Share Price of MFLOUR has dropped to historical low level. From RM2.50 in 2017 to RM0.565 as of last friday price, a drop of more than 75%. What has changed since then?

Why has the share price been fallen these much?

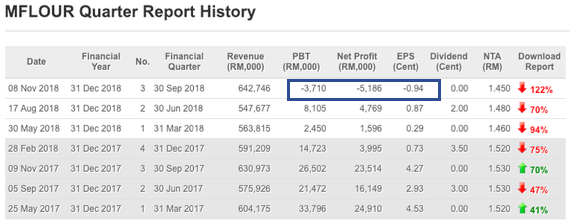

1. Negative Results in the last Quarterly Result

2. Rights Issue for Expansion - Rights Price fixed at RM0.50

Have things been improved in the Q4 2018? Its quarterly result will be released by end of this month, Feb 2019.

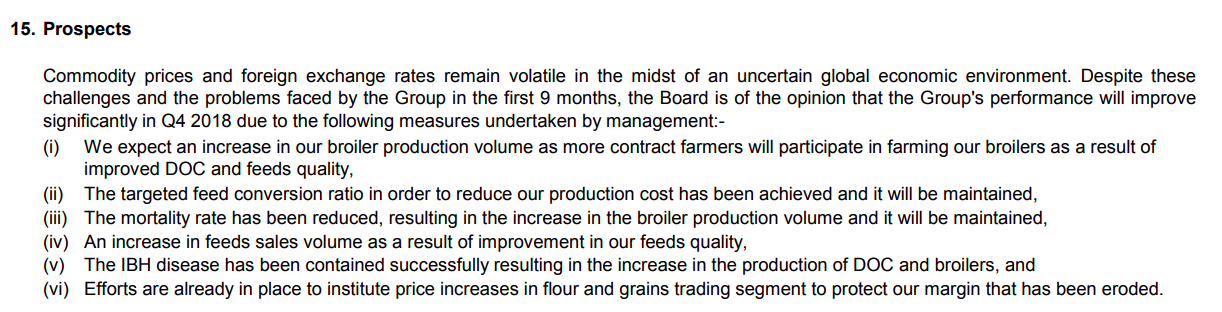

1. Strong Recovery of Earnings - Higher Poultry Prices, Higher Flour Prices, Higher Production Volume and Better Margins

Please look at last quarterly result, under prospect section, it was hinted there would be a SIGNIFICANT IMPROVEMENT in Q4 2018.

2. Rights Completed & Oversubscribed - Investment Bankers and Major Shareholders are Confident

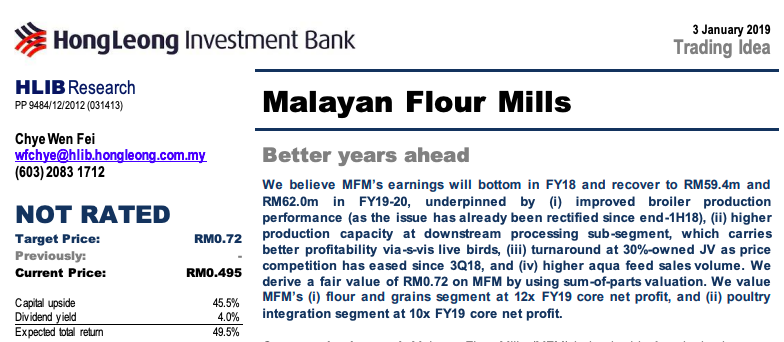

3. Better Years Ahead for MFLOUR - Hong Leong Investment Bank Research

4. Today news - Increase of Flour Prices by 5% to 10%

Source: http://www.enanyang.my/news/20190217/%E5%95%86%E7%94%A8%E9%9D%A2%E7%B2%89%E6%9C%88%E6%9D%AA%E6%96%99%E6%B6%A8%E4%BB%B75%E8%87%B310/

The worst has gone for MFLOUR. And things and prospect have been improving and strong earnings should be expected moving forward. Upcoming quarterly result to be released this month should be significantly better as hinted. Should the share price recovers to its year 2017 level, it has more than 200% upside. Should the share price recovers to around RM1, it has 100% upside.

This is PART I on MFLOUR. In Part II (I will post it in the next few days), I will be covering the current customers of MFLOUR - defensive and its strong recurring incomes, the past 10 years track record, earnings jump in FY2019 after huge capital expenditure has been spent, margin improvements, its product price movements in the last 6 months and etc.

Disclaimer:

Enjoy reading and please do your own due diligence and buy at your own risk. I have bought MFlour shares and I will continue to accummulate for medium term investment due to its positive and bright prospect. And yes, this will be my Sailang stock in year 2019.

https://klse.i3investor.com/blogs/Flour/193731.jsp