1. Kimlun Is Doing Very Well

On

27 February 2018, Kimlun relesed a sterling set of results with net

profit of RM24 mil (EPS of 7.6 sen). There was a provision of RM5.75 mil

for writing off of receivables. If added back, net profit would have

been RM28 mil, or EPS of 8.8 sen.

Kimlun is currently trading at RM2.15. Based on annualised EPS of 35 sen, being 8.8 sen x 4 (you don't have to agree with me on this), the stock is potentially trading at prospective PER of 6.1 times.

Earning visility is good going forward. The group has outstanding order book of RM2 billion (RM1.7 billion construction projects and RM300 mil concrete products). This is sufficient to last for two years.

The group is expected to secure more contracts this year in both Malaysia and Singapore. In Malaysia, High Speed Rail, East Coast Railway, etc are the major projects to be tendered out while Singapore's spending on construction is expected to increase from 2017's SGD25 billion to as high as SGD31 bil in 2018.

2. The Warrants Is What Attracts Me

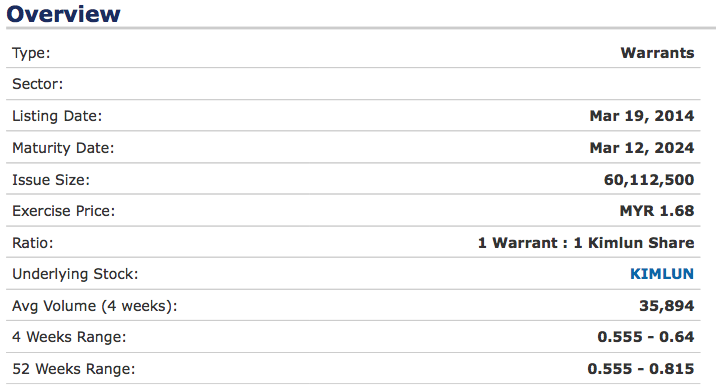

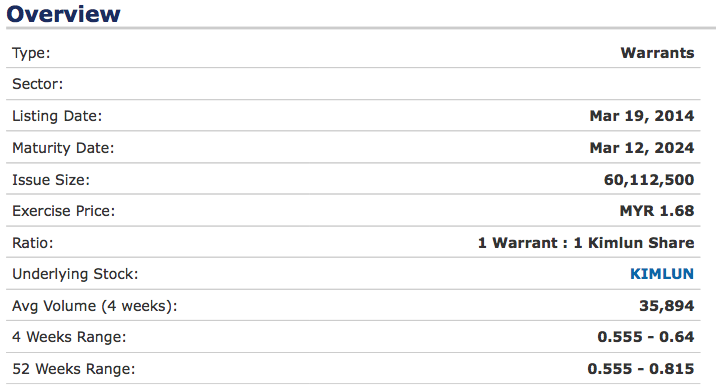

Kimlun-WA will expire in March 2024 (6 more years to go). Its exercise price is RM1.68. Based on latest price of 62 sen, conversion premium is 7% only. Gearing is high at 3.5 times.

To give you a feel of the attractiveness of the Warrants, let's say Kimlun went up by 35 sen (16% gain) to RM2.50 (PER of 7.1 times), Kimlun-WA is likely to go up by the same amount due to its almost zero conversion premium. From 62 sen to 97 sen, the gain will be an amplified 56%.

If Kimlun goes up more, the Warrants will of course gain more. Barring a major market downturn or huge earning disappointment, it is not impossible to generate 100% return over next two years.

With such favorable risk vs. reward, Apa Lagi Lu Mahu ?

Gongxifacai.

(Kimlun share price)

(Kimlun-WA price)

Kimlun is currently trading at RM2.15. Based on annualised EPS of 35 sen, being 8.8 sen x 4 (you don't have to agree with me on this), the stock is potentially trading at prospective PER of 6.1 times.

Earning visility is good going forward. The group has outstanding order book of RM2 billion (RM1.7 billion construction projects and RM300 mil concrete products). This is sufficient to last for two years.

The group is expected to secure more contracts this year in both Malaysia and Singapore. In Malaysia, High Speed Rail, East Coast Railway, etc are the major projects to be tendered out while Singapore's spending on construction is expected to increase from 2017's SGD25 billion to as high as SGD31 bil in 2018.

2. The Warrants Is What Attracts Me

Kimlun-WA will expire in March 2024 (6 more years to go). Its exercise price is RM1.68. Based on latest price of 62 sen, conversion premium is 7% only. Gearing is high at 3.5 times.

To give you a feel of the attractiveness of the Warrants, let's say Kimlun went up by 35 sen (16% gain) to RM2.50 (PER of 7.1 times), Kimlun-WA is likely to go up by the same amount due to its almost zero conversion premium. From 62 sen to 97 sen, the gain will be an amplified 56%.

If Kimlun goes up more, the Warrants will of course gain more. Barring a major market downturn or huge earning disappointment, it is not impossible to generate 100% return over next two years.

With such favorable risk vs. reward, Apa Lagi Lu Mahu ?

Gongxifacai.

(Kimlun share price)

(Kimlun-WA price)

http://klse.i3investor.com/blogs/icon8888/149107.jsp