The below commentary is solely used for educational purposes. This is my point of view using technical analysis and fundamental analysis. The commentary should not be construed as an investment advice or any form of recommendation. If you need an investment advice, please consult a licensed investment advisor. Most important do your homework before you invest. You are liable since you are the one pressing the buy and sell button.

Help my friends to advertise - free information stock ideas (technical analysis) and market outlook report available via

Telegram: https://t.me/KLSELION

Facebook: https://www.facebook.com/KLSELION/

Another stock to be “meletup” after I wrote on CCM, shall PRLEXUS follow as well? I encourage my followers to buy low now sell high later rather than buy high and sell higher to ensure some safety for margin. The intrinsic value of a company determines to undervalue stocks or overvalued stocks.

Company Core Business:

PRLEXUS is a manufacturer of sportswear for Nike Inc, ASICS and Under Armour and the rest of the market share are belongs to other and new customers. On 20th June 2016, the group raised RM56.8 million via a rights issue. The proceeds were earmarked for the setting up of an apparel factory in Vietnam and the fabric mill.

Fundamental View

The information adopted from:

http://www.theedgemarkets.com/article/fabric-mill-seen-turning-point-prolexus-growth

The financial year 2019 could see a “turning point” in Prolexus Bhd’s growth as its first fabric mill comes on stream in the first half of next year, says executive chairman Ahmad Mustapha Ghazali.

Prolexus Berhad will publish their coming result at the coming end of September with reporting the financial year 2019. Will the stock price increase before result release?

Let’s us reveal the current situation that the company facing:

Vietnam Plant Expansion Plan Benefits from Trade War

The Vietnam project is a casualty of US President Donald Trump’s decision to withdraw from the controversial Trans-Pacific Partnership agreement. The trade deal would have brought benefits to textile and apparel industry players like Prolexus, mainly in the form of an elimination of tariffs and duties among the TPP countries.

The labours of Vietnam are relatively cheaper than local which can lower down the production cost in near future.

Strengthening US Dollar

Profit before taxation on last quarter result was lower due to the weakening of the US Dollar. However, the dollar has strengthened and traded around $4.10- $4.15. Ringgit traded on 2nd of May $3.9265 (Source: Bank Negara) compared to today’s rate $4.13. The increased about 5.12%. Will help to increase profit before tax?

Had Sales of 2018 FIFA World Cup factor in?

What next after World Cup? The order is coming in for the 2020 Summer Olympics in Tokyo to boost sportswear sales. Again, the theme of Olympics in Tokyo would spur the interest of traders and investors.

Peer Analysis

In the garment business, Prolexus’ closest local peers are Magni-Tech Industries Bhd and MWE Holding Berhad (Delisted soon). Magni-Tech Industries Bhd is doing relatively well due to the strengthening of US Dollar on the recent quarter result. Will Prolexus follow Magni as well?

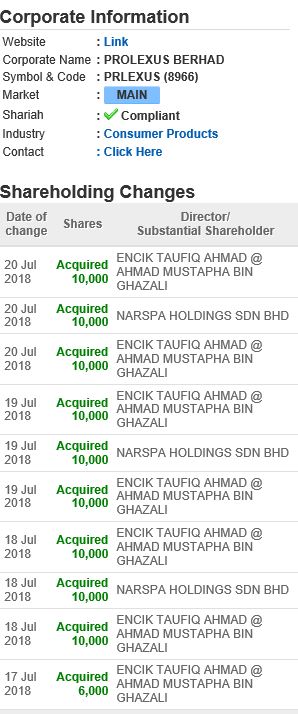

Insider Buying

A direction of the company relies on the director as well. Since the director as buy, this will increase the confidence of the shareholders.

Technical Analysis

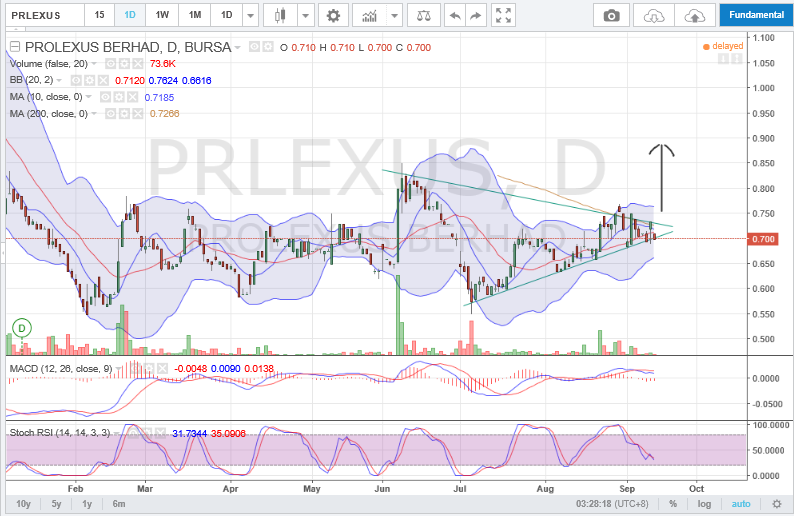

Chart wise: Symmetrical Triangle in the making. Once break 75 cents, 80 cents, next resistance will be 90cents. Prlexus have been consolidating since February, the longer it consolidated, the explosion will be more powerful.

End of Sharing. Hope everyone can be benefited from this sharing. Stay tune with me for next company sharing.

Stock Theme.

https://klse.i3investor.com/blogs/prlexusberhad/174131.jsp