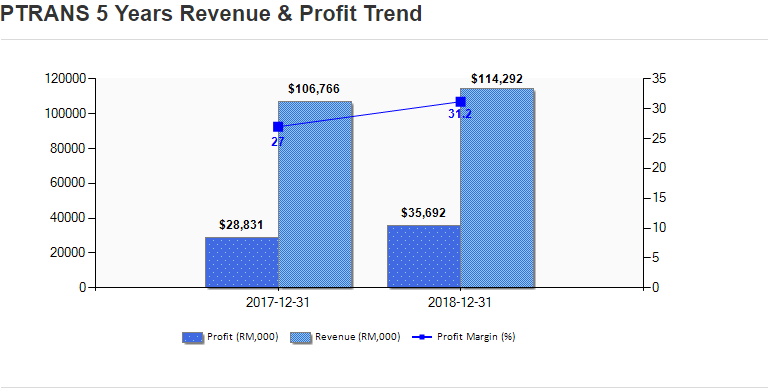

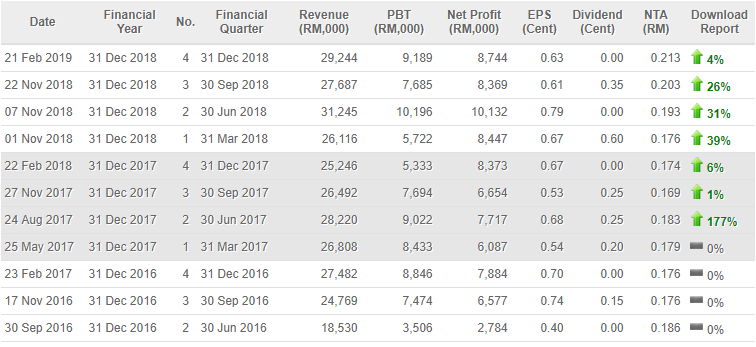

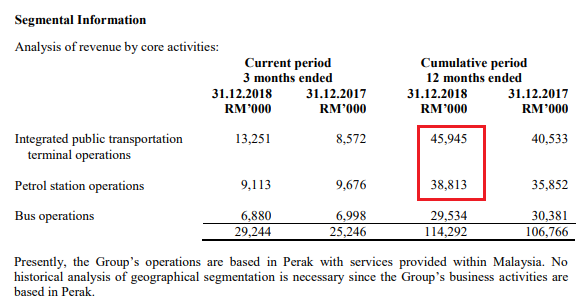

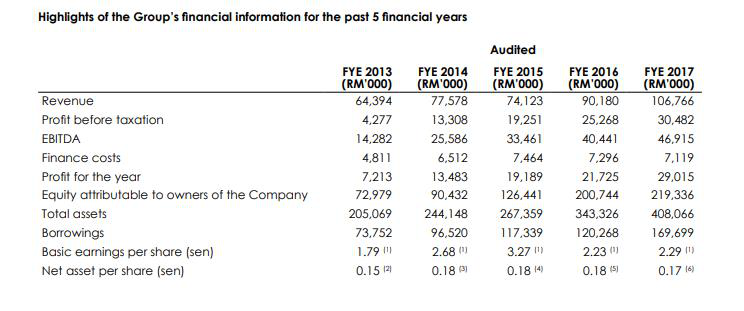

Perak Transit was incorporated in Malaysia on 5 September 2008 as a private limited company and was subsequently converted to a public company on 26 March 2010. The Company’s principal activity is investment holding. Perak Transit is principally involved in the operations of Terminal AmanJaya integrated public transportation terminal and the provision of public bus services. The Group is also involved in the petrol sales business with the operations of several petrol stations in Ipoh, Lahat and Kuala Kangsar, Perak.

The Group’s revenue was mainly derived from:

(a) Integrated public transportation terminal operations;

i. Rental of advertising and promotional (“A&P”) spaces (Average RM400k –RM 600k per billboard)

ii. Rental of shops and kiosks (Average RM1k –RM 5k per shop/kiosk dependant of psf basis)

iii. Project facilitation fee (To be confirmed)

iv. Others such as bus and taxi entrance fee and fee imposed for the

usage of the basement car park and lavatory. (Per-entry basis for

basement car park and monthly pass per request)

(b) Providing public stage bus and express bus services and bus charter services; and

(c) Petrol stations operations.

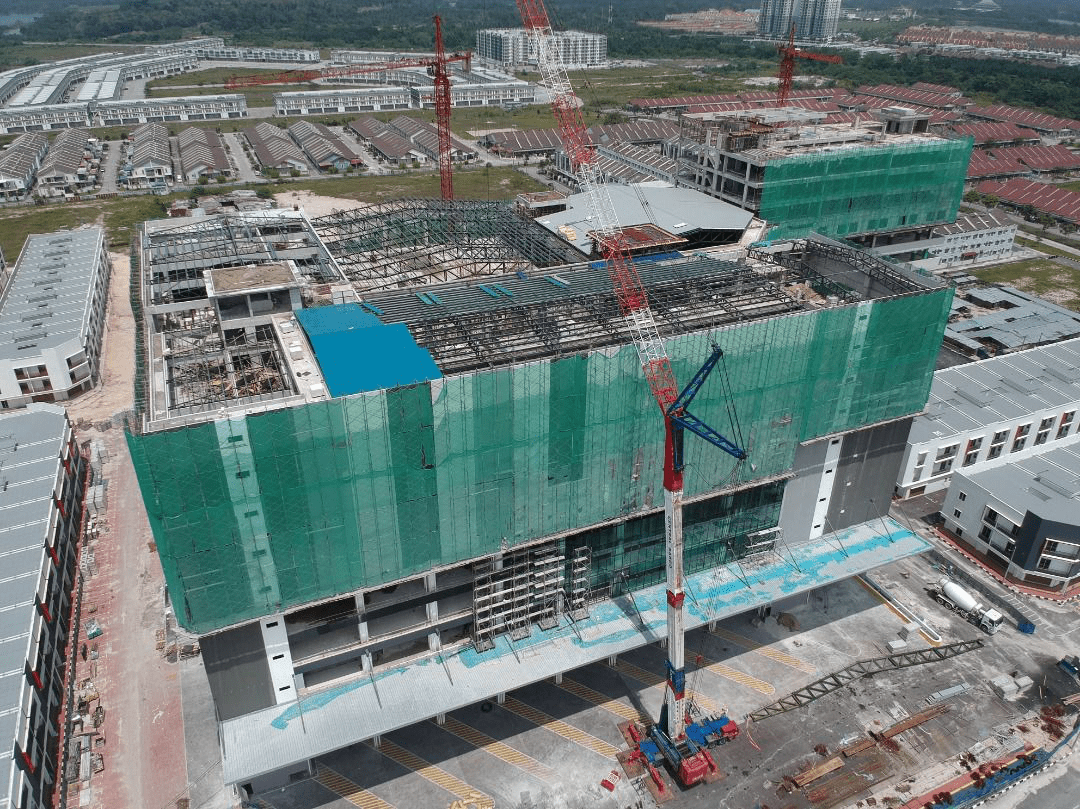

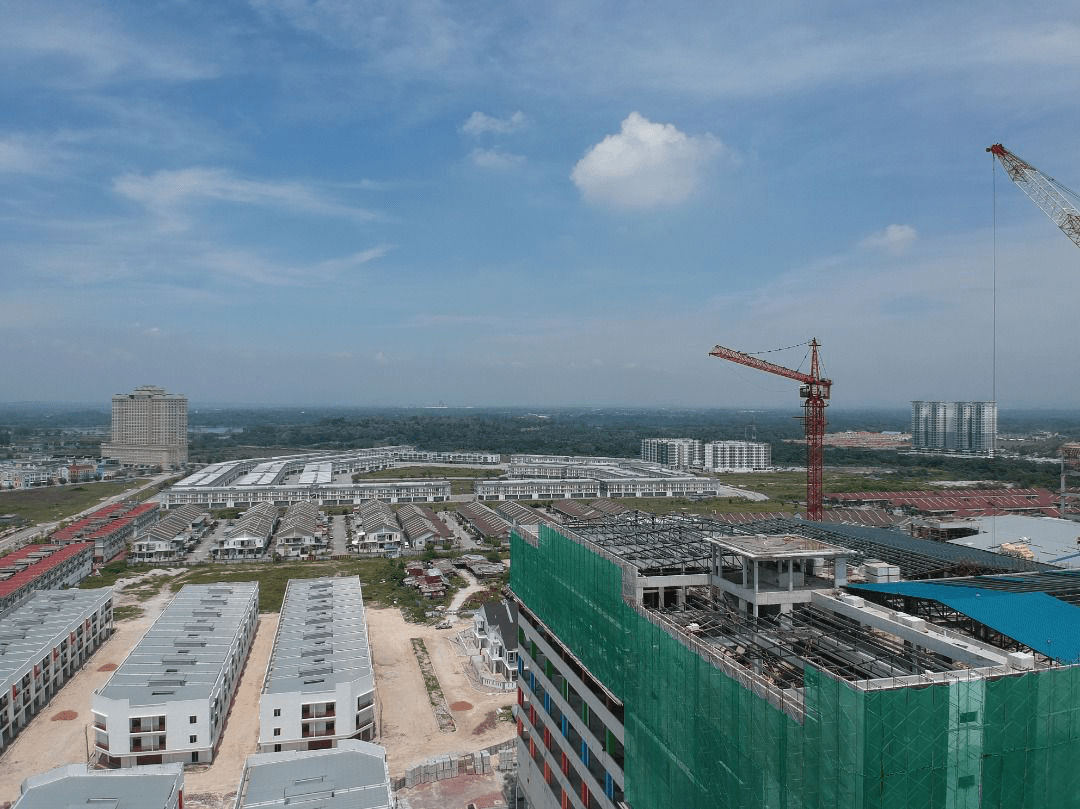

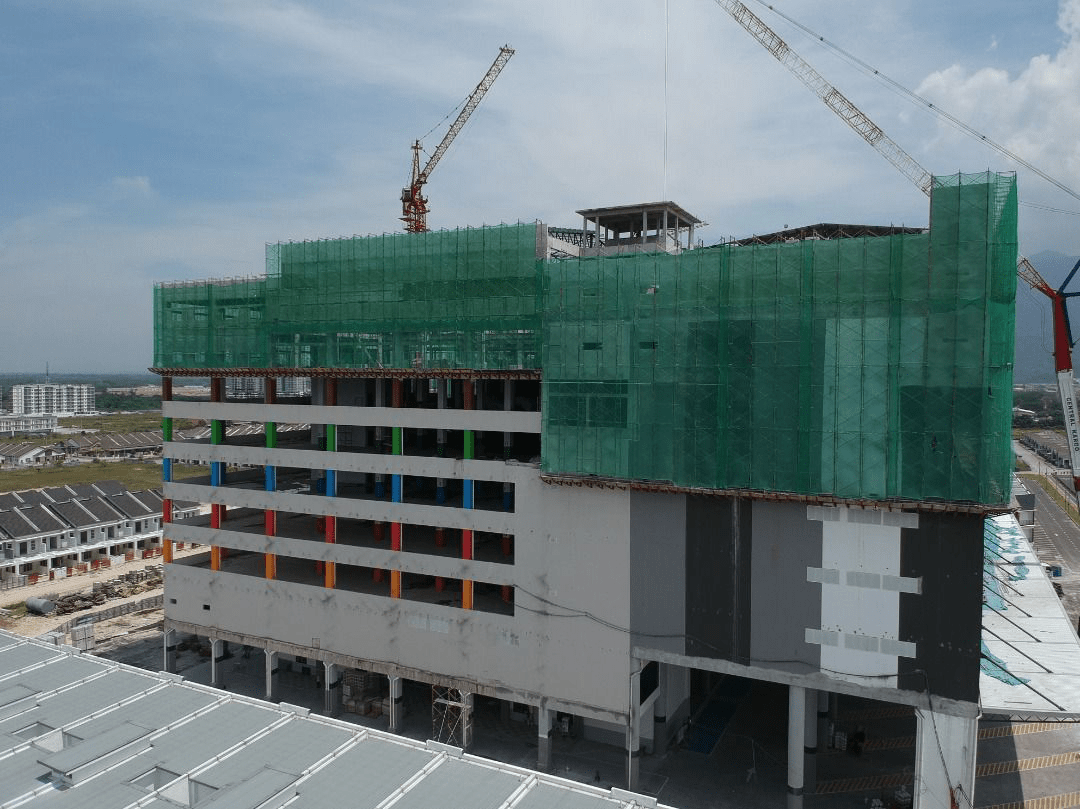

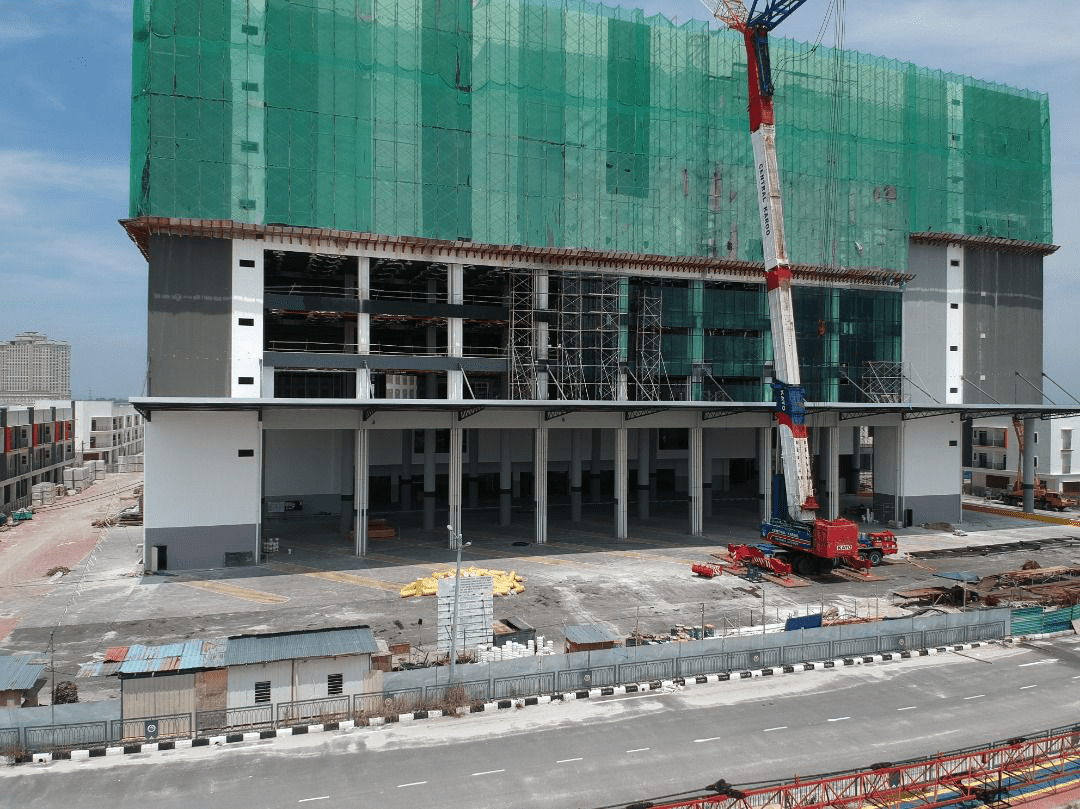

Upcoming Catalyst

Terminal Kampar construction which is 8 times bigger (410k-480k

leasable area) than Terminal Amanjaya, which will provide future earning

visibility for Ptrans. According to research analyst, 70% of F&B

lot has been taken up, and they are looking at a greater recurring

income for PTRANS, and management guided that they are confident to

secure 80% of the take up in one year which translates to annual

recurring income of approximately RM34 million (RM2.8 million / month) .

Terminal Kampar is expected to be operational starting 2nd Quarter

2019. Once Terminal Kampar is operational, we will be expecting a great

earning bump and also better cash-flow from rentals / advertising /

project facilitation.

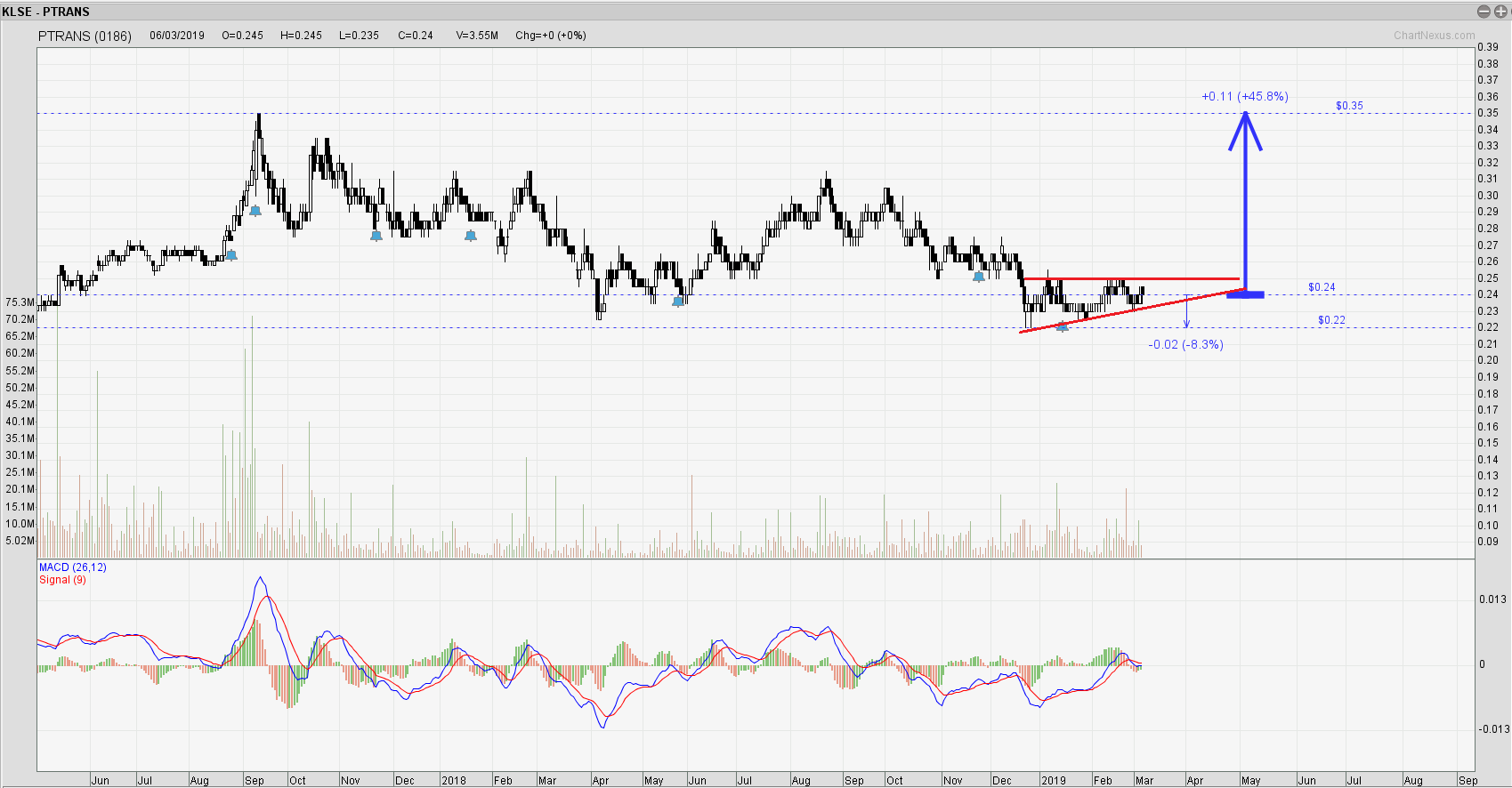

Technical Outlook

Potential upside will be +45.8 %, while potential downside will be merely 8.3%, which is a very good risk and reward.

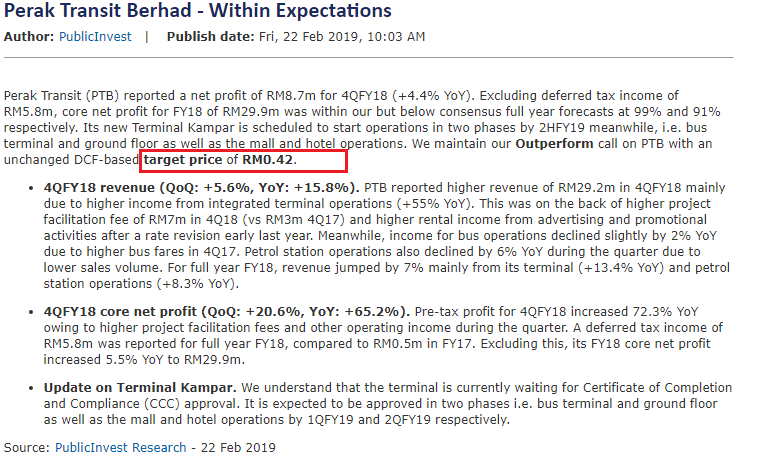

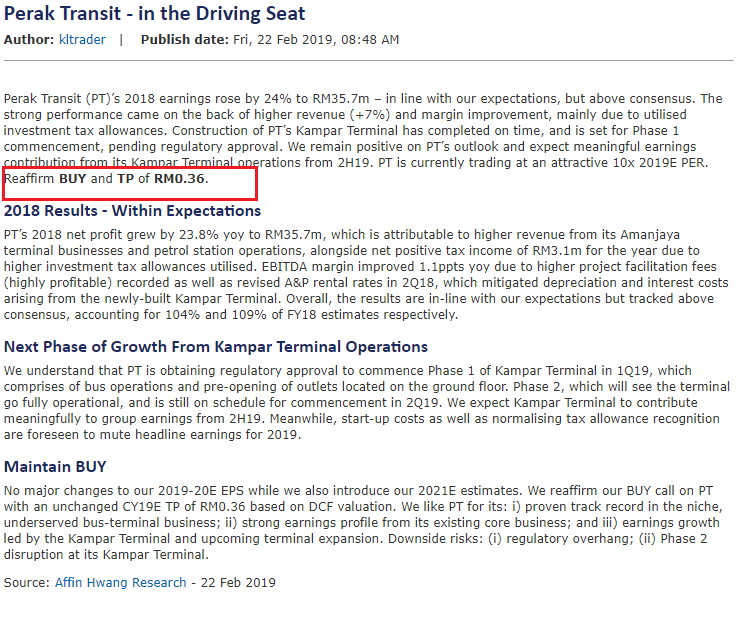

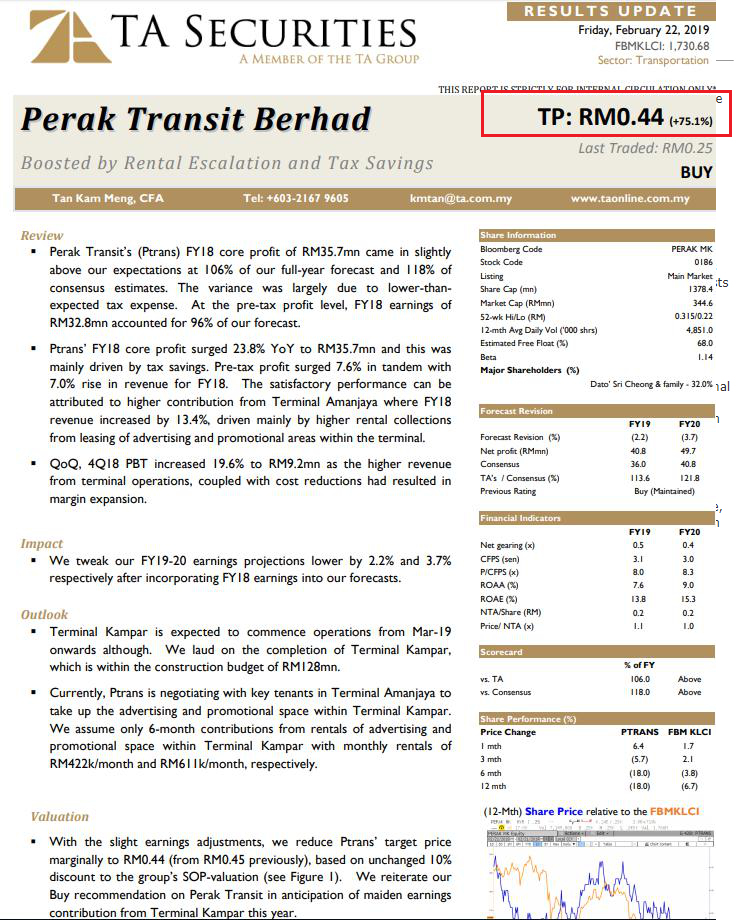

Research house Reference

Disclaimers: Information and comments presented does not represent the opinions whether to buy, sell or hold shares of a particular stock. Information shared above shall be treated solely for educational purpose only. The author may have positions in some of these instruments. The author shall not be responsible for any losses or lost profits resulting from investment decisions based on the use of the information contained herein.

https://klse.i3investor.com/blogs/infoanalytics/196882.jsp