Since I came to i3 from July 2017, I have so far covered 3 stocks. There are MASTEEL, PETRONM and HENGYUAN.

I had written 1 article for Masteel, 7 articles for Petronm and 4 articles for Hengyuan. Petronm's price has reached RM10 while Masteel price has rallied to RM1.68 and Hengyuan's pirce has touched RM8.10. Pls refer the links below for our previous Petronm and Hengyuan articles:

https://klse.i3investor.com/blogs/david_masteel/132103.jsp

http://klse.i3investor.com/blogs/david_petronm/

http://klse.i3investor.com/blogs/davidtslim/

Lion Industries Corporation Berhad (LIONIND) is involved in the manufacturing of long steel products, by Amsteel Mills Sdn Bhd (AMSB) and Antara Steel Mills Sdn Bhd (Antara) at three steel mills. AMSB’s plant located in Klang, Selangor produces billets for rolling into steel bars and wire rods while its plant in Banting Selangor, set up in 2001 produces special grade billets for rolling into specialty bars and wire rods for automotive parts, mattress and mechanical springs, turning parts, wire rods and wire ropes. The third mill operated by Antara in Pasir Gudang, Johor, was acquired in 2002 from Johor Corporation Bhd, and produces billets which are rolled into steel bars and light sections such as angle bars, flat bars and U-channels.

Lionind’s Antara also operates a Hot Briquetted Iron (HBI) plant in Labuan using the Midrex Technology from USA. Antara’s HBI is manufactured from high-purity iron ore and is rated as among the world’s best and supplied to steel mills for ironmaking, steelmaking and foundry applications.

Lionind also involves in the property development. Some of its projects are Taman Malim Jaya in Melaka, Taman Soga in Batu Pahat and Pelangi Promenade in Klang. Its joint-venture with the Eastern & Oriental Group comprises a mixed integrated development project which includes three blocks of 28-storey serviced apartments, with retail, food and beverage theme outlets located at the site of the former St Mary’s School in Kuala Lumpur.

Another business of Lionind is distributor of lubricants (HiRev brand), automotive and petroleum products and transportation.

Fundamental Data

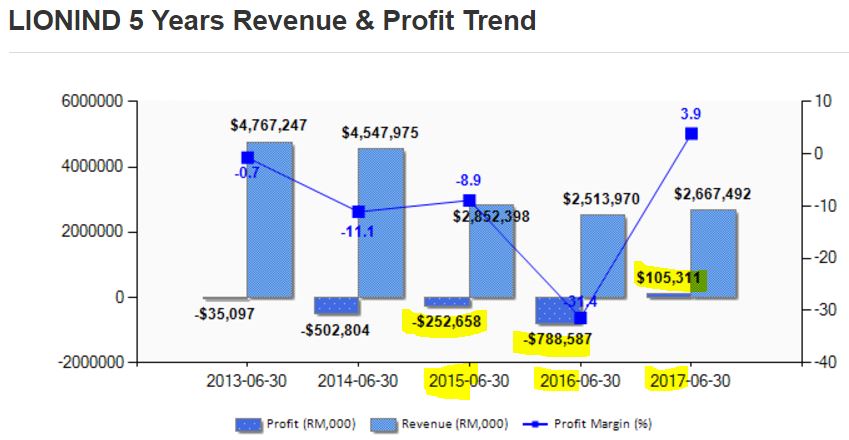

Currently Lionind is trading at PE Ratio of 9.34 (based on current price of RM1.37) with EPS of 14.67 sen. It has suffered big loss in FY2015 and FY2016 (mainly due to impairment of debt from Megasteel) but has turnaround to profit making in 2017 as shown in the graph below:

Source: http://www.malaysiastock.biz

We can observe that the net profit of FY2017 (Q1’17 + Q2’17 + Q3’17+ Q4’17) is RM105.3 mil (EPS of 15.3 sen). This is a significant improvement over FY2016 where it has suffered loss of RM788.6 mil.

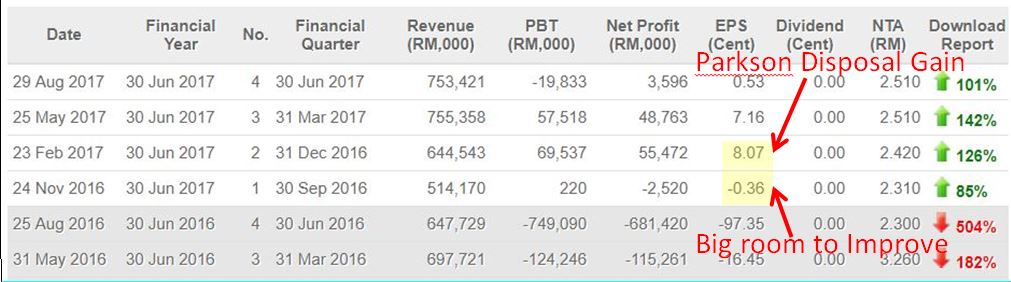

As some of you may aware, Lionind has a loss making associate company called Parkson (holding 23% shares). One of the reasons Lionind produce high profit in Q2’17 (RM55.4 mil profit) is due to disposal gain (18 mil) of a property (building) from Parkson China. Lionind incurred a small loss of RM2.5 mil in Q1’17 (July-Sept 2016). This imply a big room of improvement in coming quarter result (Q1’18) which is scheduled to be released in Nov 2017.

Parkson Loss Analysis

Many of you may be concern about the loss of parkson which may drag down Lionind’s result. First I would like to highlight that share of loss from associate companies (Parkson and others) is an “accounting loss” which it does not affect the cash flow of Lionind. The loss may affect the NTA of Lionind but Lionind actually does not need to pay the loss of Parkson with any of its cash at this moment. Even Parkson continue to suffer further loss in coming quarter, Lionind just share on-paper loss without affecting its current operation cash flow (unless Parkson proposed right issue). From the Parkson latest free cash flow and its share price, it is very low possibility that Parkson may propose for right issue to raise fund in medium term.

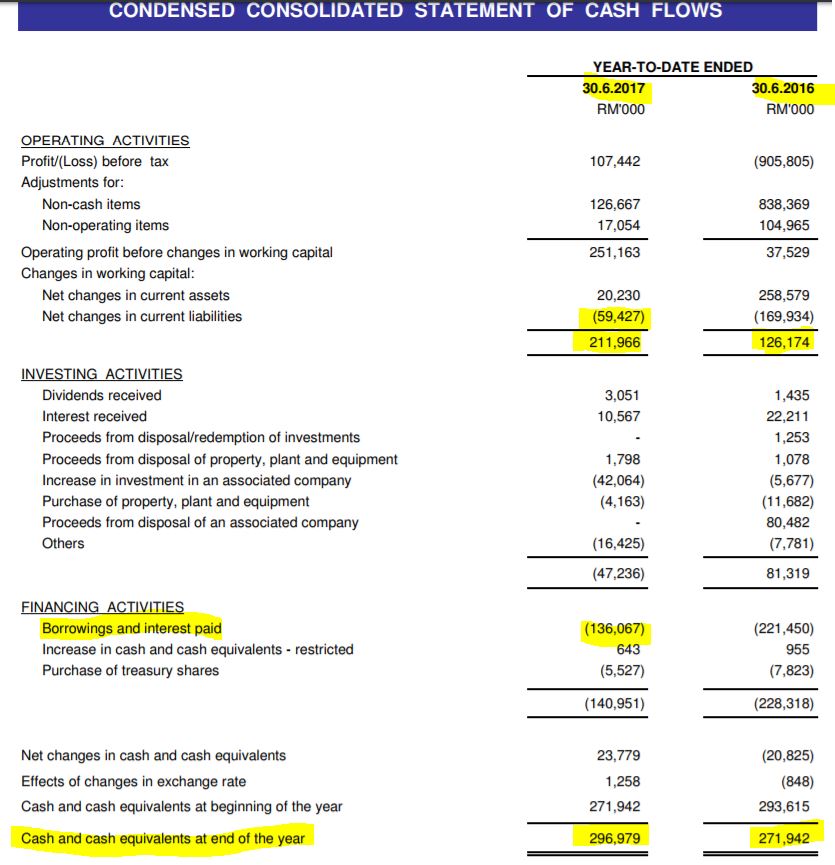

Still not convincing enough that Lionind cash flow is not affected by Parkson? Let's see the cash flow statement of Lionind as shown in the table below:

Source: Q4’17 report

You may surprise to see that Lionind actually generated RM211.9 mil cash flow from operation and RM164.73 mil free cash flow (211.9 - 47.2 (47.2 mil is total investment amount)) in the past 12 months (ended June 2017). It has also paid up RM136 mil of debt and interest in the past 12 months. The cash in hand of Lionind by end of June 2017 stands at RM296 mil which indicates that it is actually a NET cash company as its total borrowing is just RM169.8 mil.

Is Parkson really doing badly in its recent quarter result? My answer is not as bad as what you think.

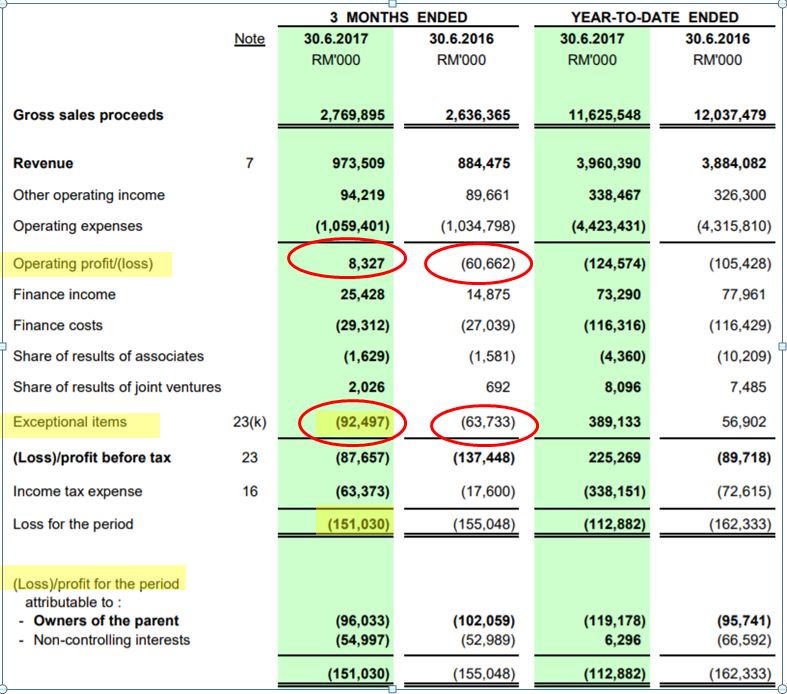

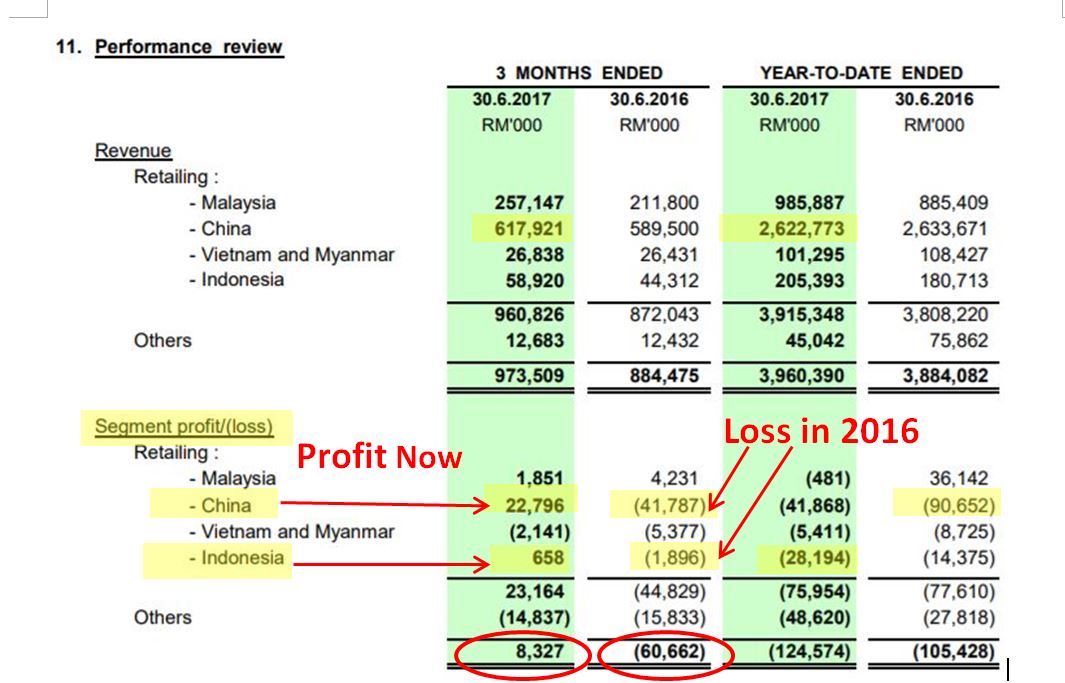

Let see the recent result of Parkson as below:

Source: Parkson FY Q4’17 report

We can observe that Parkson actually produced RM8.3 mil operation profit in Q4’17 (ended June 2017) result but it is dragged by an exceptional item of RM92 mil which cause it incurred of an accounting loss of RM150 mil. The exceptional item of RM92 mil is formed by impairment loss of Property, Plant and Equipment, intangible assets and other receivables.

Remember in 2016, Parkson still suffered RM60.6 operation loss but their exceptional item was lower and income tax expenses are much lower.

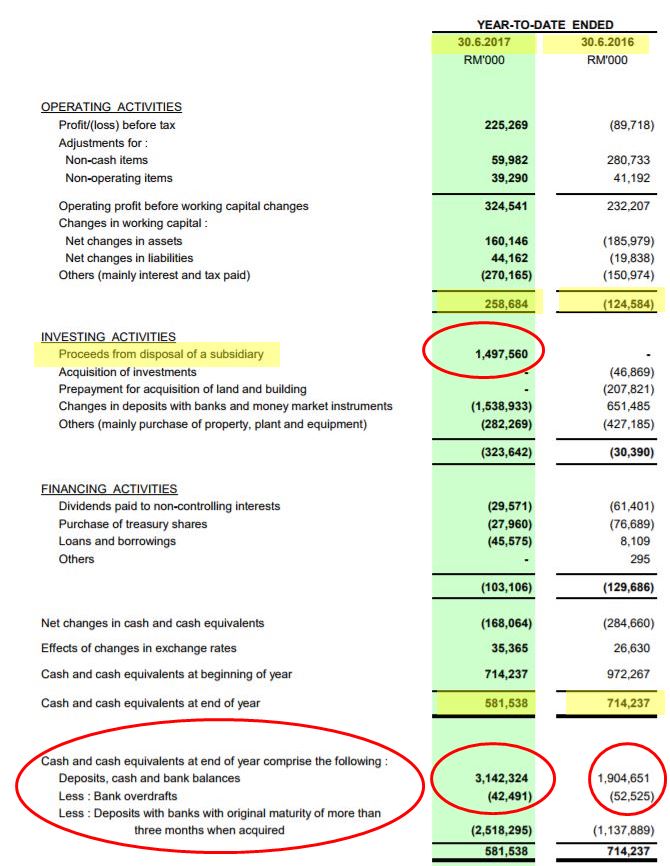

Parkson’s free cash flow actually considered healthy and they are now a Net Cash company. Let see their latest cash flow statement as below:

Source: Parkson FY Q4’17 report

From the table above, Parkson’s current cash in hand stands at RM3.14 billion (RM3142 mil) where its total borrowings are RM2.69 billion (RM2696 mil).

In short, Parkson’s operation and balance sheet has been improved but the risk is lies in its further impairment on PPE and intangible asset.

Lionind Steel division Overview

Let come back to Lionind’s future steel division’s profit visibility. The future of Lionind mainly lies in its rated production capacity among 4 rebar players in Malaysia. Let have a simple estimation of Lionind coming quarter result.

Coming quarter Profit Forecast Q1’18 (July-Sept 2017)

Let me have a forecast analysis for their coming profit for its Q1’18 (to be released in Nov) based on recent rebar price movement.

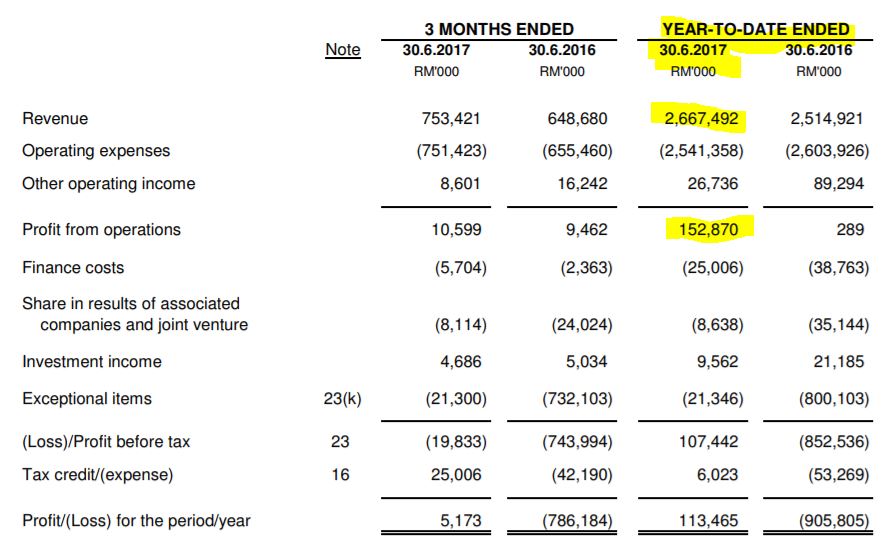

Calculation of profit (using previous year profit margin data):

Source: Q4’17 report

|

12 months (000) |

|

|

Revenue |

2,667,492

|

|

Gross Profit |

152,870

|

|

GPM (margin %) |

5.73

|

From recent 4 quarters, Lionind average profit margin is 5.73%.

Referring to my Masteel article at https://klse.i3investor.com/blogs/david_masteel/132103.jsp

The average selling price (ASP) in Q1 and Q2 of 2017 based on MITI data is around RM2080.

Based on Lionind profit margin of 5.73%, their cost per ton is estimated by formula as below (100% - 5.73% = 94.27%):

Cost per ton = 2080 X (94.27/100) = RM1960

According to MITI data and some online and other unconfirmed data, the average rebar selling price in Malaysia (price varies for different types of products and companies) for July, August to mid Sept are as shown in the table below:

|

July (RM) |

Aug (RM) |

Mid Sept (RM) |

|

|

ASP per ton |

~2200

|

~2450

|

~2650

|

|

Cost per ton |

~1960 (maintain cost as old inventory)

|

~2156 (+10%)

|

~2254 (+15%)

|

|

GPM (margin %) |

10.9

|

12

|

14.9

|

|

Average profit margin in 3 months (%) |

12.6

|

||

For August cost per ton, I estimate the cost may increase by 10% due to scrap iron price increased by 16% in July and some sales can be come from old inventory. Some scrap iron may be sourced locally and the cost for local scrap iron should be lower. For September cost per ton, I estimate the cost may increase by 15% due to scrap iron price increased by 29% in August and some sales can be come from old inventory.

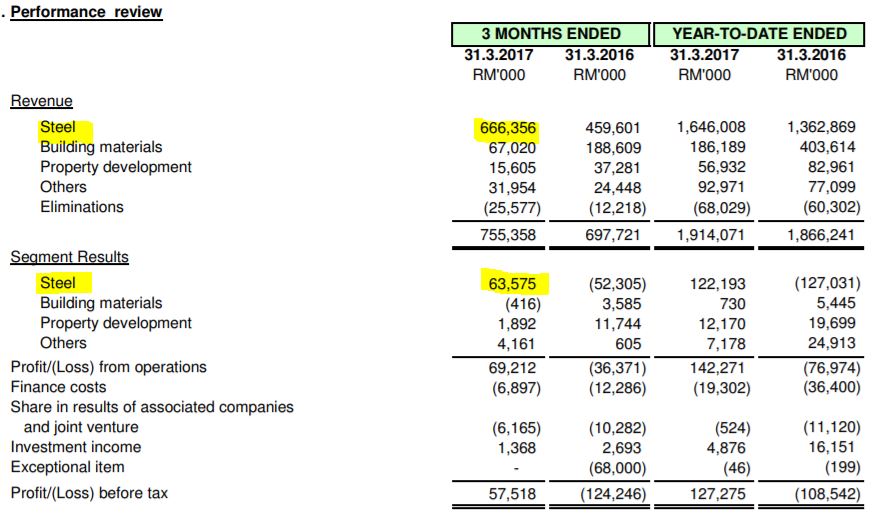

Let check the steel division revenue in Q3’17 as below:

.

Source: Q3’17 report

The gross profit from steel division was RM63 mil. This is mainly due to lower material cost and higher selling price at that period.

The new estimated average gross profit margin is as shown in the table below:

|

Projected Revenue |

660 mil |

700 mil |

750 mil |

|

Gross profit based on 12.6% (RM) |

12.6% -->83.2mil

|

12.6% -->88.2mil

|

12.6% -->94.5mil

|

Let see how much the operating expenses and finance cost from Lionind’s Q4’17 quarter report as below:

New Gross Profit = RM83.2 mil

Estimated finance cost = RM5.7 mil (take Q4’17 figure)

Estimated other income (mainly forex gain) = RM4.3 mil (take 50% of Q4 other income)

Profit before tax = 83.2 – 5.7 + 4.3 = RM81.8 mil

From Q4 report, Lionind has tax credit of RM25 mil (due to overpaid of tax maybe due to over provision of income estimation). I assume coming quarter tax rate 24% is due to I wish to be conservative.

Net Profit after 24% of tax = RM62.17 mil (before Parkson’s loss)

Assume share of loss from Parkson is around RM8 mil (as per Q4’17 loss)

Net profit after share of loss of Parkson = RM54.17 mil --> EPS of 8 sen

8 sen EPS is more than 1400% improvement of QoQ (0.53 sen) and over 2000% improvement YoY (-0.36 sen).

If next quarter Lionind can deliver 8 sen EPS, then trailing 12-month EPS will be 23.76 sen.

Based on current price of RM1.37 with a possible 23.76 sen EPS, Lionind possible forward 3-month PE (result released in Nov 2017) could be as low as 5.76. Most of the steel counters PE can reach 8 -10 which imply possible target price for Lionind is in the range of RM1.90 (PE 8x) and RM2.37 (PE 10x).

It is worth noting that EPS of 23.76 sen is Excludes income/profit from property, building material and others divisions. FYI, these divisions actually contributed RM8mil+ and RM6mil+ of profit in Q4’17 and Q3’17 respectively which is enough to compensate the loss from Parkson.

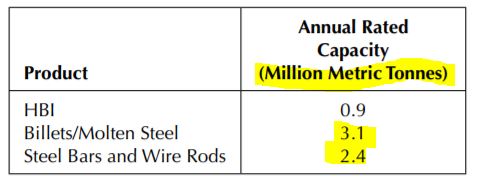

According to its annual report 2016, Lionind production capacity is as table below:

Source: Annual Report 2016

These capacities (3.1 and 2.4 mil metric ton of billets and steel bars) are largest rebar production capacities in Malaysia (larger than Annjoo). Anyway, some of the plants were shut down (Banting plant) and Johor plant also partially shut down in 2016. They are running at 50% or lower capacity in 2015 and 2016.

However, some online source news indicates that Lionind has restarted its Johor’s Antara plant operation to produce more rebar as their domestic rebar demands is increasing and price is near to 3 year high (RM2600-2800++ per ton). Let check the following news from KwongWah and Nanyang newspapers that reported for the latest rebar price has reached RM2800.

(1. http://www.kwongwah.com.my/?p=391432)

(2.http://www.enanyang.my/news/20170918/%E3%80%90%E7%8B%AC%E5%AE%B6%E3%80%91%E8%A1%8C%E6%83%85%E6%AC%A0%E4%BD%B3%E5%8F%91%E5%B1%95%E5%95%86%E5%90%B8%E7%BA%B3-%E9%92%A2%E9%93%81%E6%B6%A8%E4%BB%B7%E5%B1%8B%E4%BB%B7%E5%8F%98%E5%8A%A8%E4%B8%8D/)

Imagine if Lionind manage to increase their production capacity to 70% from current 50%, how much profit or revenue it can generate based on current rebar price?

Another advantage of Lionind is its factories are located in central area (Klang and Banting) which are closer to major infrastructure project sites. The closer distance provides lower transportation cost.

Besides, lionind got a property development arm which will buy rebar from its own company for their property development projects.

Besides, another advantage of Lionind is it can save significant amount of interests by reducing its borrowings using the cash flow generated from operation in the past 12 months (at the expense of high payable amount). Its finance cost has been reduced from RM38.7 mil in FY 2016 to RM25 mil in FY 2017. In fact, Lionind is the ONLY Net Cash rebar company listed in Malaysia.

I may cover further Parkson analysis, ROE, ROIC, debt to equity ratio etc in my part 2 article.

Risk

1. Higher scrap iron price locally and internationally which may affect their cost per ton

2. Recent there is a shortage and price hike of Graphite Electrode which is one of their materials for producing rebar or steel. Electrode (used in electric arc furnace) can provide high level of conductivity and able to sustain high level of generated heat.

3. Higher transportation cost due to rising fuel cost in Malaysia in recent two months.

Summary

1. Lionind associate company (Parkson) operation has been improving in 2017 which its China and Indonesia (due to Ramadan) operations have turned into profitable. In fact, Parkson is a net cash company which I believe it does not need any cash injection (right issue) from Lionind in medium term.

2. The share of loss from Parkson result may not affect Lionind’s cash flow at this moment. It is an accounting loss. In fact, Lionind has generated RM164.73 mil free cash flow in the past 12 months (with accounting profit of RM105.3 mil). This indicates high quality of earning of lionind and its cash flow can be used for future/current increment of production to reap more profit.

3. The rated production capacity of Lionind is the largest among the top 4 rebar manufacturers.

4. The finance cost of Lionind is lowest among 4 rebar players due to its relatively low borrowings (as compared to other 3 rebar listed companies)

5. Its PE is still single digit which is the lowest among the 4 rebar manufacturers in Malaysia. I would expect its forward 3-6 month PE will even lower at 5++ with profit visibility in coming quarter result.

6. Lionind should deserve double digit PE (PE10-12) due to it is the only net cash rebar company, highest rated production capacity and lowest finance cost among all top 4 rebar companies in Malaysia (Exclude income from property etc: RM1.90 --> PE 8x, RM2.37 -->PE 10x).

7. Its factories are strategically located in central and southern areas (Klang, Pasir Gudang) which provide some edge in transportation cost.

8. High steel (rebar) price of China, high domestic rebar demands and low inventory in local rebar manufacturers provide sustainability of high rebar average selling price in 2017.

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.