1. Be Realistic About Your Goal

Every now and then, you will hear people tell you wild stories about how

much they had made from stock market over past few years. For example,

Uncle Koon always boasted about his few hundred percent gain for

Latitude, VS, etc. I do not doubt his performance (properly documented

afterall). But I don't think everyone should aim for such kind of

return. There are certain unique factors that allow Uncle Koon to do so

well (access to insiders, Koon Bee effect, etc). Most of us do not have

such resources.

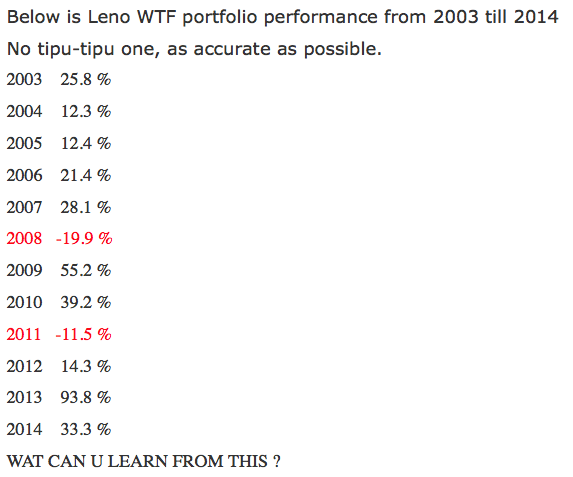

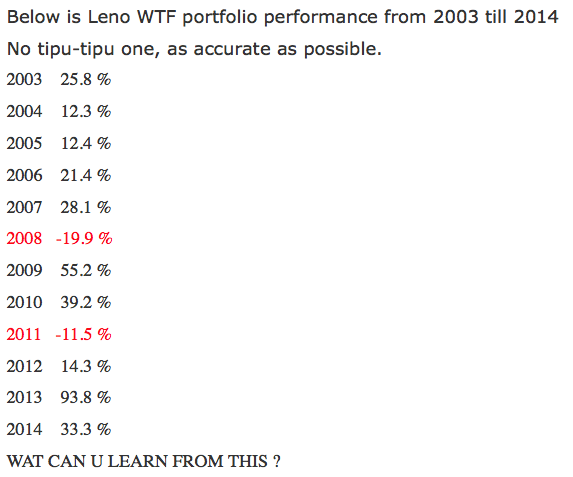

I believe the following forum member's performance is more achievable for ordinary people like us. It was posted on i3 few years ago. I liked it so much that I kept a copy of it.

http://klse.i3investor.com/blogs/WTF/67575.jsp

Key observations :

(a) No need to aim for super return. If you can achieve 10% to 20% return per annum on average, you are doing well.

(b) Don't be afraid of Market Crash. In 2008, the above author posted a loss of 19.9% (Global Financial Crisis). But he / she recovered in the subsequent year(s). It is common to experience losses during bear market (like now). Everybody also makes losses during bad time. You can't avoid it. One thing good about Bear Market is that when your portfolio shrinks, other people's portfolio also shrinks. Meaning that THERE IS PLENTY OF OPPORTUNITIES TO BARGAIN HUNT. So if necessary, reshuffle your portfolio to rope in stocks with better short term potential. When the market recovers, your portfolio will naturally recover. In a certain sense, the losses are temporary.

What you should avoid is MAKING LOSSES WHEN OTHER PEOPLE IS MAKING MONEY. In other words, try to avoid risky trades that can blow a big holes in your pocket. When the market has not crashed and you crashed, it is very difficult to recover.

2. Forget About Asset Play, Focus on Earnings

One of the most famous asset play advocate in i3 is Calvintaneng. Just check out his portfolio. There are some wins, but mostly deep losses. Why is asset play such a bad idea ? Because Malaysia investors like earnings. They are attracted to companies that make money. Every time a PLC reports losses, its share price will crash big time. When in Rome, do as the Romans do. Don't go against the tide to do the opposite. Loss making companies even though trading at huge discount to Net Assets, will get cheaper and cheaper. Avoid them.

3. Forget About Moat, Ride The Cyclicals

One of the most contentious issue when come to investing in Bursa is whether you should buy and hold forever like Warren Buffett. Based on my experience and observation, you shouldn't. Malaysia is different from the US and other developed countries. In those countries, there are many companies that have moat : Boeing, Airbus, Intel, Amazon, etc. Most Malaysia companies don't have moat. Over a period of 10 to 20 years, only a handful of Malaysia companies can consistently grow their earnings : Public Bank, Top Gloves, Sunway Group, Vitrox, Dialog, etc. If you bet on the right ones, you will do well (what is the odds that you will bet right ?). But if you bet on the wrong ones, you waste 10 years, 20 years.

It makes more sense to ride the boom bust cycles. You will be surprise how often those opportunities present themselves :-

(a) 2010 to 2014 - oil and gas (Sapura, Uzma, etc);

(b) 2015 - export (Thong Guan, Poh Huat, Hevea, etc);

(c) 2016 - Aviation (Air Asia);

(d) 2017 - Technology (MMSV, JHM, etc), steel (Ann Joo, Lion Ind, Ssteel, etc) and refinery (Hengyuan, etc).

(e) 2018 - ???

Just to make my point clear, if you are riding boom bust cycles, you need to cash out before the busts set in. No permanent holding. Just like what one prominent businessman once famously said, "everything is for sale at the right price, except for my kids". (how about his wife and parents ? I wonder)

4. Don't Look Too Far Ahead

When you pick stocks, don't pick those that have LONG GESTATION PERIOD. Based on my experience, that is the most common way people lost money (including me). For example : YTL Power's earning will get a big boost after completion of Jordan and Indonesia power projects in 2020. However, if you buy YTL Power back in 2016 (based on those long term potentials), you would have experienced huge losses as the stock has declined by closed to 50% since then.

The same is true for WCE Holdings Bhd, which is contructing the West Coast Expressway.

The Chinese says, "when the night is long, there will be many nightmares". Long gestation period exposes you to black swan events.

5. Aim Short Term, But Be Prepared To Hold Long Term

Many of the things I mentioned above, I believe most people in i3 have already been practising them. In my opinion, one thing that many people do not do is hold on to the stocks that they bought.

I have many friends that are very good at picking stocks with short term potentials (earnings growth, etc), which is exactly what I like. However, at the first sign of trouble, they dump their stocks and run for cover.

If you continue doing that, you will be so confused and stressed that you won't last long in the market. When things don't work out as envisaged, you need to be patient. Sometime, the PLCs need time to iron out the kinks.

My comments above are not simply plucked from the air. These few months, I have some free time. So I dug out all my transactions since 2010. One thing I notice is that I had not always been successful in the stocks that I bought (meaning I sold those stocks without profit, or even at small losses). However, most of those damp squids ultimately perform, albeit some time in the future.

So the lesson learned is very clear : buy decent stocks with potential for short term outperformance. However, if things don't work out as expected, hold for two to three years. Unless the industry has crashed big time, usually you will be rewarded.

Having said so, BUY and HOLD is not something that should be blindly applied. It is subject to one very important condition : DIVERSIFICATION, which is the next topic I would like to discuss.

6. Diversification

Diversification is one of the most under appreciated aspect of investing. Every now and then, somebody will talk about it. But not many people emphatise with it. In my opinion, diversification is very important. It has the magical effect of removing stress and risks from your investing activities.

The reason people do not take diversification seriously is because of the perception that diversification will cause your portfolio to become less sexy. Here is how.

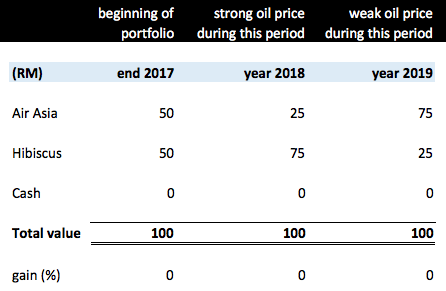

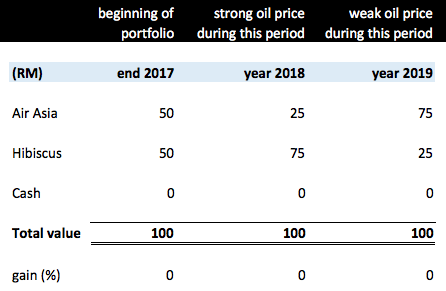

Let's say you have RM100. At the end of 2017, you invest RM50 in Airasia and RM50 in Hibiscus respectively. During 2018, oil price is strong. As a result, Hibiscus share price goes up to RM75. That is fantastic !!! However, Airasia does not do well. The high fuel price reduces its profitability. As a result, share price declines to RM25 (let's say). Due to diversification, you end up with zero return.

In 2019, the opposite happens. This round, oil price is weak. Airasia does well and its share price goes up to RM75. However, it is time for Hibiscus to suffer. Its share price declines to RM25. Once again, you generates zero return.

With your money spread out over different stocks, certain stocks' gain will some time be offset by other stocks' losses. That is what causes people to claim that diversification makes your portfolio less sexy.

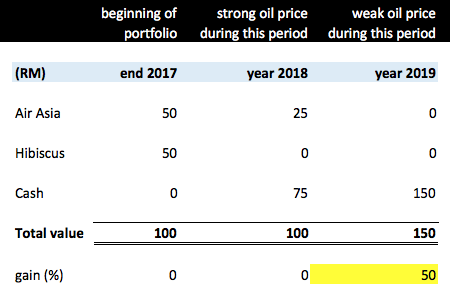

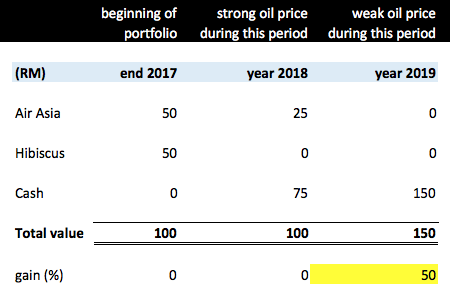

Is that claim true ? Not necessarily. Now let me tweak the model a little bit. Instead of just dumb dumb hold, I sell Hibiscus in 2018 when it reaches RM75, and I sell Airasia in 2019 after it has gone up. Now the portfolio's return looked very different - it is no more zero. Instead, the return is an impressive 50%.

Who says diversification makes your portfolio less sexy ? If it is so, that is because you have been using the wrong way to measure return.

7. Measuring Your Portfolio's Return

There is a very important lesson we can learn from the little exercise carried out above. One of the most frequently heard complain from investors is that it is very difficult to grow the portfolio. Everytime we sell a stock to take profit and reinvest the proceeds into another stock, the value of the new stock if subsequently decline, will wipe off all the gain originally made, and the portfolio reverts back to no gain. How frustrating.

Does this problem sound familiar to you ? Well, you need to change the way you measure your portfolio return. Don't put too much emphasis on book value. Instead, look at the realised gain (you can extract the information from your broker's portal). Always remember that so long as a stock is not sold, there is no loss (or gain) yet. Just ignore the fluctuation in book value, focus on the real money that goes into your pocket.

What I explain above is not an accounting gimmick for the purpose of comforting ourselves. It has a practical purpose. It allows us to ignore noises and focus on the actual return, which is the real thing that allows our portfolio to grow bigger and bigger.

Concluding Remarks

First of all, I would like to apologise to the sifus and seniors. Despite my claim of a Game Changing theory, what I write in this article is actually quite basic and based on common sense. "Game Changer" is just a marketing gimmick to attract attention.

Having said so, I would argue that simplicity is actually the strength of my investing approach. Instead of relying on what Warren Buffett and other Gurus said, I believe my approach better reflects Malaysia's market condition.

I have written several articles before about investing. However, this article is special because it covers everything from stock picking to portfolio management to perfomance measurement. I hope the information contained herein can help young people to invest their money in a proper way. That is actually the main reason I write this article.

http://klse.i3investor.com/servlets/cube/icon8888.jsp

I believe the following forum member's performance is more achievable for ordinary people like us. It was posted on i3 few years ago. I liked it so much that I kept a copy of it.

http://klse.i3investor.com/blogs/WTF/67575.jsp

Key observations :

(a) No need to aim for super return. If you can achieve 10% to 20% return per annum on average, you are doing well.

(b) Don't be afraid of Market Crash. In 2008, the above author posted a loss of 19.9% (Global Financial Crisis). But he / she recovered in the subsequent year(s). It is common to experience losses during bear market (like now). Everybody also makes losses during bad time. You can't avoid it. One thing good about Bear Market is that when your portfolio shrinks, other people's portfolio also shrinks. Meaning that THERE IS PLENTY OF OPPORTUNITIES TO BARGAIN HUNT. So if necessary, reshuffle your portfolio to rope in stocks with better short term potential. When the market recovers, your portfolio will naturally recover. In a certain sense, the losses are temporary.

What you should avoid is MAKING LOSSES WHEN OTHER PEOPLE IS MAKING MONEY. In other words, try to avoid risky trades that can blow a big holes in your pocket. When the market has not crashed and you crashed, it is very difficult to recover.

2. Forget About Asset Play, Focus on Earnings

One of the most famous asset play advocate in i3 is Calvintaneng. Just check out his portfolio. There are some wins, but mostly deep losses. Why is asset play such a bad idea ? Because Malaysia investors like earnings. They are attracted to companies that make money. Every time a PLC reports losses, its share price will crash big time. When in Rome, do as the Romans do. Don't go against the tide to do the opposite. Loss making companies even though trading at huge discount to Net Assets, will get cheaper and cheaper. Avoid them.

3. Forget About Moat, Ride The Cyclicals

One of the most contentious issue when come to investing in Bursa is whether you should buy and hold forever like Warren Buffett. Based on my experience and observation, you shouldn't. Malaysia is different from the US and other developed countries. In those countries, there are many companies that have moat : Boeing, Airbus, Intel, Amazon, etc. Most Malaysia companies don't have moat. Over a period of 10 to 20 years, only a handful of Malaysia companies can consistently grow their earnings : Public Bank, Top Gloves, Sunway Group, Vitrox, Dialog, etc. If you bet on the right ones, you will do well (what is the odds that you will bet right ?). But if you bet on the wrong ones, you waste 10 years, 20 years.

It makes more sense to ride the boom bust cycles. You will be surprise how often those opportunities present themselves :-

(a) 2010 to 2014 - oil and gas (Sapura, Uzma, etc);

(b) 2015 - export (Thong Guan, Poh Huat, Hevea, etc);

(c) 2016 - Aviation (Air Asia);

(d) 2017 - Technology (MMSV, JHM, etc), steel (Ann Joo, Lion Ind, Ssteel, etc) and refinery (Hengyuan, etc).

(e) 2018 - ???

Just to make my point clear, if you are riding boom bust cycles, you need to cash out before the busts set in. No permanent holding. Just like what one prominent businessman once famously said, "everything is for sale at the right price, except for my kids". (how about his wife and parents ? I wonder)

4. Don't Look Too Far Ahead

When you pick stocks, don't pick those that have LONG GESTATION PERIOD. Based on my experience, that is the most common way people lost money (including me). For example : YTL Power's earning will get a big boost after completion of Jordan and Indonesia power projects in 2020. However, if you buy YTL Power back in 2016 (based on those long term potentials), you would have experienced huge losses as the stock has declined by closed to 50% since then.

The same is true for WCE Holdings Bhd, which is contructing the West Coast Expressway.

The Chinese says, "when the night is long, there will be many nightmares". Long gestation period exposes you to black swan events.

5. Aim Short Term, But Be Prepared To Hold Long Term

Many of the things I mentioned above, I believe most people in i3 have already been practising them. In my opinion, one thing that many people do not do is hold on to the stocks that they bought.

I have many friends that are very good at picking stocks with short term potentials (earnings growth, etc), which is exactly what I like. However, at the first sign of trouble, they dump their stocks and run for cover.

If you continue doing that, you will be so confused and stressed that you won't last long in the market. When things don't work out as envisaged, you need to be patient. Sometime, the PLCs need time to iron out the kinks.

My comments above are not simply plucked from the air. These few months, I have some free time. So I dug out all my transactions since 2010. One thing I notice is that I had not always been successful in the stocks that I bought (meaning I sold those stocks without profit, or even at small losses). However, most of those damp squids ultimately perform, albeit some time in the future.

So the lesson learned is very clear : buy decent stocks with potential for short term outperformance. However, if things don't work out as expected, hold for two to three years. Unless the industry has crashed big time, usually you will be rewarded.

Having said so, BUY and HOLD is not something that should be blindly applied. It is subject to one very important condition : DIVERSIFICATION, which is the next topic I would like to discuss.

6. Diversification

Diversification is one of the most under appreciated aspect of investing. Every now and then, somebody will talk about it. But not many people emphatise with it. In my opinion, diversification is very important. It has the magical effect of removing stress and risks from your investing activities.

The reason people do not take diversification seriously is because of the perception that diversification will cause your portfolio to become less sexy. Here is how.

Let's say you have RM100. At the end of 2017, you invest RM50 in Airasia and RM50 in Hibiscus respectively. During 2018, oil price is strong. As a result, Hibiscus share price goes up to RM75. That is fantastic !!! However, Airasia does not do well. The high fuel price reduces its profitability. As a result, share price declines to RM25 (let's say). Due to diversification, you end up with zero return.

In 2019, the opposite happens. This round, oil price is weak. Airasia does well and its share price goes up to RM75. However, it is time for Hibiscus to suffer. Its share price declines to RM25. Once again, you generates zero return.

With your money spread out over different stocks, certain stocks' gain will some time be offset by other stocks' losses. That is what causes people to claim that diversification makes your portfolio less sexy.

Is that claim true ? Not necessarily. Now let me tweak the model a little bit. Instead of just dumb dumb hold, I sell Hibiscus in 2018 when it reaches RM75, and I sell Airasia in 2019 after it has gone up. Now the portfolio's return looked very different - it is no more zero. Instead, the return is an impressive 50%.

Who says diversification makes your portfolio less sexy ? If it is so, that is because you have been using the wrong way to measure return.

7. Measuring Your Portfolio's Return

There is a very important lesson we can learn from the little exercise carried out above. One of the most frequently heard complain from investors is that it is very difficult to grow the portfolio. Everytime we sell a stock to take profit and reinvest the proceeds into another stock, the value of the new stock if subsequently decline, will wipe off all the gain originally made, and the portfolio reverts back to no gain. How frustrating.

Does this problem sound familiar to you ? Well, you need to change the way you measure your portfolio return. Don't put too much emphasis on book value. Instead, look at the realised gain (you can extract the information from your broker's portal). Always remember that so long as a stock is not sold, there is no loss (or gain) yet. Just ignore the fluctuation in book value, focus on the real money that goes into your pocket.

What I explain above is not an accounting gimmick for the purpose of comforting ourselves. It has a practical purpose. It allows us to ignore noises and focus on the actual return, which is the real thing that allows our portfolio to grow bigger and bigger.

Concluding Remarks

First of all, I would like to apologise to the sifus and seniors. Despite my claim of a Game Changing theory, what I write in this article is actually quite basic and based on common sense. "Game Changer" is just a marketing gimmick to attract attention.

Having said so, I would argue that simplicity is actually the strength of my investing approach. Instead of relying on what Warren Buffett and other Gurus said, I believe my approach better reflects Malaysia's market condition.

I have written several articles before about investing. However, this article is special because it covers everything from stock picking to portfolio management to perfomance measurement. I hope the information contained herein can help young people to invest their money in a proper way. That is actually the main reason I write this article.

http://klse.i3investor.com/servlets/cube/icon8888.jsp