I have made a post regarding fundamental

analysis and DCF valuation on Mikromb before, and you can refer to my

previous post here :

As the company had completed their bonus

share issued to shareholders last month and had announced their last

quarter result yesterday, I wish to revisiting my valuation analysis on

this company. But before that, let me do some briefing about the company

first.

Mikro MSC is a small cap ace listed

company. It was involved in manufacturing of supporting (electronic)

components for the distribution industry such as industrial, commercial,

residential and transportation. Its hot selling product is protection

relay and it had more than 50% market share in Malaysia. MRT1, KLIA2 and

Bahrain F1 circuit are using its relay. Big electricity users are

compulsory to have a protection relay in their circuit, or else TNB will

not be supplying them electricity. The lifespan of a relay is

approximately 10 years.

Currently, Mikromb is the leading player

in Malaysia for the industry with more 50% of market share. It has

highest gross margin of more than 50% as well profit margin of more than

20% compared to its peer such as MH and Delab, thanks to its strong

R&D capability.

In terms of growth, Mikromb business are

somewhat driven by construction sector, especially infrastructure

projects. Therefore, according to management who sees there is limited

room in Malaysia due to slowing down of local construction sector, they

are now shifting their growth target from overseas market, particularly

in Southeast Asia.

Some of their export market including

Vietnam which is their key market, India, Indonesia, Iran and many other

countries with representing 40% of company's total revenue. I think

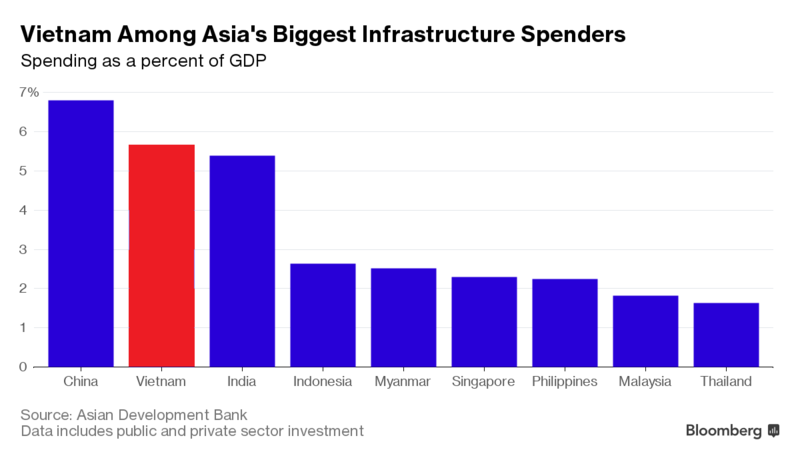

this one is interesting to share. According to ADB report, Vietnam

infrastructure spending is among the highest in SEA with average of 5.7%

in recent year.

Now lets have a look at their financials. I would like to make it straight in 5 simple points.

- The company has strong balance sheet with net cash position of RM26.4 mill, representing about 34% of company's total assets or 12% of its total market cap.

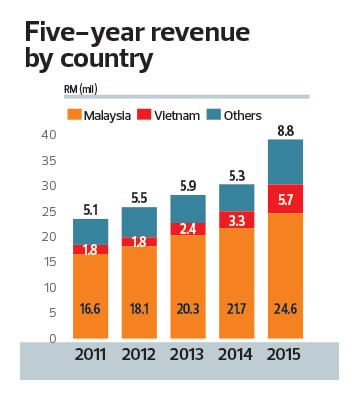

- Over the past 5 years, company revenue and net profit has growing tremendiously at CAGR of 13.25% and 16.55% respectively.

- The company has higher and stable return on capital between 18-20%.

- Operating cash flow has grow healthier from 8 million in FY12 to 14 million in FY17, reprenting CAGR of 24.47% over the past 5 years.

- Company consistently paid dividends to shareholder since listing in December 2005.

The company industrial factory

acquisation in Kota Kemuning, Shah Alam amounting of 12mil during last

year is expected to commence operations by end of this year together

with new production line that is double its existing capacity. This

would enable Mikromb increasing their production capacity to cater more

demand from its export market.

Finally, lets speak how much this company

shares should worth? By taking all the story at above and changing

amount of shares outstanding from recent bonus issued, I came at

estimated fair value of RM0.75, representing 34.8% margin of safety at

current price (RM0.49).

My simple DCF calculation is computed as below :

Given its leading position in the

industry at local present, good management and strong R&D capability

producing high quality products, I believe this company would be able

to grow bigger and better in future to become key player in the industry

globally.

Some Quick Facts I copied from company Linkedin profile:

- Mikro employs over 75 full time staff

- We are ISO 9001:2008 certified, governing Quality Management Systems

- We are ISO 14001:2004 certified, governing Environmental Management Systems

- A number of our products are KEMA certified

- Our products are used and trusted by customers in 14 countries, covering three continents

- All our products are exhaustively tested in-house before we deem them suitable for use

- Unlike major competitors, 100% of our energies go into the design and manufacture of electrical distribution equipment

Disclaimer : I have no intention neither to make buy nor sell calls to you although I do owned some shares in this company.

Thank you and happy investing.

Jeff.

http://klse.i3investor.com/blogs/valuedividend/131125.jsp

Jeff.

http://klse.i3investor.com/blogs/valuedividend/131125.jsp