Prestariang... No SKIN, No Meat, only bones. A quick takeaway...

So, in an unexpected turn of event, the government cancelled SKIN project. Without SKIN, Prestariang is left with businesses that's pretty uninspiring.

1) Business segments Prestariang has 4 main business segments... a) Software & Services & Academy - distribute and manage software licensing and providing IT and O&G training and certificates b) Education (uniMy) - providing specialised computer science and engineering education c) Employment Services - human resource management services for foreign worker and d) SKIN

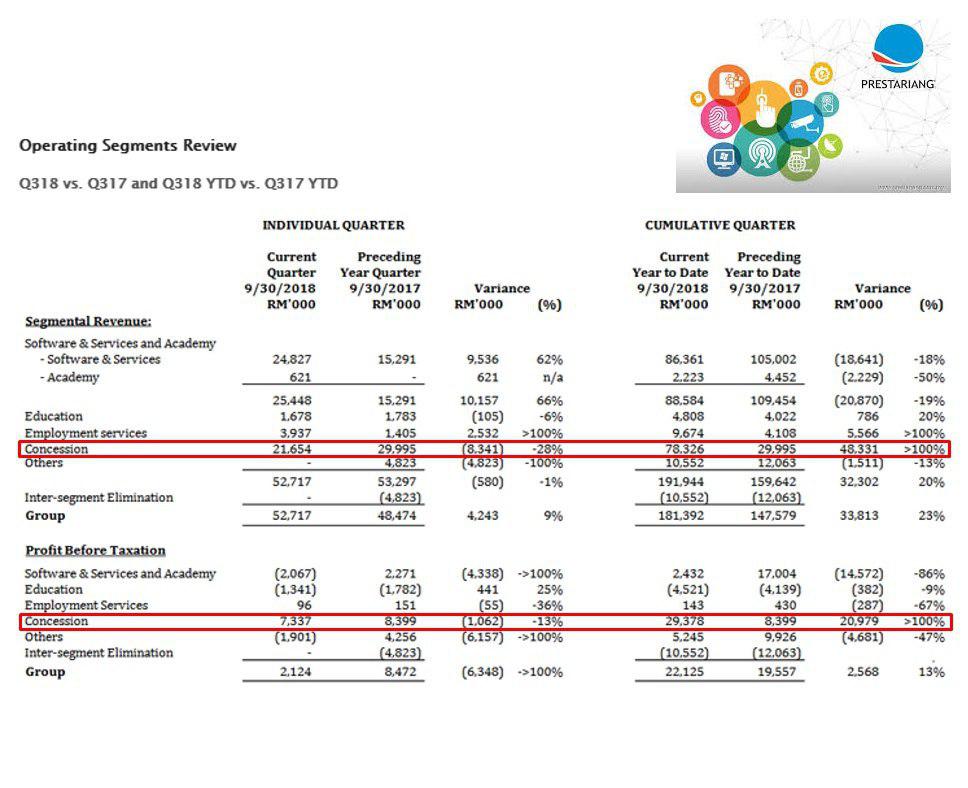

2) How much SKIN contribute to bottom line a) In 9m 2018, SKIN contributes to 43% of revenue and 131% of PBT. which means that... b) Without SKIN, the company is running at RM 7 million loss for 9m 2018. (see image)

Source: Company

3) It's other business, how much issit worth? Prior to the take up of SKIN in 2015, the average 3 years mean valuation (2012-2015) - when it was simply Malaysia’s largest ICT software and training service provider was at around 15x PER.

source: Bloomberg, Stockbit

However, it seems that recently, its core business is not doing well... (Software segment is -19% revenue and -86% profit to record a mere RM2.5m in profit in 9m 2018).

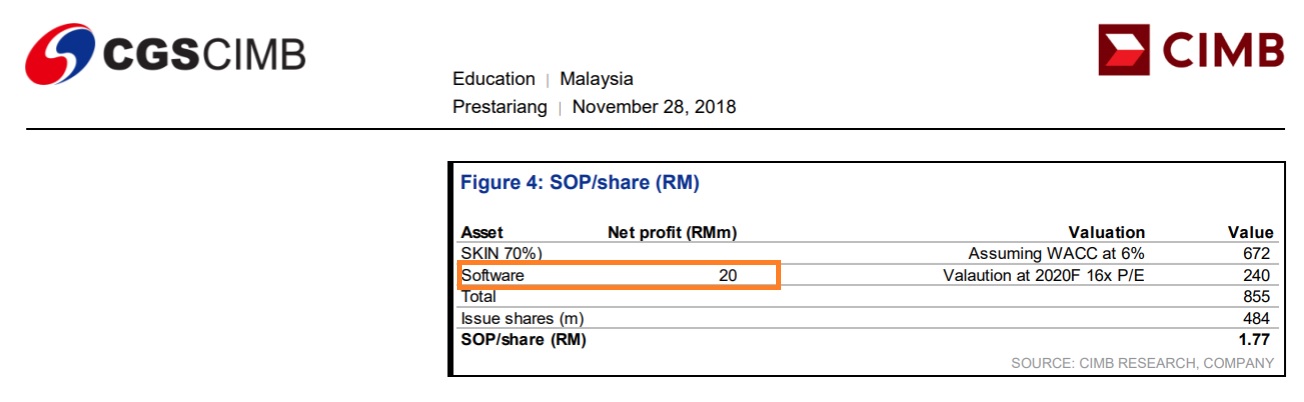

CIMB analysts Nigel Foo predict that in 2020, this software segment will produce a profit figure of around RM 20million. Personally not so sure if this figure is achievable... Yes, last year software business contributed RM 18m in profit, but it feels like this business is not one for the future. Additionaly we also must remember that uniMY is still running at a loss.

source: CIMB research report

But, assuming he's right, and in FY 2020, Prestariang closes RM 20m in profit (for all segments), that's FY EPS2020 of 0.04. A fair value of 10x PE (based on 30% discount on historical pre SKIN PE ratio of 15x) will valued Prestariang at RM 0.40. Personally think this is blue sky and bull case scenario as there are pretty big assumptions and uncertainties to play here...

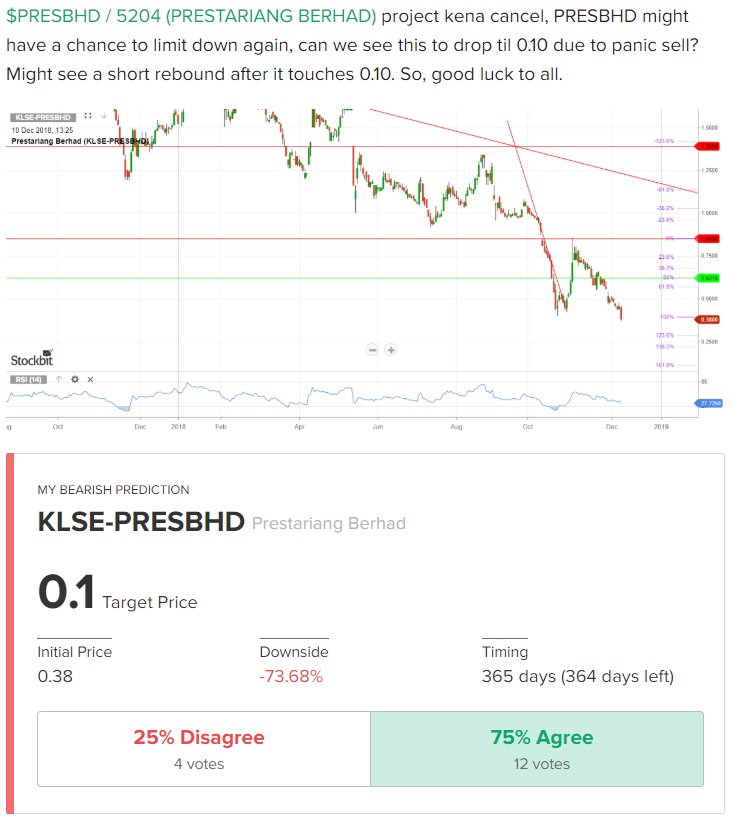

4) Technicals

Breached downtrend channel, heading to all time low of RM 0.24. RSI still downtrend and still have room to go before it touches previous low...

source: Stockbit

5) Verdict

Prestariang had a good core business of software, training and education but this business segments are facing real challenges and not growing ever since SKIN was onboarded. SKIN was their golden egg, which is now being taken away. Without profits from SKIN, 9m 2018 is running at a loss as the other business segments seems unable to fill the gap.

******

A fellow trader had this target price... Majority of retailers voted yes for super bearish outlook for Prestariang

Source: Stockbit

https://klse.i3investor.com/blogs/nicklee/186078.jsp