Since I came to i3 from 7 July 2017, I have so far covered 2 stocks, one was PETRONM & the other one was HENGYUAN.

I had written 7 articles for Petronm and 4 articles for Hengyuan. Petronm's price has reached RM10 while Hengyuan's pirce has touched RM8.10. Pls refer to the links below for my previous Petronm and Hengyuan articles:

http://klse.i3investor.com/blogs/david_petronm/

http://klse.i3investor.com/blogs/davidtslim/

Malaysia Steel Works (KL) Bhd (“Masteel”) principal business activities involve in the production of steel billets and steel bars for the construction sector. Masteel also has an associate company which is a Bio Nexus certified company that manufactures radioisotopes and radiopharmaceuticals which are used by hospitals for cancer imaging.

Masteel’s factories are located in Petaling Jaya and Bukit Raja, Klang, which their combined 2016 annual production capacity is 700,000 MT for billets and 600,000 MT for steel bars (source: production capacity from Annual report 2016).

Fundamental Data

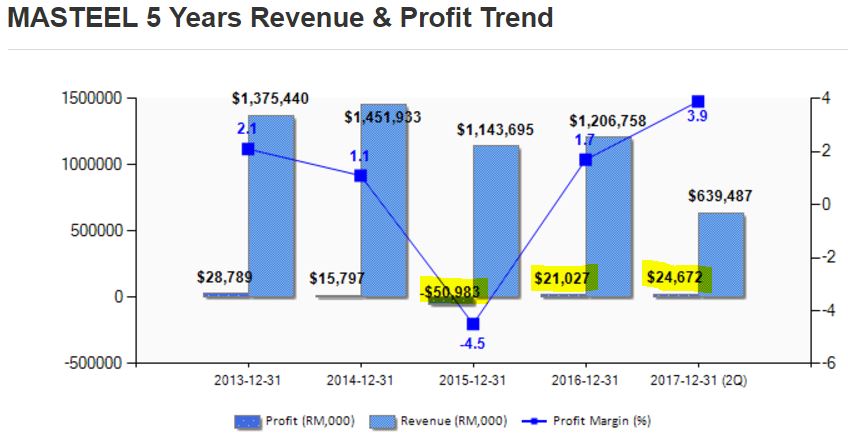

Currently Masteel is trading at PE Ratio of 11.2 (based on current price of RM1.32) with EPS of 11.86 sen. Its profit has been improving from 2015 (loss making in 2015) as shown in the graph below:

Source: http://www.malaysiastock.biz

We can observe that the net profit of recent two quarters (Q1’17 + Q2’17 = 24.67 mil) already exceeded the entire 2016’s net profit (RM21 mil). In fact, it has shown improvement of 63% of profit before tax for the 6 months periods of 2017 vs 2016 (RM30.2mil vs 18.5mil).

Source: http://www.malaysiastock.biz

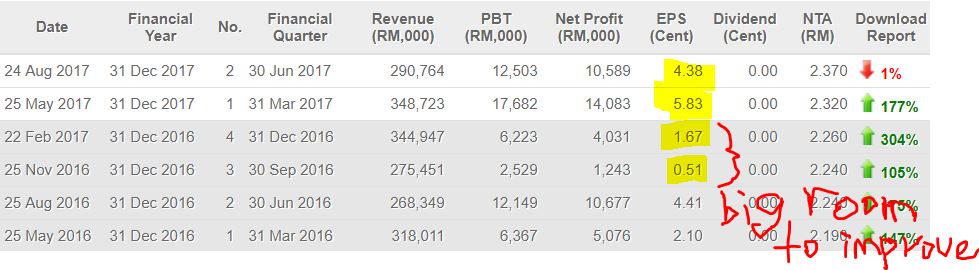

As some of you may aware, rebar (steel bars and billets) price has gone up more than 30% in from June to early September. From the table above, Masteel has a BIG improvement room to increase its EPS in the coming two quarters results where the corresponding EPS in Q3’16 and Q4’16 are 0.51 sen and 1.67 sen respectively.

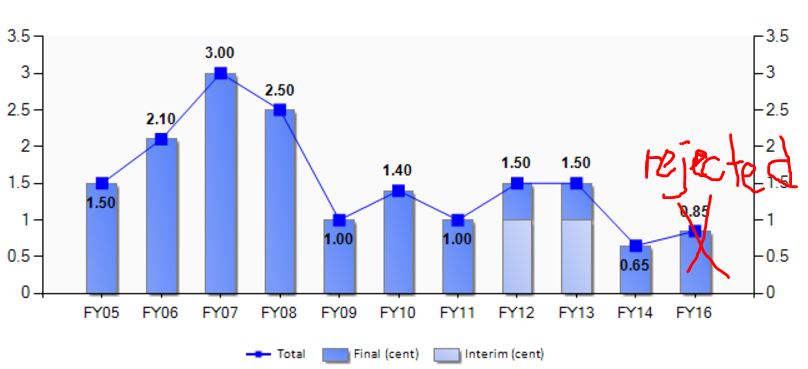

Masteel has considerable low dividend yield of 0.7% and considerable high NTA of RM2.37. More importantly, it has been distributing dividend over past 10 years (except 2016 due to majority shareholders voted down the dividend resolution in AGM) as shown in the graph below:

Coming quarter Profit Forecast for Q3’17 (July-Sept 2017)

Let me have a forecast analysis for their coming Q3’17 (to be released in Nov) based on recent rebar price movement and its materials cost.

Calculation of profit (using previous quarter profit margin data):

1) Gross Profit margin (GPM) = (Gross Profit / Revenue) X 100%

Gross Profit = Revenue - cost of goods sales

(Revenue = total tonnage X ASP), where ASP = Average selling price

Let us go through Masteel gross profit margin in Q1 and Q2 of 2017 as table below:

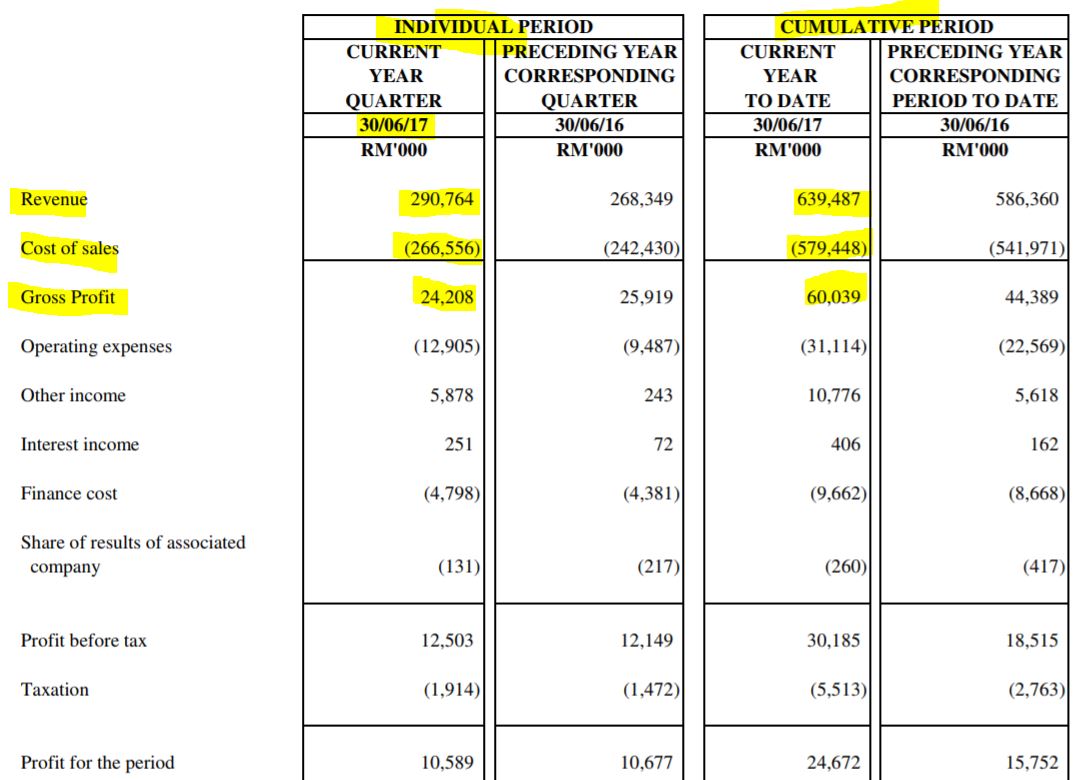

Source: Q2’17 report

| Q1 (000) | Q+Q2 (000) | |

| Revenue |

290,764

|

639,487

|

| Gross Profit |

24,208

|

60,039

|

| GPM (margin %) |

8.326

|

9.388

|

| Average GPM (margin %) |

8.86

|

|

From recent two quarters, Masteel average profit margin is 8.86%.

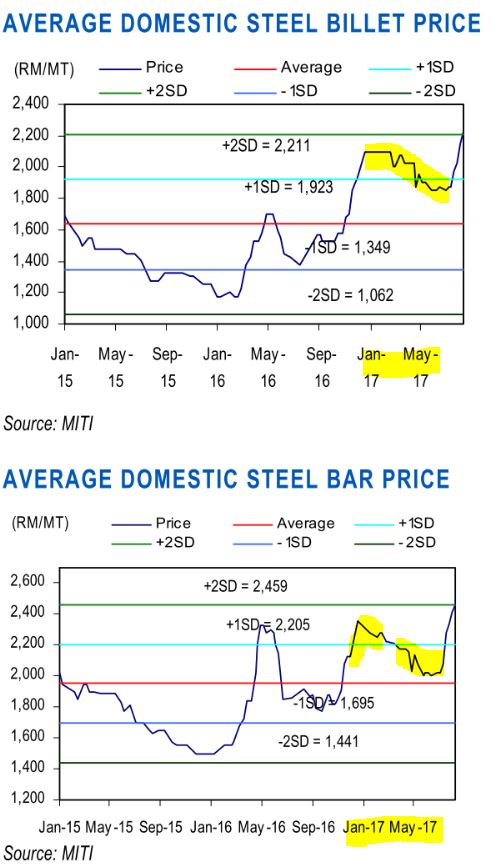

Let us go through the average selling price (ASP) in Q1 and Q2 of 2017 based on MITI data

The ASP of steel billet and steel bar price is around RM2000 and RM2150++ respectively for Q1 and Q2 2017. Let take an ASP of these two products at RM2080 in Q1 and Q2 of 2017.

Based on Masteel profit margin of 8.86% (refer to earlier table), their cost per ton is estimated by formula as below (100% - 8.86% = 91.15%):

Cost per ton = 2080 X (91.14/100) = RM1900

According to MITI data and some online and other unconfirmed data, the average rebar selling price in Malaysia (price varies for different types of products and companies) for July, August to early Sept are as shown in the table below:

Rebar price online link: http://www.thestar.com.my/business/business-news/2017/08/23/exceptional-q3-earnings-seen-for-steel-firms/

| July (RM) | Aug (RM) | Early Sept (RM) | |

| ASP per ton |

~2200

|

~2450

|

~2600

|

| Cost per ton |

~1900 (maintain cost as old inventory)

|

~2050 (+8%)

|

~2185 (+15%)

|

| GPM (margin %) |

13.6

|

16.2

|

16.0

|

| Average profit margin in 3 months (%) |

15.3

|

||

Source: MITI newsletter

By referring to table above, for July cost per ton, I estimate the cost per ton may not change due to the sales in July mainly come from old inventory (RM433 mil).

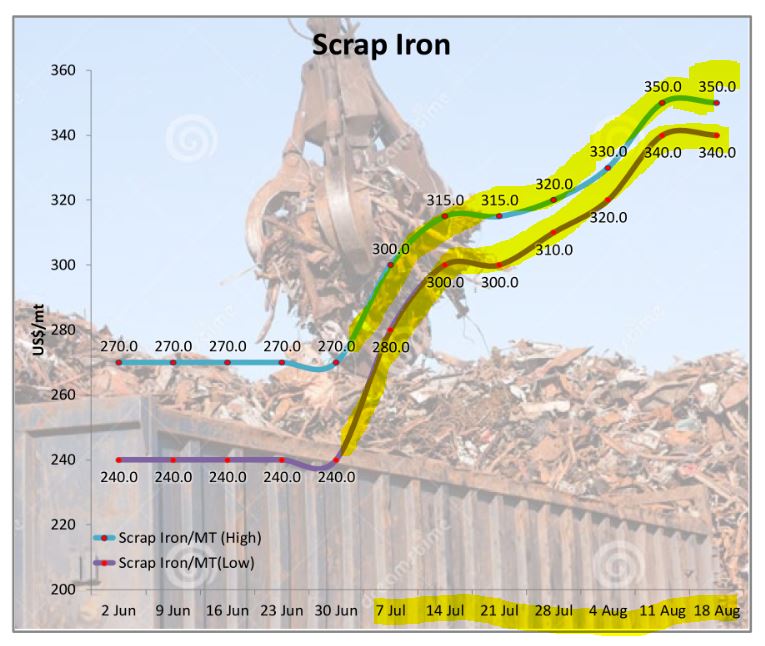

For August cost per ton, I estimate the cost may increase by 8% due to scrap iron price increased by 16% in July (refer to MITI scrap iron price chart where scrap is their main material) and some sales can be come from old inventory (July production is for August sale). Some scrap iron may be sourced locally and the cost for local scrap iron should be lower.

For September cost per ton, I estimate the cost may increase by 15% due to scrap iron price increased by 29% in August and some sales can be come from old inventory (August production is for Sept sale). Again, some lower cost scrap iron may be sourced locally.

The new estimated average gross profit margin is as shown in the table below:

| Projected Revenue | 330 mil | 400 mil | 450 mil |

| Gross profit based on 15.3% (RM) |

15.3% --> 50.5mil

|

15.3% -->61.2mil

|

15.3% -->68.85mil

|

It is worth noting that inventory value of Masteel is RM433 which is higher than 3-month revenue of Q2 and Q1. If Masteel can clear up 90% of its INVENTORY, it is possible to achieve revenue of RM390 mil in Q3. Remember RM433 inventory is still valued at ASP of RM2080 per ton value during the time of end of June (Q2). If it can sell its inventory stock at RM2400 to RM2500 per ton in Q3, how much revenue and profit Masteel can generate?

Let see how much the operating expenses and finance cost from Masteel Q2’17 quarter report as below:

New Gross Profit = RM50.5 mil

Estimated operation expenses = RM12.9 mil (take Q2 figure)

Estimated finance cost = RM4.8 mil (take Q2 figure)

Estimated other income (mainly forex gain) = RM2.4 mil (take 40% of Q2 other income)

Net Profit before tax = 50.5 – 12.9 – 4.8 + 2.4 = RM35.2 mil

From Q2 report, their income tax rate is 15.3% (relatively low). I assume coming quarter tax rate 20% is due to I wish to be conservative.

Net Profit after tax = RM28.16 mil --> EPS of 11.02 sen

11.02 sen is more than 100% improvement of QoQ (4.38 sen) and over 2000% improvement YoY (0.51 sen)

It is worth noting that 11.02 sen EPS already considered the recent issuied private placement shares dilution.

2016 and 2017 Quarter Profit Comparison

2016 (mil, EPS in sen)

|

2017 (mil, EPS in sen)

|

|

| Q1 |

5.0, 2.1

|

14.08, 5.83

|

| Q2 |

10.68, 4.41

|

10.6, 4.38

|

| Q3 |

1.2, 0.51

|

estimated (~28.16,~11.02)

|

| Q4 |

4.03, 1.67

|

?? estimated about 20.44, 8 sen

|

| Total |

21.03, 8.69

|

Estimated(~73.28, ~29.3 sen)

|

Besides, government imposed a 13% safeguard tax on imported rebar serve as an additional protection in case China’s rebar price drops below the domestic price.

The profit estimation in the table above excludes revenue from radioisotopes which has shown rapid growth in revenue for the last 3 years (from RM1.4m to RM3.3m, still relatively small compared to steel biz).

Currently, domestic steel billets are trading at small discount to China’s billet and rebar prices. Let have a look on China’s rebar price at graph below:

Source: http://www.sunsirs.com

Based on current price of RM1.32 with a possible 29.3 sen EPS, Masteel possible forward 6-month PE (result released in Feb 2018) could be as low as 4.5. Most of the steel counters PE can reach 8 -10 which imply possible target price for Masteel is in the range of RM2.34 (PE 8x) and RM2.93 (PE 10x).

Risk

1. Higher scrap iron price locally and internationally which may affect their cost per ton

2. Recent there is a shortage and price hike of Graphite Electrode which is one of their materials for producing rebar or steel. Grap. Electrode (used in electric arc furnace) can provide high level of conductivity and able to sustain high level of generated heat.

3. Higher transportation cost due to rising fuel cost in Malaysia in recent two months. Masteel factory is located in Bukit Raja which is closer to LRT project which provides some advantage to its transportation cost as compared to its Peers.

Summary

1. Masteel will be benefited from recent rebar price rally from RM2000 to RM2600++ and this will drive its profit of the coming quarter to a new high (Possible EPS of 11.02 sen in coming quarter).

2. Masteel high inventory level (RM433 mil) is higher than past 3 quarter revenues (from RM290 mil to RM349 mil). This make it has a good chance to reap high profit from recent high rebar average selling price.

3. Its factories are strategically located in central areas (Bukit Raja) which provide some edge in transportation cost.

4. It has proposed a 1-for-5 bonus issue that was approved at the EGM held June 2017.

5. It is a mid capital rebar counter which the weak Q3’16 and Q4’17 results indicates that it still has big room of improvement in term of EPS or PE ratio. If next quarter can deliver 11 sen EPS, then Masteel’s fair value could be RM2.34 (PE 8x) to RM2.93 (PE 10x, before bonus).

6. High steel (rebar) price of China, high domestic rebar demands and low inventory in local rebar manufacturers provide sustainability of high rebar average selling price in Q4’17.

Technical Chart:

The price had broken up major resistance at 1.27.

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

http://klse.i3investor.com/blogs/david_masteel/132103.jsp