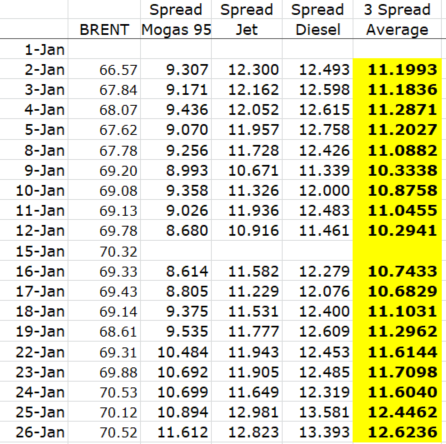

Past 26 days of Crack Spread data (CME website)

As we know the profit margin of Hengyuan is highly dependent on crack spread data. Mogas 95 and diesel are two major products of Hengyuan (about 80%). Based on Malaysia petrol price movement, we need to start to use Feb future contract data from CME as rollover was started from around 23 Jan (almost no price change on CME Jan contract data after 23 Jan).

Let us have a look on the average spread data in Jan 2018 (extracted from CME website).

Source: CME webste (Jan and Feb data for the 3 products Mogas 95, diesel & Jet fuel)

Refined products supply in coming 3-6 months maybe limited due to the start of maintenance season of some refineries around the world.

https://oilprice.com/Energy/Oil-Prices/Oil-Prices-Ease-As-Refinery-Maintenance-Season-Draws-Near.html

Another news for Hengyuan is it has secured financing facilities totaling RM1.7 billion to refinance its existing term loan and also to partially finance its planned capital expenditure.

https://www.thestar.com.my/business/business-news/2018/01/23/hengyuan-gets-rm1pt7b-financing-from-ambank-ccb-maybank/

I will give you an analysis later on for this finance facilities in my complete report.

Summary:

1. Mogas 95 daily spread shows strong recovery in past 5 days and now its spread has reached USD11.612 (Feb Contract due to rollover)

2. Diesel spread is at 52-weeks high at USD13.393 (CME price for Diesel is USD83.91)

3. Average crack spread data in the past 26 days of Jan for Mogas 95, diesel, jet fuel is about USD11.24. This margin is still a very lucrative margin for Hengyuan.

4. Future data (March, April) for Mogas 95 and Diesel still at high level which indicate that the estimated future profit margin (spread) for refiners is still strong enough.

5. Malaysia Petrol and diesel price may increase on next Wednesday (31 Jan) unless RM to USD rate keeps increasing which may compensate some of the hike in the Mogas and diesel price. Based on the RM rate on 26 Jan, I think the increment of RM is not sufficient to compensate the price increment in Mogas and diesel.

6. My complete HY part 9 report maybe available in 1-2 weeks time.

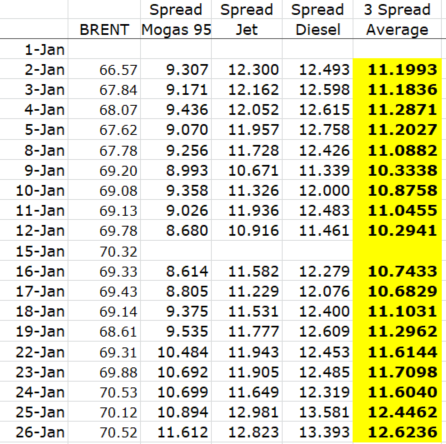

As we know the profit margin of Hengyuan is highly dependent on crack spread data. Mogas 95 and diesel are two major products of Hengyuan (about 80%). Based on Malaysia petrol price movement, we need to start to use Feb future contract data from CME as rollover was started from around 23 Jan (almost no price change on CME Jan contract data after 23 Jan).

Let us have a look on the average spread data in Jan 2018 (extracted from CME website).

Source: CME webste (Jan and Feb data for the 3 products Mogas 95, diesel & Jet fuel)

Refined products supply in coming 3-6 months maybe limited due to the start of maintenance season of some refineries around the world.

https://oilprice.com/Energy/Oil-Prices/Oil-Prices-Ease-As-Refinery-Maintenance-Season-Draws-Near.html

Another news for Hengyuan is it has secured financing facilities totaling RM1.7 billion to refinance its existing term loan and also to partially finance its planned capital expenditure.

https://www.thestar.com.my/business/business-news/2018/01/23/hengyuan-gets-rm1pt7b-financing-from-ambank-ccb-maybank/

I will give you an analysis later on for this finance facilities in my complete report.

Summary:

1. Mogas 95 daily spread shows strong recovery in past 5 days and now its spread has reached USD11.612 (Feb Contract due to rollover)

2. Diesel spread is at 52-weeks high at USD13.393 (CME price for Diesel is USD83.91)

3. Average crack spread data in the past 26 days of Jan for Mogas 95, diesel, jet fuel is about USD11.24. This margin is still a very lucrative margin for Hengyuan.

4. Future data (March, April) for Mogas 95 and Diesel still at high level which indicate that the estimated future profit margin (spread) for refiners is still strong enough.

5. Malaysia Petrol and diesel price may increase on next Wednesday (31 Jan) unless RM to USD rate keeps increasing which may compensate some of the hike in the Mogas and diesel price. Based on the RM rate on 26 Jan, I think the increment of RM is not sufficient to compensate the price increment in Mogas and diesel.

6. My complete HY part 9 report maybe available in 1-2 weeks time.

If you interested on my analysis report, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is

strictly for sharing purpose, not a buy or sell call of the company.

http://klse.i3investor.com/blogs/davidtslim/145706.jsp