I have covered Thong Guan since Dec 2015. My 1st article about Tguan. https://klse.i3investor.com/blogs/thongguan/88654.jsp

Written total 15 article about Thong Guan and the last published on 26 Aug 2017.

Thong Guan share price started crashing in November 2017. A drop of 42% as of today from approximately RM 4.50 in end 2017.

I think now is the time for me to buy more again and if I'm luckly, I may profit another round like 2015. Why i say so?

Reason No.1

If you have read all my articles, there are several points i always emphasize when i buy Thong Guan.

1) Thong Guan is operating on Cost-Plus basic. Meaning any movement on the cost will have significant impact to Thong Guan Gross Profit Margin. The cost-past-through must be as efficient as possible while saving -pass-through must be as inefficient as possible.

2) Main cost of the business is Resin (in particular LLDPE). I usually track this cost based on Cost of Goods Sold

3) The resin price is influenced by the feed stock type, either crude oil or natural gas. Crude oil price up WILL NOT result in resin price up. https://klse.i3investor.com/blogs/thongguan/98542.jsp

Now, let revisit the main factor that affecting Thong Guan's gross profit margin. The LLDPE resin. (other type of resin response similarly)

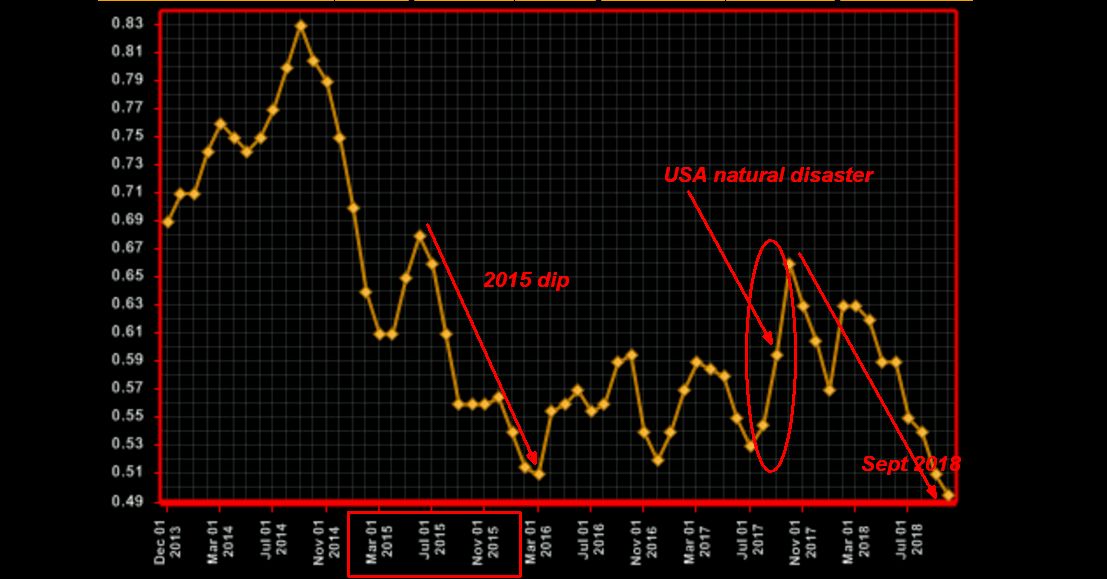

Above chart show latest LLDPE price till 27 Sept 2018. Notice that:

(1) current resin price is at multi year low, even lower than 2015- 2016.

(2) the spike in end 2017 due to USA disaster has reflected in Thong Guan 2017 Q4 result. (Apparently the cost-past-through was not efficient as it used to be.

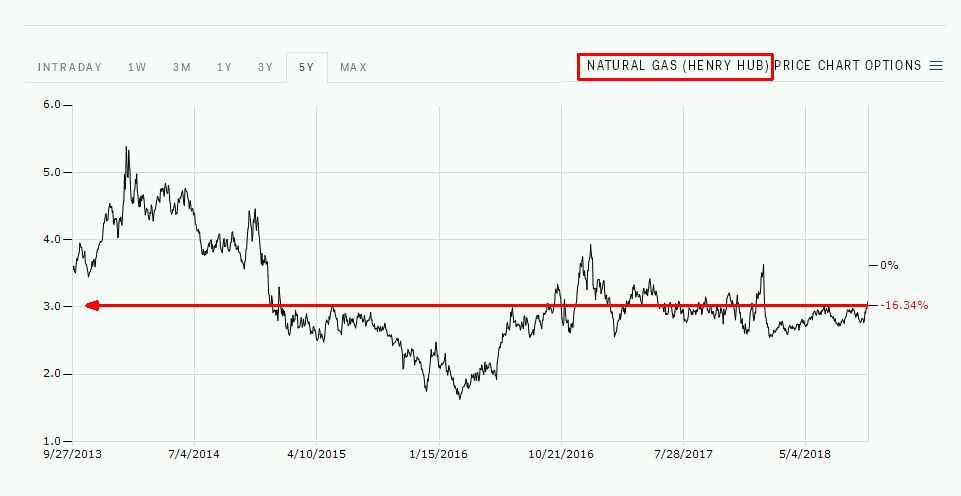

(3) The continue down trend in resin price is mainly due to stable natural gas price and over supply of resin after 2016 where many facilities has come online. The chart below show the price of natural gas and brent crude oil, the price is relatively stable for natural gas at around USD 3.00 per mmBTU, but brent crude has advanced to above USD 81/bl. This show the positive relationship between resin and natural gas, not crude oil.

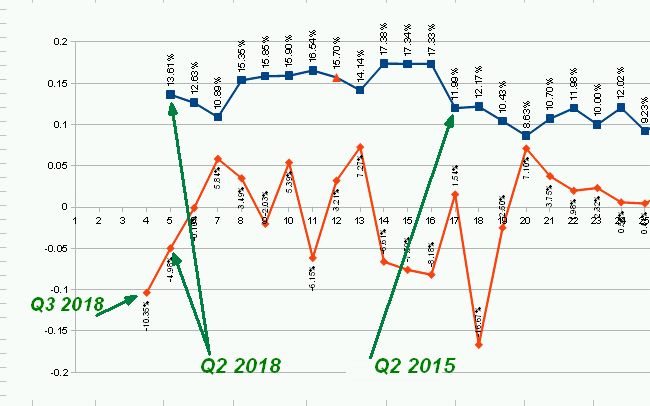

Let check back the cost-past-through graph again. I have put in latest average resin price change for Q3 2018.

Above graph shows the impact on resin price change (red line) to Thong Guan Gross Profit Margin.

(1) Notice that Thong Guan Gross Profit has been recovering steadily from 10.69% Q4 2017 (due to unexpected resin price spike), to 12.63% Q1 2018 to 13.61% in (Q2 2018

(2) Further tipping of resin price should propel the gross profit margin. Currently the permanent factor that suppressing resin price is the major new resin facilities go online which increases the supply. An acute factor is the trade war tariff on plastic resin. The concept i suppose is quite similar to USA corn price.

Reason No.2

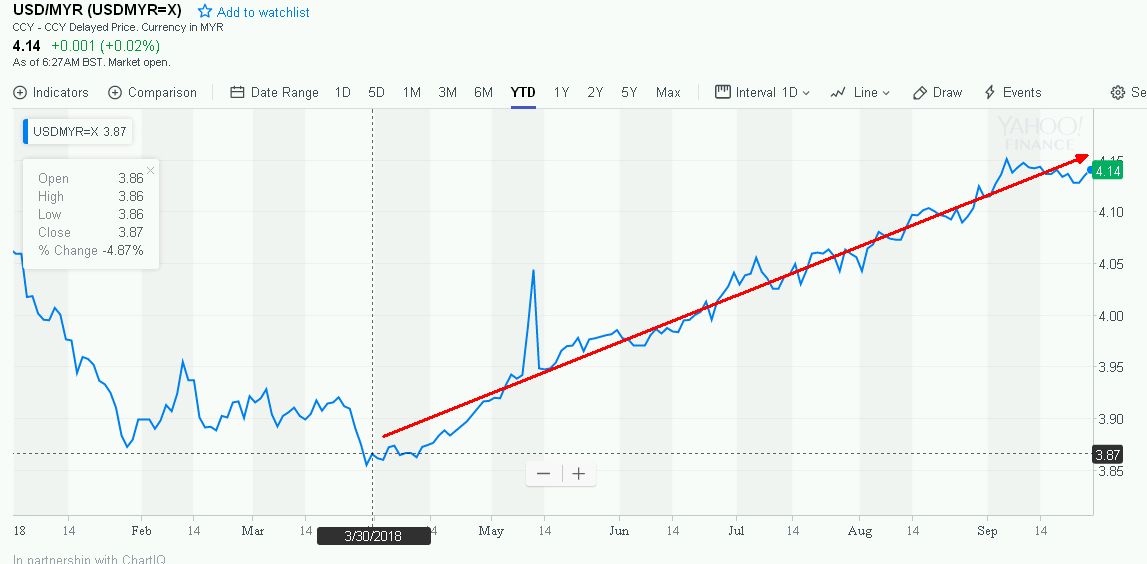

Weakening Ringgit will generally benefit Thong Guan. (But, it again depends on Net Foreign currency exposure of Thong Guan. https://klse.i3investor.com/blogs/thongguan/90965.jsp)

Reason No. 3

Thong Guan's core earning is recovering for the past several quarters.

Q2 18 - RM 10.224 mil (further recovering)

Q1 18 - RM 9.429 mil (recovering)

Q4 17 - RM 5.067 mil (hit by resin price spike)

Q3 17 - RM 15.575 mil

Reason No. 4

Trade war Beneficialy: https://www.thestar.com.my/business/business-news/2018/08/06/thong-guan-spending-rm35mil-to-expand-capacity-at-sungai-petani-plant/

Target Price:

Based on 2015'Q3 to 2017' Q3 (Total 9 quarters with favourable forex and resin trend),

Average quarter revenue stood at RM 193.4 mil & Average quarter core profit stood at RM 14.8 mil.

This offer an average net profit margin of 7.65 %

By speculating Thong Guan Next 4 quarter total Revenue at RM 840 mil (being RM 420 mil 1H 2018 x 2),

That offer Thong Guan RM 64.3 mil net profit.

At current total outstanding shares of 136 mil, projected EPS for trailling 12 months should be RM 0.47.

At PE 10, RM 4.70 should be reaceable within 1 year.

Key risk: Resin price spike due to unforseen circumstances.

Conclusion:

I shall see if i will get my 2nd round.

Cheers,

YiStock

Some of my opinion for F&B segment:

|

chankp7010,

Q1 2018 F&B segment Loss Before Tax was amounted to RM 326k while Profit Before Tax for plastic segment was RM 10.1 mil. I would say the F&B segment P/L is really not significant at the moment. Posted by chankp7010 > Jul 16, 2018 12:14 PM | Report Abuse May I ask YiStock if you had taken into account the losses incurred for the food and beverages dept? If Q 2 profit is above RM12 mil, then the price will definitely move north soon. Thank you. |

Fabien, is way below my expectation. It was like totally NO cost-past-through.

The gross margin for Q4 had fallen to only 10.9% in comparison to immediate 3 quarter average of 15.7%. Roughly 4.8% spike in resin price; which is equivalent to RM10.1 mil profit roughly, did not pass over to customers. Why no cost pass through? My speculation of reason is the spike is not caused by oil/ natural gas but 1 off natural disaster. I hope somebody can go to question the management in coming AGM.

Together with RM 2 mil forex loss, i would say approximately RM 12 mil of knee jerk in Q4 2017.

The gross margin for Q4 had fallen to only 10.9% in comparison to immediate 3 quarter average of 15.7%. Roughly 4.8% spike in resin price; which is equivalent to RM10.1 mil profit roughly, did not pass over to customers. Why no cost pass through? My speculation of reason is the spike is not caused by oil/ natural gas but 1 off natural disaster. I hope somebody can go to question the management in coming AGM.

Together with RM 2 mil forex loss, i would say approximately RM 12 mil of knee jerk in Q4 2017.

Marche restaurant did not really impact the earning i think. I say so because of the

1% different of administrative cost compared to total revenue between Q3 & Q4 2017.

Furthermore, the higher cost could be due to set up cost, thereafter, the running cost should stabilized too.

Anyway, the resin cost has now stabilized. Restaurant already buka for biz.

Conclusion: I hope this Q4 17 is 1 off knee-jerk. Total revenue is still pretty impressive.

Fabien Extraordinaire Stock: [TGUAN]: THONG GUAN INDUSTRIES BHD

Jan 30, 2018 11:01 AM | Report Abuse

@YiStock, was the recent Q4 margin compression within ur expectations?

02/03/2018 11:31

https://klse.i3investor.com/blogs/thongguan/175763.jsp