0="" k="" nbsp="" p=""> Based on above, the current Price is Fair and the health of the company financial is Great.

C)Company Activities

i)From AR2016

ii)Newspaper Articles

The Star on 9th Jan 2017

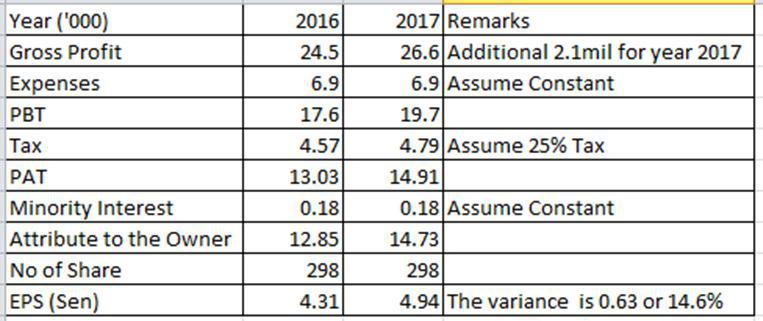

From the above article, the additional gross profit is around 2.1mil,

Based on 2016, the estimation of EPS for the year 2017 as below:

As mentioned by the Boss, expect to growth 10% to 20% yearly

D)Technical Analysis

From the Chart, the Stochastic is under 20% which is at the oversold region.

The Danco started to retrace since mid of May 17 and is almost 35% without any BAD news,

Is it a bit RIDICULOUS? but is an opportunity to buy "CHEAP" with Good Quality Product.

E)Conclusions

DancoMech is a continue growth company which good to invest for long term.

Note :

This is not a buy or sell call, the author just share the information.

http://klse.i3investor.com/blogs/Danco/129189.jsp