The article written here is for the purpose of sharing idea. Neither promoting nor cornering the stock.

UCREST is AN UNDERVALUED GEM

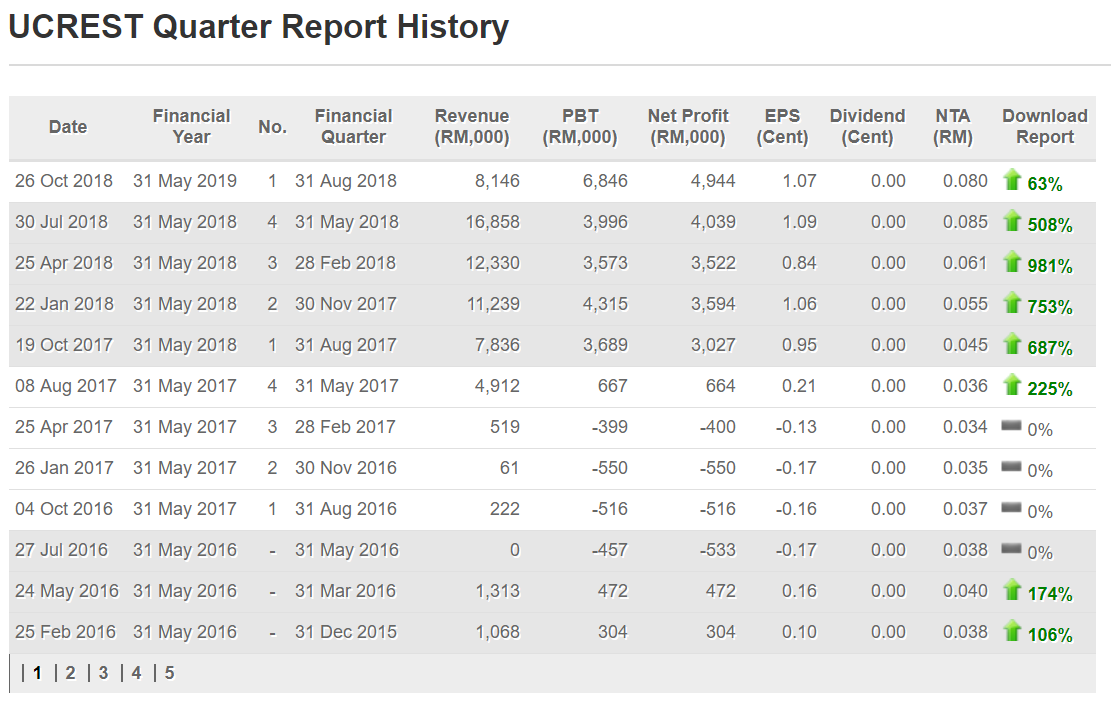

The market has strongly underappreciated the stock despite its strong 1QFY19 earnings. Its FY19 is ended in May 2019.

Maybe investors do not understand to read its 1QFY19 earnings.

For your information, its 1QFY19 was its core earnings. The reason its gross profit was same with its revenue due to no hardware (device) to sell in that particular period. Therefore, no cost of goods sold incurred.

So, if we annualised its 1Q19 EPS, we would get 4.3sen for its FY19EPS as a base case estimate. At current price, it has traded at PE of only 6.7x!

Are you kidding me? UCREST is the only technology player in the world provides ''cloud hospital system''. The cloud is a new digital and big thing to healthcare industry.

Alibaba or other global technology players are also eyeing to penetrate into healthcare industry but they are more towards payment gateway.

In other words, the cloud is allowing patients to receive personal care from doctor no matter where they are.

The cloud system bridges the physical gap between doctor and patients. It connects multiple medical, healthcare, fitness and tracking devices, with mobile applications running on smartphones and tablets, which enables patients to measure their vital signs such as blood pressure, blood oxygen level, body temperature, bone density, body mass index and others, and upload them to the cloud system.

The information will then be accessed and assessed by doctors who could then provide consultations to their patients online.

The cloud is currently used by renowned doctors and patients in US, China, Singapore, Malaysia, Taiwan, Indonesia, Russia and Middle East countries for the diagnosis, management and treatment of chronic diseases such as cardiovascular diseases (CVD), cancer, diabetes, hypertension, sleep apnea, stroke rehabilitation and other diseases.

It has started implement this cloud and mostly in Russia as the country is ready to move towards digitalisation.

The group is also working towards becoming a licensee to set up Pathway’s clinical laboratories in its existing markets outside of Malaysia, of which China appears to be a primary choice.

Why investors should not concern with its orderbook?

What investors misunderstood is its orderbook is depleting while this is not the case. It already has secured patients and will grow from here when they penetrate into more hospitals and more markets.

If we assess its 1Q19 earnings, it is on an uptrend although revenue was lower QoQ. This is because no revenue was generated from hardware products as no hardware product to sell. However, this product is not its core business. It depends on its customers' order and the Group just buy the hardware from vendor to complement its cloud system and make a slim margin from it.

Its core revenue and profit is what you see in 1Q19, which is from software (cloud system). GPM margin and net profit margin would remain volatile but I advise you not to look at it as a measurement for its outlook. This is accounting treatment for software company. Therefore, I would rather look at its uptrend in its profit.

More profit to come!

What you see in FY18 (ended May 2018) was the beginning of profit growth. FY19 and FY20 would be snowballing from FY18, which translate into huge earnings jump.

Its profit is expected to continue growing higher as its cloud system will generate more revenue from increasing number of hospitals' patients. Currently, they have just secured few hospitals in Russia and China.

Not resting on its laurels, UCREST is expected to penetrate into more thousands hospitals in Russia and China and secure more patients going forward and in fact, China market is even bigger than Russia.

In base case estimate, its FY19EPS of 4.3sen is conservative and it could perform even better than this.

Valuation wise

UCREST is another type of technology player and play important role in healthcare industry. If we compare with its closest competitor, there is none. To be fairly valued, it should be between technology players and healthcare players multiple.

Looking at D&O, Techfast, Eforce and other similar type of technology players have traded at least at 20x PE or above even though market cap are just between RM100mil and RM300mil.

Meanwhile, KPJ has traded at 32x.

To be conservative, if we were to peg at discount 20% to technology players and 50% to healthcare player, which is 16x PE to UCREST's annualised FY19 EPS of 4.3sen, UCREST is fairly valued at 69sen! Its current price is 29sen only.

We think UCREST is recesion proof stock as its profit generated from healthcare industry. With this and its technology system, UCREST deserves to be trading at 16x! Therefore, by right, its share price would remain stable when the market is down and skyrocket when the market is up.

https://klse.i3investor.com/blogs/dieforrich/181153.jsp