1. DAYANG is one of the largest providers of offshore platform services in Malaysia. It is principally involved in the provision of offshore Topside Maintenance Services (TMS), minor fabrication operations, offshore hook-up and commissioning, and charter of marine vessels relating to the oil and gas companies (like Petronas etc).

2. It owns a fleet of 9 offshore support vessels (excluding subsidiary Perdana's young fleet of 17 vessels). The vessels are known as Dayang Pertama, Dayang Maju, Dayang Cempaka, Dayang Berlian, Dayang Nilam, Dayang Zamrud, Dayang Topaz and Dayang Opal. As at the end of December 2018, its total orderbook stood at RM3.0 billion; which can last at least until 2023.

3. DAYANG delivered the highest ever revenue and earnings in 4Q18 quarter, on the back of a revenue improvement of 64.9%, a reversal of impairment loss on PPE amounting to RM20.8m and forex gain of RM15.4m. Core earnings in 4Q18 was about RM80m as compared to an adjusted loss of RM33.6m in 4Q17.

4. The surge in revenue in 4Q18 was driven by much higher lump sum order and vessel utilization rate of 73% (vs 4Q17: 51%). In FY18, due to lower debt as compared to FY17, lead to lower net finance costs (-13.6%), Dayang made a profit turnaround of RM164.2m (EPS 17.02 sen) in FY18.

5. In view of the substantial pick-up in the work orders in the last three quarters of FY18, the management is optimistic that the strong earnings trend would be sustainable in FY19, on the back of strong contract execution track records, high profit margin and 3 billion orderbooks.

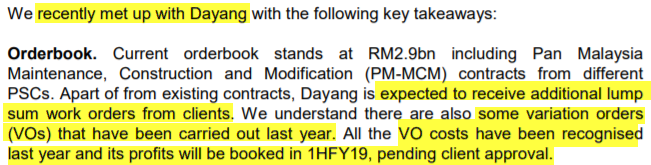

6. A few recent Investment banks reports saying Dayang recent quarter strong performance may not be sustainable due to lump sum orders may not repeatable. However, let me share with you an interesting excerpt from Hong Leong’s Dayang research report as below:

It is stated that Dayang is expected to receive additional lump sum orders from clients in their meeting with management. Actually Dayang has been recorded lump sum revenues for 2017 and 2018 which were 251 millions and 473 millions respectively.

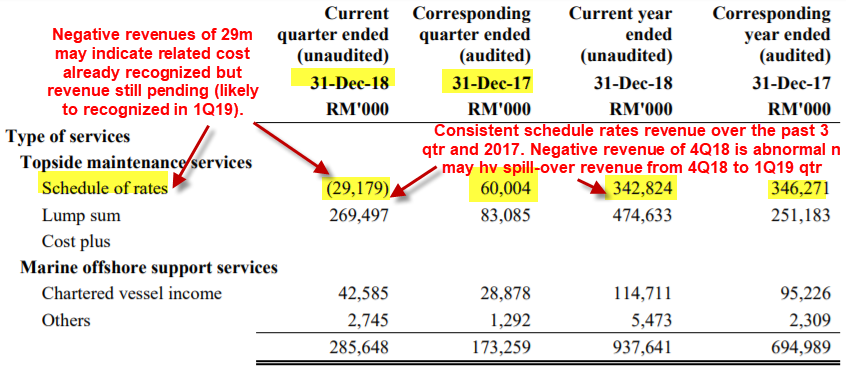

Another more interesting fact from last qtr report (Q4) of Dayang is the missing of schedule rates revenue which is likely to book or surface in coming quarter result. Let see the extract from Dayang last quarter report on its schedule rate revenue as below:

Source: Dayang 4Q18 report (page 18)

Negative revenues of schedule rates of TMS division may due to related cost already recognized but revenue still pending or not yet recognized. If this leftover schedule rate revenue can be recognized in 1Q19, then profit margin may be even higher than conventional quarter due to related cost already recognized or booked.

The schedule rates revenue for 2017 and 2018 were 346 mil and 371 mil respectively (total of Q1,Q2 and Q3 revenues but exclude Q4). This average schedule rates revenue over the past 3 quarter about 123mil, thus, I estimate the possible leftover schedule rates revenue could be around 120 mil+. Don’t forget there is also normal schedule rate revenue in 1Q19 which may make double or exceptional higher schedule rate revenue in 1Q19 (normal + leftover from 4Q18).

Even assuming high lump sum revenue or profit may not sustainable in 1Q19 (estimated to drop 50-60%), the leftover schedule rate revenues from 4Q18 may be enough to cover the revenue of lump sum orders. Besides, according to HLB report (guidance from management), there are some variation orders have been carried out but not yet reflected in their revenue (pending client approval).

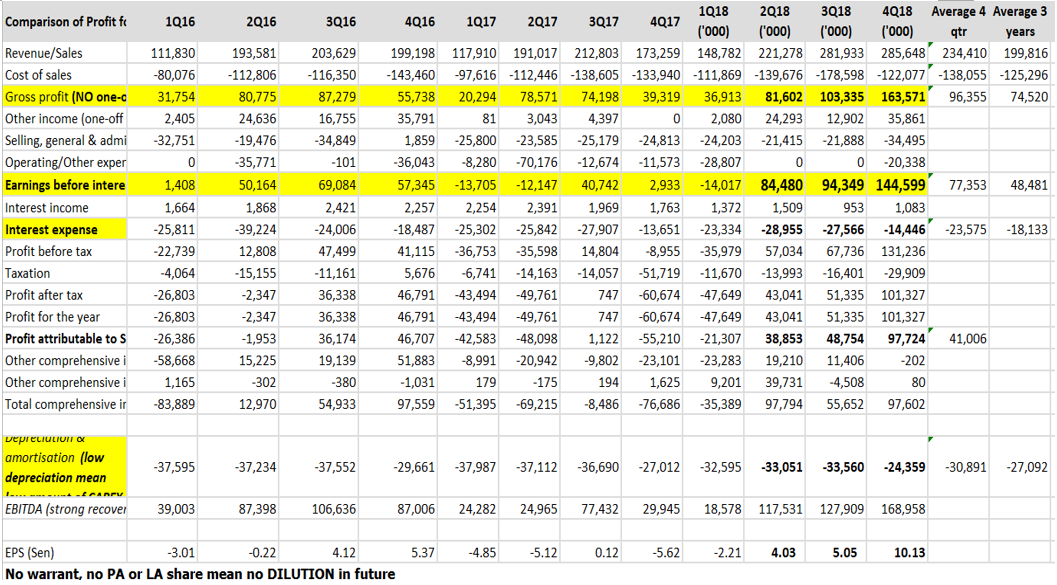

7. One of the metrics to evaluate the earning capability of a company is by looking at its gross profit margin and general & admin expenses. The table below shows the gross profit (no one-off profit) and admin expenses of Dayang in the past 3 years.

We can see dayang has achieved impressive gross margin and keep admin expenses low in the recent 3 quarter on the rising revenue trend. This leads to higher Ebit (earning before interest and tax) and resulting in higher net profit in recent 3 qtr.

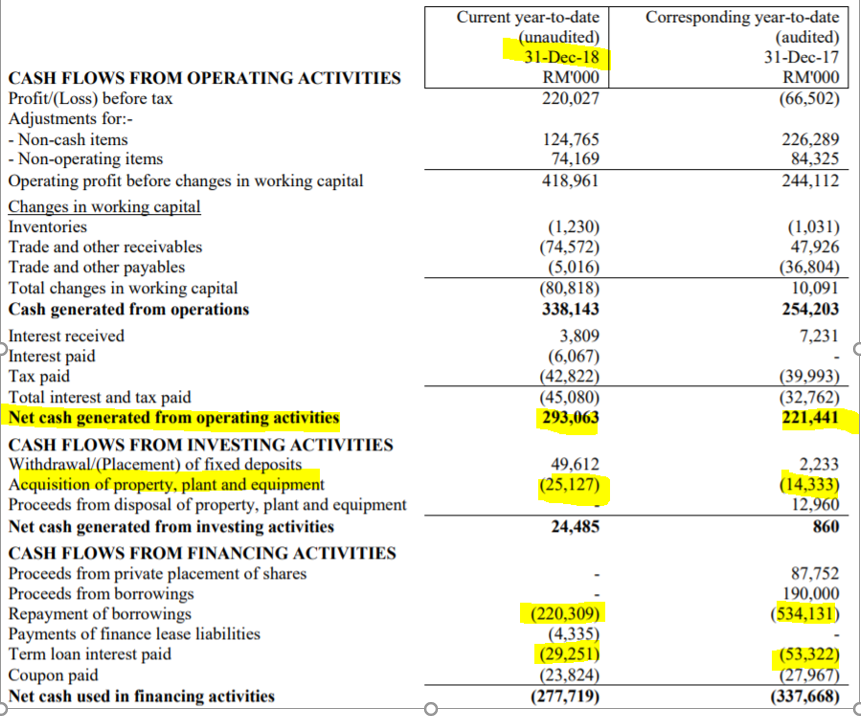

8. High quality of earning. Cash flow from operation is a metric to evaluate quality of earning of a company. Let see the cash flow from operation of Dayang as below:

Source: 4Q18 report

Dayang has generated 293mil cash from operation with an 25 mil capex spent on PPE (property, plant and equipment) in FY2018. In addition, Dayang has paid off about 250mil of borrowings in 2018.

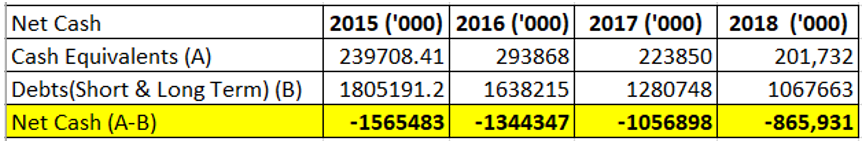

9. Improving balance sheet due to strong cash from operation. Dayang has paid off more than 550 mil debt over the past 3 years (net debt reducing from 1.56B to 0.86B) from the impressive free cash flow as shown in table below:

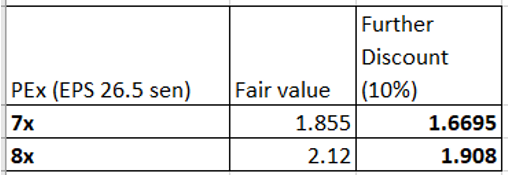

10. Attractive Valuation - Achieved net profit of RM97 million last quarter. Exclude one-off earnings (reversal of impairment), adjusted net profit about RM80 mil. Annualize = 320mil, discount 20%, discounted annualized profit = 256mil --> Estimated FY19 EPS = 26.5 sen. Fair value of Dayang can be summarized on the table below:

The first 20% discount is due to this EPS estimation is based on highest quarter profit and there is a possibility that coming quarter may not achieve the similar high earning (maybe due to previous qtr result has big lump sum which may not sustaianble in 2018).

The second 10% discount is due to there is a possibility that Dayang may propose private placement due to good share price to raise some fund to prepare for Perdana Bhd coming right issue fund raising. The maximum private placement (pp) is up to 10% where this pp can cause dilution of EPS up to 10%.

Why Dayang should worth PE of 7-8x? Below are the justifications for this valuation:

- Strong and Stable Margins - Average Gross Profit margin of above 35% and Net Profit margin of above 15%, one of the most efficient O&G service providers among all.

- Proven track records of project execution with good profit and never fall into operation loss over the past 7 years (except in 2016 & 2017 due to non-cash big impairment from subsidiary Perdana Bhd, impairment is not belong to operation loss)

- Strong orderbook of 3 billion and good profit visibility for the next 3-4 years as Dayang has shown improving profit for last 3 quarters.

- Strong cash flow generation over the past 3 years and pare down debt of 700 mil in 3 years.

11. Contract awards secured by Dayang and Perdana from international clients (not only from Petronas) as table below:

|

Date secured |

Effective date |

Types of works |

Client |

|

Sept 2017 |

5-yr contract, effective from 20/9/17 |

Maintenance, construction and modification Services Package A (Offshore) |

PETRONAS Carigali Sdn Bhd |

|

Aug 2018 |

5-yr contracts effective from 17/7/18 - 16/7/23 |

provision of Pan Malaysia Maintenance, Construction and Modification (PM-MCM) |

JX Nippon Oil & Gas Exploration (M) and Repsol Oil & Gas Malaysia Limited |

|

Oct 2016 by DAYANG's 60%-owned subsidiary, Perdana Petroleum |

3-yr contract worth RM67m effective from Sept/2018 - 2019 |

to supply one unit of floating accommodation vessel |

Petronas Carigali Sdn Bhd |

|

Nov 2018 |

3-yr subcontract, USD100mil, effective from 1/1/19 - 31/12/21 |

provision of Facilities Maintenance Support in Turkmenistan |

Gujurly Inzener |

Comparison is not for Public. SWOT analysis is not for Public.

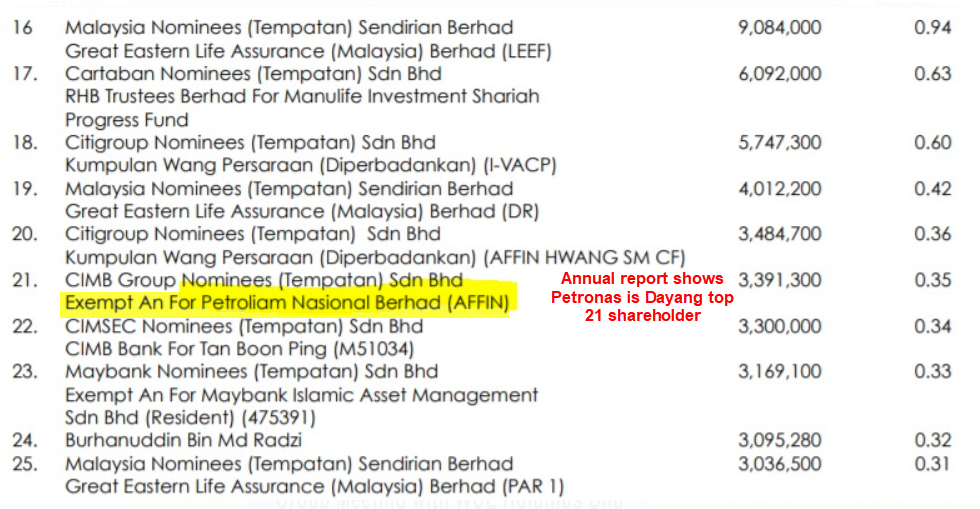

12. Let see the annual report of Dayang and see who is the top 21 shareholder

Source: Annual report 2017

In fact dayang receiving increasing order of lump sum works in 2017 and 2018 from Petronas. One of the reasons I guess is due to 25 years track records and experience of Dayang in MCM in Oil & Gas. Another possible reason maybe due to Petronas may try to take care of Dayang in contract awards due to Dayang's track records and project execution capability. FYI, the schedule rate revenue mainly come from 3B orderbook which is mainly based on call-out basis (refer to their AR). The high gross margin of their lump sum works maybe due to their arrangement of charter vessel by campaign to another campaign and fully utilize them at offshore.

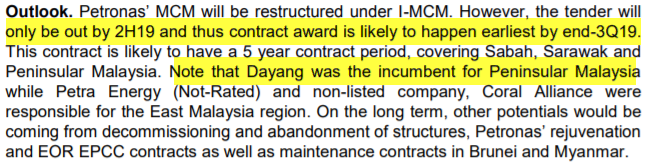

13. Let see the outlook of Dayang from HLB recent report (after their meeting with management) as below:

Source: HLB Dayang report (19 March)

Oil price in 1Q19 and April 2019 remain strong and currently close to USD69 per barrel. Petronas also needs more income in 2019 as they need to pay higher dividend to government of Malaysia. Thus, more oil rig may be in operation that lead to higher maintenance or modification works.

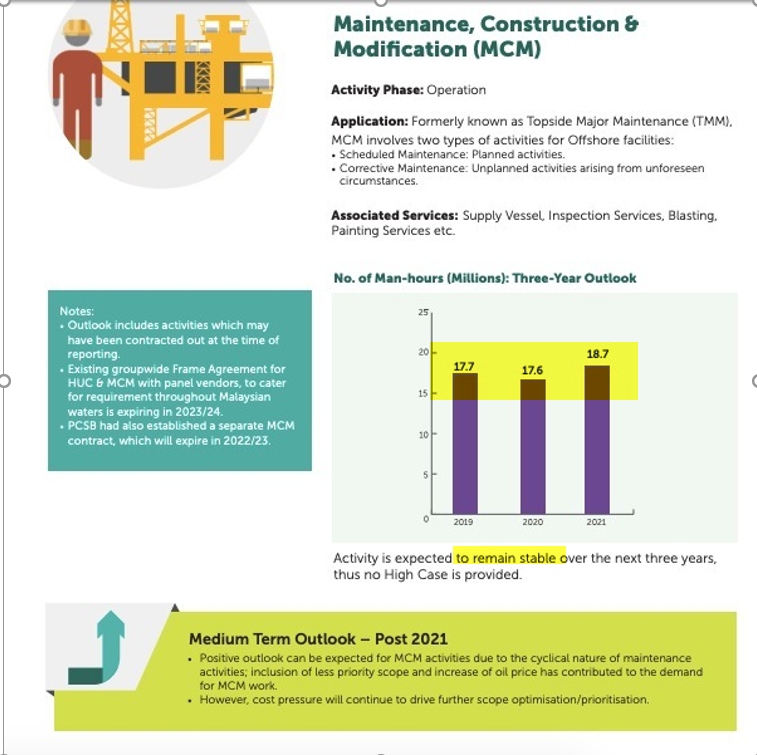

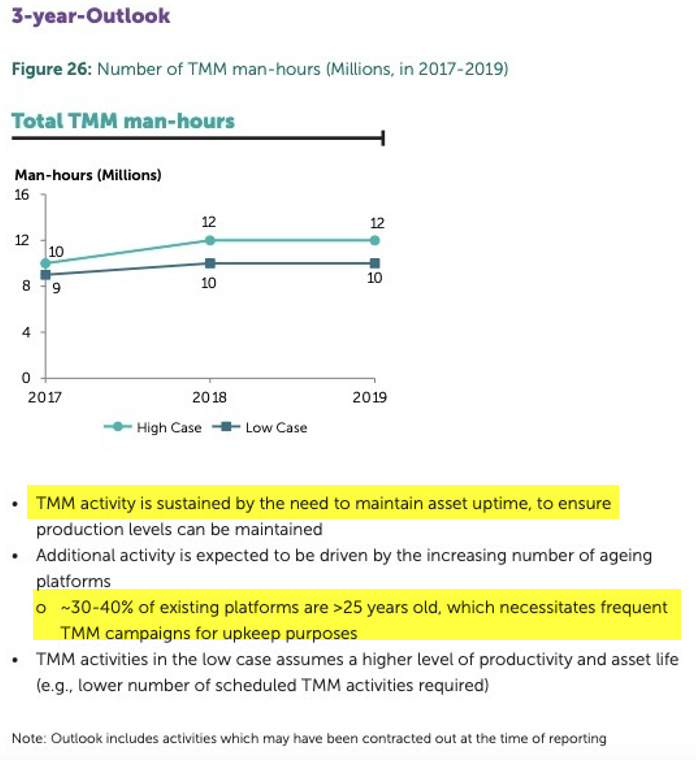

14. Increase of activities in MCM segment in Petronas activity outlook report 2019 to 2021 - Dayang is a direct beneficiary. In the report, “The respective offshore fabrication, linepipes, offshore installation and hook-up & commissioning (HUC)/ maintenance, construction & modification (MCM) segments will also see increase of workflows in 2019-21. Report bellow show the MCM activities outlook of Petronas.

If you interested on my analysis report, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

https://klse.i3investor.com/blogs/lionind/201179.jsp

https://klse.i3investor.com/blogs/lionind/201179.jsp