1. Stock of The Year

In 2016, I nominated Air Asia at RM1.66 as the Sailang Stock.

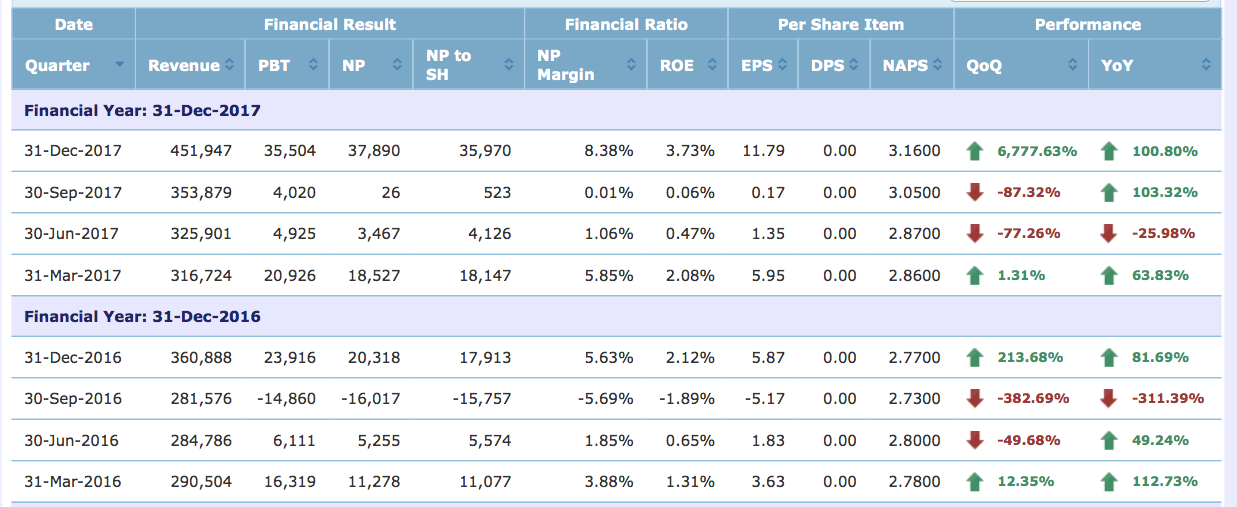

In 2017, I nominated Hengyuan at RM6.90 as the Sailang Stock.

In 2018, I am nominating Muda Holdings at RM2.15 as the Sailang Stock.

2. Massive Expansion of Profit Margin

Muda Holdings is principally involved in manufacturing of carton boxes by using recycled paper as raw material. Its manufacturing plants are mostly located in Malaysia.

Carton boxes manufacturing is not a glamorous business. However, something important happened to the industry recently.

In mid 2017, China announced that it will stop importing foreign wastes for recycling purpose (plastic bottles, old newspaper, etc) because those things can cause massive pollution to its air and rivers. The ban came into full force by end 2017.

Pursuant to the above, China's paper making industry experienced severe shortage in raw material supply. This has caused paper product selling price to skyrocket as manufacturers passed on the cost to consumers.

In this globalised world, whatever happened in the Factory of The World will spill over to other economies. As a result, the selling price of Muda's carton boxes had also gone up, boosting its revenue.

On the other hand, due to China's import ban, developed countries such as Australia, Europe, US and Japan suddenly found that their market for waste products had disappeared overnight. There is currently an oversupply of waste products all over the world. Plastic bottles and old newspaper are piling up in developed countries.

As a result, Muda's raw material cost has also dropped substantially.

To sum up all the above in simple mathematical term :

Increase in Revenue + Decrease in Raw Material Cost = PROFIT MARGIN EXPANSION

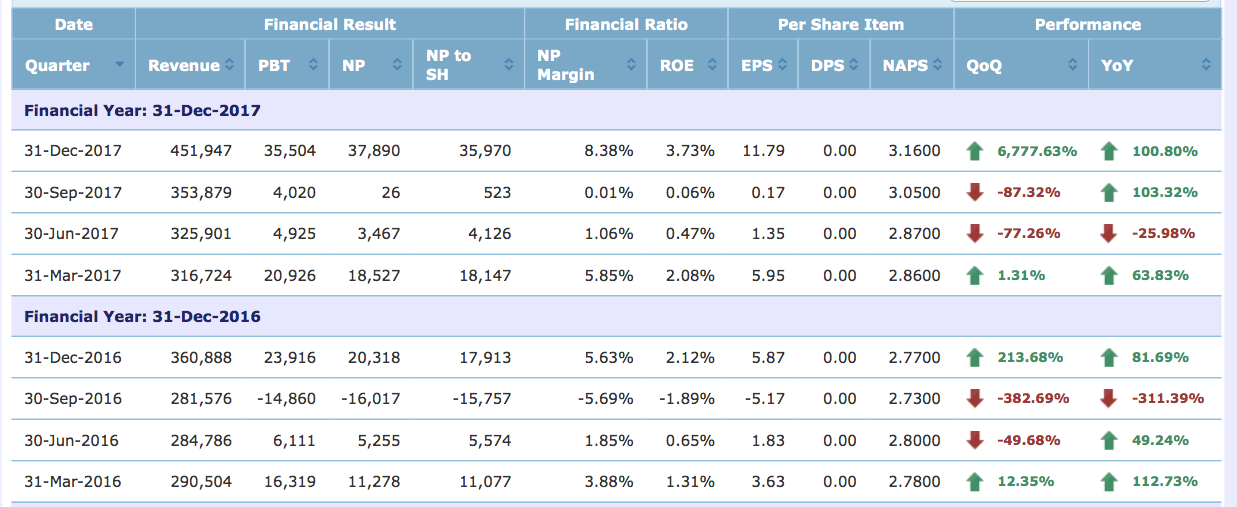

The effect of this positive development in the industry has already started to show up in Muda's December 2017 quarterly result.

Note : Muda's strong profitability in Q4 of FY2017 contains certain exceptional items. Please study its accounts to find out more.

All eyes on coming quarters. Hopefully the company can continue to deliver strong profitability.

3. Concluding Remarks

By nominating Muda as the Sailang Stock for 2018, I am not saying that its share price will very likely skyrocket in the future. All I am saying is that the abovementioned positive developments have made the domestic carton box manufacturing industry relatively defensive in this uncertain time. As a result, the company's earning visibility looked good.

Success in stock market is 50% about skill, 50% about luck. There is no guarantee that we can make money by punting Muda, but this is one stock that I think gives us a decent chance.

For further information, please refer to the following excellent research article by our fellow forum member :-

http://klse.i3investor.com/blogs/david_masteel/151327.jsp

Have a nice day.

http://klse.i3investor.com/blogs/icon8888/154696.jsp

In 2016, I nominated Air Asia at RM1.66 as the Sailang Stock.

In 2017, I nominated Hengyuan at RM6.90 as the Sailang Stock.

In 2018, I am nominating Muda Holdings at RM2.15 as the Sailang Stock.

2. Massive Expansion of Profit Margin

Muda Holdings is principally involved in manufacturing of carton boxes by using recycled paper as raw material. Its manufacturing plants are mostly located in Malaysia.

Carton boxes manufacturing is not a glamorous business. However, something important happened to the industry recently.

In mid 2017, China announced that it will stop importing foreign wastes for recycling purpose (plastic bottles, old newspaper, etc) because those things can cause massive pollution to its air and rivers. The ban came into full force by end 2017.

Pursuant to the above, China's paper making industry experienced severe shortage in raw material supply. This has caused paper product selling price to skyrocket as manufacturers passed on the cost to consumers.

In this globalised world, whatever happened in the Factory of The World will spill over to other economies. As a result, the selling price of Muda's carton boxes had also gone up, boosting its revenue.

On the other hand, due to China's import ban, developed countries such as Australia, Europe, US and Japan suddenly found that their market for waste products had disappeared overnight. There is currently an oversupply of waste products all over the world. Plastic bottles and old newspaper are piling up in developed countries.

As a result, Muda's raw material cost has also dropped substantially.

To sum up all the above in simple mathematical term :

Increase in Revenue + Decrease in Raw Material Cost = PROFIT MARGIN EXPANSION

The effect of this positive development in the industry has already started to show up in Muda's December 2017 quarterly result.

Note : Muda's strong profitability in Q4 of FY2017 contains certain exceptional items. Please study its accounts to find out more.

All eyes on coming quarters. Hopefully the company can continue to deliver strong profitability.

3. Concluding Remarks

By nominating Muda as the Sailang Stock for 2018, I am not saying that its share price will very likely skyrocket in the future. All I am saying is that the abovementioned positive developments have made the domestic carton box manufacturing industry relatively defensive in this uncertain time. As a result, the company's earning visibility looked good.

Success in stock market is 50% about skill, 50% about luck. There is no guarantee that we can make money by punting Muda, but this is one stock that I think gives us a decent chance.

For further information, please refer to the following excellent research article by our fellow forum member :-

http://klse.i3investor.com/blogs/david_masteel/151327.jsp

Have a nice day.

http://klse.i3investor.com/blogs/icon8888/154696.jsp