One of the most common thing we read when investing is the word “10 PE”. We usually see it in different ways,

“Buy only if below 10PE”

“This company should be worth at least 10PE”

Etc.

Why is this the case? Well, here’s how it came about. You need to first start to think of things in terms of %.

10 PE in this case is 10%.

Why 10%? Well, when investing, in order for someone to take more risk, the particular asset need to appear to provide higher returns. For example,

Fixed Deposit/Money Market: 3.5%

5 year Treasury: 4%

5 year Treasury: 4%

10 Year Treasury 4.5%

AAA Bonds: 5%

SP500 stocks: 10%

Low grade bonds: 11%

Penny Stocks: 13%

Real Estate: 15%

Venture Capital: 25%

Why is there such a big jump from AAA bonds to stocks? Well, for bonds, there is a fixed coupon rate (lets say 5%), and the capital is almost guaranteed, depending on what it is backed by, and if you studied it properly.

Stocks on the other hand, do not have a fixed coupon, but it has earnings. One can then use one’s judgement to estimate the future earnings of the company, and thus derive a coupon rate.

Low grade bonds and penny stocks, due to lower liquidity as well as potentially shakier business, one would naturally require a higher rate of return.

For real estate, liquidity is close to zero, and thus it only makes sense if you can appear get significantly higher returns.

For venture capital, a lot of it is very speculative, with more than 70% of investments failing, or may often require a greater fool to buy at a higher price, and is highly illiquid, it would need to appear to provide much much higher returns, in order to someone to be willing to invest.

“Appear”

One of the words you may have noticed me using often when writing this article is “Appear”.“When investing, in order for someone to take more risk, the particular asset need to APPEAR to provide higher returns”

Why do i say appear? This is because for me, the phrase “High Risk, High Return” and “Low Risk, Low Return” does not make sense.

Just because it appears to give higher returns does not necessarily result in that.

The expected value of high risk, high reward investments and low risk, low reward investments is exactly the same.

For example,

-

10 high risk, high reward investment of RM1,000 each, for a total of RM10,000.

-

10 low risk, low reward investment of RM1,000 each, for a total of RM10,000.

For the person making the low risk low reward investment, none of his investment died, and all returned 20%. He ends up with RM12,000, and a return of 20%.

What we need to aim for, is strong management of risk, “Low Risk, High return”, “High risk, extremely high return” etc.

In addition, the reason why these asset class that appear to give higher returns, is also because they are unpopular to begin with! And thus only have small amounts of money invested in it, enabling those with the time to find great deals.

But the moment, they become popular, the prospective returns will be pressed by the sheer amount of money invested.

Investing is one of those odd areas, where the more popular it is, the more likely you are to make losses.

But the moment, they become popular, the prospective returns will be pressed by the sheer amount of money invested.

Investing is one of those odd areas, where the more popular it is, the more likely you are to make losses.

Applying this in investing

Therefore, by using 10 PE or 10% return. Or in other words, to be able to obtain your entire investment over 10 years (undiscounted) along with the principal (which due to zero growth in earnings, does not change).This is a reasonable amount of expected baseline return for a company that does not grow, when it comes to stocks.

Does this mean that say, 20PE, or 5% return on investment is unreasonable? Well this depends. There are a few scenarios, where it would make sense to pay a high price.

-

The earnings of the business is absolutely certain (or at least much more).

This is why people are willing to prescribe higher PE to REITS or consumer goods. There is a saying, if you know the business extremely well, you don’t really need a margin of safety.

However, do not that economic reality changes can be drastic. SEARS, went from being the absolute biggest and monopoly in retail in the US, to almost bankrupt. The stock price went from a peak of USD155 to USD0.4.

That is a 99.74% drop in value. It’s usually what you don’t even know that you don’t know that kills you.

-

The company’s earnings is expected to grow around 15% per annum for 10 year.

If a company’s earnings grow at 15% per annum, by the end of the 10 years, it would essentially earn back its entire investment (assuming you paid 20 times earnings) undiscounted.

However, if it was discounted to present value, ( a bird in hand is worth more than bird in the bush), it may not be worth it. Therefore, the rule of thumb is that, a company where you pay 20PE, needs to be able to grow earnings at 20% per annum for 10 years in order to be worth it.

Rule of thumb: For every additional 1PE, you need an additional 2% growth in earnings.

20PE; 20% Growth

19PE: 18% Growth

18PE: 16% Growth

17PE: 14% Growth

16PE: 12% Growth

15PE: 10% Growth

14PE: 8% Growth

13PE: 6% Growth

12PE: 4% Growth

11PE: 2% Growth

10PE: 0% growth.

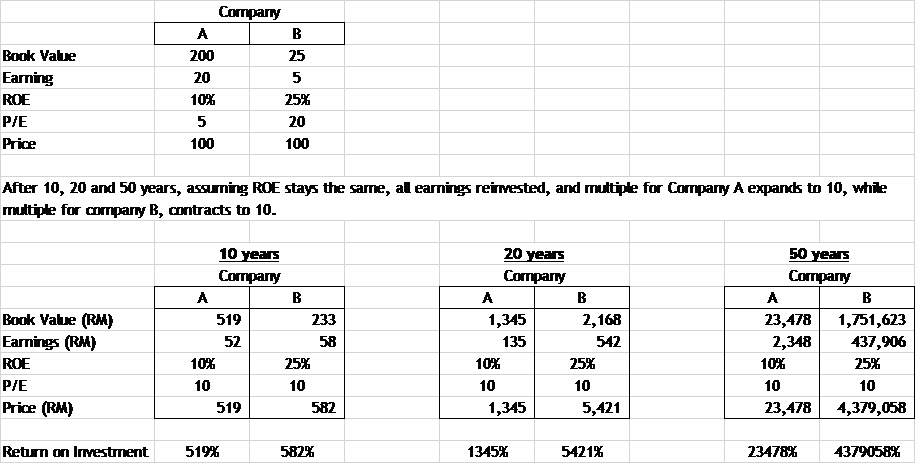

However, as we are buying a company and not a bond, the value of our principle actually increase when earnings grow, instead of being fixed.

As we can see from this table,

I wrote something briefly on this,

https://klse.i3investor.com/blogs/PilosopoCapital/164458.jsp

Which is why, when it comes to investing in stocks. It is much more lucrative to strive to find wonderful companies at fair or even somewhat above fair value.

Having said that, this is relatively common knowledge, it is one of Warren Buffets most famous sayings after all.

And thus, when a company like this is identified, they are often extremely expensive and priced to perfection. With investors often being willing to pay even 30-50PE for companies whose future or current growth is far from certain.

However, few things can be as rewarding financially and mentally as finding a few of these companies to invest in your lifetime.

Conclusion

I hope this was as useful to you, as it was to me when i found out, and as i wrote this piece.

As always, let me know what you think, criticism is always PREFERRED.

And even if it’s just blind criticism, it’s ok. When Stockraider calls you a pondan, it probably means you are on the right track! ahaha

https://klse.i3investor.com/blog/PilosopoCapital/178096.jsp