Highlights:

Worry about high jet fuel price effect on Airasia’s profit?

Many may think high fuel price (specifically is jet fuel) will affect Airasia’s profit. No doubt Airasia cost is correlated to jet fuel cost but I would like to show you that there is a way to mitigate the fuel cost by increasing the carried capacity (more aircrafts, more available seat, lower cost per unit). To understand airline operation cost, it is important to know what is Cost per ASK (Available Seat Kilometers). ASK of an airline refer to passenger carrying capacity or in other word is equal to the number of seats available multiplied by the number of or kilometers flown. Cost per ASK can give us of an airline Unit Cost (include jet fuel cost). Let us go through the cost per ASK for Airasia when it experienced high jet fuel cost in 1Q2018 as below:

Source: 1Q18 report

What I can notice from the table above is Cost / ASK (sen) dropped to 13.55 sen as compared to 13.61 YoY when Average Fuel Price (US / barrel) has increased from 76 to 83 (increased 9%)

How Airasia can maintain this low Cost / ASK while jet fuel cost is at high level of US83 per barrel? Airasia manage to maintain low Cost / ASK in 1Q18 is due to the following reasons:

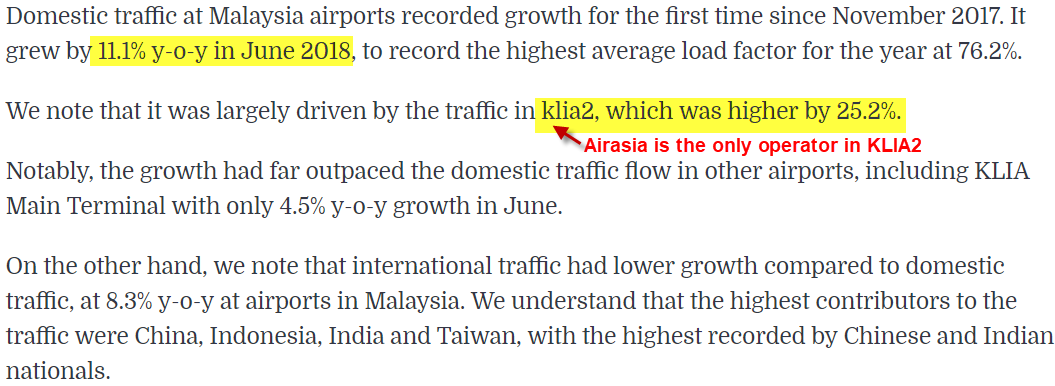

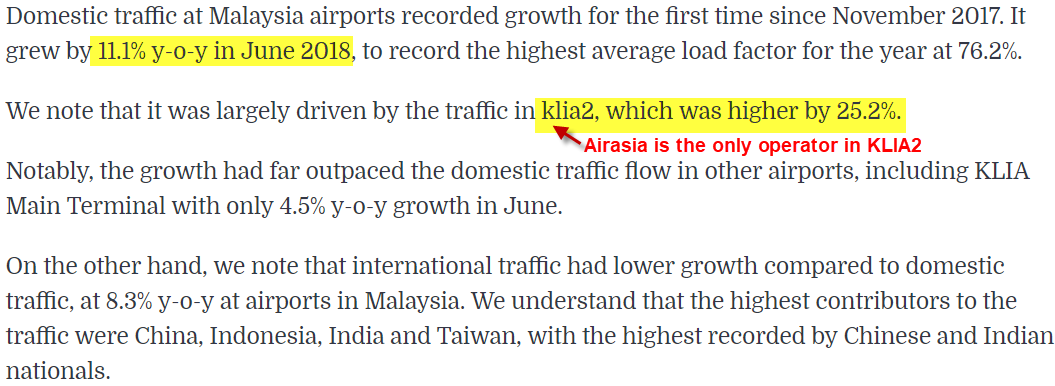

Airasia only hedged about 12% of its FY18F jet fuel needs at US$69/ barrel. The higher average jet fuel cost may pressure Airasia’s earnings but the impact maybe not so big in view of its efficiency in cost control (by higher aircraft utilization, higher passenger carried and load factor). Let see the June 2018 statistic of KLIA2 passengers as published by Airport Berhad Malaysia (Theedge news) as below:

Source: http://www.theedgemarkets.com/article/strong-load-factor-seen-aviation-industry

The traffic in May and June should be helped by General Election 14, Ramadan and Hari Raya Aidifiltri travelling where Airasia has increased their flights frequently during these periods.

Remember, Airasia still achieved relative good profit under Jet fuel price of USD83 in 1Q18 while MAS reduced 263 weekly flights and Malindo reduce 364 weekly flights (Domestic and Int). Source: Refer to page no 4 of the Airasia 1Q2018 result presentation slides.

How to do a stock Valuation?

For me, valuation of a stock is a combination of Math and art. By using Math, one may calculate its PE, discounted cash flow, NTA (net tangible asset) etc to get a valuation. By using art, one needs to imagine the future growth (may due to expansion), future profit catalyst, future new products, future product selling price and cost. By combining these two valuation methods can lead to a more comprehensive quantitative and qualitative analysis.

Anyway, there is a lot of assumption need to be made for both methods of valuation. I normally feel comfortable with the assumptions and my investment decision may not solely depend on valuation. The assumptions could be wrong and can lead the wrong valuation sometime. Valuation is only good when you are plan to dispose the assets or for valuer to judge the NTA or book value. Personally I treat book value just as a guideline but not as the rule to follow. Practicing valuation is more for us to understand the margin of safety of our investment.

3 types of value in a Stock

How do I value Airasia?

Method 1: By current earning power (PE)

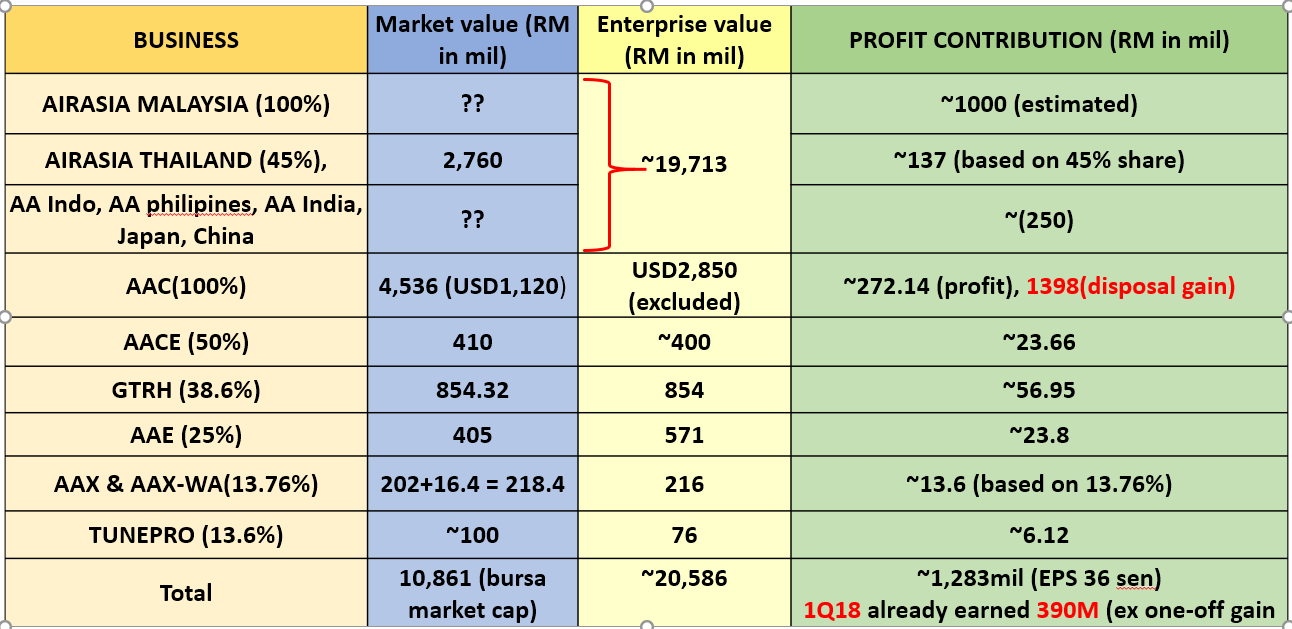

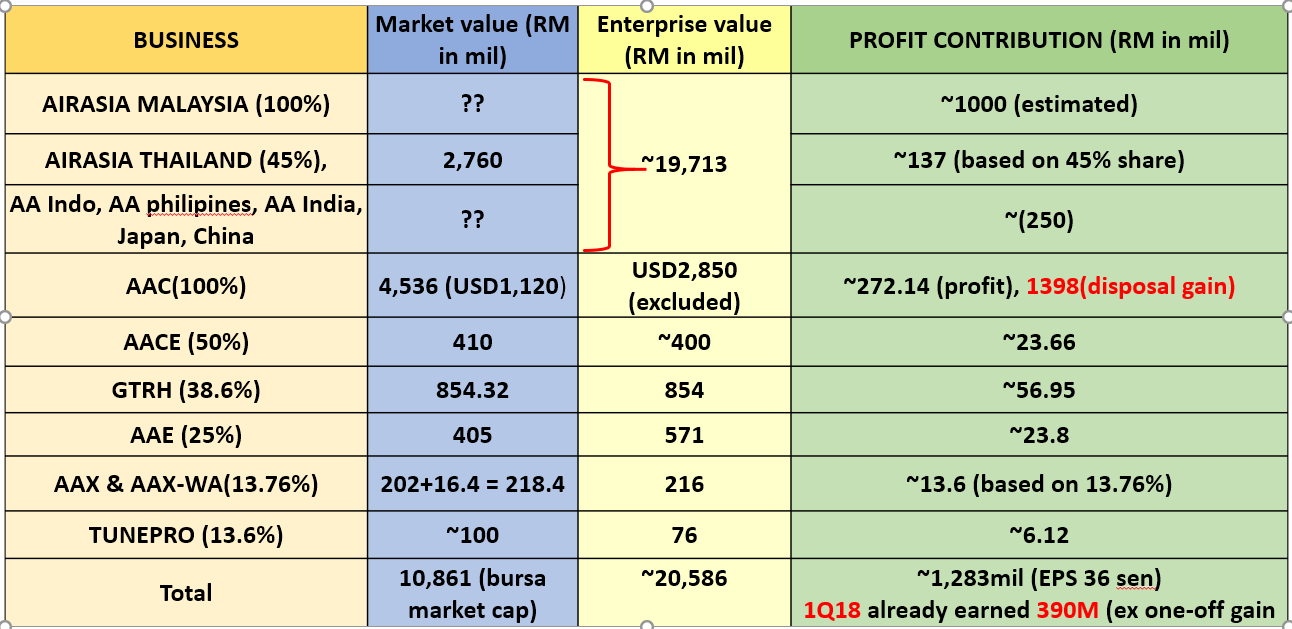

Due to Airasia is in the mid of rationalization of its non-core assets (two assets already sold, AAC in the final stage of disposal), so PE valuation method is applicable to some of the Airasia non-core assets. Let see what are the Airasia subsidiaries, Joint venture (including digital venture) and associate companies as below:

Price tag and enterprise value for each business of Airasia

AirAsia has sealed a deal to dispose its aircraft leasing operations (under AAC) to BBAM (namely Herondell, Incline B and FLY Leasing) for a total consideration of US$1,185M (RM4.536billion), inclusive of cash US$1,085m (RM4.2bn). The enterprise value (EV) of AAC operation is US$2,846.2m (RM11.1bn). The disposal of AAC includes existing 80 aircrafts, up-coming 4 new aircrafts and existing 14 aircraft engines.

Based on the EV valuation, AAC is valued at PE of 17x for FY17 (estimated US$68m profit contribution to AirAsia), substantially higher than AirAsia PE of about 10x (based on EPS of 30.7sen which excludes remeasurement gain on GTR and disposal gain, include these gain, PE is about 5x).

The interesting part of completion of AAC sales is Airasia group will become a net cash airline company, where transfer of debt of RM6.5 billion to BBAM and part of the proceeds will be used to repay its borrowings. The impact to sales of AAC includes loss of income and higher lease expenses of about RM403M, which can be offset by savings of RM110M finance costs and RM206M depreciations (depreciation goes to new owner BBAM) for Airasia.

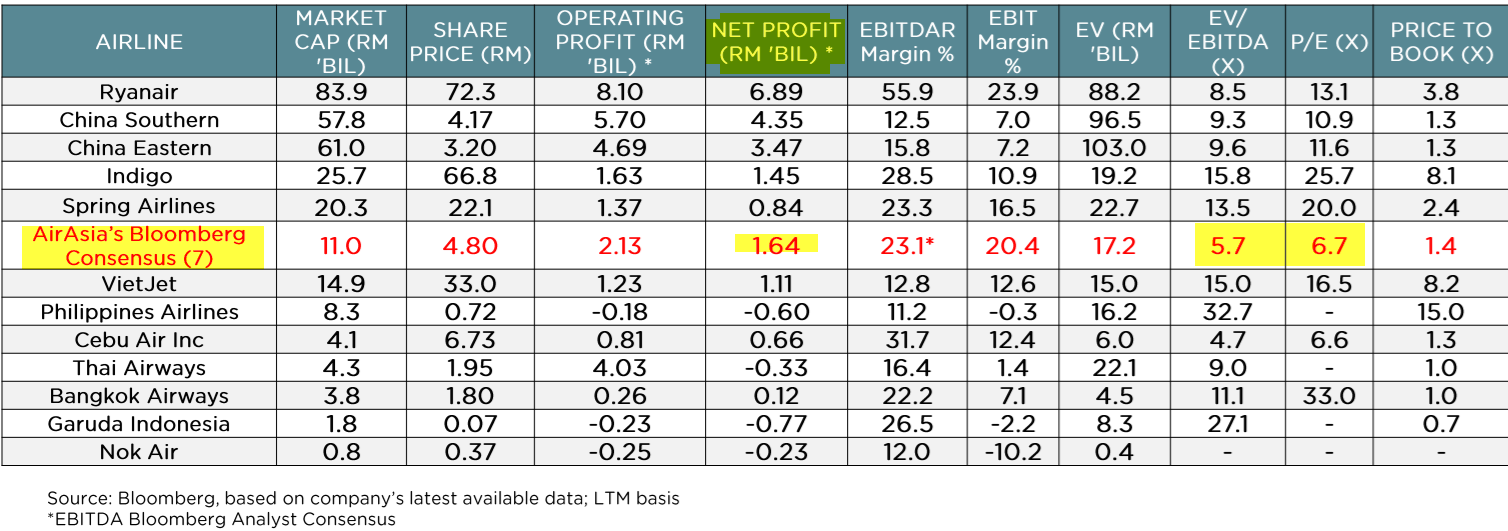

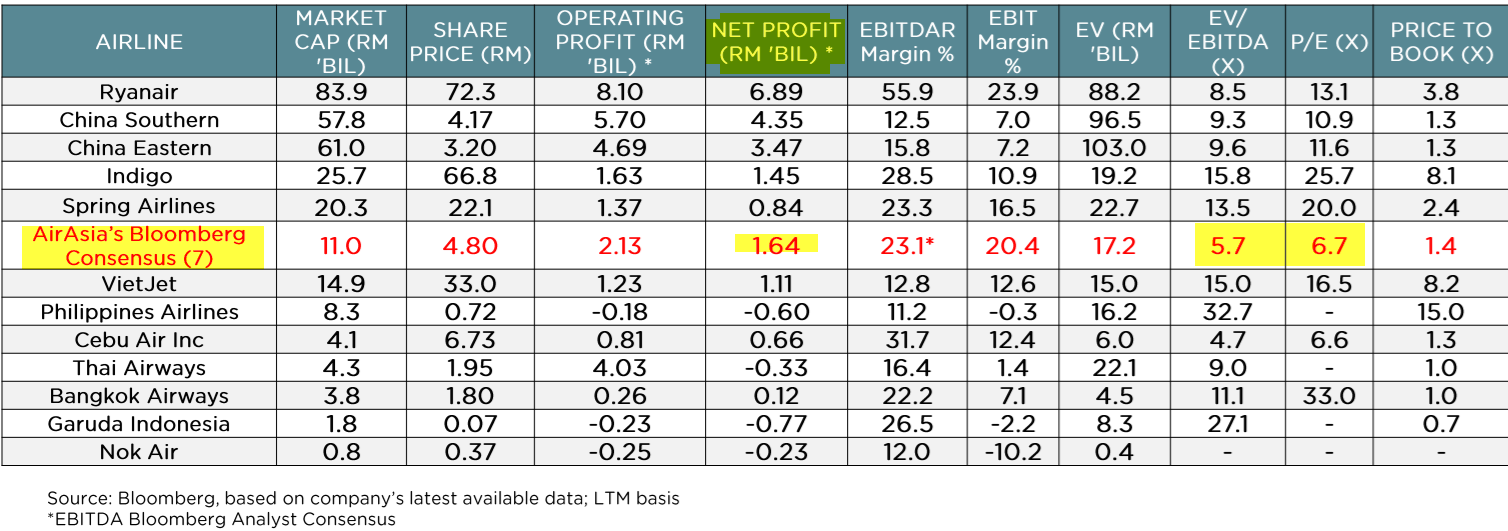

From the table of enterprise value, the estimated profit of Airasia for FY2019 (after AAC sales and special div) is about 1.283 billion, which translated to EPS of 36 sen. With PE multiple valuation of 11x, Airasia should worth RM3.96 per share. This is just solely based on current earning power from airline business of Airasia without considering its digital venture businesses potential. Table below is a comparison for different budget airlines in the world (sector average PEx is 15x).

Source: Bloomberg and Airasia 1Q2018 result presentation slides

Method 2: By Future Growth value (PEG)

The price/earnings to growth ratio (PEG ratio) is a stock's price-to-earnings (P/E) ratio divided by the growth rate of its earnings for a specified time period. The PEG ratio is used to determine a stock's value while taking the company's future earnings growth into account and is considered to provide a more complete picture for a growing company.

The PEG ratio formula for a company is as follows:

PEG Ratio = Price-to-Earnings (PE) / Annual Earnings Per Share Growth

The is coming from the future growth potential of the company and the value is the collection of cash flow generated from the company in the future. However, the future is uncertain but huge potential.

Airasia Digital Transformation (BIG PAY, OURSHOP, Rokki etc using Big Data and AI Technology)

Most of the young generation lifestyle is digital-oriented.

Before I talk about digital transformation of Airasia, let me show you some of the companies that running digital related businesses. Some of the big name of these companies including Alibaba (Alipay, 支付宝 is not listed under Alibaba), Tencent (Wechat pay), Amazon (Amazon pay, its platform), Grab (Grab pay), Paypal. Some of the local cashless payment solution providers in Bursa including Ghlsys and Revenue. Let see market valuation of these e-commerce and digital pay related companies.

Source: Investing.com and Malaysiastockbiz.com

What I can observe the above companies (except GHL and Revenue) is they possess a big database of customer and they can sell products/services to them. As of the 2016 report, Amazon had 310 million active customers. In the most recently reported quarter, Tencent's WeChat had 963 million monthly active users. For Alibaba, its online shopping customers as of the third quarter of 2017 is 488 million active buyers who ever access its Taobao platform in the previous twelve months. For Paypal, in the first quarter of 2018, there was 237 million customers active worldwide.

Finding:

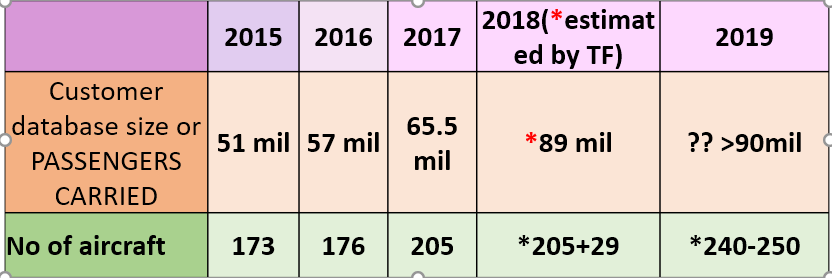

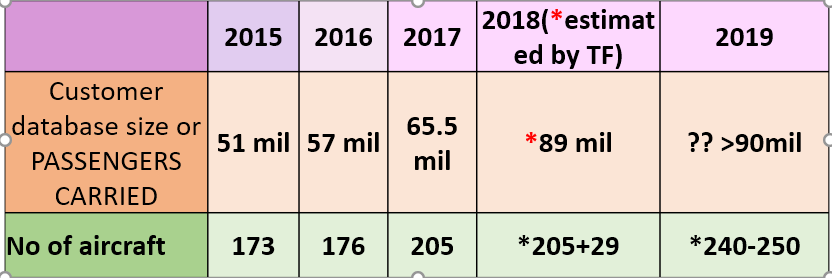

Source: Annual report of 2015, 2016, 2017

Source: Annual report of 2017

From the table, we can observe that Airasia has carried 65.5 mil passengers in 2017 and expected to carry 89 mil passengers in 2018. Besides, their airasia.com website has 125 mil page views per month and 27 mil unique visitors per month. What I can forecast it their expected customer database in 2018 easily reach 89 mil and this figure may reach 100 mil in 2019-2020.

FYI, Airaisa current revenue via internet rate (mainly from ticket sales) is 70.4% (source from AR 2017). What Airasia want to do in in 2018-2020 is digitalization or digital venture that extend to or leverage on the same customer database to other businesses like logistic (via red cargo & red box), online duty-free retails marketplace (Ourshop, newly launched in July), mobile payment (BIG PAY), online remittance (BIG PAY, future project), Inflight Wifi (Rokki), Inflight food & beverage (Santan), online financing (provide loan, future project) and other related services.

All these services (especially online duty-free retail) can be helped by using the power of Big Data analytic. Big Data can help in analyze Airasia huge customer database (80M+ passengers) by predicting their future purchasing behavior which resulting higher sales (based on their search, travel destination or past purchase products records)

All these services can help in increasing Airasia Ancillary revenue which they have achieved about RM47 per pax in 1Q18 (including baggage fee). If exclude baggage fee, the ancillary revenue generated by these services is about 262mil in 1Q18 (10% of their 1Q revenue, 11% YoY improvement vs 1Q17). I expect higher contribution from newly introduced online duty-free retail, mobile payment and online remittance services in 2018-2020 revenue.

Let me has a simple forecast on the possible future revenue from online duty-free retail (Ourshop) and mobile payment or e-Wallet (Big Pay) services as table below:

By assuming 10% net profit margin from online duty-free retails and

zero profit contribution from Big Pay (due to promotion to attract more

customer) in 2018-2020, they will be about 525 mil revenues from and can

increase Airasia revenue and net profit by about 5%.

Remember, this is just from 1 digital service and there are a few

promising services like e-remittance which can send money to their home

countries for foreign workers in Malaysia. The advantage of e-remittance

is it can reduce the agent transfer fee (money changers, banks) and the

transaction can be done through mobile apps. Airasia customer database

covers 21 countries (mostly in Asia) and a lot of the customers from

middle class and low-income people that work in overseas.

The estimated EPS or profit growth rate for Airasia could be in the range of 10% in 2018 (capacity expansion, exclude one-off asset disposal profit), 12% in 2019 (capacity expansion, cost saving on new aircraft and digital biz contribution) and 15% in 2020 (cost saving using AI and IoT and digital biz contribution). Let assume 10-15% of growth rate in EPS in 2018-2020 to calculate Airasia PEG as table below:

A rule of thumb is that any PEG ratio below 1.0 is considered to be a

good value. Airasia current valuation still consider cheap based on its

forward PE ratio and future growth rate. The PEG ratio of 0.83 for

FY2018 indicates that it is still undervalue relative to its growth

potential.

Let see the last 15 year Airasia carried passenger and its aircraft fleet expansion (CAGR more than 20%) as per chart below.

Risk

Appendix 1 (other Appendices are Not for public)

- After disposal of AAC (70-75 sen dividend to be distributed by 4Q2018), Airasia will become a NET CASH airline company (from 0.9x net gearing now, 10.2 billion net debt 2 years ago) as the cash proceed of AAC sale is RM4.1 billion and transfer of debts RM6.5billion (refer appendix 1 for sup. doc) to BBAM. Further dividend (about USD100 mil or `11 sen dividend from Expedia AAE sales) is expected in 2019. There is another asset on sale is ACL (another 35 aircrafts) and may take some time to close deal (ACL’s price tag around USD300 mil).

- Bear in mind after Airasia become a net cash company, its finance cost will be much lower and it got dividend policy of 20% which depend on their cash flow from operation to distribute normal dividend on top of special dividend.

- Post disposal, the loss of AAC’s income is estimated at RM273 mil and higher lease expenses of RM130 mil (AAB portion), which will be offset by savings of RM110 mil finance costs and RM206 mil depreciations expenses for Airasia (refer to AllianceDBS report dated 1 Mar). The estimated net effect (income – saving) is a loss of about 87 mil income which can be compensated by higher revenue from aircraft fleet expansion and ancillary income (digitalization).

- Even average jet fuel price was about USD83 in 1Q18, the cost per ASK (available seat kilometer) still maintain at relatively low level (13.55 sen) as per 1Q17 when jet fuel price at USD76. Airasia manage to achieve this low unit cost by constantly adding new aircraft (more available seat, higher utilization hours and high load factor of > 80%) and also reducing other related costs.

- Excluding one-off disposal gain from AAC & GTRH, the estimated profit from operation in FY2018 is about 1.283 mil (EPS of 36 sen). With PE multiple valuation of 11x, Airasia’s fair value should worth RM3.96 per share. This is just solely based on current earning power from airline business without considering its digital venture businesses potential. Its sector average PE is at about 15x.

- Last 15 years Airasia carried passenger and its aircraft fleet expansion have been growing at CAGR of more than 20% (refer to the chart at the last page). Its has gain more domestic market in Malaysia and Thailand with its aggressive ticket price (54% and 30% market share in Malaysia and Thailand).

- One of its future growing airline markets is from China. China tourists like to have mobile pay and e-commerce experiences (online shopping like Taobao, Alipay and Wechat pay). Airasia has implemented its digitalization transformation plan which I think have great potential in long run (much lower capex in digitization venture compared to their airline businesses).

- Due to Airasia has huge customer database (80mil+ passengers per year), it has launched multiple digital ventures from online duty-free retail (Ourshop) Big Royalty, to mobile e-Wallet (Big Pay) services to increase ancillary income. Digital transformation will provide future profit growth which Airasia has a big advantage to leverage on its existing big customer database which others digital company competitors need to spend million to billion to buy customers database (like giving offer or free vouchers to gain more users like 11street etc).

- Digital ventures advantage is they are light asset (low capex required) and their biggest asset is their big customer database which they can use this database to increase their ancillary income.

- Airasia planning for more rapid fleet expansion in 2018-2020, expected to end 2018 with about 225 aircraft (+29), around 270 aircraft in 2020 which provide continuous revenue and passenger growth.

- The risk lies in surge in jet fuel oil price and USD appreciation which may affect its operation cost.

Many may think high fuel price (specifically is jet fuel) will affect Airasia’s profit. No doubt Airasia cost is correlated to jet fuel cost but I would like to show you that there is a way to mitigate the fuel cost by increasing the carried capacity (more aircrafts, more available seat, lower cost per unit). To understand airline operation cost, it is important to know what is Cost per ASK (Available Seat Kilometers). ASK of an airline refer to passenger carrying capacity or in other word is equal to the number of seats available multiplied by the number of or kilometers flown. Cost per ASK can give us of an airline Unit Cost (include jet fuel cost). Let us go through the cost per ASK for Airasia when it experienced high jet fuel cost in 1Q2018 as below:

Source: 1Q18 report

What I can notice from the table above is Cost / ASK (sen) dropped to 13.55 sen as compared to 13.61 YoY when Average Fuel Price (US / barrel) has increased from 76 to 83 (increased 9%)

How Airasia can maintain this low Cost / ASK while jet fuel cost is at high level of US83 per barrel? Airasia manage to maintain low Cost / ASK in 1Q18 is due to the following reasons:

- Higher capacity (more new aircrafts --> higher available seat and fuel saving of A320) lead to higher passengers carried which can bring down the unit cost or cost / ASK.

- Higher aircraft utilization (13.12 hours per day, highest over past 5 years) and route rationalization.

- Stronger MYR in 1Q18 help to reduce the cost / ASK ex-fuel by 4%.

- Lower other cost.

Airasia only hedged about 12% of its FY18F jet fuel needs at US$69/ barrel. The higher average jet fuel cost may pressure Airasia’s earnings but the impact maybe not so big in view of its efficiency in cost control (by higher aircraft utilization, higher passenger carried and load factor). Let see the June 2018 statistic of KLIA2 passengers as published by Airport Berhad Malaysia (Theedge news) as below:

Source: http://www.theedgemarkets.com/article/strong-load-factor-seen-aviation-industry

The traffic in May and June should be helped by General Election 14, Ramadan and Hari Raya Aidifiltri travelling where Airasia has increased their flights frequently during these periods.

Remember, Airasia still achieved relative good profit under Jet fuel price of USD83 in 1Q18 while MAS reduced 263 weekly flights and Malindo reduce 364 weekly flights (Domestic and Int). Source: Refer to page no 4 of the Airasia 1Q2018 result presentation slides.

How to do a stock Valuation?

For me, valuation of a stock is a combination of Math and art. By using Math, one may calculate its PE, discounted cash flow, NTA (net tangible asset) etc to get a valuation. By using art, one needs to imagine the future growth (may due to expansion), future profit catalyst, future new products, future product selling price and cost. By combining these two valuation methods can lead to a more comprehensive quantitative and qualitative analysis.

Anyway, there is a lot of assumption need to be made for both methods of valuation. I normally feel comfortable with the assumptions and my investment decision may not solely depend on valuation. The assumptions could be wrong and can lead the wrong valuation sometime. Valuation is only good when you are plan to dispose the assets or for valuer to judge the NTA or book value. Personally I treat book value just as a guideline but not as the rule to follow. Practicing valuation is more for us to understand the margin of safety of our investment.

3 types of value in a Stock

- Current earning power value (PE)

- Future Growth value (PEG)

- Asset value (discount to book value or intrinsic value)

How do I value Airasia?

Method 1: By current earning power (PE)

Due to Airasia is in the mid of rationalization of its non-core assets (two assets already sold, AAC in the final stage of disposal), so PE valuation method is applicable to some of the Airasia non-core assets. Let see what are the Airasia subsidiaries, Joint venture (including digital venture) and associate companies as below:

Price tag and enterprise value for each business of Airasia

AirAsia has sealed a deal to dispose its aircraft leasing operations (under AAC) to BBAM (namely Herondell, Incline B and FLY Leasing) for a total consideration of US$1,185M (RM4.536billion), inclusive of cash US$1,085m (RM4.2bn). The enterprise value (EV) of AAC operation is US$2,846.2m (RM11.1bn). The disposal of AAC includes existing 80 aircrafts, up-coming 4 new aircrafts and existing 14 aircraft engines.

Based on the EV valuation, AAC is valued at PE of 17x for FY17 (estimated US$68m profit contribution to AirAsia), substantially higher than AirAsia PE of about 10x (based on EPS of 30.7sen which excludes remeasurement gain on GTR and disposal gain, include these gain, PE is about 5x).

The interesting part of completion of AAC sales is Airasia group will become a net cash airline company, where transfer of debt of RM6.5 billion to BBAM and part of the proceeds will be used to repay its borrowings. The impact to sales of AAC includes loss of income and higher lease expenses of about RM403M, which can be offset by savings of RM110M finance costs and RM206M depreciations (depreciation goes to new owner BBAM) for Airasia.

From the table of enterprise value, the estimated profit of Airasia for FY2019 (after AAC sales and special div) is about 1.283 billion, which translated to EPS of 36 sen. With PE multiple valuation of 11x, Airasia should worth RM3.96 per share. This is just solely based on current earning power from airline business of Airasia without considering its digital venture businesses potential. Table below is a comparison for different budget airlines in the world (sector average PEx is 15x).

Source: Bloomberg and Airasia 1Q2018 result presentation slides

Method 2: By Future Growth value (PEG)

The price/earnings to growth ratio (PEG ratio) is a stock's price-to-earnings (P/E) ratio divided by the growth rate of its earnings for a specified time period. The PEG ratio is used to determine a stock's value while taking the company's future earnings growth into account and is considered to provide a more complete picture for a growing company.

The PEG ratio formula for a company is as follows:

PEG Ratio = Price-to-Earnings (PE) / Annual Earnings Per Share Growth

The is coming from the future growth potential of the company and the value is the collection of cash flow generated from the company in the future. However, the future is uncertain but huge potential.

Airasia Digital Transformation (BIG PAY, OURSHOP, Rokki etc using Big Data and AI Technology)

Most of the young generation lifestyle is digital-oriented.

Before I talk about digital transformation of Airasia, let me show you some of the companies that running digital related businesses. Some of the big name of these companies including Alibaba (Alipay, 支付宝 is not listed under Alibaba), Tencent (Wechat pay), Amazon (Amazon pay, its platform), Grab (Grab pay), Paypal. Some of the local cashless payment solution providers in Bursa including Ghlsys and Revenue. Let see market valuation of these e-commerce and digital pay related companies.

Source: Investing.com and Malaysiastockbiz.com

What I can observe the above companies (except GHL and Revenue) is they possess a big database of customer and they can sell products/services to them. As of the 2016 report, Amazon had 310 million active customers. In the most recently reported quarter, Tencent's WeChat had 963 million monthly active users. For Alibaba, its online shopping customers as of the third quarter of 2017 is 488 million active buyers who ever access its Taobao platform in the previous twelve months. For Paypal, in the first quarter of 2018, there was 237 million customers active worldwide.

Finding:

- If a company has a big database of customers and can generate good revenue from them (even not making much profit), then market is willing to give high valuation to them for its possible future growth. Their PEx can be range from 38 to 285.

- For Bursa companies (GHL and Revenue), they are mainly engaged in the local distribution, deployment and maintenance of Electronic Data capture (EDC) terminals as well as provision of electronic transaction processing services (like payment gateway) for payments. They do not own big database of customer but they still have foreseeable growth and market also give them high PE valuation of 21-56x.

Source: Annual report of 2015, 2016, 2017

Source: Annual report of 2017

From the table, we can observe that Airasia has carried 65.5 mil passengers in 2017 and expected to carry 89 mil passengers in 2018. Besides, their airasia.com website has 125 mil page views per month and 27 mil unique visitors per month. What I can forecast it their expected customer database in 2018 easily reach 89 mil and this figure may reach 100 mil in 2019-2020.

FYI, Airaisa current revenue via internet rate (mainly from ticket sales) is 70.4% (source from AR 2017). What Airasia want to do in in 2018-2020 is digitalization or digital venture that extend to or leverage on the same customer database to other businesses like logistic (via red cargo & red box), online duty-free retails marketplace (Ourshop, newly launched in July), mobile payment (BIG PAY), online remittance (BIG PAY, future project), Inflight Wifi (Rokki), Inflight food & beverage (Santan), online financing (provide loan, future project) and other related services.

All these services (especially online duty-free retail) can be helped by using the power of Big Data analytic. Big Data can help in analyze Airasia huge customer database (80M+ passengers) by predicting their future purchasing behavior which resulting higher sales (based on their search, travel destination or past purchase products records)

All these services can help in increasing Airasia Ancillary revenue which they have achieved about RM47 per pax in 1Q18 (including baggage fee). If exclude baggage fee, the ancillary revenue generated by these services is about 262mil in 1Q18 (10% of their 1Q revenue, 11% YoY improvement vs 1Q17). I expect higher contribution from newly introduced online duty-free retail, mobile payment and online remittance services in 2018-2020 revenue.

Let me has a simple forecast on the possible future revenue from online duty-free retail (Ourshop) and mobile payment or e-Wallet (Big Pay) services as table below:

|

Passenger database size |

*2018 – 89mil *(forecast) |

*2019 – 95mil |

*2020 – 105mil |

|

Online duty-free retails marketplace (Ourshop) |

Assume 2% of passengers spend RM100 à RM178 mil revenue |

Assume 3% of passengers spend RM100 à RM285 mil revenue |

Assume 5% of passengers spend RM100 à RM525 mil revenue |

|

Mobile payment (Big Pay) – provide discount on retails, waive on bank/credit card transaction fee on ticket buying, collect BIG points to be used in other platform purchase (like Groupon) |

Assume 1% of passengers using BIG PAY --> Gain 0.89 mil users and collected prepaid some amount of fund (Big Pay is a debit card), Improve Cashflow and future ticket & retail biz. |

Assume 2% of passengers using BIG PAY -->Gain 1.9 mil users and collected prepaid some amount of fund (Big Pay is a debit card), Improve Cashflow and future ticket & retail biz. |

Assume 5% of passengers using BIG PAY --> Gain 5.25 mil users and collected prepaid some amount of fund (Big Pay is a debit card), Further Improve Cashflow and future ticket & retail biz. |

The estimated EPS or profit growth rate for Airasia could be in the range of 10% in 2018 (capacity expansion, exclude one-off asset disposal profit), 12% in 2019 (capacity expansion, cost saving on new aircraft and digital biz contribution) and 15% in 2020 (cost saving using AI and IoT and digital biz contribution). Let assume 10-15% of growth rate in EPS in 2018-2020 to calculate Airasia PEG as table below:

|

|

2018E* (*estimated) |

2019E* (*estimated) |

2020E* (*estimated) |

|

PE |

8.7 based on current price of 3.15 |

10 |

12 |

|

Growth |

10% |

12% |

15% |

|

EPS (exclude one-off gain on AAC n expedia disposal |

39.6 sen |

40.3 sen |

41.4 sen |

|

PEG |

0.87 |

0.83 |

0.8 |

|

|

2018E |

2019E |

|

PEx |

10-11 |

11-12 |

|

EPS (exclude one-off disposal gain |

39.5 sen |

40.3 sen |

|

Fair Price |

RM3.95 -4.35 |

RM4.35 -4.8 |

Risk

- Further depreciation of the MYR against the USD. A stronger USD will pressure Airasia’s profitability as a significant portion of its operating and financing costs are in USD.

- Surge in jet fuel price which may cause unit cost to ASK to rise on jet fuel (currently about USD85-88). Group CEO (Tony) said jet fuel price below USD100 is manageable for Airasia.

- World crisis like war, terrorism and epidemic outbreak which affect tourism industry

- High speed Railway project of Singapore and Malaysia (in long run of 6-7 years if the project is revived which is not likely to happen).

If you interested on my future analysis reports, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is

strictly for sharing purpose, not a buy or sell call of the company.

http://klse.i3investor.com/blogs/lionind/167103.jsp