On 1 Sept 2018, I've posted an article namely, " A Stock Pitch to Koon Yew Yin - Lay Hong Berhad". Please see the link below for your reference. As a result, the share price has bottomed out & moved up from RM0.53 to RM0.67, signifying a 26% of return in two weeks time.

Note: The green arrow shows the point of time where previous article on LayHong was posted.

Source: https://klse.i3investor.com/blogs/lionind88/

Today, a golden opportunity has arrived for LayHong-WA.

LayHong-WA was traded at the peak of RM0.80 few months ago. Unfortunately, it has dropped to RM0.255 as of today, 23 Sept 2018. It has dropped by more than 68%. What value has been emerged?

1. LayHong-WA is traded at negative premium. A no-brainer Buy.

In other words, it is a no-brainer buy. With the nature of 3 years of maturity and 2.63 gearing ratio, the average premium should be around 20% by using other company warrants as a reference.

At premium of 20%, LayHong-WA price would be valued at more than RM0.40. It shows a 57% upside.

2. LayHong Eggs Prices Shoot to the Sky

Due to the weather problem in China, the eggs production has been reduced substantially in China. As a result, Hong Kong who usually imports eggs from China, has decided to buy the eggs from Malaysia. As a result, eggs prices shot up to the sky and it will help to improve the profitability of LayHong tremondously.

Source: http://www.orientaldaily.com.my/s/260540

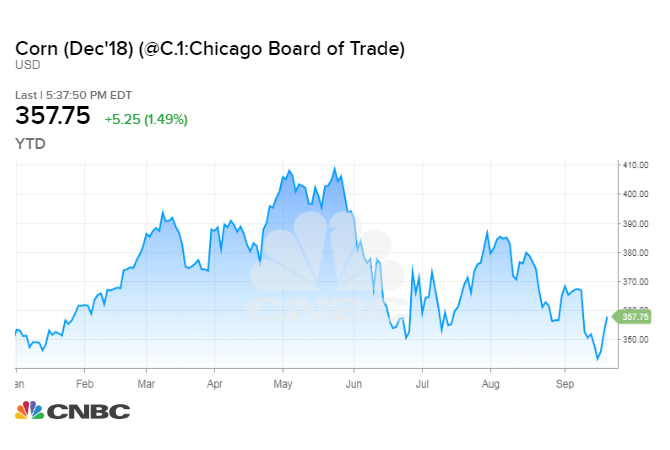

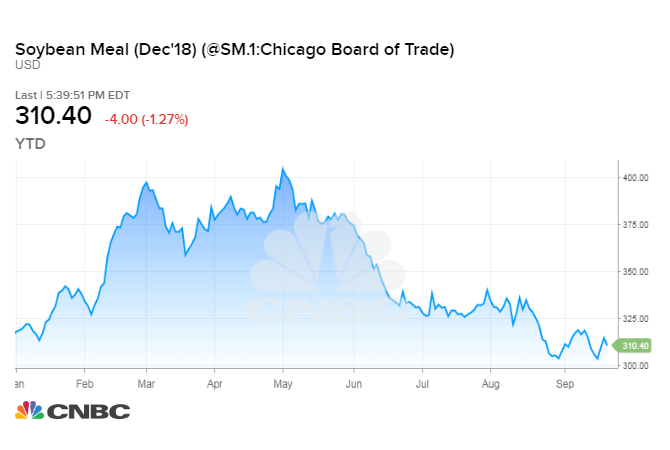

3. Raw Materials Costs - A New Low

LayHong's raw materials come from Corn and Soybean Meal. Based on the latest data, the prices for corn and soybean meal dropped significantly and it means lower cost for LayHong - which will potentially lead to higher profit.

Conclusion:

Please do your own research and homework and I believe you will eventually find how attractive LayHong-WA is at current price of RM0.255. Happy investing!

https://klse.i3investor.com/blogs/lionind88/175063.jsp