The company is involved in the power generation and environment business. In the environment business, it provides water supply services, operate water and wastewater treatment plants primarily in Malaysia. The Company also have operations in Asia market such as China and Thailand. We have researched on this company and here are 3 key points to take note about Ranhill Berhad before you invest in it.

#1: Sustainable Core Business

Figure 1: Ranhill's Business Segment

Ranhill’s main source of income is derived from its environment

business segment which contributes approximately 78% of the total

revenue. Under this segment, the Company through its subsidiary,

Syarikat Air Johor Holdings (SAJH), held the exclusive license to supply

treated water to entire state of Johor. This puts the Company in a

monopoly position.While its power division is one of the largest Independent Power Producer (IPPs) in Sabah which contributes approximately 22% of the Company’s total revenue. It owns two 190 MW power plants in the state which accounts for 37.4% of the state’s total licensed capacity.

Figure 2: Revenue and Profit Segment

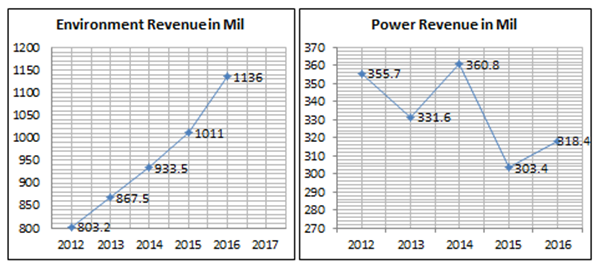

Figure 3: Financial Highlights of Environment and Power Segment

In Figure 3, the revenue for Environment segment has been growing at

CAGR of 9% over the past 5 years since year 2012. The increase in

revenue is due to higher volume of water consumption arising from larger

customer base, resulting from new development of housing and industrial

areas in Johor. The income generated is recurring in nature but

investor should also look into the moats and business risk.2. What are the Moats?

(i) Stable cash flow from water and power business generated from its concession assets, i.e IPP in Sabah and license to supply water in Johor are Ranhill’s crown jewel. In Sabah, the group’s two power plant have Power Purchase Agreement (PPA) with Sabah Electricity Sdn Bhd to sell electricity over 21 years period which will end in 2029. Hence, the two power plant will continue to sell electricity for another 12 years before the agreement ends.

On the other hand, the group operates under an asset light model in Johor where water assets are owned by Pengurusan Aset Air Berhad (PAAB) and Ranhill is licensed to supply treated water. This exclusive rights to supply treated water to consumer is renewable every three years and has renewed by Suruhanjaya Perkhidmatan Air Negara (SPAN) for three periods. KPI set by SPAN has to be met and it is highly regulated.

Figure 4: KPI set by SPAN

(ii) Exclusive water operator in Johor where the

supply of treated water to consumer covers Johor’s most dense area such

as Muar, Johor Bahru and Kota Tinggi. Out of 3 million population in

Johor, Ranhill is currently supplying treated water to 1 million

population in Johor (about 33% market share).

(i) Heavily reliant on Johor State to renew contract and licenses which is not conducive for Ranhill’s business model. Since the rights to supply treated water to consumer in Johor needs to be renewed every three years, there’s a risk that the state will refuse to grant renewal rights. This will severely impact Ranhill’s revenue as their main earnings contribution comes from water treatment segment.

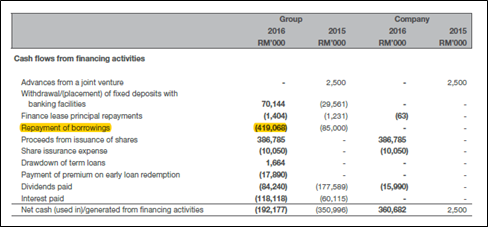

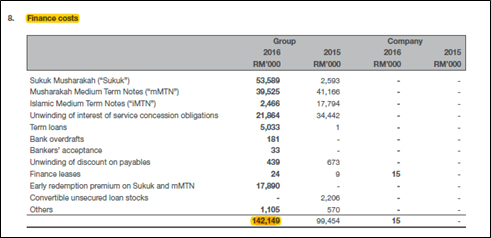

(ii) High gearing at extreme high borrowings post question on its sustainability. Gearing is the measurement of a company being able to service their debt in a given year. In FY2016, Ranhill’s Operating Cash Flow stood at RM150.2 million while its Finance Cost stands at RM142.1 million. This gives a debt servicing ratio of 94% despite the management has pared down its borrowing in the year 2016.

Figure 5: Cashflow Statement and Finance Cost Notes

My INSIGHTS

No doubt Ranhill’s business model is recurring in nature which is what value investor is looking for, but the business risk must be thoroughly investigated and understood. In my opinion, the business risk is high due to its significant borrowings. In addition, the exclusive rights for Ranhill to supply treated water in Johor will affect Ranhill’s income if the renewal fails after the 3 years. Even though SPAN has renewed Ranhill’s license for three periods, we must not assume it will be renew for another 3 years. There is still an element of uncertainty here. This is a classic example of a company where its income is recurring and monopoly in nature but lurking with major business risks.

You may find other articles here (http://www.stocksinsights.com/)

http://klse.i3investor.com/blogs/IntelligentContrarians/137872.jsp