Tuan-tuan and puan-puan, I know that many lose mood over many small

caps plunge as well as lacklustre KLCI performance. New year is coming,

and life goes on. I wish all traders and investors at i3 a resilient

year ahead as we look forward to the uncertain future with the

determination to do better for ourselves and our loved ones.

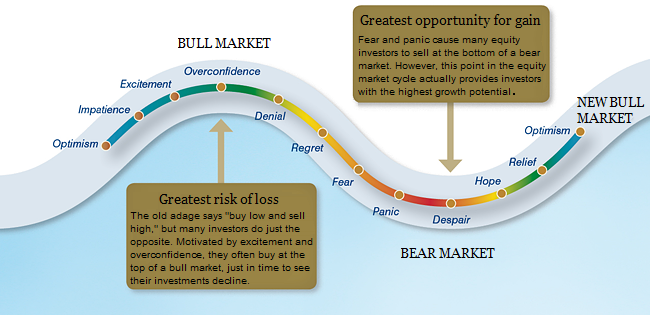

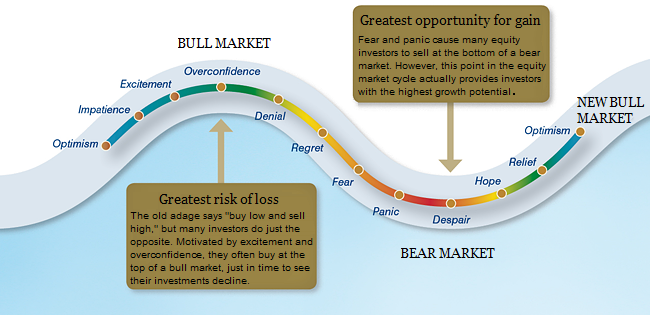

Here are some homework I did as part of my preparatory examination into the PhD programme. I will be embarking a journey in the area of behavioral finance. Specifically, I focus on the role personality plays in making financial decision. Potential mediating factors include investor's biases, which is the purpose of this post. If you find it boring, maybe this picture will help (that's what I will be studying).

As an introductory work, there are some two dozens of biases documented and studied in the ivory tower of academia. The surge of interest on behavioral finance (as opposed to rational finance) is seen on wealth management. Questions like why we tend to buy at the tops and sell at the bottoms, for example, have a deeper explanation. If time permits, I will present my work-in-progress as I slowly chew and digest this field of knowledge.

Recent drama at i3community on margin calls, people losing their underpants, or betting too big on one position is not a novel phenomenon. Yet, it is novel every time it surfaces on public forum like this, because it helps us to be sober and exercise due diligence in our decisions. To quickly capitalize these stories as enduring lessons (hopefully), here are few biases as a start:

1) Commitment bias

2) Confirmation bias

3) Overconfidence bias

Let's start with commitment bias. Imagine that you're in a poker game. You are half way through the game, and the money on the table gets larger. You betted a meaningful portion of your wealth too. Now what do you do? All the people are watching at your next action. Commitment bias says that one tends to consistently support a past idea or decision because of the ongoing effort (time, money, resources) invested on a particular task. Commitment bias is present when one favors his own position over increasing evidence against his thesis. You can't stop halfway. You need to keep raising the stake in order to win the game.

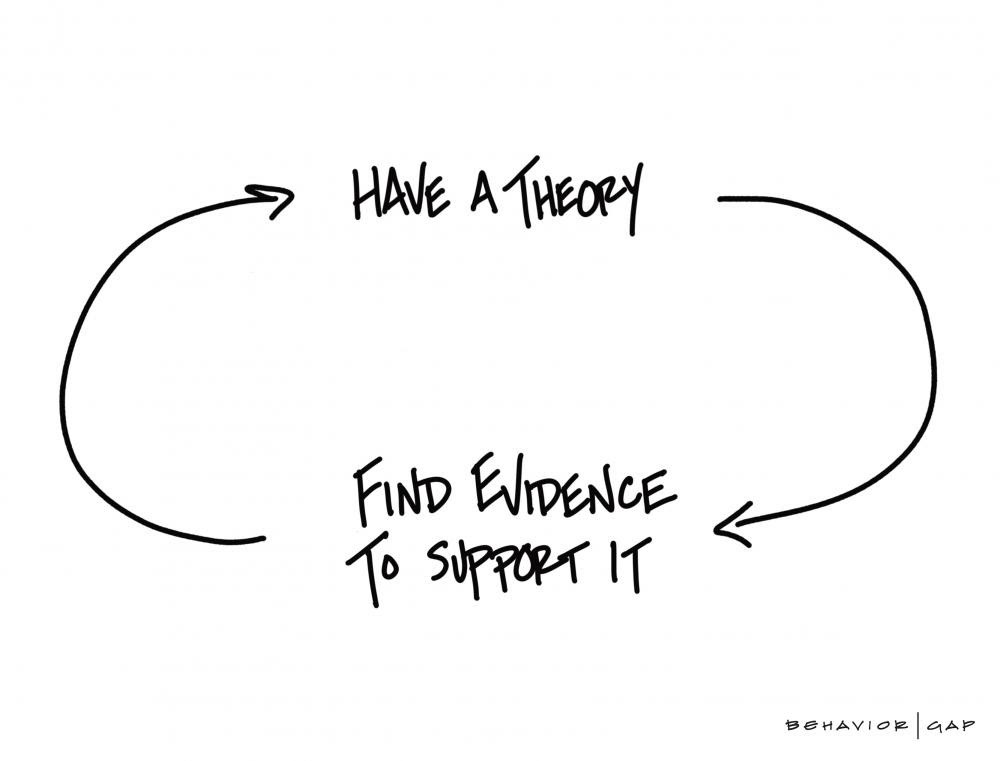

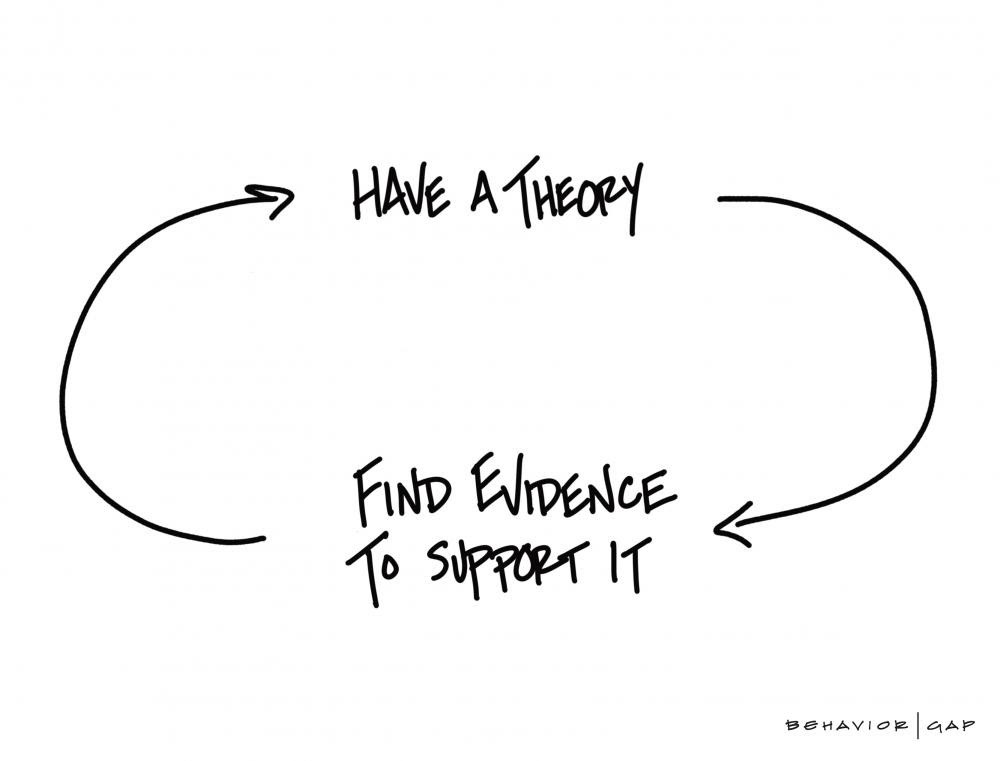

Confirmation bias works hand-in-hand with the commitment bias. What the former does is that because of increasing resources dedicated to one's position, he or she seeks to further confirm his stand by selectively gathering new information that supports his earlier decision. This is popular in the debate scene, where one conveniently ignored arguments made by the counter party. I must be right, and here is my evidence.

Overconfidence bias, as self-explanatory as it was, is the killer of execution. A person get confident when he has done his homework. A person then get over confident when with his homework he has a consecutive winning records under his belt. This is normally depicted by star fund managers who outperformed the benchmark over a few years period. If left unchecked, it can lead to flowerly promise. All it takes is one wrong forecast, or one bad year to wipe his reputation off the market. What this bias essentially points to us is that when we get over confident, we tend to equate ourselves as someone capable. I made money, it must be me. The reality is, stock market return is outside one's control.

What do you think? Can we overcome these three biases in financial decision? Happy winter solace and Merry Christmas.

https://klse.i3investor.com/blogs/testing.com/187536.jsp

Here are some homework I did as part of my preparatory examination into the PhD programme. I will be embarking a journey in the area of behavioral finance. Specifically, I focus on the role personality plays in making financial decision. Potential mediating factors include investor's biases, which is the purpose of this post. If you find it boring, maybe this picture will help (that's what I will be studying).

As an introductory work, there are some two dozens of biases documented and studied in the ivory tower of academia. The surge of interest on behavioral finance (as opposed to rational finance) is seen on wealth management. Questions like why we tend to buy at the tops and sell at the bottoms, for example, have a deeper explanation. If time permits, I will present my work-in-progress as I slowly chew and digest this field of knowledge.

Recent drama at i3community on margin calls, people losing their underpants, or betting too big on one position is not a novel phenomenon. Yet, it is novel every time it surfaces on public forum like this, because it helps us to be sober and exercise due diligence in our decisions. To quickly capitalize these stories as enduring lessons (hopefully), here are few biases as a start:

1) Commitment bias

2) Confirmation bias

3) Overconfidence bias

Let's start with commitment bias. Imagine that you're in a poker game. You are half way through the game, and the money on the table gets larger. You betted a meaningful portion of your wealth too. Now what do you do? All the people are watching at your next action. Commitment bias says that one tends to consistently support a past idea or decision because of the ongoing effort (time, money, resources) invested on a particular task. Commitment bias is present when one favors his own position over increasing evidence against his thesis. You can't stop halfway. You need to keep raising the stake in order to win the game.

Confirmation bias works hand-in-hand with the commitment bias. What the former does is that because of increasing resources dedicated to one's position, he or she seeks to further confirm his stand by selectively gathering new information that supports his earlier decision. This is popular in the debate scene, where one conveniently ignored arguments made by the counter party. I must be right, and here is my evidence.

Overconfidence bias, as self-explanatory as it was, is the killer of execution. A person get confident when he has done his homework. A person then get over confident when with his homework he has a consecutive winning records under his belt. This is normally depicted by star fund managers who outperformed the benchmark over a few years period. If left unchecked, it can lead to flowerly promise. All it takes is one wrong forecast, or one bad year to wipe his reputation off the market. What this bias essentially points to us is that when we get over confident, we tend to equate ourselves as someone capable. I made money, it must be me. The reality is, stock market return is outside one's control.

What do you think? Can we overcome these three biases in financial decision? Happy winter solace and Merry Christmas.

|

To vote for Bursa's Templeton Meter: https://docs.google.com/forms/d/e/1FAIpQLSeuyzVxpup3KfBSsdc3GHvcyf7pHKJ_04Mjcpjj7rMMtKvibA/viewform?usp=sf_link |

|

To ask a question: https://klse.i3investor.com/blogs/testing.com/183645.jsp |