I like to look for companies with great potential. Looking for great potential company is not difficult, but the willingness to grow with them is the challenge.

I come accross MMAG when a good friend of mine signal to me.

Brief History:

- MMAG Holdings Berhad (Formerly known as Ingenuity Consolidated Berhad) is a "Total Business ICT Solutions Provider".

- http://www.thesundaily.my/news/1076991

Nothing to shout about except bloodshed in year 2012 when share price collapsed. Further more, ICT biz operate under extremely thin margin environment (look at ECS income statement) and short product life span. I will avoid company operate under such difficult condition.

The Turning Point:

In year 2015, a RTO took place and we see WONG ENG SU, the former Chief Operating Officer of Gdex, together with Jeff Chong, Maxis’ former vice-president of Mobility Products and International Service emerged as substantial shareholders, bought over the share held by former owner, Chin Boon Long & wife Tan Swee Ying. The later has since resigned.

Read more at http://www.thestar.com.my/business/business-news/2015/04/04/ingenco-stirs-interest-on-entry-of-new-shareholder/#JPkpHuSV6wT26RKV.99Chong

The company name has been change to MMAG and a series of restructuring took place which both Wong & Jeff Chong wishing to turn around the company from a pure ICT focus company to

(1) Last mile delivery, logistic and ware housing specialist

(2) Mobile distributing and Leasing service provider

It is not difficult to guess since Wong Eng Su has 15 years of experience in GDEX while Jeff Chong has more than 15 year experience in telecommunication industry under Maxis and Digi.

http://www.focusmalaysia.my/Mainstream/mmag-grows-logistics-business

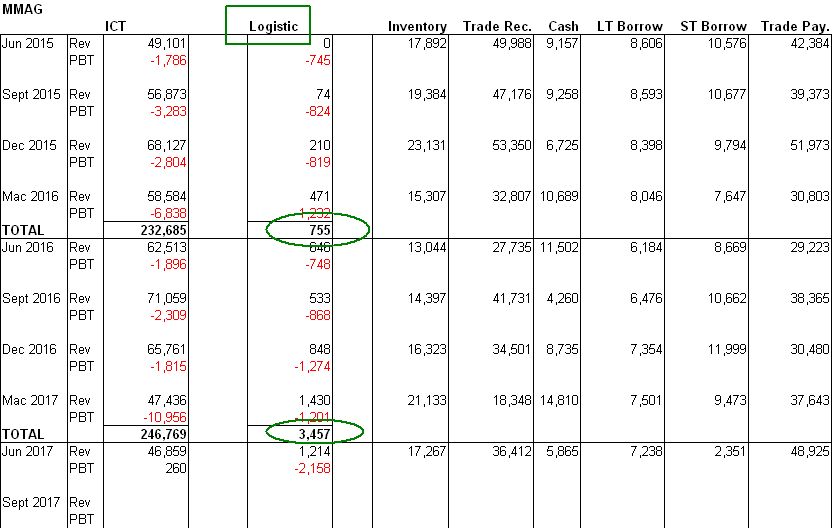

Some Financial Data:

Key Observation:

1) ICT segment

- continue bleeding.

- the restructuring still going on under this segment by Jeff Chong

2) Courier Service Segment

- this segment was introduced in Sept 2015 when Wong Eng Su took over MMAG. Total FY 2015 revenue was RM 755k. It has since then grow nearly 400% in a year to RM 3.457 million in just 1 year.

- the segment is not in profit yet and i suppose this is quite common for every new venture during initial stages.

What to shout about?

(1) MMAG has just done a cash call via Rights Isssue with free warrant + ICPS. Let see below how much cash they will raise and what are the plan they have? (Maximum Scenario)

| Cash in company | 10,197,805 | ||||||

| Maximun fund to raise from Rights @0.25 | 36,958,539 | ||||||

| Maximun fund to raise from ICPS @0.15 | 30,366,831 | ||||||

| TOTAL | 77,523,175 | ||||||

| no. of shares | 455,502,463 | 0.1702 | cash per share | ||||

The total share upon completion of the cash call will increased MMAG cash level from RM 10.2 mil (include the special bumiputra issue ) to RM 77.5 mil. This is equivalent to RM 0.17 per share, not include MMAG-WA & MMAG-PA which will matured in 5 year.

This is huge sum of money for business expansion program.

(2) The Business Expansion Plan

LOGISTIC & COURIER Segment - Allocation RM 40.4 million

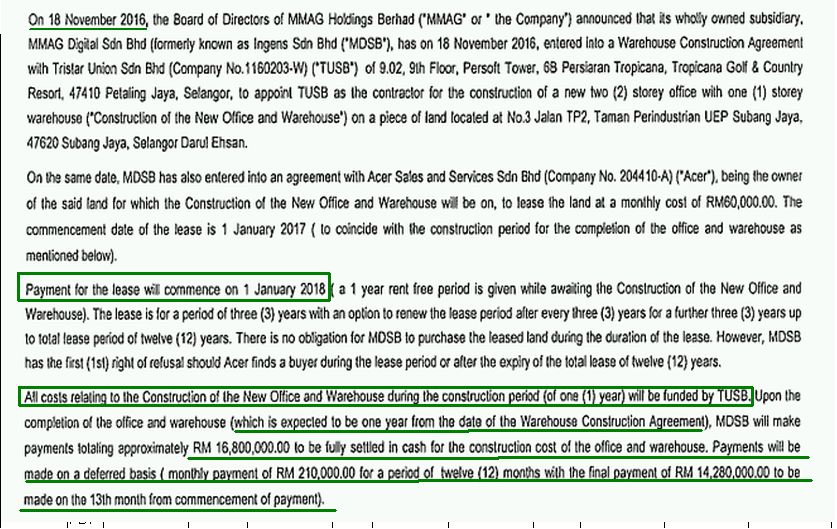

MMAG has wonderfully planned the expansion course. What happened is that the expansion plan has actually started back in November 2016. Therefore, the favourble operating result should be seen in upcoming several months.

- A 131,132 sf warehouse cum office has been built on a piece of land leased from Acer which is expected to be completed in Nov 2017 (this month).

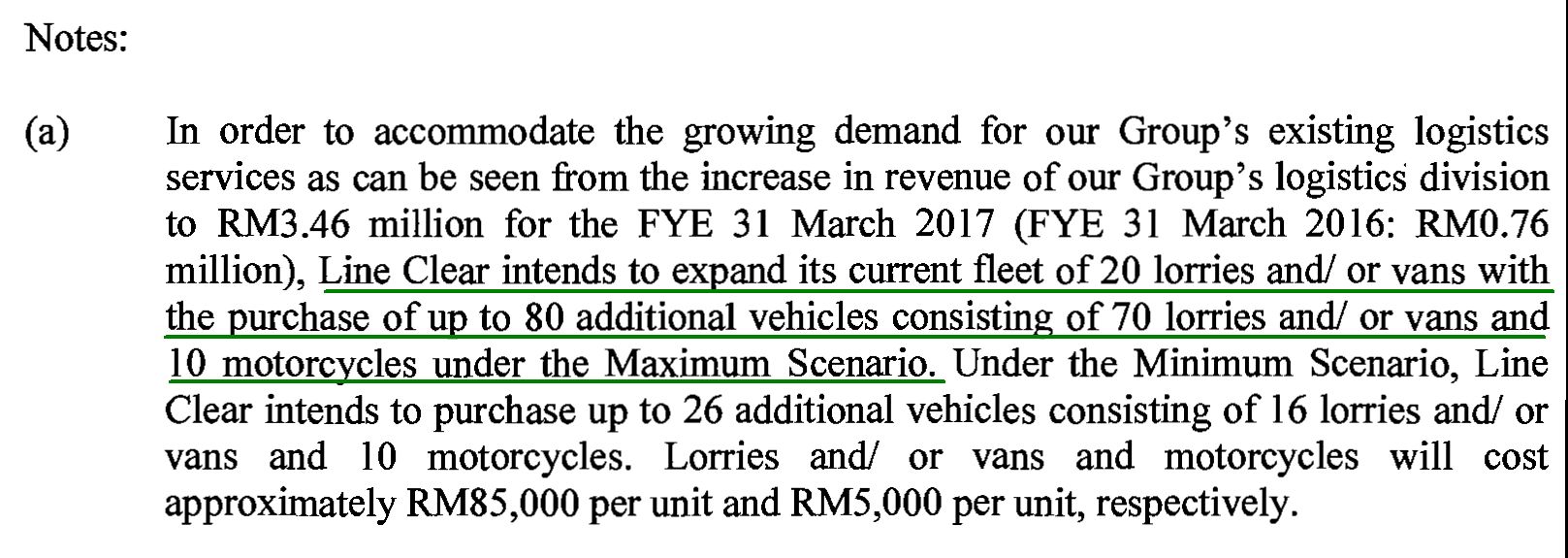

- the second part is to expand the courier fleet from 20 fleets to 100 fleets with 15 more new branches nation wide.

- However, based on interviewed done by Focus Malaysia dated 14 - 20 Oct 2017 issue, the company has already grew the fleet from 20 to 70 fleet and staff force has grew from 30 to 220 staffs now.

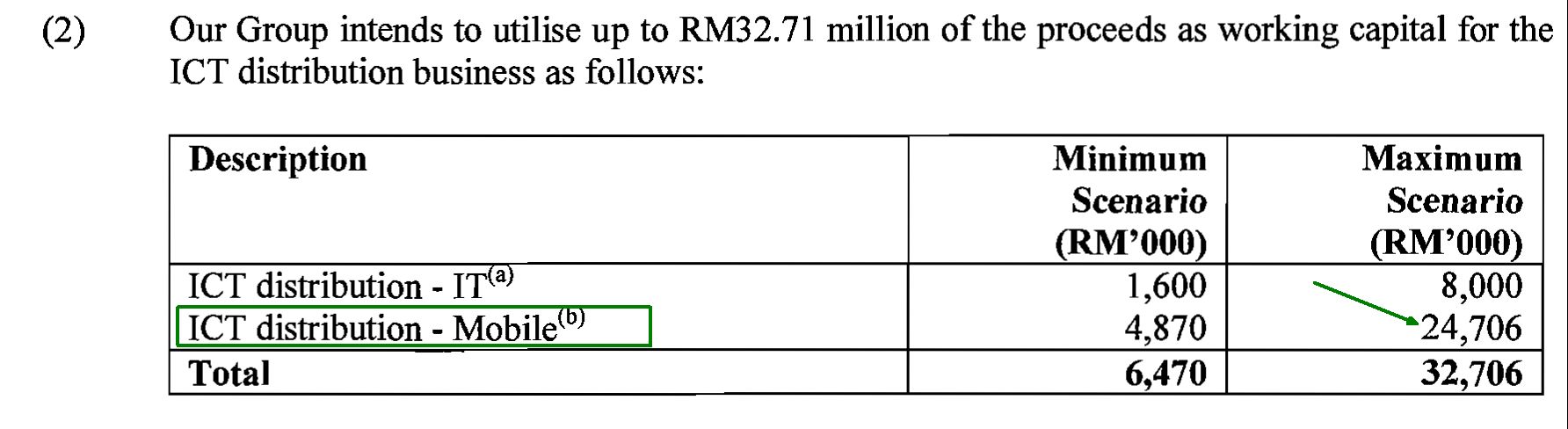

ICT & Mobile Phone segment - Allocation RM 32.7 mil

MMAG has plan to be key distributor for mobile phones in Malaysia while maintaining the normal pc/ labtop distributor.

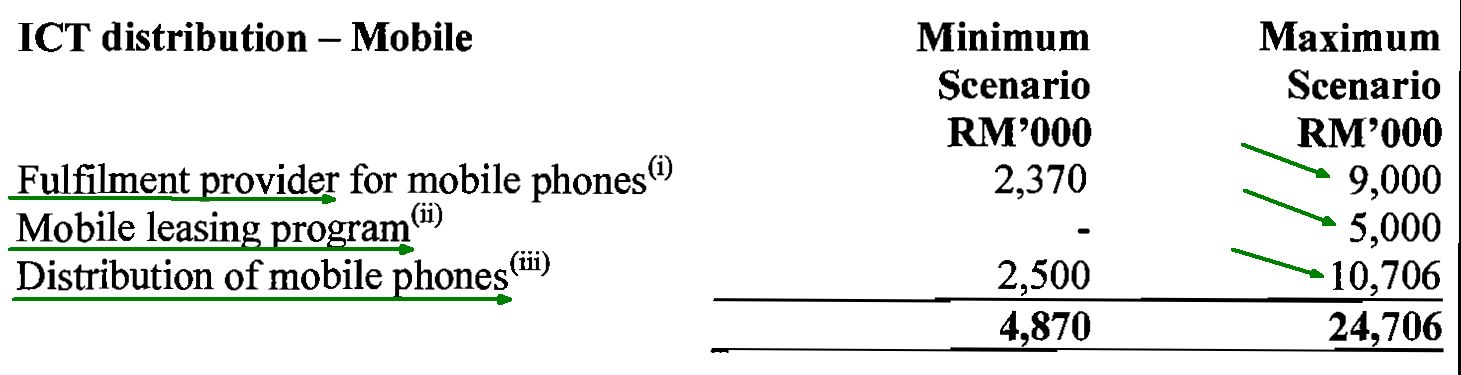

Below Key breakdown on the ICT distribution- Mobile

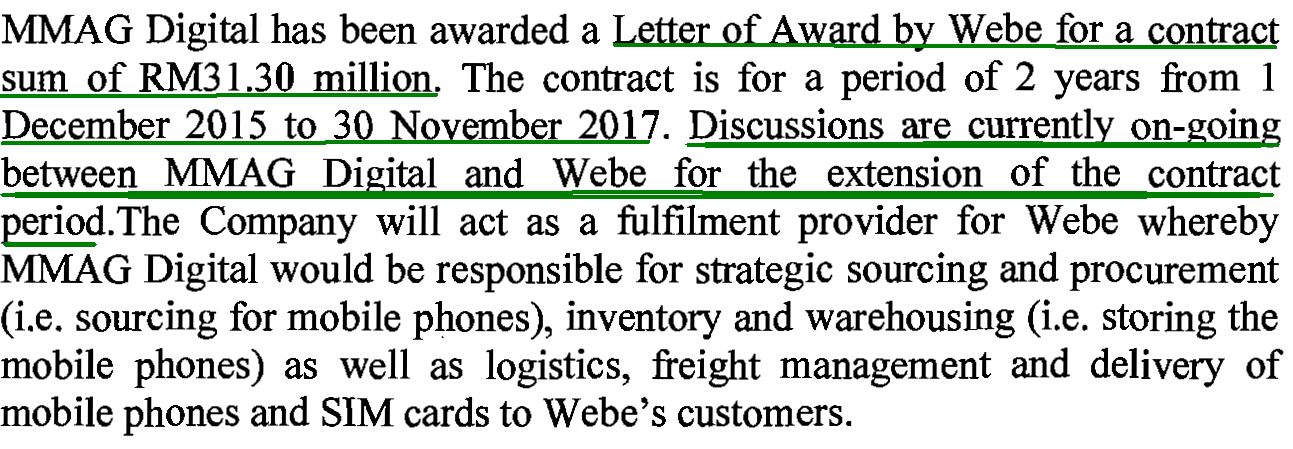

(a) Fulfilment-

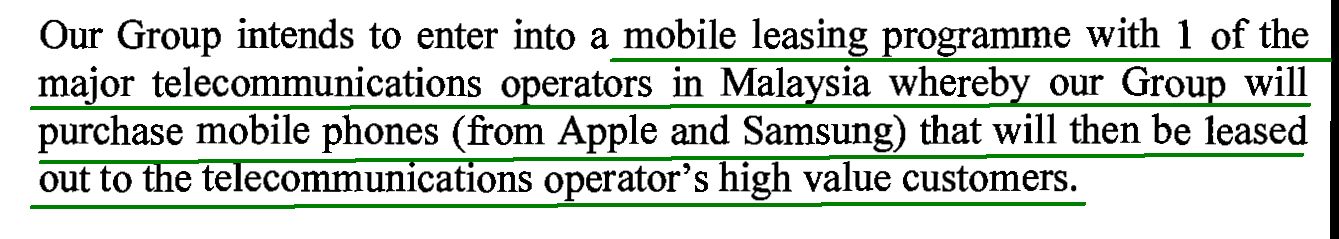

(b) Mobile Leasing- based on article in Focus Malaysia , the telecommunication company is Digi

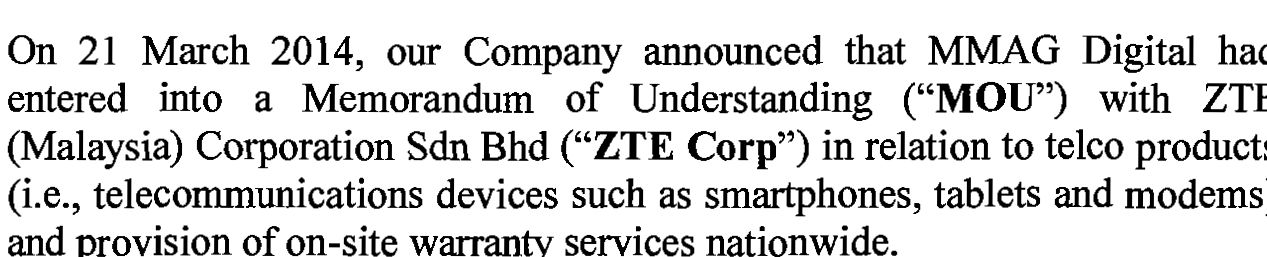

(c) Distributiing Mobiles Phone-

About Recent Development on Cash call and shareholding:

| Tan Swee Ying | 57,338,100 | 18.88% | ||||||

| Marina Teguh | 45,140,790 | 14.87% | Marina Teguh RTO price | |||||

| Innofarm | ?? | @24 sen | 45,140,781 | |||||

| Landasan debt settlement | ||||||||

| Sold to | <-------------- td=""> | Sold to | <-------------- td=""> | @22 sen | 36,363,330 | |||

| Tan Swee Ying | Innofarm | |||||||

| 57,338,100 | 39,612,000 | |||||||

| @ 27 sen | @20.5 sen | Special bumiputra issues | ||||||

| @20 sen | 28,855,000 | |||||||

I' m not very sure if above figures are correct. It is very interesting to see above where,

(1) Wong Eng Su & Jeff Chong RTO price is @ RM 0.24.

(2) Innofarm has disposed all the stakes to Tan Swee Ying and she is now the largest shareholder of MMAG.

Question is the disposal by Innofarm to Tan Swee Ying was transacted on 31 Oct 2017 which is 1 day before the Rights Issue Ex-Date (1 Nov 2017).

My best guess of why Innofarm doing so since the rights issue with free warrant seem to be a sure win bet based on my calculation:

39,612,000 shares will entitled for

(1) 19,806,000 Rights Issue x RM 0.25 = RM 4.95 mil (1 rights share for every 2 mother share)

(2) 29,709,000 free warrant with exercise price RM 0.20 = RM 0 (free and 2 rights share get 3 free warrant)

The ex-date mother share price was RM 0.23. Therefore, the theoretical warrant price listed should be at least RM 0.03 with no premium or RM 0.09 with 25% premium

If the above 29,709,000 warrant can be sold at RM 0.06 per warrant and resulted in RM 1.78 million.

Therefore, the cost for the rights converted mother share should therefore at RM 0.16 per share, a substantially lower (approximately 43%) than current market traded price of RM 0.23. What if the warrant is trading at 10 sen, 20 sen or 30 sen?

Because of this, Innofarm disposed all mother shares to Tan Swee Ying?

Will Innofarm subsequently buy MMAG-OR and convert them into mother share?

Lay hong is currently expanding same day delivery service for its product and courier service partner is a must. That is my initial thought of why innofarm buying into MMAG.

Noted also during 5 days OR trading, the mother share was traded at around 23 sen, but the OR can trade to as high as 5 sen, which mean 5 sen + 25 sen exercise price = 29 sen or 26% premium

This raise another question, if above guess is true, why is Tan Swee Ying willing to buy the stake at RM 0.27 per share?

姜还是老的辣?

Summary:

1) I like MMAG because it is turn around and the balance sheet is not too bad. Plus massive cash in flow from cash call.

2) MMAG is now an courier & logistic focus player

3) MMAG ICT department will go through business reconceptual and i hope it will do well.

MMAG is a very similar play like Frontken (focusing on Semiconductor related).

As for when we can start seeing profit flow into the company, I don't know either. As usual, I hope for the best.

Can i wait? Can you wait? Tough question to answer.

Cheers!

YiStock

http://klse.i3investor.com/blogs/MMAG/138040.jsp