1. Introduction

This stock drew my attention because of analysts' extremely bullish earning projections. Not one analyst, at least three.

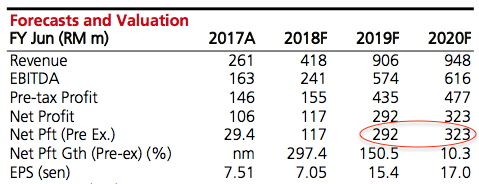

(Alliance DBS, 3 April 2018)

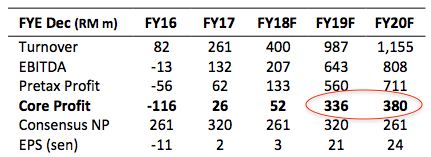

(BIMB Securities, 3 April 2018)

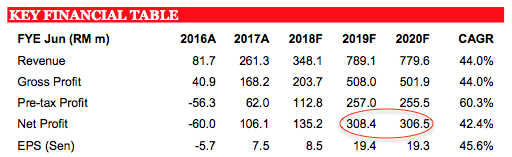

(Public Investment Bank, 30 May 2018)

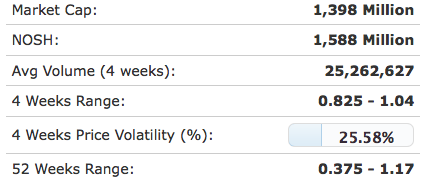

As shown above, analysts are expecting the company to report net profit of more than RM300 mil from FY2019 onwards. Since Hibiscus' financial year end is June, FY2019 is just a few months away. The company's existing market capitalisation is RM1.4 billion. As such, net profit of RM300 mil is a BIG DEAL. Let's find out more.

2. A Little Bit of Background

Hibiscus started out as a Special Purpose Acquistion Company (SPAC). It was listed as a cash company on Bursa. The company then made use of the cash to acquire profit generating assets. In the initial first few years since IPO, Hibiscus has not done well. It acquired a few assets, but they are mostly not very profitable.

The breakthrough came in 2015. Due to the depressed oil price, Hibiscus had opportunity to acquire 50% interest in Anasuria Clusters, an offshore oil field in UK. With daily production of about 3,000 barrels of oil, the 50% Anasuria generated net profit of approximately RM50 mil per annum.

In October 2016, Hibiscus announced that it was acquiring 50% equity interest in North Sabah Production Sharing Contract ("North Sabah PSC") for an extremely cheap price of RM200 mil. The vendor was Shell. Petronas holds the remaining 50% interest. The acquisition was completed recently on 31 March 2018.

This transcation is what gets analysts excited and make bullish earning projections for FY2019 onwards.

(As a matter of fact, the company's earning could spike as early as Q4 of FY2018, as North Sabah PSC will officially be part of the group effective 1 April 2018).

3. North Sabah PSC

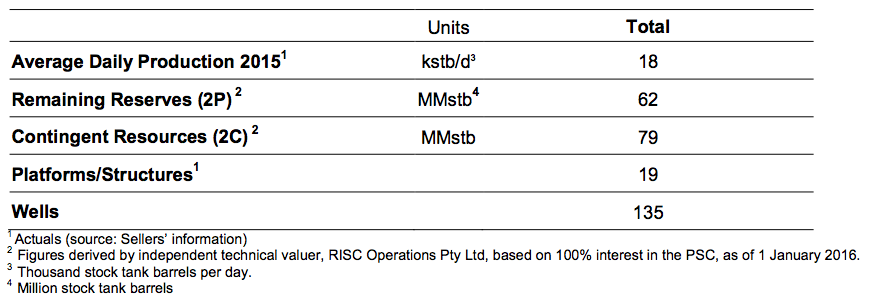

(Source : Company announcement dated 12 October 2016)

The North Sabah PSC is much bigger than Anasuria. Anasuria produced approximately 3,000 barrels per day (based on 50% interest). The North Sabah PSC produced around 7,000 barrels per day (based on 50% interest). Both assets will last for at least another 20 to 30 years.

4. Historical Profitability

Talk no use, show me the money. How has the company been performing in the past ?

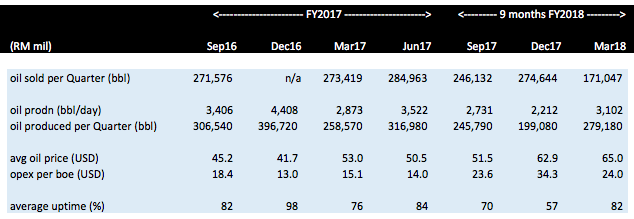

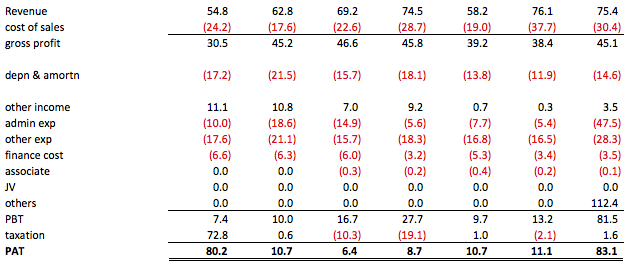

Key observations :-

(a) I have tabulated the past 7 quarters P&L in a systematic way. Please study the table to feel the figures.

(b) In FY2017, after excluding the exceptional items, the group reported total PBT of RM40.1 mil (being -3.3+3.1+11.9+31.5, near the bottom of table). Based on zero tax rate (which was the average in that year), PAT was RM40.1 mil.

(c) In Q3 of FY2018, admin and other expenses spiked from the average of RM30 mil per quarter to RM75.8 mil (very bad). By excluding exceptional items and applying the normalised RM30 mil expenses (please refer yellow highlighted), FY2018 Q4 PBT will be RM32.1 mil. This will lead to FY2018 nine months PBT of RM59.3 mil. As mentioned above, Q4 could get a big boost from incorporation of North Sabah PSC contribution. However to be conservative, lets' assume Q4 PBT of RM16.1 mil (same as Q2 FY2018), FY2018 PBT could be about RM75.4 mil. Based on assumed zero tax rate (as per the FY2018 nine months average), PAT works out to be RM75.4 mil as well.

5. Concluding Remarks

According to the analysis above, the group's earning capacity before North Sabah PSC contribution is approximately RM40 mil to RM60 mil. In the coming quarter, North Sabah PSC will be reflected in the accounts. Can earning grow as analysts expected ? We can only find out when the result is released by end August 2018.

Recently the market is bad. Many people are in bad mood. They came out to attack each other. This is so childish. Grow up and behave like an adult. There is no sure win in stock market. Everybody is guessing (albeit educated guesses). No matter how good your analysis is or how accurate your insider information is, there is always something unpredictable in the future that can crop up. If you cannot handle the stress of losing money (actually paper loss) during bad time, put your money in FD. Nobody owes you a living.

Have a nice day.

http://klse.i3investor.com/blogs/icon8888/161804.jsp