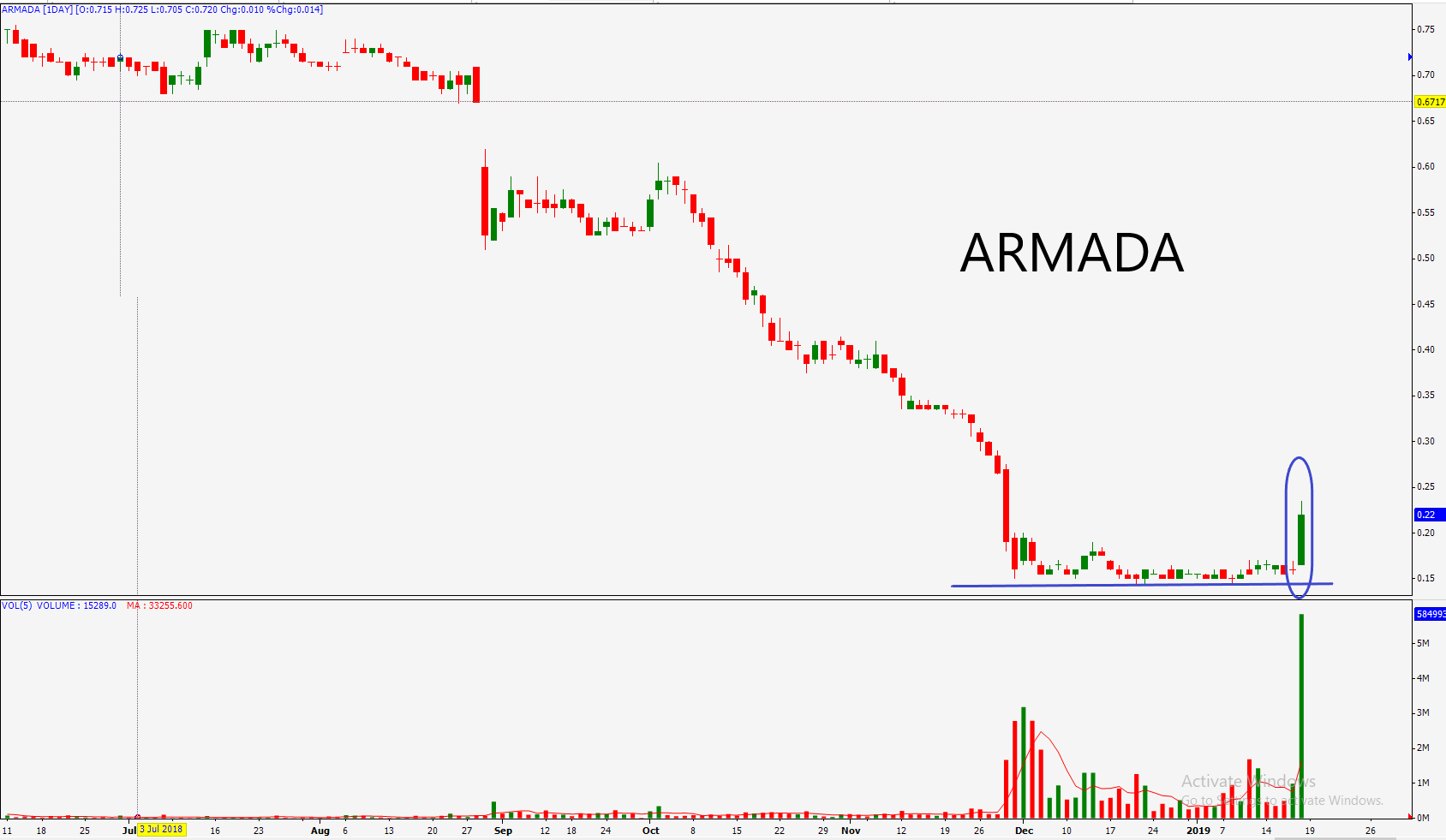

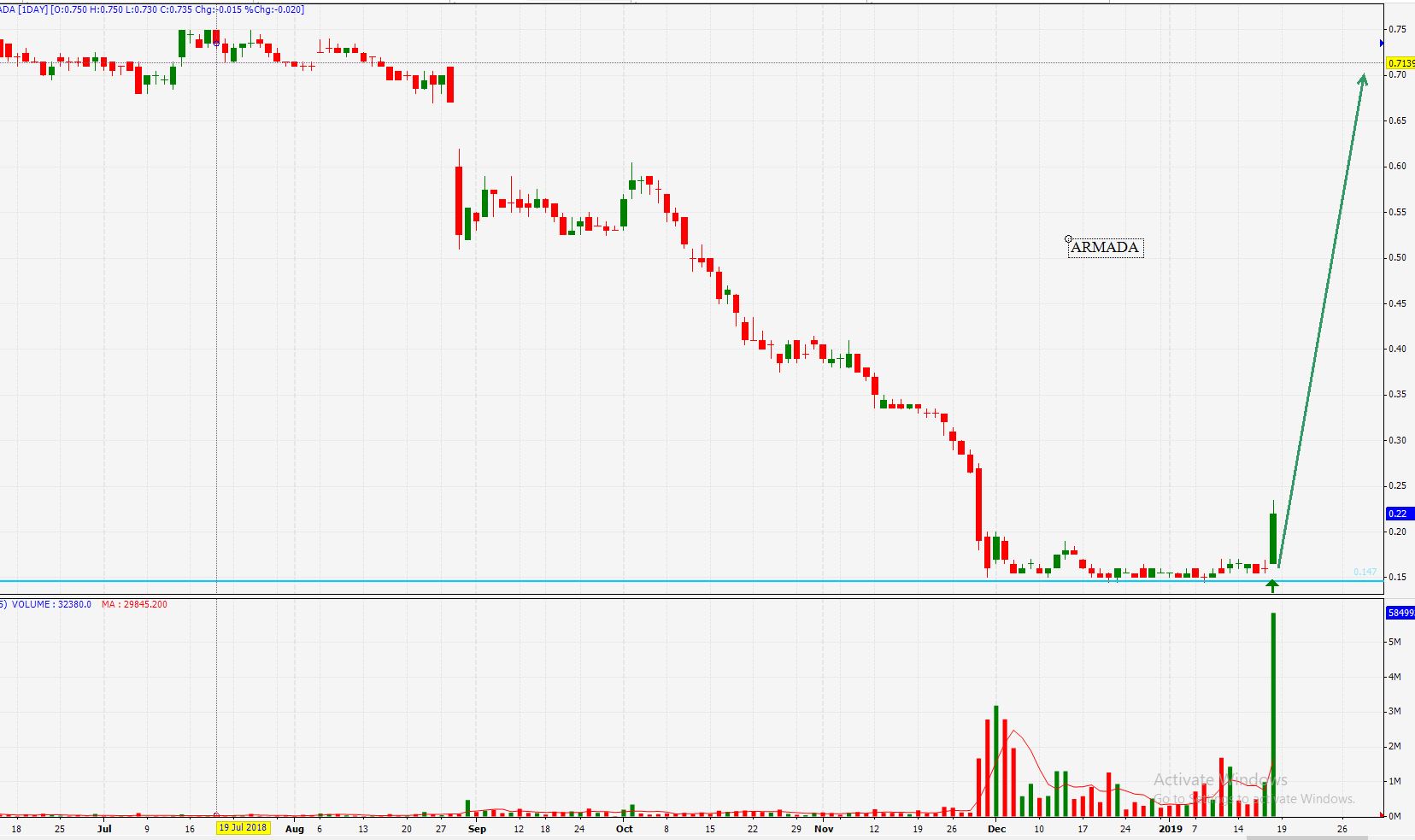

No doubt that Energy sector(o&g) is the most discussed topic this month, from hibiscus and carimin to armada energy and sapura energy. We believe those stocks sentiment more or less are brought up by master Koon and master Fong. We also believe that this energy sentiment not only will help to improve retailer’s confidence level, it is also strong enough to influence investment bank or private investment firm stock picks decision. For example, last Friday cimb gave an unexpectedly high target price of armada, RM0.70.

No matter all the report cards can be trusted or not, armada already breaks up from the bottom consolidation of the price. it is nearly 40% gain in a single day

We bought Armada at RM0.16 before cimb report for the reason of the relatively low price (you can visit our telegram channel to find out). After Cimb report out, we also bought some shares at RM0.175 and RM0.195. We have reasons to believe the momentum will continue to next psychology

price level at RM0.25 but we will not chase it until next entry retrace level.

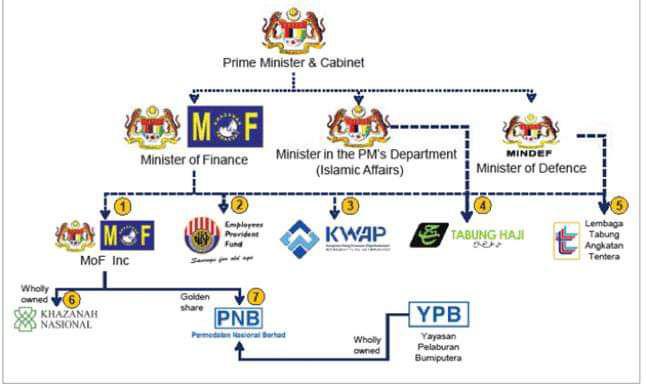

Instead of keep on purchase armada to average up, we bought sapura energy on last Friday at RM0.285. By right we are supposed to seek for better entry level after new ordinary shares and warrants to be listed. Due to the craziness, positive momentum of Armada plus everyone is still waiting for newly listed sapura energy shares for entry confirmation. Why not we take the action first? Buy sapura energy now might not at the lowest price but it is RELATIVELY at a bottom low price. If sapura continue to drop, we will buy more. Almost all right shares are subscribed by Permodalan Nasional Bhd at RM0.30 in order to rescue sapura energy. We analyze that it is a low probability that PNB will sell below RM0.30. We are happy to be able to buy below RM0.30

Related Pelabuhan National Bhd news: http://www.theedgemarkets.com/article/pnb-hold-40-stake-sapura-energy-postcash-call

Master Fong oil and gas stock purchase requirement:

故所购买的油气股,必须具备以下全部或部分条件:

(1)有关公司最好有财雄势大的财团或机构作后盾,确保必要时有能力出手援救。

(2)最好选购大公司的股票,大到不能倒则更佳。这不纯粹是安全问题,而是因为国际油气公司不会将合同颁给小公司,以免受到延误,故大公司在竞标国际合同时占有优势。

(3)最好是手头握有数额可观合同的公司,确保三五年内即使标不到工程,或是得标数目低于预期,业务也不会受到影响。

(4)尽量选购本身拥有油田,同时也从事油气业支援服务的公司。

(5)所选公司最好现金流量属“净流入” 。

(6)尽量买在扣除“资产减值”之后,仍有盈利或亏蚀额不大的公司的股票。

(7)尽量购置营业量大的公司股票,营业量不大,表示有关公司没有竞标优势,若因竞标激烈而赚率又低,怎料取得可观盈利?

Cold eye's o&g stock pick conditions(Brief translated) :

1) best for company backup by consortium or institutions with the strong financial position

2)best for large companies, they are too big to fail

3)large contracts on hand which can last 3 to 5yrs

4)prefer companies that own oil field and support o&g services

5)cash flow net inflow

6)buy companies that have a profit or little loss after deducting asset impairments

7)buy companies that with large business volume and competitive advantage

从国民投资机构的角度看,该机构是根据沙布拉附加股说明书,乘机将在沙布拉能源的股权,由12%提高至48%左右(包括优先股及凭单转为普通股)。该机构此举,一方面稳定了沙布拉能源的财务,一方面也为属下的土著单位信托,取得了一家大马跨国油气企业的控制权,可谓一箭双雕Brief translated: From the perspective of the National Investment Agency, the agency is based on the Sapura Attachment Note, taking the opportunity to increase the stake in Sapura Energy from 12% to around 48%. The agency’s move stabilized Sapura’s finances on the one hand and the indigenous unit trusts on the other. It gained control of a Malaysian transnational oil and gas company.

Dear long term investors, Is sapura meet those conditions?? U find out, please comment =)

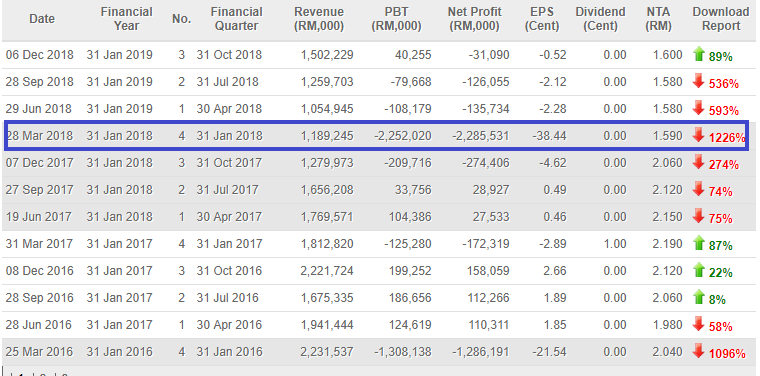

Sapura energy the worst is over, how do we know?? Look at QR summary below:

2018Q4 result: loss before tax and impairment = (RM119mil)

Impairment loss = (RM2.1billion )

Loss after tax and impairment = (RM2.2 billion)

Losses above are history record, we analyze that it will not happen on coming few years again

Now, look at 2019Q3 result(latest): before tax and impairment = RM40mil

Impairment loss = RM 0

Taxation = (RM71mil)

Loss after taxation = ( RM31mil)

We compare QR from the 2019Q4 result to 2019 Q3 result then we concluded that:

Sapura no more bloody breaking record impairment loss coming, it is one off.

Sapura result from:

Record lump sum negative to significant negative to

Smaller negative to positive before taxation.

It is improving each QR.

Now question yourself, is upcoming QR will significantly better than 2018 Q4??

If no, price at rock bottom. Limited risk

If yes, you should know what to do.

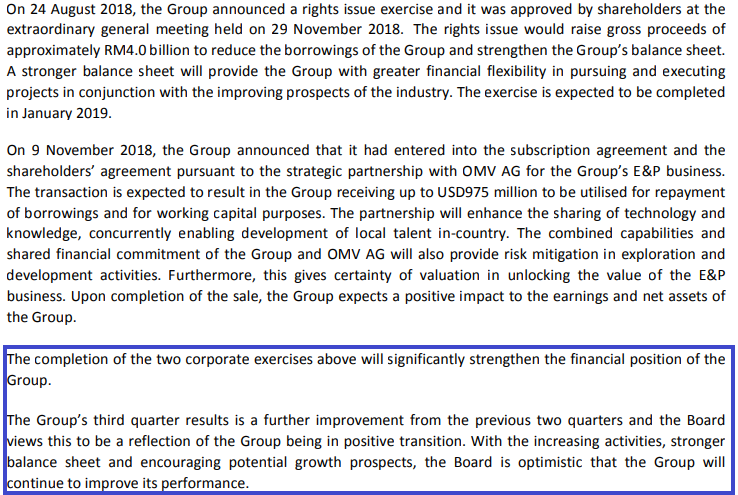

Finally, we compare cimb armada report card with sapura energy 2019qr3 prospect:

Armada Default risk :

Probability default low: continuing negotiation for an extension to the may 2019F repayment deadline

Sapura Default risk:

There were no issuance and repayment of debt securities, share buy-back, share cancellations, shares held under trust and resale of shares held under trust during the quarter ended 31 October 2018 (obtain from sapura qr3 report)

If you like our analysis, free subscription to our channel on

For author himself tp:

Entered at RM0.285 , next average entry RM0.22, RM0.25, RM0.32, RM0.35

TP1 RM0.5 TP2???

CL1: will hold until next QR to decide.

We bought both armada and sapura energy. This article is not a buy call, just sharing our own strategy.

Maybe coming article : Professional player executing regulated short sell overnight (RSS) on sapura energy is wrong decision?(not idss). To be continue

DISCLAIMER: Investment involves risk, including possible loss of principal and other losses. This article and charts are provided for information only and should not be construed as a solicitation to buy or sell any of the instruments mentioned herein. The author may have positions in some of these instruments. The author shall not be responsible for any losses or lost profits resulting from investment decisions based on the use of the information contained herein. If investment and other professional advice are required, the services of a licensed professional person should be sought.

https://klse.i3investor.com/blogs/share4u2019/190833.jsp