On stock picks, we are fairly selective this round.

We even ran a Model Portfolio Optimisation to have a better idea on

potential performance of our new list of Top Picks as per their

respective historical performance.

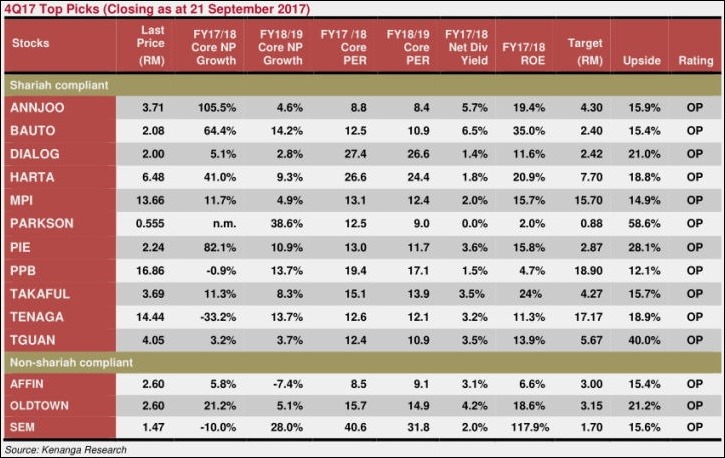

To leverage on the rising trend of commodities, we pick ANNJOO (OP, TP: RM4.30) as one of our Top Picks. For Oil & Gas sector, we choose DIALOG (OP, TP: RM2.42). Apart from capitalising on better oil prices, the decision was also made based on the near completion of RAPID project. Moreover, the stock offers lower volatility as per our Model Portfolio Study.

To leverage on the rising trend of commodities, we pick ANNJOO (OP, TP: RM4.30) as one of our Top Picks. For Oil & Gas sector, we choose DIALOG (OP, TP: RM2.42). Apart from capitalising on better oil prices, the decision was also made based on the near completion of RAPID project. Moreover, the stock offers lower volatility as per our Model Portfolio Study.

We also select BAUTO (OP, TP: RM2.40) as one of our Top Picks as we have upgraded the sector. Besides, with the new launching of car models, we could have already seen the worst in the latest quarterly numbers. We have also recently upgraded the rating and earnings estimates of TGUAN (OP, TP: RM5.67). The undemanding valuation of the stock provides ample room of upside from here. The same goes to AFFIN (OP, TP: RM3.00) as well. Despite the uncertainty over higher provision arising from the implementation of MFRS9, the undemanding valuations of 0.5x P/BV (vs. its 1-year historical average of 0.7x P/BV) could have already factored such concerns. We had also just initiated coverage on TAKAFUL (OP, TP: RM4.27) inspired by: (i) its undemanding valuation, which is trading at 2-year forward PER of 15x vs industry’s 17x as well as (ii) its reasonably good 2-year earnings CAGR of 14% (anchored by the growing demand for Takaful products, low penetration rates as well as government initiatives).

To leverage on potential Consumer consumption play ahead of Budget announcement, we have OLDTOWN (OP, TP: RM3.15), PARKSON (OP, TP: RM0.88) and SEM (OP, TP: RM1.70). Recall that PARKSON is also one of the Top Picks in the previous quarter based on the angle of “Deep-Value” play and potentially a “Turnaround” play as well.

PPB (OP, TP: RM18.90) is also selected as we have a more conservative view on crude palm oil (CPO) outlook. Our analyst reckon that CPO could trade at an average price of RM2,400/tonne for 2018 in contrast to the revised average CPO average of RM2,700 (from RM2,550 earlier) for 2017. The lower CPO should benefit downstream players like PPB.

As for exporters, despite the

uncertainties over US interest rate direction, growth prospects for

these players seem promising. Besides, our Modern Portfolio Study

continues to suggest that continuous investment in export-oriented

industries could achieve better return (of course with higher risk).

Among the exporters, we choose HARTA (OP, TP: RM7.70), MPI (OP, TP:

RM15.70) and PIE (OP, TP: RM2.87) as Top Picks for the quarter.

TENAGA (OP, TP: RM17.17), on the other hand, remains as our all-time favourite.

TENAGA (OP, TP: RM17.17), on the other hand, remains as our all-time favourite.

Alternative Picks from MidS Coverage

On

a separate note, we also have three OUTPERFORM calls among MidS

coverage that seem exciting and could also serve as alternatives to some

of the Top Picks above. KESM (OP, TP: RM18.40) could be a replacement

for MPI and PIE. PWROOT (OP, TP: RM2.70) can be an alternative

investment to OLDTOWN. ULICORP (OP, TP: RM5.60); on the other hand,

while it is not a direct comparable to ANNJOO as it is a downstream

player, the company is likely to see stronger growth in coming quarters

after the completion of its new plants. The company may not only benefit

from capacity expansion, it will also benefit from the expansion of

margin from its downstream business. We also believe its cost of

production may not see much impact from hike in steel prices with its

leading market position allowing pass-through of additional cost to

end-clients.

source: Kenanga Research – 03/10/2017