“W T K Holdings Berhad ("WTK") Group ("the Group") is a diversified group with operations in the timber, plantation, adhesive tape and oil & gas sectors.” – This is from their corporate website, except that oil & gas was wound up. It is the 6th largest timber company in Sarawak.

WTK’s share price has been trading at record low, due to oil and gas misadventure (which has been wound up in 2017), increase in timber tax and restrictions in log exports hitting their bottom line.

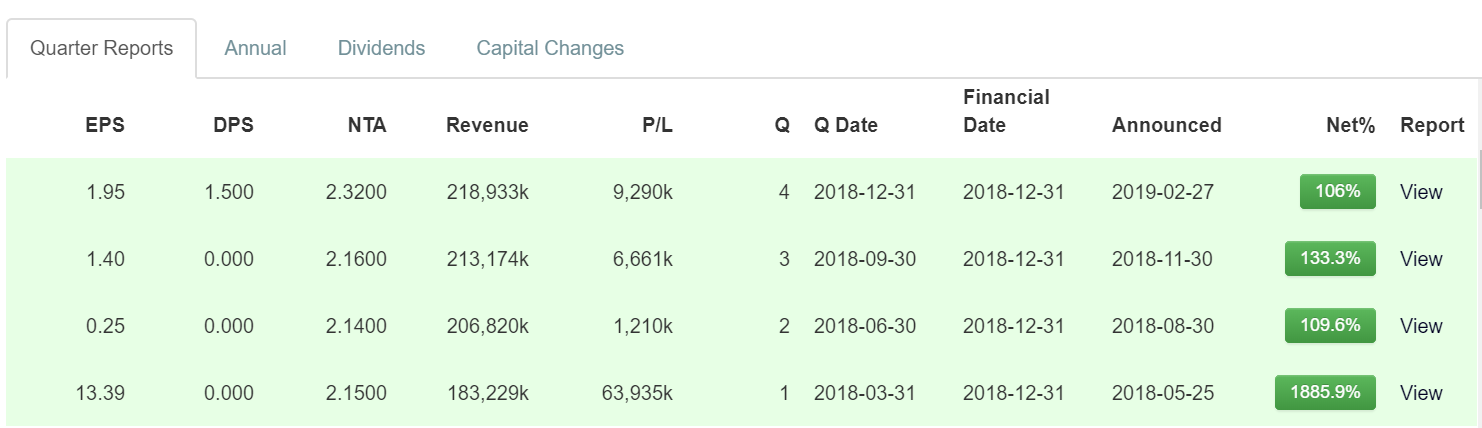

I am applying Mr Koon’s golden rule that the company must report 2 consecutive earnings growths and it must be selling below P/E 10.

We should ignore the Q1 2018 result, as the huge EPS was the result of the write-back of impairment loss provided for in Q4 2017.

As you can see, WTK’s earnings have increased for the last 2 quarters, so it satisfies Mr Koon’s rule no.1.

Say, we annualise the EPS of Q4 2018, 1.95 sen x 4 = 7.8 sen, and share price is 58.5 sen. So this meets Mr Koon’s rule no.2. But, the story doesn’t end here.

------------------------------------------

Let’s delve further into the Revenue, particularly WTK’s timber revenue, which consists of logs and plywood. (Timber revenue = Logs + Plywood)

RM423.7m (Plywood) / RM667.9m (Timber) = 63.4%. I can best estimate Plywood to make up 63.4% of WTK’s Timber Revenue.

Plywood estimated Q4 2018 revenue = RM180.8m (per Q4 2018 Announcement) x 63.4% = RM114.6m.

-----------------------------------------------------------------------------

Let’s project the Q1 2019 results. I would project the plywood revenue & earnings, since this forms >50% of their total revenue.

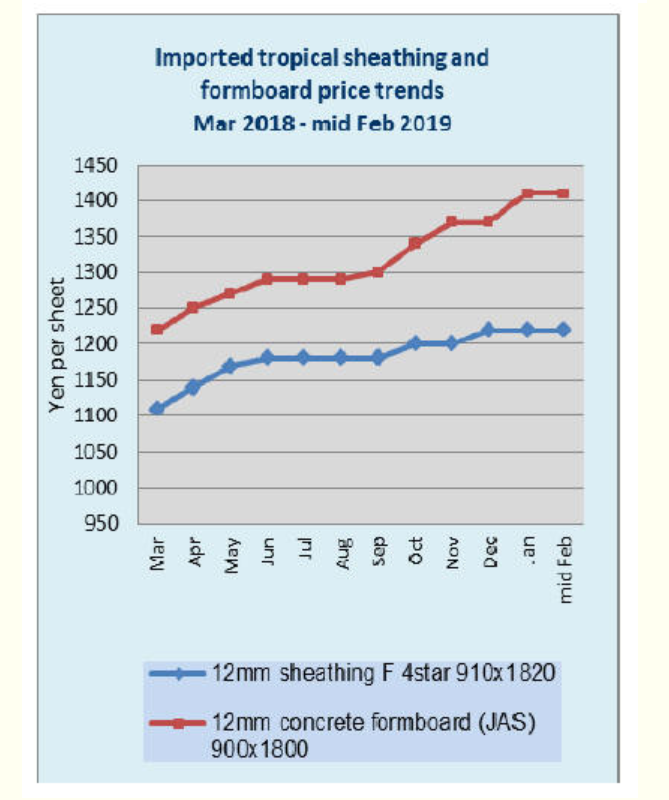

Source: http://www.globalwood.org/market/timber_prices_2019/aaw20190202c.htm - WTK’s plywood is 81% exported to Japan, according to Q1 2018 result announcement.

I estimate the prices of plywood imported to Japan in Q1 2019, to be 5% higher than in Q4 2018.

Assume plywood production unchanged, estimated increase in Plywood revenue in Q1 2019:

RM114.6m x 5% = RM5.7M, this revenue increase is earnings, since cost is fixed for the same quantity!

Estimate Q1 2019 EPS: (RM9.2m + RM5.7M) / 481.3M shares = 3.1 sen, annualise = 12.4 sen. Say, give a P/E ratio of 10, this is RM1.24 !

Of course, this guesstimate is not taking into account recovery of palm oil prices in Q1 2019 – will help reduce WTK’s palm oil losses, or any changes in production volume / RM exchange rate fluctuation.

https://klse.i3investor.com/blogs/WTK%2010%20March%202019/197222.jsp