I've recommended a stock, MFLOUR back in 17 Feb 2019 when it was trading at RM0.565. Now, the share price is at RM0.765. A potential gain of more than 35%. Please refer to the source below.

MFLOUR - My 2019 Sailang Stock - Historical Low Price at the Best Time

Source: https://klse.i3investor.com/blogs/Flour/193731.jsp

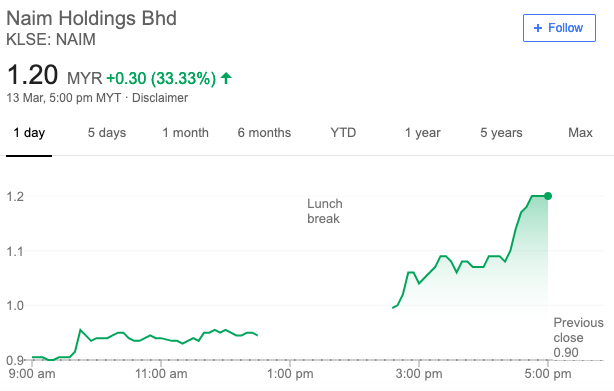

Today, Naim (who owns 26% of Dayang) was limit up to RM1.20, signifying a 33.3% of return.

What about Dayang?

I would eleborate on a few points explaining why Dayang has a good upside potential even at this price. I would not mention those facts which already known by the investors, such as earnings sustainability hinted by management team, RM3 bil orderbook and etc.

1. Limit Up of Naim's Share Price - Strong Interest in Dayang

First, Naim owns 26% of Dayang. However, please note that Naim may not be a good alternative investment for Dayang. The main reason is because the strong cash flows generated by Dayang are only reflected in Naim's account on paper. Naim will not be able to enjoy the cash flows (in layman terms: can see, but cannot spend) but Dayang will get to enjoy the cash flows they generated in a full scale. Once investors realise the fact of this, interest may be switched back to Dayang itself.

2. Dayang as a beneficiary by Petronas' capital spending of RM50 bil this year

"Meanwhile, the aggressive international expansion would probably benefit the services players which already have a strong international presence (i.e. Sapura Energy and Yinson Holdings Bhd) or companies that are eager to seek overseas growth (i.e. Malaysia Marine and Heavy Engineering Holdings Bhd [MMHE] and Dayang Enterprise Holdings Bhd)," Lim wrote in the note.

3. At RM1.69, Dayang is trading at 1-year forward PER of 4X

Should the O&G theme continues to be strong, a forward PER of 8X would give Dayang another 100% upside at current price, under bullish scenario. Personally, I'm looking at 50%.

4. Dayang - MoU with PKNM Energy Sdn Bhd and Main Velocity Sdn Bhd to establish a coorperation and collaboration in exploring, securing and operating any projects in Melaka.

5. Perdana's share price went up by 50% - Dayang owns 60% of Perdana - their majorshareholder.

If a full potential of Dayang is being realised by investors, would there be a limit up tomorrow? That's a question.

Disclaimer:

Enjoy reading and please do your own due diligence and buy at your own risk. I've sold all my MFlour shares and switched to Dayang. I do have Dayang shares now and I may continue to accummulate more for medium term investment due to its positive and bright prospect.

https://klse.i3investor.com/blogs/dayang88/197767.jsp