1. Latest Quarter Result

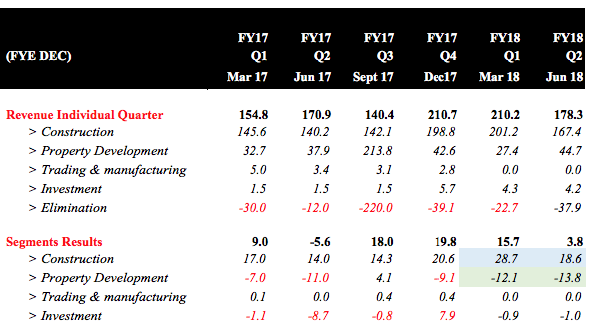

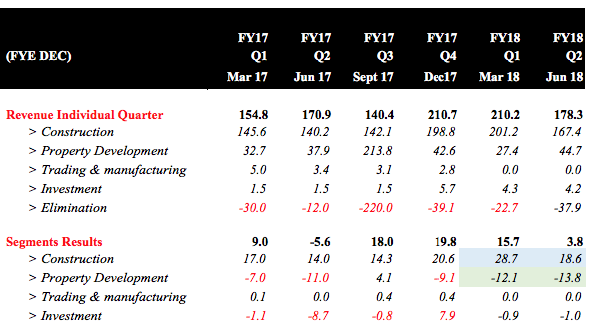

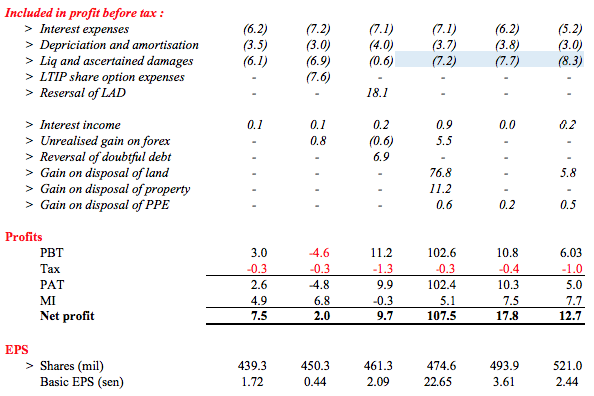

Yesterday, Jaks released its June 2018 quarter. Please refer to table below :-

Key observations :

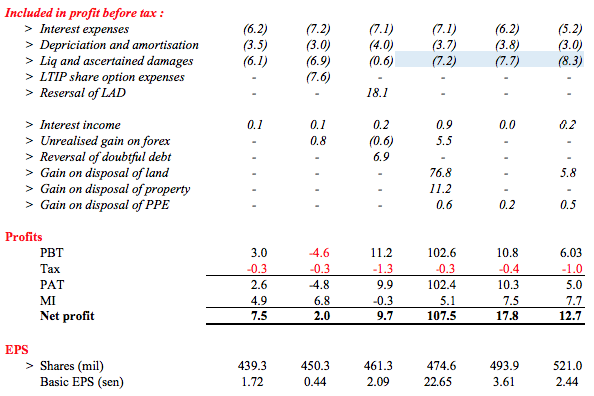

(a) Earning declined from RM17.8 mil to RM12.7 mil. Who is the culprit ? Surprisingly, it is not the property division, which has attracted most attention recently due to the Star Media court case. The property division's operating loss maintained at more or less RM13 mil (LAD was maintained at roughly RM8 mil).

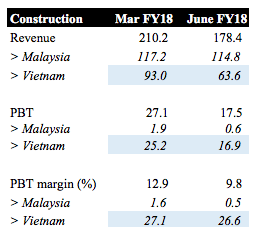

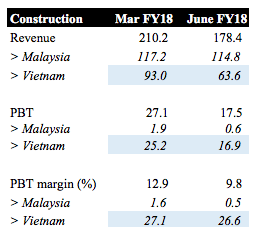

(b) The culprit is actually the construction division, which saw its operating profit declined from RM28.7 mil to RM18.6 mil, a drop of RM10.1 mil. This was mostly due to lower revenue of Vietnam IPP project, which declined from RM93 mil to RM63.6 mil. Accordingly, PBT declined from RM25.2 mil to RM16.9 mil. Please refer to table below.

The company did not provide explanation on why Vietnam IPP revenue declined. But it could simply be due to status of progress billing. Nothing to be alarmed at, in my opinion. Please note that for two consecutive quarters, Vietnam IPP's PBT margin was mainatined at impressive 27%. This is important as the fat margin supports our argument (and assumption) that Vietnam IPP will be the key earning driver going forward.

2. Vietnam IPP's Construction Profit Is Merely An Accounting Gimmick ?

As we all know (as explained by KYY), Jaks' China partner was the one doing the work while Jaks was allocated a portion of the construction profit. This leads to certain forum members claiming that the construction profit is not real - it is "something that you can see but cannot touch".

Is that really the case ? Of course not.

Those profit is the building block for its ultimate 30% economic interest in the IPP. At the beginning, Jaks owns zero economic interest in the IPP. As time goes by, the construction profit allocated to it by the China partner will be automatically ploughed into the IPP as capital injection. So it is true that Jaks does not get to lay its hand on the profit. However, as construction progresses, its economic interest in the Vietnam IPP will gradually increase. At the point of completion, it will own 30% of the IPP, without the need to inject much capital.

How can it be not real ?

3. Next Quarter Result Could Potentially Be Bad

Next quarter result might factor in losses related to the RM50 mil Bank Guarantee (if they loss the court case). But it is a one off exceptional item. I think most investors will ignore it and focus on the actual operating figures.

4. Any Regret Buying Into Jaks ?

Nope. So far so good. Price has declined to around 95 sen. But that is peanuts compared to my average cost of RM1.00+.

My investment thesis for Jaks remained unchanged. Balance sheet remained reasonably sound with RM460 mil interest bearing debt backed by RM220 mil cash. The group is unlikely to get into financial difficulty.

I am happily holding on, with my eyes on end 2019 for potential 100% gain.

Have a nice day.

https://klse.i3investor.com/blogs/icon8888/171767.jsp

Yesterday, Jaks released its June 2018 quarter. Please refer to table below :-

Key observations :

(a) Earning declined from RM17.8 mil to RM12.7 mil. Who is the culprit ? Surprisingly, it is not the property division, which has attracted most attention recently due to the Star Media court case. The property division's operating loss maintained at more or less RM13 mil (LAD was maintained at roughly RM8 mil).

(b) The culprit is actually the construction division, which saw its operating profit declined from RM28.7 mil to RM18.6 mil, a drop of RM10.1 mil. This was mostly due to lower revenue of Vietnam IPP project, which declined from RM93 mil to RM63.6 mil. Accordingly, PBT declined from RM25.2 mil to RM16.9 mil. Please refer to table below.

The company did not provide explanation on why Vietnam IPP revenue declined. But it could simply be due to status of progress billing. Nothing to be alarmed at, in my opinion. Please note that for two consecutive quarters, Vietnam IPP's PBT margin was mainatined at impressive 27%. This is important as the fat margin supports our argument (and assumption) that Vietnam IPP will be the key earning driver going forward.

2. Vietnam IPP's Construction Profit Is Merely An Accounting Gimmick ?

As we all know (as explained by KYY), Jaks' China partner was the one doing the work while Jaks was allocated a portion of the construction profit. This leads to certain forum members claiming that the construction profit is not real - it is "something that you can see but cannot touch".

Is that really the case ? Of course not.

Those profit is the building block for its ultimate 30% economic interest in the IPP. At the beginning, Jaks owns zero economic interest in the IPP. As time goes by, the construction profit allocated to it by the China partner will be automatically ploughed into the IPP as capital injection. So it is true that Jaks does not get to lay its hand on the profit. However, as construction progresses, its economic interest in the Vietnam IPP will gradually increase. At the point of completion, it will own 30% of the IPP, without the need to inject much capital.

How can it be not real ?

3. Next Quarter Result Could Potentially Be Bad

Next quarter result might factor in losses related to the RM50 mil Bank Guarantee (if they loss the court case). But it is a one off exceptional item. I think most investors will ignore it and focus on the actual operating figures.

4. Any Regret Buying Into Jaks ?

Nope. So far so good. Price has declined to around 95 sen. But that is peanuts compared to my average cost of RM1.00+.

My investment thesis for Jaks remained unchanged. Balance sheet remained reasonably sound with RM460 mil interest bearing debt backed by RM220 mil cash. The group is unlikely to get into financial difficulty.

I am happily holding on, with my eyes on end 2019 for potential 100% gain.

Have a nice day.

https://klse.i3investor.com/blogs/icon8888/171767.jsp