In i3, it's quite common to see FA people, X-factor, TA, business sense, etc... debating over the effectiveness of their respective strategies. This article is not for the purpose of choosing sides but rather examine the effectiveness of some of the strategies. To avoid further contentions, the context chosen is not as expected but still be able to prove a point. Thanks to Kcchongnz probably for being one of the pioneer practitioner of Greenblatt's Magic Formula, the article will demonstrate the result of the Magic Formula in the Korean stock market.

Greenblatt's Magic Formula

As mentioned in The Little Book That Beats The Market, the Magic Formula is basically "a long-term investment strategy designed to buy a group of above-average companies when they are available at below average-prices". The essence of the formula lies within a combination of earnings yield and returns on invested capital. I believe the formula works because occassionally great companies are mispriced and can present a great opportunity for the wise investor. Undoubtedly, the formula only work on average and not on every single stock so this is likely to be a point that skeptics tend to attack a lot despite the portfolio as a whole generating meaningful returns.

Backtesting Result from July 2005

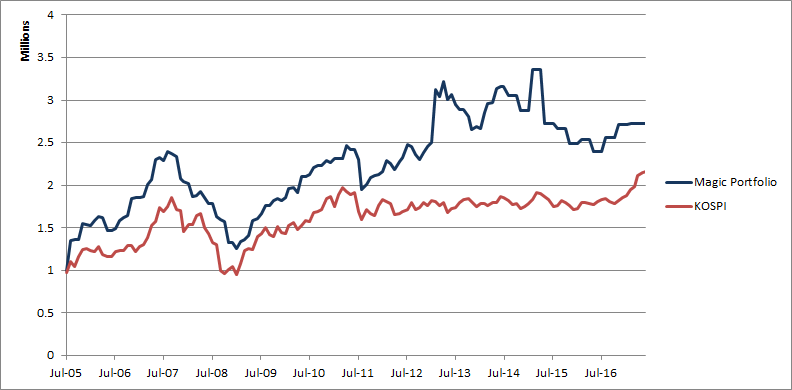

The result is obtained using data from 2005 July to 2017 July using monthly data of Korean equities excluding dividend returns. Another reason the Korean market is chosen is because this is one of those market with very high retail participation and low institutional participation. This translates to a very high tendency of speculation and the perceived failure of various fundamental analysis processes since the market is moved very significantly by retail speculators. Employing earnings yield and returns on capital paired with another metric for enhancement purposes in the screening process, a portfolio consisting of eight stocks are established with equal weights (or re-established) every 3 years because this is a long-term investment strategy (I would make it 5 years or more but I believe most people's patience wouldn't exceed 3 years especially when holding underperformers). The result of $1,000,000 invested from July 2005 will be shown as followed:

On a compounded annual growth rate basis, the magic portfolio yield 8.7% while KOSPI yield 6.86%, generating approximately 1.84% excess return without any other additional fundamental analysis being performed. The point here is that even in a highly speculative market, the magic formula is able to somehow outperformed the benchmark index.

Backtesting Result From Other Months

Since some people may argue a single month of execution may be purely based on luck, the backtest is repeated for portfolio establishment execution based on other months. Similarly, some parties may argue for the long-investment horizon so different investment horizons are also presented as follow:

As January 2006 and March 2006 starting point will have ending point of 2018, all the returns above are computed until 2014 / 2015 for comparison purposes. The column denoting 1-year re-adjustment meant that the portfolio is liquidated and re-established annually so those who are lack of patient seemed to be able to make a decent return as well. However, it is clear that longer duration of holding produces better returns although the 2-year strategy's returns dwarf the 3-year strategy's return.

Conclusion

When running a causality test, the value factor actually became the most significant (very high t-critical value and beta but not displayed here to avoid the technicalities) factor which validifies the importance of value in subsequent returns. Why does the Magic Formula work? Probably because it allows one to purchase "great quality at a reasonable price". Who knows....

http://klse.i3investor.com/blogs/asdas/129017.jsp