Recently Pentamaster has revealed more details about the listing in HK. Just to share some of my thinking and it may not be 100% correct. Please treat this as gossip write up only.

My biggest question: What is in it for me? EPS got diluted? I try to summarize the whole HK listing into 3 diagram belows.

(1)The changes within Pentamaster

Let do some simple mathematic:

(a) Noted that the retained profit has increased to RM 68,174,733. Together with the Share premium of RM 6,019,703, the total distributable reserve has now raised to RM 74,194,476. This allowed pentamaster to conduct, at pentamaster corporation berhad level, 1:1 bonus issue. Important? Yes. Because i need a lot of liquidity if i'm a high growth company.

(b) The Net Asset Per Share has up by 16 sen / 19% post share award scheme.

Answer: This arrangement sounds good to me.

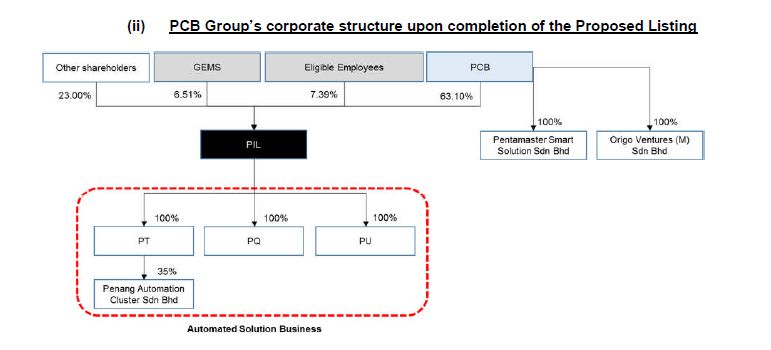

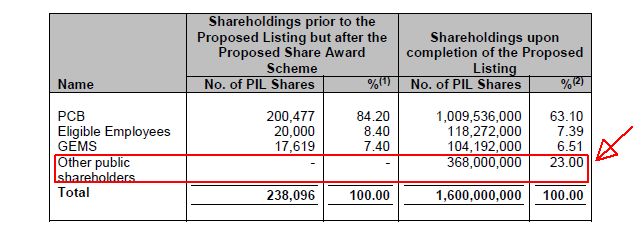

(2) The details of share holdings in PIL is listed as below post HK listing.

(a) Whatever sounds good above (increased in retained profit & Net asset per share) is due to selling of shares to eligible employees and GEMS. You get some, after you lose some.

(b) Worth to note that the increase in retained profit and net asset per share is NOT due to the CASH MONEY to be raised via HK IPO.

(c) PIL will issue 368 million new shares, of which, to be subcribed by the public during HK IPO. The total shares to be issued in PIL is therefore 1.6 bil. This resulted in the further dilution of Pentamaster Corp holding to 63.10% only in PIL.

From the proposal page 10:

"In any event, the earnings contribution from the PIL Group will be reduced to the extent of the

dilution of the PCB Group’s equity interest in PIL from 92.60% presently to approximately 63.10%

following the completion of the Proposed Listing. Accordingly, there may be a corresponding

reduction in the earnings and EPS of the PCB Group assuming the earnings of the PCB Group

remains unchanged."

(d) One glance, this is really hurt. View from different perpective, how am i going to get compensated by this reduction of 23% EPS?

My answer are:

- it depends on how much cash money that the IPO going to raise!

Afterall, the money that going to raise via HK IPO, say RM X, 63.10% of it is belongs to me (if my understanding is correct). We will know the numbers when actual IPO in HK took place. If the cash proceed per share raised is 2 or 3 times more then the 23% eaten up EPS per year, seriously, i don't mind.

- the money raised from HK IPO, will eventually generate how much more business and profit in PIL, which in turn benefit the Pentamaster Corp Berhad.

to be continue...

http://klse.i3investor.com/blogs/YiStock/132098.jsp