Perdana had very good performance recently, with share price gained 50% a day. Many people had missed the boat, but since the share price of Sealink just moving towards north, so I think this is a second chance to us to grab another limit up oil and gas counter.

(a) Breakout chart with strong momentum.

People will lie, but graphs and charts won’t. Sealink just had a breakout yesterday which the share price hit the highest within 52 weeks, at RM0.195.

What Does a Breakout Tell You? A breakout occurs because the price has been contained below a resistance level or above a support level, potentially for some time. The resistance or support level becomes a line in the sand which many traders use to set entry points or stop loss levels. When the price breaks through the support or resistance level traders waiting for the breakout jump in.

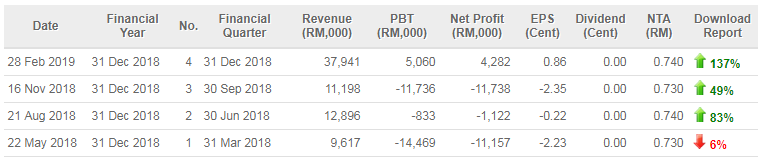

(b) A good turnaround story — Both revenue and profit hit the highest, the worst is over.

Sealink is a Sarawak based ship building company. Now people eyeing on oil and gas counters which look undervalued. The group has a very good turnaround story with the latest earnings per shares as high as 0.86 sen.

The latest earnings per share for Perdana and Sealink are 1.17 sen and 0.86 sen respectively. Based on forward per calcalution, target price for Sealink should be — 0.86 sen x 4 x 10 = RM0.35.

But since Perdana also can hit RM0.54 with forward per of 1.17 sen, so I think the TP should be around RM0.30 to RM0.40. In addition, the net assets of Sealink as high as RM0.74, so it’s quite reasonable.

(c) Net assets as high as RM0.74.

If you give a 50% discount for the net assets of Sealink, it still worth RM0.37. Whatever, NTA also a benchmark for us to value a stock. I must say that the share price of Sealink is too far away from the net assets value. So it must correct by itself when the right timing is coming.

(d) Ranging from RM0.09 to RM0.745 within five years. Now it looks deeply undervalued.

The oil and gas has good recovery with Brent oil price standing at $68 recently. So I think the downside risk for Sealink very low. But I see a very huge potential upside there.

The share price of Sealink is very easy to shoot up as Perdana, because both of this two counters had underperformed for a very long period. Now looks like it’s the right timing to shine.

There are two types of investors here. One is based on FA, another one is based on TA. Whatever, please do your own homework before buying. Thank you for reading.

Some useful links for you to refer.

3 https://www.malaysiastock.biz/GetReport.aspx?file=AR/2018/4/23/5145%20-%201657598845797.pdf&name=SEALINK%20ANNUAL%20REPORT%202017.pdf

https://klse.i3investor.com/blogs/ekorharimau/197936.jsp

https://klse.i3investor.com/blogs/ekorharimau/197936.jsp