The below commentary is solely used for educational purposes. This is my point of view using technical analysis and fundamental analysis. The commentary should not be construed as an investment advice or any form of recommendation. If you need an investment advice, please consult a licensed investment advisor. Most important do your homework before you invest. You are liable since you are the one pressing the buy and sell button.

Help my friends to advertise - free information stock ideas (technical analysis) and market outlook report available via

Telegram: https://t.me/KLSELION

Facebook: https://www.facebook.com/KLSELION/

Fundamental ViewCompany Background

Dancomech Holdings Bhd (DANCO) is engaged in trading and distribution of PCE and Measurement Instruments. The Company offer its products to palm oil and oleochemicals, oil & gas and petrochemical, and water treatment & sewerage industries. The majority of its customers are from industries such as palm oil and oleochemicals, oil and gas and petrochemical, water treatment and sewerage. For now, it has a diverse customer base of 1,459 customers from various industries.

The company hasn’t recorded any losses over the last 30 years, not even in 1997.

Cash Rich Company

This company is a relatively cash rich company. Danco is currently sitting on a huge cashpile of RM49.9mil, translates to 29.6sen/share. Gearing is relatively low. The company stands to enjoy a cleaner balance sheet with a growing corporate treasury to fund future growth.

Recovery of Oil & Gas Business Spurs the Demand of Equipment

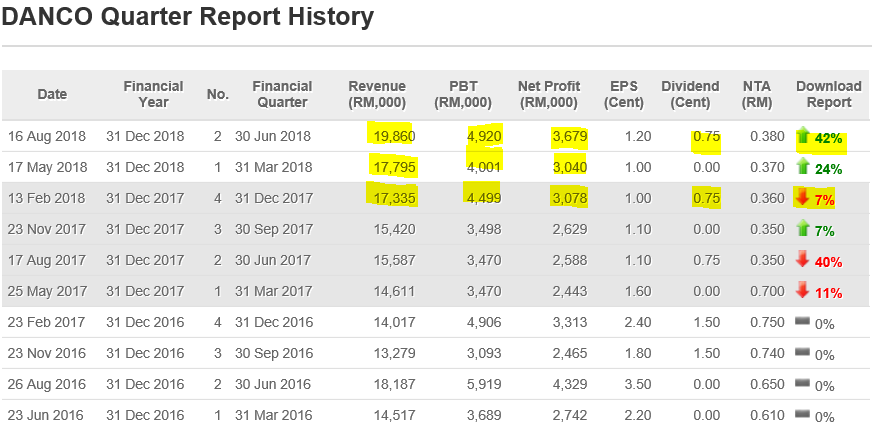

As big oil companies slashed investment on new projects and exploration during the downturn, the sales of equipment turn slowed. However, boosted by higher crude prices recently, the company sales had improved in recent quarter. Latest result as below:

Expansion in Johor Bahru For Rapid Project

During the IPO, Dancomech raised RM18mil, out of which RM6.5mil has been earmarked for expansion - namely for the purchase of offices or a warehouse. Specifically, Dancomech is looking to spend some RM2.5mil for a new office cum store in Johor Bahru.

“Johor is an extremely important market for us. The setting up of a new office in Johor Bahru will enable us to implement our business strategies, expand our market coverage and customer base, as well as strengthen our position in Johor,” said Daniel.

Daniel said that there was already increased demand for its products in tandem with the on-going Refinery and Petrochemical Integrated Development (Rapid) project in Pengerang, Johor.

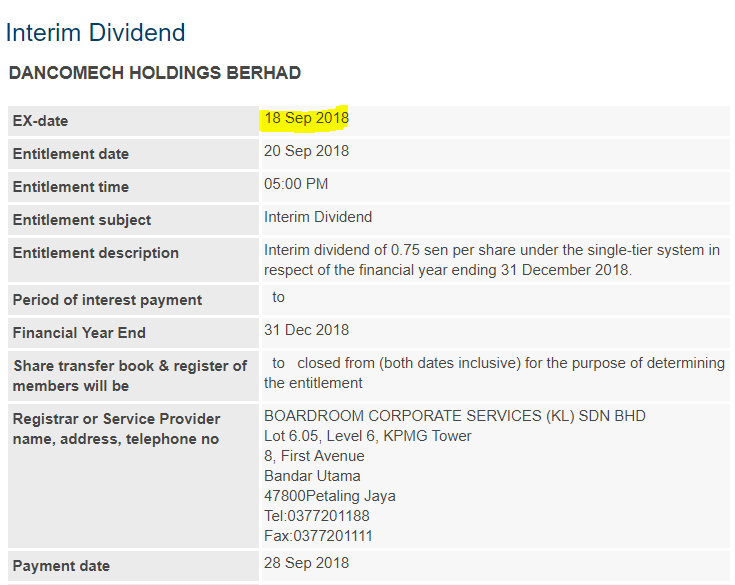

Consistently Rewarding Shareholders

Dancomech implemented a dividend payout ratio of up to 30% of its future net profits to shareholders. Yield about 3.33% per annum which are better than FD in bank.

Recent Dividend:

Peer Analysis

Presently there are only four to five players in the valves business. Danco’s closest listed peer is Unimech Bhd. Compared to peers, Danco is doing relatively quite well compared to peers.

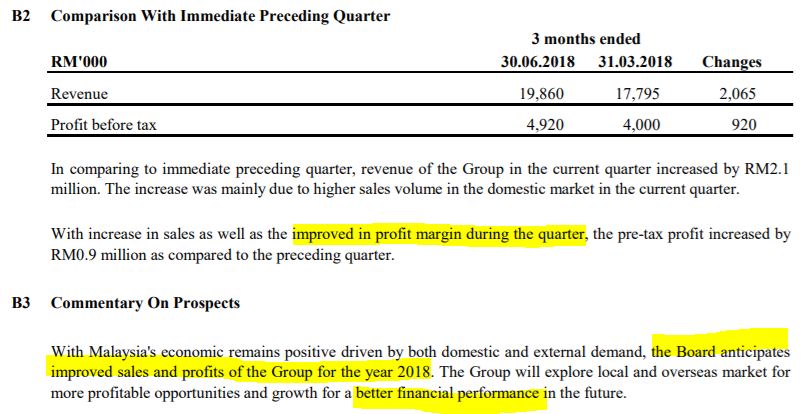

Promising Prospect in Near Term

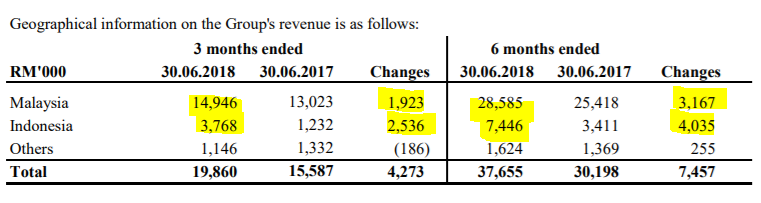

Doing Well in Local Market and Indonesia

Stock Price Below Intrinsic Value

I calculated the intrinsic value around 0.64 based on current earnings and growth which I feel undervalued for an equipment and instruments company. “This is not a buy call!”

Technical Analysis

Ascending Triangle in the making. Once break 50 cents, next resistance will be 54cents. Danco have been traded actively since after result annoucement in August, the company uptrending after result annoucement.

Thanks for viewing. Hope everyone can be benefited from this sharing. Stay tuned with me for next company sharing.

Stock Theme.

https://klse.i3investor.com/blogs/Dancomech/174255.jsp