As discussed in my Lionind's part 1 article (https://klse.i3investor.com/blogs/lionind/133131.jsp),

Lionind has involved in a few businesses like steel manufacturing,

trading, property development, distribution of lubricants and

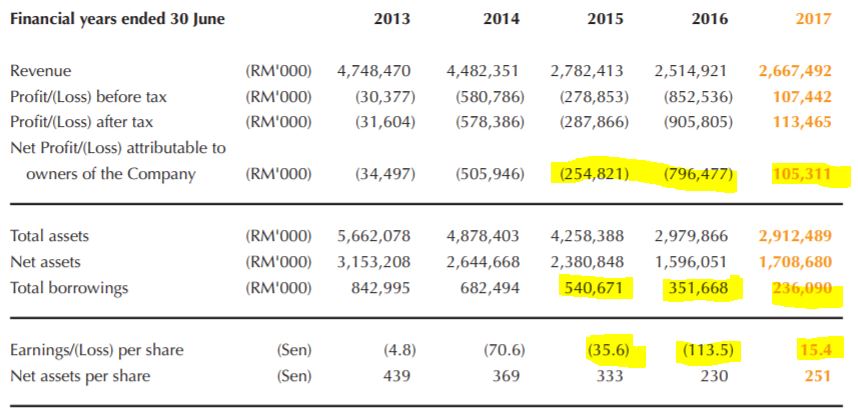

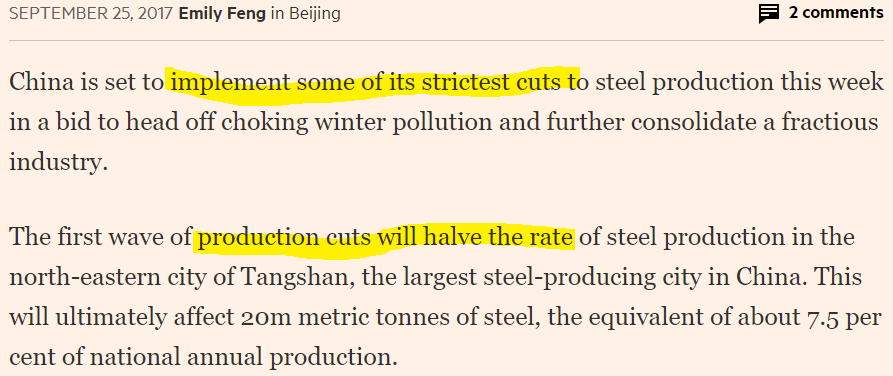

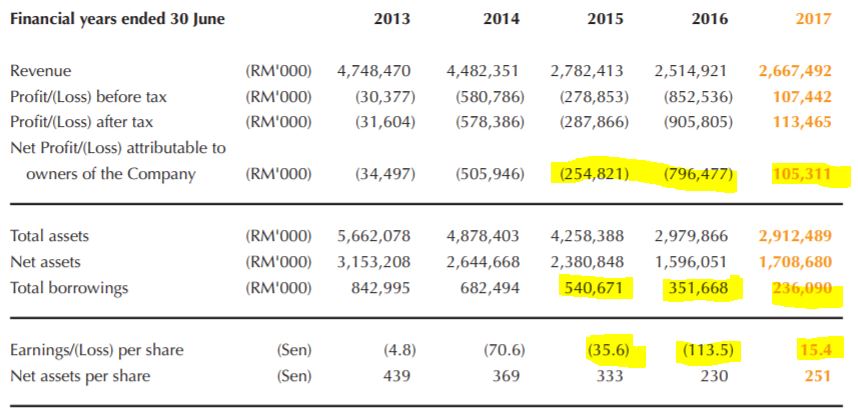

transportation. Let us have a look on 5 years group financial highlights as below:

Source: Annual report 2017

Overall, the Lionind group posted a profit before tax of 107.4 mil against a loss of 852.5 mil a year ago which included impairment losses on receivables of RM607.0 million and property, plant and equipment of RM193.1 million. The key here is significant reduction of impairment in FY2017 vs 2016. Let us see the group whole year cash flow statement as below:

Source: Annual report 2017

From the figure above, the effect of share of losses from associate companies (Parkson etc) is reducing from RM35.9 mil to RM9.2 mil from 2016 to 2017. In fact, these are on-paper losses where they were added back as positive cash flow in the cash flow statement.

In short, with minimum (or zero) future impairment and good rebar average selling price in Q4, Lionind may improve its FY2018 earning (estimated profit of RM160mil to RM180 mil or EPS of 26 sen for forward 12 months).

For Lionind future 1 year prospect, let see the following statement from latest Lionind 2017 annual report as below:

Source: Annual report 2017

The FY2017 profit of RM76 mil from long steel products business is just contributed by only one plant in Bukit Raya. The good news is its Johor plant (ANTARA) has resumed operation in Sept 2017 and Banting plant maybe resume operation in Nov. This information signified Lionind future profit will be contributed by 2 plants (if include Banting will be 3 plants).

As some of you may aware, there was big impairment in FY2016 on property, plant and equipment (PPE) from the closure of Johor Antara and Banting plants. Due to Antara plant already reopened in Sept, I expect there might be some reversal of impairment in coming quarter result. If there is really some reversal of impairment, the on-paper accounting profit (non-cash) of Lionind will be improved.

A lot of you may only aware Lionind owns a loss making Parkson associate company. Actually many of you may not notice that Lionind also got a profit making subsidiary listed company (Lionind holding 74% shares) called Lion Forest Industries Berhad. Lion Forest Berhad (Lionfib) operates in four segments: building materials and steel products, petroleum, lubricants and automotive products (tire and others). Others business of Lionfib include investment holding, provision of transportation services, sale and distribution of motor vehicles. Let see the fundamental data of Lionfib as below:

Source: http://www.malaysiastock.biz (Lionfib just released result on 21 Nov)

Again, the losses in 2016 in Lionfib are mainly due to impairment of receivables from Megasteel and Lion DRI. From FY16’s annual report, the amount due from Megasteel has been fully impaired (RM382mil). Lionfib has reported profitable results in 2017 and Q1’2018 in the absent of impairment.

Lionfib is a net cash company with cash in hand of RM99.6 mil with total borrowings of RM23.4 mil. Currently Lionfib is in net cash position of 76.1 mil which is equivalent to 33 sen per share. FYI, Lionfib currently trading at 78 sen.

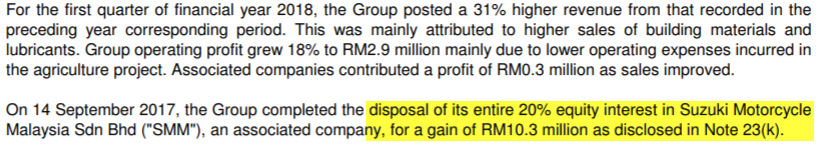

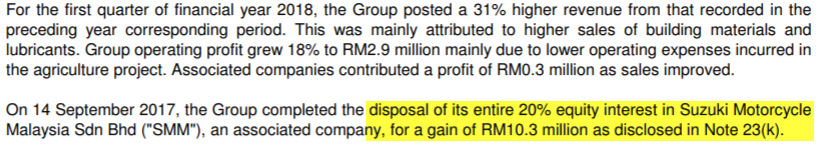

What is the catalyst of the coming quarter for Lionfib? Lionfib’s whollyowned subsidiary company, Lion AMB has completed sales of its entire 20% equity interest in Suzuki Motorcycle Malaysia Sdn Bhd for a cash consideration of RM17.3 million. The Disposal was completed on 14 September 2017. Lionfib may record a one-off gain (RM10.3 mil) from this disposal which may benefit Lionind which controlling 74% of shares of Lionfib. Let see the Lionfib latest Q1’18 report as below:

Source: Lionfib Q1’18 report

Lionind will share this disposal gain (under exceptional item) of about RM7.6 mil (74% share). Actually, Lionind got 8 associated companies including Lion Insurance Company Limited, Angkasa Amsteel Pte Ltd, Lion Asiapac Limited, Renor Pte Ltd, Lion Titco Resources Sdn Bhd, Lion Corporation Berhad and Lion Asiapac Limited which need to added up all their profit or loss.

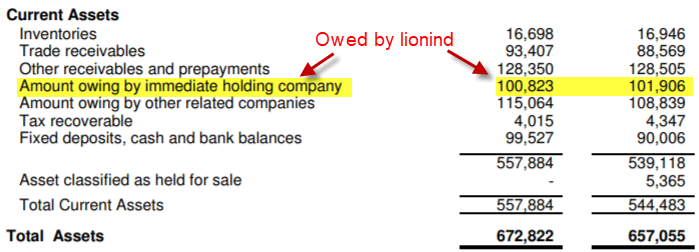

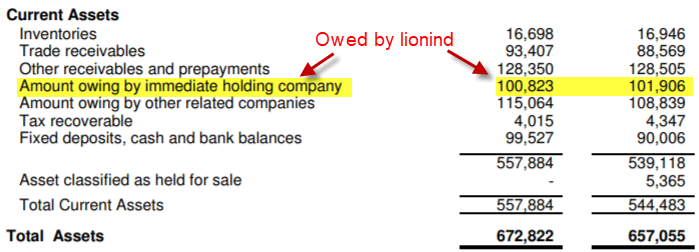

Other than this one-off gain, the cash flow of Lionfib maybe can further improve due to there is big amount of receivable owning by holding company Lionind (not profitable and net cash) as below:

Source: Lionfib Q1’18 report

Remember Lionind cash flow and future profitability improving a lot in 2017. As a result, there is a possibility Lionind may reduce its debt owes to Lionfib in 2018.

Lionind Key Financial Ratio

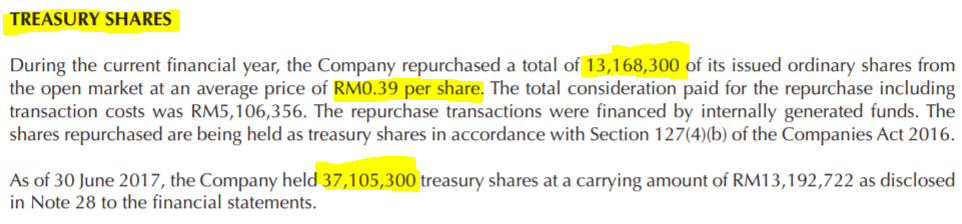

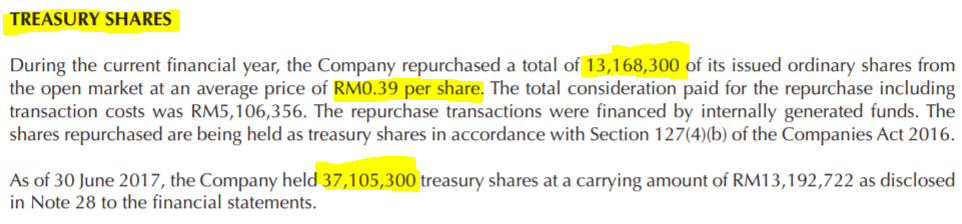

Before we go to the key financial data of Lionind, I wish to show you the total treasury shares of Lionind as below:

Source: Annual report 2017

Lionind held 37.1 mil treasury shares which purchased at an average price of 35.5 sen (from 13.19/37.1). Remember current price of Lionind is RM1.43 which indicates that the treasury share has an on paper profit of RM1.2 per share which can translate to RM45.2 mil. If Lionind short of cash, it can release some of its treasury share to open market (market value of the treasury share is RM57.8 mil).

What are the treasury shares?

Treasury shares are kept in the company's treasury and are not out in the open market.

What are the advantages and disadvantages of treasury shares for both the company and for the investors in the company?

Advantage

Disadvantage

Let see some key financial data of Lionind as table below:

One can see Lionind has reasonable PE (9.75 at price of RM1.43) and good cash flow. The PE is expected to further improve to below 6.5

and cash flow will be improved with higher profit (refer to my lionind

part 1 article) in the coming quarter result (expected to be released on

23 or 24 Nov).

Effect on Lionind for Parkson Coming Quarter Result

As some of you may aware, Parkson Retail Asia reported a loss of Singapore dollars 12.9 mil on 14 Nov 2017. FYI, Parkson Malaysia is a holding company which its subsidiary East Crest International, holds 68% of Parkson Retail Asia.

Meanwhile, Parkson China (s listed co in HK as the name of Parkson Retail Group Limited) reported a loss of RMB22.6 mil on 15 Nov. Parkson Holding berhad holding 55% share of Parkson Retails Group Limited.

Estimated Total Parkson loss (Asia+China) = 40mil X 0.68 + 13.85mil X 0.55 = RM35 mil

(RM40mil is converted from Sing Dollar 12.9mil, RM13.85mil is converted from RMB22mil)

Due to Lionind directly and indirectly hold Parkson of 23.2%, the sharing of Parkson loss for Lionind is as below:

Estimated Share of Loss = RM35mil X 0.232 = RM8.12 mil

Anyway, there will be one-off disposal gain from its subsidiary company (Lionfib) for its Suzuki motorcycle business which can offset part of the losses of Parkson (one-off gain of RM7.6 mil for Lionind 74% of shares).

My estimation for Lionind coming quarter profit around RM60 mil in part Lionind part 1 article before consideration of Parkson’s loss. Conservatively (assume no major impairment from associate companies), I expect Lionind should reported RM54 to RM60 mil profit in coming Nov result. This is just partial contribution from its ANTARA plant from Sept 2017. The profit of Lionind in Q2’18 (Oct-Dec) may have higher visibility in view of full contribution of Antara’s plant and also partial contribution of Banting plant.

Asia Steel Outlook

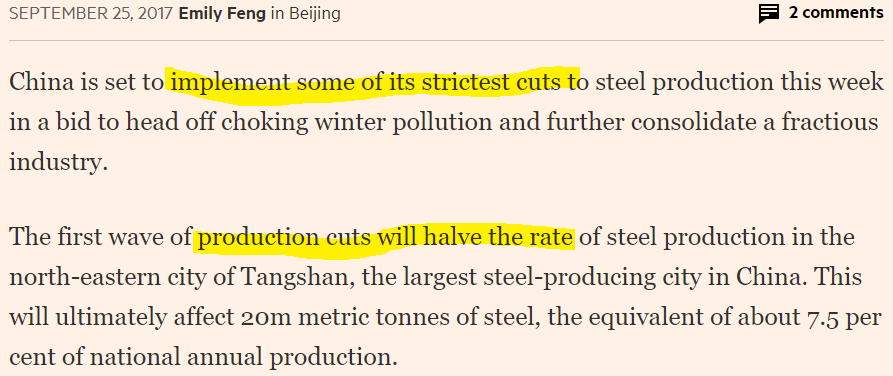

The online data show that China dominates the global steel market producing and consuming roughly 50% of all steel globally. Currently, there is limited incentive for increasing the upstream capacity in steel in china. In fact, China actively reducing its capacity under its “supply-side reform” program. This program mainly aims to cut China steel producers production capacity by half in winter season. Let see one of the news reported this production cut as below:

https://www.ft.com/content/df5b1478-a1df-11e7-9e4f-7f5e6a7c98a2

Consolidation in steel industries is a theme both in Europe and China to strengthen their competitiveness. In Europe, I can notice that the announced plans by ArcelorMittal to merge with ILVA, and Thyssenkrupp to merge with Tata. In China, I can notice the merger of Baosteel and Wuhan Iron and Steel.

In short, the steel industry consolidation in China and Uerope will result in the reduciton of steel supply.

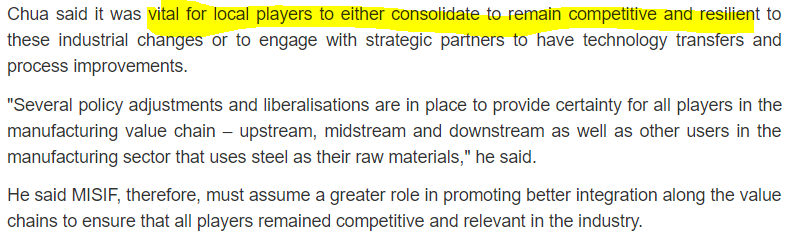

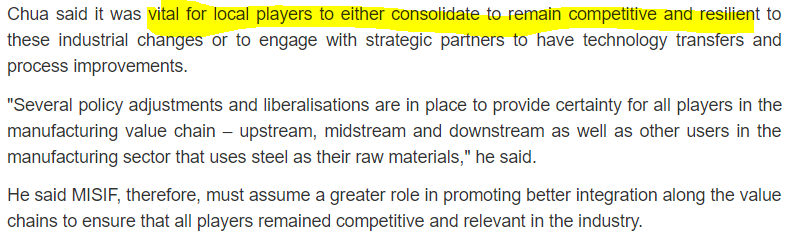

Malaysia government also started to urge industry to consider consolidation. Let see the recent news as below:

http://www.thesundaily.my/news/2017/10/26/malaysias-iron-steel-industry-urged-innovate-plan-future

Malaysia Rebar Industry Outlook

First, let us revisit Malaysia rebar price in Nov according to MITI data as below:

Source: MITI_Weekly_Bulletin (Oct and Nov)

Let us also check the international scrap iron (Lionind and Masteel raw materials) from the MITI data as below:

Source: MITI_Weekly_Bulletin (Oct and Nov)

Let us revisit the China rebar price which normally may affect our local rebar price as below:

Source: http://www.sunsirs.com

Let me just summarize what are the positive factors that can drive the rebar industry as below:

1. Raw material (International scrap iron) price dropping from USD380 to USD310.

2. RMUSD rate appreciation (4.14 now) in Nov which implies that rebar players stand to have lower import cost for their raw materials and possible to have some forex gain.

3. Local rebar price stabilize at RM2450 per ton

4. China rebar price is on uptrend and recent price has been gone up to RMB4100++. High china rebar price will make local rebar price maintain at RM2400++ or above and provide some export opportunities.

5.Specifically, Lionind which possesses the largest production capacity in Malaysia has restarted its Antara plant stand to benefit from lower material cost and stable rebar average selling price.

Let me have a SWOT analysis on lionind as below:

SWOT analysis (S-strengths, W-weaknesses, O-opportunities, and T-threats)

Summary

1. Lionind’s associate company (Parkson) operation still in loss making as per reported in the latest Parkson Retails Asia and Parkson China. There will be share of loss from Parkson but based on my calculation is loss is about RM8 mil+ which may not affect much of its profitable rebar business. In fact, the loss maybe offset by one-off disposal gain from Suzuki Motorcycle business.

2. My estimation of Linind coming quarter earnings of EPS of 7-8 sen is still likely to happen even in the event of Parkson’s loss.

3. Lionind has restarted its Antara plant stand to benefit from lower material cost and stable rebar average selling price. It also plant to restart its Banting plant which may further increase its production to reap higher profit in current market.

4. There is a possibility of reversal of impairment in coming 1 or 2 quarter in view of Lionind has restarted is Antara and plan to restart its Banting plant (which impaired in previous financial years)

5. RM to USD rate shows appreciation (4.14 now) in Nov which can help Lionind to lower down their raw material import price and has some forex gain (some of its loan is in USD).

6. High steel (rebar) price in China should be sustainable due to their government order to cut their production by half in winter season (4 months). The high china rebar price may help local rebar price and provide export opportunity for Lionind and other 3 rebar players to South East Asia countries.

If you interested on my analysis report, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

http://klse.i3investor.com/blogs/lionind/138897.jsp

Source: Annual report 2017

Overall, the Lionind group posted a profit before tax of 107.4 mil against a loss of 852.5 mil a year ago which included impairment losses on receivables of RM607.0 million and property, plant and equipment of RM193.1 million. The key here is significant reduction of impairment in FY2017 vs 2016. Let us see the group whole year cash flow statement as below:

Source: Annual report 2017

From the figure above, the effect of share of losses from associate companies (Parkson etc) is reducing from RM35.9 mil to RM9.2 mil from 2016 to 2017. In fact, these are on-paper losses where they were added back as positive cash flow in the cash flow statement.

In short, with minimum (or zero) future impairment and good rebar average selling price in Q4, Lionind may improve its FY2018 earning (estimated profit of RM160mil to RM180 mil or EPS of 26 sen for forward 12 months).

For Lionind future 1 year prospect, let see the following statement from latest Lionind 2017 annual report as below:

Source: Annual report 2017

The FY2017 profit of RM76 mil from long steel products business is just contributed by only one plant in Bukit Raya. The good news is its Johor plant (ANTARA) has resumed operation in Sept 2017 and Banting plant maybe resume operation in Nov. This information signified Lionind future profit will be contributed by 2 plants (if include Banting will be 3 plants).

As some of you may aware, there was big impairment in FY2016 on property, plant and equipment (PPE) from the closure of Johor Antara and Banting plants. Due to Antara plant already reopened in Sept, I expect there might be some reversal of impairment in coming quarter result. If there is really some reversal of impairment, the on-paper accounting profit (non-cash) of Lionind will be improved.

A lot of you may only aware Lionind owns a loss making Parkson associate company. Actually many of you may not notice that Lionind also got a profit making subsidiary listed company (Lionind holding 74% shares) called Lion Forest Industries Berhad. Lion Forest Berhad (Lionfib) operates in four segments: building materials and steel products, petroleum, lubricants and automotive products (tire and others). Others business of Lionfib include investment holding, provision of transportation services, sale and distribution of motor vehicles. Let see the fundamental data of Lionfib as below:

Source: http://www.malaysiastock.biz (Lionfib just released result on 21 Nov)

Again, the losses in 2016 in Lionfib are mainly due to impairment of receivables from Megasteel and Lion DRI. From FY16’s annual report, the amount due from Megasteel has been fully impaired (RM382mil). Lionfib has reported profitable results in 2017 and Q1’2018 in the absent of impairment.

Lionfib is a net cash company with cash in hand of RM99.6 mil with total borrowings of RM23.4 mil. Currently Lionfib is in net cash position of 76.1 mil which is equivalent to 33 sen per share. FYI, Lionfib currently trading at 78 sen.

What is the catalyst of the coming quarter for Lionfib? Lionfib’s whollyowned subsidiary company, Lion AMB has completed sales of its entire 20% equity interest in Suzuki Motorcycle Malaysia Sdn Bhd for a cash consideration of RM17.3 million. The Disposal was completed on 14 September 2017. Lionfib may record a one-off gain (RM10.3 mil) from this disposal which may benefit Lionind which controlling 74% of shares of Lionfib. Let see the Lionfib latest Q1’18 report as below:

Source: Lionfib Q1’18 report

Lionind will share this disposal gain (under exceptional item) of about RM7.6 mil (74% share). Actually, Lionind got 8 associated companies including Lion Insurance Company Limited, Angkasa Amsteel Pte Ltd, Lion Asiapac Limited, Renor Pte Ltd, Lion Titco Resources Sdn Bhd, Lion Corporation Berhad and Lion Asiapac Limited which need to added up all their profit or loss.

Other than this one-off gain, the cash flow of Lionfib maybe can further improve due to there is big amount of receivable owning by holding company Lionind (not profitable and net cash) as below:

Source: Lionfib Q1’18 report

Remember Lionind cash flow and future profitability improving a lot in 2017. As a result, there is a possibility Lionind may reduce its debt owes to Lionfib in 2018.

Lionind Key Financial Ratio

Before we go to the key financial data of Lionind, I wish to show you the total treasury shares of Lionind as below:

Source: Annual report 2017

Lionind held 37.1 mil treasury shares which purchased at an average price of 35.5 sen (from 13.19/37.1). Remember current price of Lionind is RM1.43 which indicates that the treasury share has an on paper profit of RM1.2 per share which can translate to RM45.2 mil. If Lionind short of cash, it can release some of its treasury share to open market (market value of the treasury share is RM57.8 mil).

What are the treasury shares?

Treasury shares are kept in the company's treasury and are not out in the open market.

What are the advantages and disadvantages of treasury shares for both the company and for the investors in the company?

Advantage

1.Improves Shareholder Value

One of the benefits of owning treasury stock is that the company can

improve the shareholder value. When a company buys back stock it does

not necessarily change the value of the company, but it does change the

number of outstanding shares. For example, when calculating EPS or PE,

the profit will be divided by a smaller total outstanding number of shares (mean EPS or PE will be higher due to EPS and PE calculations exclude treasury shares)

2.Shareholder Perception

When a company engages in a stock buyback to increase treasury stock,

this give a signal to other investors that the company views the share

price at that time is undervalue. In addition, another signal to

investor of share buy back is the company has excess cash.Disadvantage

1.Tie Up Cash

The disadvantage of treasury share is it will tie up your company's

cash. If your company hold onto too many treasury shares, you cannot

access the money that have tied up in treasury shares.Let see some key financial data of Lionind as table below:

|

|

Lionind (12-month up to June 17 result) |

Lionind(upcoming Q1’18 result) |

|

Revenue |

2667M |

? |

|

PE |

9.75 |

? expect to improve below 6.5 |

|

EPS |

14.67sen |

? expect to improve to 23 sen |

|

ROE |

5.8% |

? expect to improve |

|

Net profit margin (%) |

3.94 |

? expect to improve |

|

Cash & Equivalents |

337.9M |

? |

|

Total debt |

169.9M |

? |

|

Net Cash |

168M |

? expect to improve |

|

ROIC |

5.14% |

? expect to improve |

|

Debt to equity ratio |

0.09 |

? |

|

Price/Free Cash Flow |

4.79 |

? expect to improve |

Effect on Lionind for Parkson Coming Quarter Result

As some of you may aware, Parkson Retail Asia reported a loss of Singapore dollars 12.9 mil on 14 Nov 2017. FYI, Parkson Malaysia is a holding company which its subsidiary East Crest International, holds 68% of Parkson Retail Asia.

Meanwhile, Parkson China (s listed co in HK as the name of Parkson Retail Group Limited) reported a loss of RMB22.6 mil on 15 Nov. Parkson Holding berhad holding 55% share of Parkson Retails Group Limited.

Estimated Total Parkson loss (Asia+China) = 40mil X 0.68 + 13.85mil X 0.55 = RM35 mil

(RM40mil is converted from Sing Dollar 12.9mil, RM13.85mil is converted from RMB22mil)

Due to Lionind directly and indirectly hold Parkson of 23.2%, the sharing of Parkson loss for Lionind is as below:

Estimated Share of Loss = RM35mil X 0.232 = RM8.12 mil

Anyway, there will be one-off disposal gain from its subsidiary company (Lionfib) for its Suzuki motorcycle business which can offset part of the losses of Parkson (one-off gain of RM7.6 mil for Lionind 74% of shares).

My estimation for Lionind coming quarter profit around RM60 mil in part Lionind part 1 article before consideration of Parkson’s loss. Conservatively (assume no major impairment from associate companies), I expect Lionind should reported RM54 to RM60 mil profit in coming Nov result. This is just partial contribution from its ANTARA plant from Sept 2017. The profit of Lionind in Q2’18 (Oct-Dec) may have higher visibility in view of full contribution of Antara’s plant and also partial contribution of Banting plant.

Asia Steel Outlook

The online data show that China dominates the global steel market producing and consuming roughly 50% of all steel globally. Currently, there is limited incentive for increasing the upstream capacity in steel in china. In fact, China actively reducing its capacity under its “supply-side reform” program. This program mainly aims to cut China steel producers production capacity by half in winter season. Let see one of the news reported this production cut as below:

https://www.ft.com/content/df5b1478-a1df-11e7-9e4f-7f5e6a7c98a2

Consolidation in steel industries is a theme both in Europe and China to strengthen their competitiveness. In Europe, I can notice that the announced plans by ArcelorMittal to merge with ILVA, and Thyssenkrupp to merge with Tata. In China, I can notice the merger of Baosteel and Wuhan Iron and Steel.

In short, the steel industry consolidation in China and Uerope will result in the reduciton of steel supply.

Malaysia government also started to urge industry to consider consolidation. Let see the recent news as below:

http://www.thesundaily.my/news/2017/10/26/malaysias-iron-steel-industry-urged-innovate-plan-future

Malaysia Rebar Industry Outlook

First, let us revisit Malaysia rebar price in Nov according to MITI data as below:

Source: MITI_Weekly_Bulletin (Oct and Nov)

Let us also check the international scrap iron (Lionind and Masteel raw materials) from the MITI data as below:

Source: MITI_Weekly_Bulletin (Oct and Nov)

Let us revisit the China rebar price which normally may affect our local rebar price as below:

Source: http://www.sunsirs.com

Let me just summarize what are the positive factors that can drive the rebar industry as below:

1. Raw material (International scrap iron) price dropping from USD380 to USD310.

2. RMUSD rate appreciation (4.14 now) in Nov which implies that rebar players stand to have lower import cost for their raw materials and possible to have some forex gain.

3. Local rebar price stabilize at RM2450 per ton

4. China rebar price is on uptrend and recent price has been gone up to RMB4100++. High china rebar price will make local rebar price maintain at RM2400++ or above and provide some export opportunities.

5.Specifically, Lionind which possesses the largest production capacity in Malaysia has restarted its Antara plant stand to benefit from lower material cost and stable rebar average selling price.

Let me have a SWOT analysis on lionind as below:

SWOT analysis (S-strengths, W-weaknesses, O-opportunities, and T-threats)

|

Strengths |

Weaknesses |

|

1.Largest production capacity, utilization rate still low

2.Lowest PE among top 4 rebar players

3.Net Cash company

4.Good cash flow generation

5.No dilution from warrant or loan stock.

6.Lower transportation cost due to its factories are strategically located in central and southern areas

|

1.Loss from Parkson

2.High payables

3.No dividend since 2014

|

|

Opportunities |

Threats |

|

1.Malaysia rebar safeguard tax for 3 years to reduce import from China

2.High Rebar price from July to Nov 2017.

3.China production cut in winter season

4.A lot of infrastructure projects running in 2017 and 2018 which provide demands for rebar.

|

1.High Graphite Electrode price

2.High scrap metal price

3.Higher transportation cost due to higher fuel price in recent two months

4.Slow down in property which may reduce rebar consumption

|

1. Lionind’s associate company (Parkson) operation still in loss making as per reported in the latest Parkson Retails Asia and Parkson China. There will be share of loss from Parkson but based on my calculation is loss is about RM8 mil+ which may not affect much of its profitable rebar business. In fact, the loss maybe offset by one-off disposal gain from Suzuki Motorcycle business.

2. My estimation of Linind coming quarter earnings of EPS of 7-8 sen is still likely to happen even in the event of Parkson’s loss.

3. Lionind has restarted its Antara plant stand to benefit from lower material cost and stable rebar average selling price. It also plant to restart its Banting plant which may further increase its production to reap higher profit in current market.

4. There is a possibility of reversal of impairment in coming 1 or 2 quarter in view of Lionind has restarted is Antara and plan to restart its Banting plant (which impaired in previous financial years)

5. RM to USD rate shows appreciation (4.14 now) in Nov which can help Lionind to lower down their raw material import price and has some forex gain (some of its loan is in USD).

6. High steel (rebar) price in China should be sustainable due to their government order to cut their production by half in winter season (4 months). The high china rebar price may help local rebar price and provide export opportunity for Lionind and other 3 rebar players to South East Asia countries.

If you interested on my analysis report, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

http://klse.i3investor.com/blogs/lionind/138897.jsp